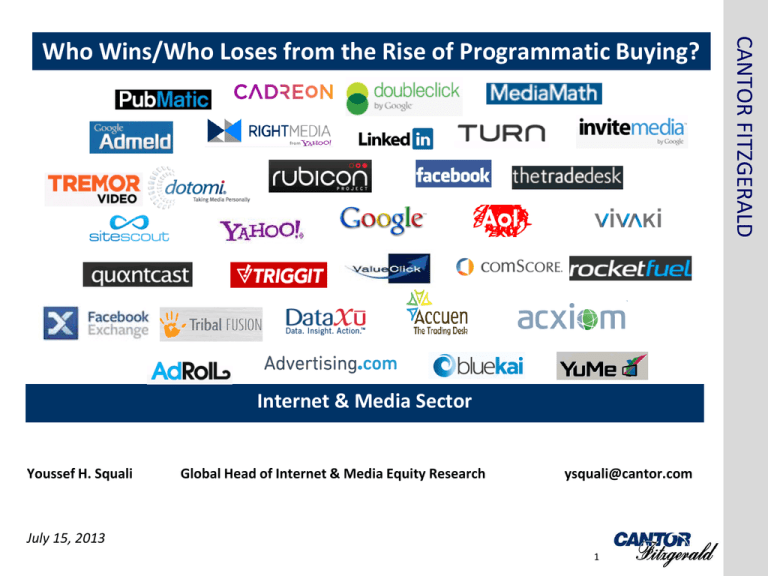

Cantor Fitzgerald U.S. Equity Research

advertisement

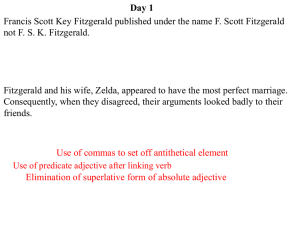

Internet & Media Sector Youssef H. Squali Global Head of Internet & Media Equity Research ysquali@cantor.com July 15, 2013 1 CANTOR FITZGERALD Who Wins/Who Loses from the Rise of Programmatic Buying? Mission: Identify investable trends early, and ride them hard Internet has turned many a business model on its head by: Eliminating one or more intermediary layers Doing it faster and cheaper Bringing more convenience 2 CANTOR FITZGERALD The View from Wall Street The rapid adoption of RTB is … Transforming the way ads are bought and sold – NASDAQ as proxy Allowing/enhancing price discovery Bringing intelligence to every impression Enabling scale beyond what existed before In time, it will allow the sale of premium display, video and mobile But… several issues need to be resolved before RTB enters prime time 3 CANTOR FITZGERALD The Big Picture around RTB CANTOR FITZGERALD U.S. RTB Digital Display Ad Spending Forecast RTB by the Numbers: Roughly $3.5 billion revenue in 2013 Growing at 70+% Y/Y At a 5 year CAGR of ~34% ~20% of digital display advertising or, ~8% of total Internet advertising 4 In 5 years, RTB could account for 30-50% of total display ad spending 5 CANTOR FITZGERALD U.S. RTB Digital Display Ad Spending Forecast Indexed Price Performance 135 • The Cantor Internet Index (equalweighted index of 60+ Internet cos) vs. the S&P 500. Price (Indexed to 100) 130 125 130.63 120 115 110 119.33 105 100 95 90 85 07/2012 09/2012 11/2012 01/2013 Internet 03/2013 S&P 500 05/2013 Source: FactSet Prices Source: FactSet and Cantor Fitzgerald research 300 Indexed Price Performance Price (Indexed to 100) 258.31 250 200 150 • Over the last 5 years, the CII has dramatically outperformed the S&P 500. 129.22 100 50 0 01/2009 01/2010 Internet 01/2011 S&P 500 01/2012 01/2013 Source: FactSet Prices Source: FactSet and Cantor Fitzgerald research 6 CANTOR FITZGERALD So Why Does Wall Street Care? RTB is Growing Significantly Faster than Overall Internet Advertising 100.0% 90.0% RTB CAGR: 34.3% Internet CAGR: 80.0% 70.0% 60.0% 50.0% 40.0% 30.0% 20.0% 10.0% 0.0% 2012 2013E 2014E 2015E 2016E 2017E US Internet Ad Revenue Growth US RTB Display Ad Spend Growth Source: IAB, eMarketer, and Cantor Fitzgerald research 7 CANTOR FITZGERALD So Why Does Wall Street Care? $ $ ADVERTISER ADVERTISING AGENCY $ AGENCY TRADING DESK $ DSP (BUYER PLATFORM) SSP (SELLER PLATFORM) PUBLISHER INVENTORY $ $ PROGRAMMATIC GUARANTEED DIRECT ORDER AUTOMATION $ $ AUCTION MARKET $ Source: Rubicon and Cantor Fitzgerald research You’ve got to simplify the story! 8 CANTOR FITZGERALD The Digital Display & RTB Ecosystem • Consolidation around publishers, large integrated ad exchanges and advertisers likely. • As larger players build their tech stacks, point solutions to be acquired or wither away. • Google is currently in the lead with a full service stack, but Facebook’s FBX is likely another big beneficiary. Select Ad Technology and Marketing Services M&A Activity - To Date Announced 5/17/2013 12/12/2012 9/20/2012 7/31/2012 6/4/2012 11/30/2011 11/1/2011 8/2/2011 6/16/2011 6/13/2011 4/21/2011 9/17/2010 8/4/2010 1/4/2010 9/15/2009 8/9/2009 9/27/2007 9/4/2007 7/24/2007 5/18/2007 5/17/2007 5/16/2007 4/30/2007 4/13/2007 1/15/2007 Target Name Acquity Group Ltd. CyberAgent FX, Inc. LBi International NV Wildfire Interactive, Inc. Buddy Media, Inc. Efficient Frontier, Inc. interCLICK, Inc. Dotomi, Inc. MediaMind Technologies, Inc. Admeld, Inc. GreyStripe AKQA, Inc. Slide, Inc. Quattro Wireless, Inc. Omniture Razorfish, Inc. Traffix, Inc. BlueLithium, Inc. TACODA, Inc. aQuantive, Inc. 24/7 Real Media, Inc. Acxiom Corp. Right Media, Inc. DoubleClick, Inc. TradeDoubler AB Target Description Digital strategy, multi-channel digital marketing, brand e-commerce Internet media and advertising Digital communication services Social media marketing software provider Social marketing and content management Online performance and social media marketing Data driven advertising solutions Personalized and pertinent marketing Ad management and distribution platform Supply Side Platform (SSP) Selling and serving mobile ads Interactive marketing agency Widgets on social networks, blogs and desktops Mobile advertising company - iAds Web analytics and marketing services company Interactive marketing/tech and digital ad buying Internet, mobile technology, and traditional marketing Advertising network - behavioral targeting Online advertising services - behavioral targeting Advertising network Digital display marketing solutions Enterprise data, analytics and SAAS company Right Media ad exchange Ad exchange and other digital marketing tech/services Performance-based digital marketing and technology Base Equity Value(USD) 305.71 254.89 558.92 250 689 374.7 226.88 287.38 429.63 400 70.6 600 179 275 1656.5 530 160.49 300 273.9 5,373.63 603.57 1,843.40 680 3,100 839.97 Acquirer Name Accenture Plc Yahoo Japan Corp. Publicis Groupe SA Google, Inc. salesforce.com, inc. Adobe Systems, Inc. Yahoo!, Inc. ValueClick, Inc. DG FastChannel, Inc. Google, Inc. ValueClick, Inc. Dentsu, Inc. Google, Inc. Apple, Inc. Adobe Publicis Groupe SA New Motion, Inc. Yahoo!, Inc. Time Warner, Inc. Microsoft Corp. WPP Group Plc Silver Lake Partners LP Yahoo!, Inc. Google, Inc. Time Warner, Inc. Source: MergerStat, FactSet, and Cantor Fitzgerald research 9 CANTOR FITZGERALD Consolidation is Inevitable 1. The trend toward automated direct buying is only in its infancy, but the shift has begun. 2. Automation, data and effectiveness that RTB brought to the auction market will be utilized for premium direct ad buys as well 3. Video and mobile are the next frontier 4. Consolidation will happen. Scale matters; point solutions will give way to integrated offerings. 10 CANTOR FITZGERALD In Summary: Internet & Media Sector Youssef H. Squali Global Head of Internet & Media Equity Research ysquali@cantor.com July 15, 2013 11 CANTOR FITZGERALD Who Wins/Who Loses from the Rise of Programmatic Buying?