Airline Challenges – Current Strategies: A personal

advertisement

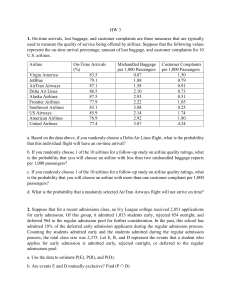

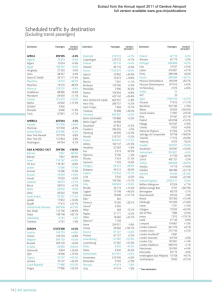

Opening session AIRLINE CHALLENGES CURRENT STRATEGIES A personal perspective by Pierre J. Jeanniot INDUSTRY CHALLENGES Economic cycles Financial crises Government actions Terrorism Environmental constraints Infrastructure 2013 profit $12.9 billion passenger load factor 80.3% yield 0.3% forecast - 2014 profit $18.7 billion REGIONAL FORECASTS Asia-Pacific $3.7 billion North America $8.6 billion Europe $3.1 billion Middle East $2.2 billion South America $1.0 billion Africa $0.2 billion NORTH AMERICA Full Service Network Carriers North American Hybrid Models FOUR MAJOR CARRIERS consolidation, slot reduction OPPORTUNITIES FOR NEW LCC’s EUROPE THE SHORT-HAUL MARKET low-cost airlines overtaking legacy airlines regional offerings – HOP! leisure brand - Transavia alliance and partnerships “SCORE” cost reduction program 81.5 million passengers st 1 base outside Europe Business model - changing pre-tax profit +27.9% hybrid model for business passengers one of the fastest growing airlines aims to connect the world via Istanbul MIDDLE EAST WORLD GULF HUBS recent aircraft & engine technology-driven the world economy continues to shift ... so do the traffic flows equity alliance strategy ASIA PACIFIC INDIA World’s largest democracy hard to do business ! Changing Aviation Policies new airlines, many LCCs fuel costs Indian rupee depreciation all LCCs losing money – except Indigo Full Service Segment lacked liquidity major losses heavily indebted New Joint Ventures Tata Sons – Singapore Airlines full service airline Tata Sons – Telestra Tradeplace – Air Asia low cost carrier - LCC LATIN AMERICA co-operative model “virtual airline” buys aircraft individual airlines operate flights CONSOLIDATION highly profitable! largest LCC in Brazil 15% domestic market AFRICA traffic growth +6% p.a. accident rate mostly government-owned . urbanization emerging middle class strong services Africa could industrialize aviation would play an important role ! North America Europe Asia Pacific Latin America Gulf Airlines Africa SHAPING FORCES New airplanes and engines Narrow bodies Less fuel burn – lower operating costs SHAPING FORCES New airplanes and engines Wide bodies Less fuel burn – lower operating costs Continued impact of IT INTERNET SOCIAL MEDIA SELF HANDLING MOBILE DEVICES CURRENT TRENDS Ancillary Revenues up to 20% of total intake New Distribution Capability diversified product distribution OBSERVATIONS Aviation continues to change. It needs to adapt … And it needs STRONG LEADERSHIP