1 - Outdoor Media Centre

advertisement

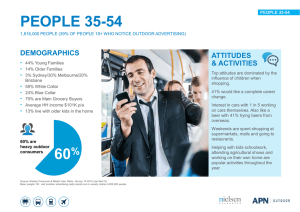

10+ reasons why retail brands should use Outdoor Outdoor is a great point of sale medium • Outdoor can place a message nearer a retail outlet than any other medium Operational efficiency now attracting large supermarket chains • • The medium can now deal operationally with short term, price sensitive campaigns and faster cycles Large retailers like Tesco are now using this greater flexibility to great effect Outdoor delivers a proven high ROI for retail brands • • Econometric research from Brand Science shows that Outdoor delivers high ROI to retail clients High ROI for every pound invested Outdoor has national, regional and local capability: precision targeting • Outdoor can be bought nationally, regionally or locally with great precision • Select by road type, proximity distance or catchment area with no wastage Outdoor delivers high awareness: essential for openings, sales, or every day • Outdoor gives high brand awareness for retailers to establish and grow their brands Outdoor is a high impact medium with very high levels of attention • • Outdoor gets noticed. It can’t be switched on, or turned over According to TGI 2010, 97% of UK adults have seen outdoor advertising in the past week Outdoor allows advertisers to be competitive • In a competitive market where share is vital, an advertiser needs a competitive medium Outdoor is a great directional medium and can activate a visit • • • Everyone sees Outdoor It can be a great reminder and directional tool, prompting an impulse visit to store For online retail too, Mindshare research* found Outdoor to be more effective than TV, radio and print for driving brand search on the internet * “The Branding Power of Outdoor” Mindshare 2010 Outdoor can target an audience type, mindset or moment • • Outdoor reaches the relevant audience and can stimulate a buying decision Targeting can range from students to duty free shoppers, harassed mums or grey panthers Outdoor is the most visual medium: best for leaving a lasting branding impression • • • Outdoor advertising messages get noticed They are capable of anchoring a strong visual brand memory in the brain This can be triggered again at point of sale Proven effective • • • Retail brands are one of the fastest growing areas for outdoor Retail brand count is increasing Proven effective for Tesco, M&S, KFC, H&M, Westfield, Pizza Hut… Outdoor is the medium experienced most recently before shopping • • Advertising messages get noticed 92% Outdoor Radio TV Outdoor overwhelmingly the most recent medium 36% Newspapers 6% 4% Seen or heard advertising in 30 minutes before shopping Source: Ipsos DMMA, 506 respondents in diverse shopping environments More mobile people make more frequent shopping trips Go ‘top up’ food shopping on way home from work twice a week or more 50 47 44 45 39 40 % 35 30 Light Mobility Light Mobility Source: Mobile Pound Research, Dipsticks Research Moderate Mobility Moderate Mobility Base: 1100 London interviews Heavy Mobility Heavy Mobility Receptive audience: most people on the street are buying something Q: Have you bought or do you expect to buy anything during this trip out today? Already bought something Already bought something & expect to buy something else Not bought anything but expect to buy something Not bought and don't expect to buy anything 26% 0% 10% 30% 20% 30% 40% 15% 29% 50% 60% 70% 80% 85% bought or expect to buy something Source: London Shopper Survey, Clark Chapman Research (324 random London street intercept interviews) 90% 100% Outdoor audience is the biggest audience for retailers and centres Adult 000’s 9,000 Heavy outdoor 8,000 7,000 Heavy TV 6,000 Heavy internet 5,000 4,000 Heavy radio 3,000 Heavy newspaper 2,000 1,000 Heavy magazine 0 Visit shopping centres Visit shopping centres 2-3 times a month Visited department store last 3 months Source: CBS Outdoor, TGI Media Neutral quintiles 2010 “Heavy” quintile is the 20% of the media audience who consume that medium most, ie the most typical consumer of that medium Heavy cinema Leading retail advertisers trust Outdoor Top retail advertisers in Outdoor 2010 (average spend £1.34m) McDonalds, Marks & Spencer, Kentucky Fried Chicken, Tesco, H&M Hennes, Asda Stores, Burger King, Specsavers, Matalan, Pizza Hut, Waitrose, Currys Group, JD Sports, Wm Morrison, Sainsburys, Miss Sixty, Iceland, Decathlon, Capital Shopping Centre, John Lewis, Sunway, TK Maxx, Go Outdoors, Uniqlo, Best Buy, Cooperative food, Eric N Smith Jeweller, Harrods, Land Securities, Realm Shopping Centre, Westfield, McArthur Glen, HMV Music, B&Q, Magnet, Clas Ohlson, Trafford Centre, Mango, Tiffany & Co, Dolce & Gabbana, House of Fraser, Oracle Shopping Centre, Vision Express, Boots the Chemist, Selfridges Source: Nielsen Media Research