Causes of the Great Depression & Hoover`s Response

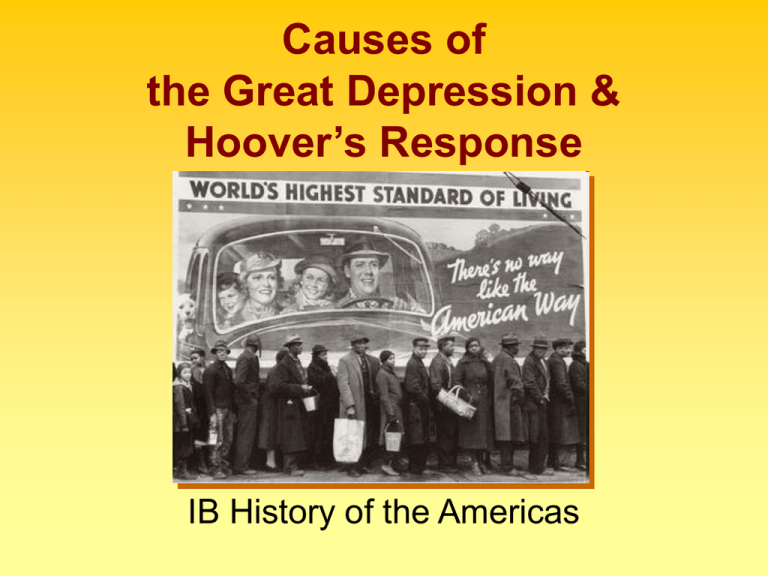

advertisement

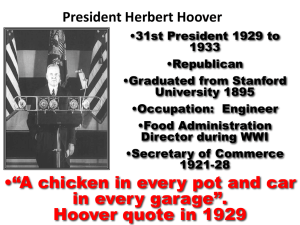

Causes of the Great Depression & Hoover’s Response IB History of the Americas Myths and Misconceptions • Many people believe that the crash of the stock market was the cause of the Depression. Not so, it was only a symptom. • Many people also believe that Herbert Hoover’s laissez-fair economic philosophy prevented the federal government from taking steps to prevent the crisis. Hoover was proactive in trying to ease the impact of the depression, it was too little, too late. • Many people think that the Great Depression was the only major economic crisis in U.S. history. Nope, but it was the worst. • Many people do not realize that the Depression was global and affected almost every capitalist economy on earth • Some believe that FDR and the New Deal ended the Depression. Wrong again, WWII ended he Depression The Facts • In September of 1929 the U.S. economy began showing signs of contraction (decline from the growth of the 1920’s) • August 1929, recession begins, GDP falls by and unemployment rises. • Automobile sales fall 30% in 1929. • By 1929 farm incomes fall more than 50% • September 1929 stock prices begin to fall, the market crash on Black Tuesday October 29th losing 90% of its value by 1932. • By 1932 US GDP fell 30% • 1929-1932 US factory production fell 46% • 1929-1932 US wholesale prices fell 32% • 1929-1932 US exports fell 70% • 1929-1932 US unemployment will reach 25% (33% in some regions) US Unemployment 1910-1960 Abstract of the US Department of Labor US GDP 1910-1960 Based on data from: Louis D. Johnston and Samuel H. Williamson, "What Was the U.S. GDP US Farm Prices 1928-1932 US Bureau of Labor Statistics US Industrial Production US Stock Market 1928-1932 US Bureau of Labor Statistics Many did not realize how severe the downturn was until 1932, when the economy had technically “hit bottom.” Brother Can You Spare a Dime? Once I built a railroad, I made it run I made it race against time Once I built a railroad, now it's done Brother, can you spare a dime? Once I built a tower, up to the sun Bricks and mortar and lime Once I built a tower, now it's done Brother, can you spare a dime? Overproduction Banking Practices & Fed Policies Causes of the Great Depression Stock Market Political Decisions 1. Over-production Overproduction • The “roaring twenties” was an era of great prosperity and economic growth. • Average output per worker increased 32% in manufacturing and corporate profits rose 62%. • The availability of so many consumer goods, such as electric appliances, radios and automobiles, offered to make life easier. • Americans felt they deserved to reward themselves after the sacrifices of World War I. A return to normalcy. • This led to a high demand for such goods, so companies began to produce more and more, in order to meet that demand. Overproduction • Mass advertising fed mass consumption to satisfy the needs of mass production. • Wages for labor remained stagnant (mechanization of labor, Taylorism, suppression of union collective bargaining). Businesses were investing profits in the stock market and not in workers wages. So…. • The uneven distribution of wealth grows. 1922 1% of the population owns 36.7% of the nations wealth by 1929 it has grown to 44.2% • Eventually business produced more than consumers could purchase. You can only own so many radios, cars, and appliances. • August 1929 Recession begins, two months before the stock market crash. During this two month period, production fell 20%, wholesale prices at 7.5 %, and personal income fell 5%. Farm Overproduction • In 1929, Agriculture still makes up half of the US economy • During World War I, with European farms in ruin, the American farm was a prosperous business. • Increased food production during World War I was an economic “boom” for many farmers, who borrowed money to enlarge and modernize their farms. • The government had also subsidized farms during the war, paying high prices for wheat and grains. • When the subsidies were cut, it became difficult for many farmers to pay their debts when commodity prices dropped to normal levels. So… • Over production of consumer goods and agricultural goods means… • Supply was greater than demand. • A surplus of goods in the market begins to drive prices down. • Declining prices means declining profits • Declining profits means stock values (for corporations) begin to fall. • Oh my!!! 2. Banking & Money Policies Consumer Credit • The uneven distribution of wealth didn’t stop the poor and middle class from wanting to possess luxury items, such as cars and radios… • But, wages were not keeping up with the prices …and that created problems! Consumer Credit • One solution was to let products be purchased on credit. • The concept of “buying now and paying later” caught on quickly. • By the end of the 1920s, 60% of the cars and 80% of the radios were bought on installment credit. • Consumerism in the New Era saw a change in US buying behavior. Thrift, saving, and frugality were replaced with consumption, and keeping up with the Jones’ The Federal Reserve Board • The Federal Reserve Board was created by Congress in 1917 in response to the Banking Crisis of 1907. • The Fed was created as the US central bank with two primary functions: – 1) Regulate and inspect the nations commercial banks, by assuring banks had sufficient cash reserves – 2) Regulate the amount of money circulating in the economy. Known as Monetary Policy • To stimulate growth the Fed increases money in circulation by lowering interest rates for member banks, and decrease in the amount of money banks are required to keep in reserve Fed Monetary Policy • The Federal Reserve was suppose to serve as a protective “watchdog” of the nation’s economy. • It had the power to set the interest rate for loans issued by banks. • In the 1920’s, the Fed encouraged buying on credit by lowering interest rates (discount rate) • Eventually so many people were buying on credit that inflation increased. So… • By 1929 the Fed decided to slow the rapid (runaway?) growth by increasing interest rates. • Raising interest rates means that it cost more to borrow and raises the price of existing debt. • So. People borrowed less and purchased fewer goods. • They also started using available cash to pay off debt and therefore purchased fewer goods. • Less demand = surplus goods = deflation = declining profits = declining stock prices = rising unemployment • Oh my! 3. STOCK MARKET ACTIONS The Stock Market • The Stock Market is seen as an indicator of the nation’s economy. • In reality it is only and index of the value of corporate stocks based primarily on the market demand for a particular stock • As an investment the goal is to buy low and sell high. • The value of stocks soared in the 1920’s as corporate profits rose, fueled by mass consumption. (Fueled by credit, shhhhhh!!!) • Once a rich man’s game, everyone was “in the market” in the 20’s • Optimism was high, and speculation was rampant Stock Market: Buying on Margin • Buying on the margin means that you can purchase shares with a don payment. • The Margin Requirement in 1926 was 10%. So a $100 share of stock could be yours with only a $10 down payment • Speculators expect the value of the stock to go up in price enough (at least 90% to break even) covering the balance. • Buying on the margin encouraged thousands of small time, new (inexperienced) investors to purchase stocks • As long as corporations were selling goods and turning a profit stock prices rose and buying on the margin was safe. • As long as… George Olsen "I'm In The Market For You” I'll have to see my broker Find out what he can do. 'Cause I'm in the market for you. With margin I'm all through. 'Cause I want you outright it's true. We'll count the hugs and kisses, When dividends are due, 'Cause I'm in the market for you. Stock Market: Banks & Margins • In 1927 banks did two stupid, greedy things – 1) Banks began letting customers borrow money to buy stocks and used the customers stock holdings as collateral for the loan. They gave money to people with no money to gamble – 2) Banks started to use depositors money to speculate in the stock market. Normally banks pay you interest for savings. Then they loan it to businesses or families that were good risks to buy homes or start companies etc. Not speculate in the market! • By 1929, banks had made billions of dollars in risky loans with little collateral to back them up if borrowers defaulted. So what went wrong? Stock Market Crash • Black Tuesday, October 29th 1929. • The market bubble bursts with a panic sell off of 16 million shares of stock. • Investors lose 26 billion dollars (312 billion in 2010 dollars) • The crash was not a one day event, stocks falling in September. Wealthy investors stepped in a bought up shares at bargain prices. • Those who bought on margin, however, panicked. • It is impossible to know exactly what caused the initial panic but the market crash exposed the other problems in the economy setting into motion a deep lack of confidence in the economy. So… • Banks made risky loans to borrowers to buy stocks on the margin. • Banks used depositors money to speculate in the market • When panic shook the market, the banks were left holding the bag • Oh my… 4. Bad Fed Banking Policies • With the loss of confidence in stocks, people began to lose confidence in the security of their money being held in banks. • Customers raced to their banks to withdraw their savings. (k.a. bank run) • Customers closed accounts and banks were left without cash reserves putting them on the brink of failure. 4. Bad Fed Banking Policies • In its regulatory role, the Federal Reserve was also established to prevent bank closings. • It was suppose to serve as the lender of last resort to banks on the verge of collapsing. However, • The Fed lowered the reserve requirement for banks, so the banks did not have the cash to cover customer withdrawals. And the Fed did not provide short term loans to banks to cover the loses. • 1930 the Fed cuts interest rates from 6% to 4% in attempt to increase the money supply So… • Banks started to close, increasing the panic. • 1930, 60 banks fail every month, by 1933 over 9,000 banks fail (40% of the 1929 total) So… • The Fed fails to manage the bank and currency crisis. • Depositors now hide their money at home and banks have no money to lend • Banks close and large amounts of money disappear from the economy So… • Less money = less consumption = less production • Businesses go bankrupt • People get laid off • Thus the economy begins an irreversible downward spiral. • Banks close and large amounts of money disappear from the economy • By 1931, GNP falls by 18%, unemployment reaches 16%(8 million) 4. Bad Political Decisions: Political Decisions • The severity of the Depression could have been lessened if policy makers would have been open to new ideas • Conservative economic policy – Laissez fair, let the market right itself without government intervention – Balance the budget, do not spend more than collected in tax revenue • Prevailing belief that private charities, churches, state and local governments provide relief and assistance to the poor, not the Federal Government – Most of these were ill equipped to deal with the number of people in need “The sole function of the government is to bring about a condition of affairs favorable to the beneficial development of private enterprise.” ~Herbert Hoover (1930) “The Fed will stand by as the market works itself out: Liquidate labor, liquidate stocks, liquidate real estate… values will be adjusted, and enterprising people will pick up the wreck from lesscompetent people." ~ Andrew Mellon (1930) Hoover’s Political Decisions • Contrary to popular history Hoover’ commitment to laissez fair made the Depression worse • Hoover initiated several programs to help the economy recover but it was too little, too late • Hoover favored volunteerism, or cooperation between business and government over coercive policy Hoover’s Political Decisions • Hoover promoted volunteerism. Cooperation between government and business instead of coercive policies. • He showed some pro-labor policies: – Asked business leaders to hold wages steady even though profits were falling – Authorized repatriation for 50,000 Mexicans (and Mexican-Americans) to ease unemployment and cut the relief rolls in California Hoover’s Political Decisions • Hoover promoted volunteerism to prop up failing banks. • National Credit Corporation / Reconstruction Finance Corporation (RFC) • 1931, Hoover urged the larger (East Coast) banks to provide low interest loans to struggling rural banks • Large banks were unwilling to offer loans without holding the smaller banks most valuable collateral. • RFC failed to help the smaller banks. Hoover’s Political Decisions • Rising unemployment led to homeowners defaulting on mortgages and renters being evicted from apartments. • The homeless settled in shanty towns called Hoovervilles • 1932, Federal Home Loan Bank Act, was passed to spur new home construction, and reduce foreclosures. • Foreclosures dropped briefly in late 1932. Hoover’s Political Decisions • The Revenue Act of 1932 reversed the Mellon tax cuts. Increase taxes on struggling corporations and the wealthy = more money in the federal treasury to fund aid without deficit spending (more on this later) • Emergency Relief and Construction Act of 1932. federal money funneled to states to start public works projects (roads, drainage, schools) to put people back to work – Problem, it is not that easy to spend large amounts of money quickly on shovel-ready projects – Federal money trickled into states as the problem of unemployment grew exponentially Hoover’s Three Biggest Mistakes • Signing the Smoot-Hawley Tariff • Revenue Act of 1932 • Balancing the budget Hoover & Smoot-Hawley • The Smoot-Hawley Tariff was signed (reluctantly) by Hoover in 1932 • It came on top of the Fordney-McCumber Tariff of 1922, which had already put American agriculture into a tailspin. • Smoot-Hawley raised tariffs by 50% • Congress believed the tariff would make imports too expensive and Americans would buy American goods, increasing demand • European countries retaliated with their own tariffs and U.S. exports fell by almost 70% Hoover & Smoot-Hawley • The trade war cost American farmers 1/3 of their market causing agricultural prices to fall and putting more farmers into bankruptcy. • Tariffs damaged an already shaky economy in Germany. • Germany begins to default on reparations payments to England and France required by the Versailles Treaty – France and England fall behind in their payments on loans from U.S. banks (used to buy weapons during WWI) – Weakening large U.S. banks Billions of Nominal Dollars Smoot Hawley Tariff of 1930 and Trade Reform Act of 1934 7 6 5 4 Exports Imports 3 2 1 0 1929 1930 1931 1932 1933 1934 1935 1936 1937 1938 1939 1940 Revenue Act of 1932 & Balancing the Budget • Concern over growing deficits Congress passes and Hoover signs the Revenue Act of 1932 • The act reversed Mellon’s tax cuts. – Raising business taxes from 12% to 13.75% – Raised taxes on every bracket – Lower income brackets increases form 1% to 4% – Raised taxes on the wealthy from 24% to 64% • The problem with raising taxes is that it takes money out of the economy. • Business facing lower profits had to now pay more taxes. To cut cost they laid off workers • Since nothing seemed to help the economy, Hoover and Congress decided to balance the Federal budget. – Cut spending (ex. veteran’s benefits) • This shrunk the money supply even more So… • Hoover was not the laissez-fairie • He supported government actions to ease the crisis But • It was not enough And • He fell back on conservative economic policy and tried to balance the budget • Smoot-Hawley • Ohhh….!!! Let’s Review • • • • • • Overproduction Stagnant wages Federal monetary policy Banking practices Stock market Political decisions Next. The FDR Mystique