Challenges & Prospects Monir Hossain - UNO-EF

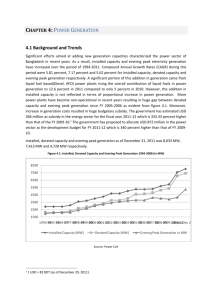

advertisement

A Developing Power System: Challenges & Prospects (Case study on Bangladesh) Monir Hossain Graduate Student (PhD) Electrical Engineering University of New Orleans 1 Bangladesh at a Glance • Official Name : People’s Republic of Bangladesh CHINA • Political System : Parliamentary Democracy INDIA INDIA : 158 million • Area : 147,570 km2 • Time Zone : GMT+6 Hours • GDP Per Capita : SYLHET RAJSHAHI INDIA INDIA • Population USD 829 (FY 2013) • GDP Growth Rate: 6-7% (High compare to other SARAC countries) DHAKA • Major Maritime Ports: Chittagong, Mongla BARISAL • Currency KHULNA CHITTAGONG : BDT (1 BDT = USD 0.014) • Major Industries : Textile & RMG, Jute, Pharmaceuticals, Ship breaking 200 miles 500 km 2 Bangladesh Power System Year 1972 Infrastructure: Generation: 165MW 132kV Line: 1583 ckt km 66kV Line: 167 ckt. km Bangladesh Grid Network Year 2003 Infrastructure: Generation: 3200MW 230kV Line: 1365 ckt. km 132kV Line: 4961 ckt. km 230/132kV SS: 7 (3150 MVA) 132/33kV SS: 63 (5507 MVA) Bangladesh Power System Year 2014 Infrastructure: Generation: 10GW 400kV Line: 54.7 ckt. km 230kV Line: 3038 ckt. km 132kV Line: 6224 ckt. km HVDC Station: 1 (500 MW) 230/132kV SS: 17 (7525 MVA) 132/33kV SS: 103 (11780 MVA) 0 2012-13 2010-11 2008-09 2006-07 2004-05 2002-03 2000-01 1998-99 1996-97 1994-95 1992-93 1990-91 1988-89 1986-87 5,000 1984-85 10,000 1982-83 15,000 1980-81 20,000 1978-79 25,000 1976-77 30,000 1974-75 35,000 1972-73 40,000 883 681 1,031 1,202 1,256 1,387 1,538 1,817 2,016 2,236 2,529 2,885 3,261 3,768 4,302 4,560 5,308 6,214 6,759 7,345 7,857 8,450 8,746 9,295 10,266 10,901 11,243 12,194 13,638 14,739 16,255 17,445 18,458 20,302 21,408 22,978 23,268 24,946 26,533 29,247 31,355 35,118 38,229 45,000 1970-71 Historical Energy Net Generation (GWh) in Bangladesh Net Energy Generation in GWh Present Structure of Power Sector Apex Institution Power Division, Ministry of Power, Energy & Mineral Resources (MPEMR) Regulator Bangladesh Energy Regulatory Commission (BERC) Generation Bangladesh Power Development Board (BPDB) Ashuganj Power Station Company Ltd. (APSCL) Electricity Generation Company of Bangladesh (EGCB) North West Power Generation Company Ltd. (NWPGCL) Independent Power Producers (IPPs) Transmission Power Grid Company of Bangladesh Ltd (PGCB) Distribution Bangladesh Power Development Board (BPDB) Dhaka Power Distribution Company (DPDC) Dhaka Electric Supply Company Ltd (DESCO) West Zone Power Distribution Company (WZPDC) Rural Electrification Board (REB) through Rural Co-operatives Bangladesh’s Power Sector: At a Glance Electricity Growth Generation Capacity (MW) : : 2014 10% 10,213 Maximum Generation (MW) : 7,556 Total Consumers (in Million) Transmission Lines (ckt.km) Distribution Lines (km) Per Capita Generation (including Captive) : : : : 14.2 9,322 288,787 Access to Electricity : 62% (including Off-Grid Renewable) 321 8 Primary Fuel Supply Options Gas: Only 16 TCF proven reserve. No significant gas discovery in recent years. Depleting gas reserve restricts gas based generation expansion Hydro: Present capacity 230 MW. No further significant potential Coal: Total 3.2 billion ton reserve in 5 mines. Mines are located at dense populated area. Oil: Depends on importing. Renewable: Present capacity only 70 MW. High prospect of solar. 9 Present Installed Generation Capacity Public Sector SL. 1. 2. 3. BPDB APSCL EGCB 4. NWPGCL 5. RPCL 1. 2. 3. 4. 5. 6. Installed Generation Capacity (MW) 4186 777 622 300 77 Subtotal 5,962 (58%) Subtotal 1330 99 226 167 1929 500 4,251 (42%) Private Sector IPPs SIPPs (BPDB) SIPPs (REB) 15 YR. Rental 3/5 YR. Rental Power Import Total 10,213 Considering 20 % Maintenance and Forced Outage, Available Generation Capacity is about 7500 MW without fuel constraint 10 Fuel Mix: FY-2013 FY-2013 Furnace Oil 14.56% Diesel 1.95% Coal 3.02% Hydro 2.34% Natural Gas 78.12% Total Net Generation : 38,229 GWh 11 Typical Summer Load Curve 8000 7000 6000 SHORTAGE MW 5000 OIL 4000 HYDRO 3000 COAL 2000 HVDC 1000 GAS 0 12 Typical Winter Load Curve 6000 5000 SHORTAGE OIL MW 4000 HYDRO COAL 3000 HVDC 2000 GAS 1000 0 13 Estimated Future Demand 35000 30000 25000 MW 20000 15000 10000 5000 0 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 14 Challenges Huge demand supply gap causes regular load shedding High growth rate of electricity due to new electrification & industrial growth Fuel crisis due to depleting gas reserve Arranging fund for investment Scopes & Prospects Efficiency improvement of existing power plants. Fuel diversification. Regional power trading. Efficiency improvement of existing power plants. Total gas based power plants: 6500MW Average efficiency of gas based power plants: 30% Efficiency of modern CCPP (Gas)= 60% Possible output using same amount of gas= 13000MW Fuel Diversification Coal: Local Coal + Imported Coal Solar: Road Map for Coal Power Development K-D-P 6x1000 MW Meghnaghat 2x660MW Chittagong 4x660MW Moheshkhali/Matarbari 4x660MW Railway Khulna 2x660MW Total 14,000MW Coal Center Chittagong Matarbari Sonadia Island : Potential Coal PS : Potential Coal Center : Ocean-going vessel : Transship Solar Power Huge potential in solar Land constraint Rooftop Solar Panels Islands for Mega Solar Bangladesh 20 Regional Power Trade Hydro Power Potential & Solar Powercorridor Transmission India needs corridor Nepal & Bhutan has excess potential 80GW Huge prospect in solar 60GW 30GW Bangladesh Main limitation: Land constraint Islands can be identified for solar (2000MW) 22 Regional Power Exchange: Possibilities 6.5GW 6x6.5GW 1GW 6.5GW 2GW 4-6GW 1GW 1GW Probable Power Generation: Primary Fuel Sources by 2030 Sl. No. 1 2 3 4 Description Capacity (MW) Domestic Coal Imported Coal 6,000 8,000 Domestic Gas Solar 13,000 2,000 5 Regional Grid 6 Others (Oil, Hydro) Total 8,000-10,000 15,00 41,500 Probable Location (s) North West Region at Mine Mouth Chittagong and Khulna Near Load Centers Islands, Rooftop Barapukuria, Jamalpur, Dhaka, Bheramara Near Load Centers Recommended Strategic Policy Ensuring Investment Friendly Environment Efficient use of gas: Simple Cycle to Combined Cycle Conversion Coal Policy Deep Sea Port & Coal Centre Locations Identification for Mega Solar Friendly Relation with Neighbor’s Participation on Hydro Power Development Projects (India, Nepal & Bhutan) THANKS 26