Iranian Oil Exports and Sanctions

advertisement

Iranian Oil Exports and Sanctions:

A Case for more transparency from

the Obama Administration

Nathaniel Kern

Foreign Reports Inc.

May 1, 2014

Notes on data

•

•

•

•

Data in this report is current as of May 1, 2014. Individual countries importing Iranian oil report

their data between 15 and 45 days after the month in question has ended.

Sources: General Administration of Customs (China); KNOC (South Korea); METI (Japan); Reuters’

tanker discharge data (India); EPDK (Turkey); Bureau of Energy, Ministry of Economic Affairs

(Taiwan). Taiwan and Turkey won’t publish data until mid-May. Our assumption is that Taiwan

imported no oil from Iran in March and that Turkey’s imports were the same as the average during

the past six months. Data does not include unreported imports by Syria or the UAE or product

imports by China.

Unless otherwise noted, all data is in ‘000 of b/d. Chinese and Indian data is converted from tonnes

to barrels at 7.2 barrels per tonne.

Copies of this presentation are available at ForeignReports.com

(c) Foreign Reports Inc.

2

Officially Reported Imports of Iranian Oil Nov. 2011 to date

The Long Perspective: Imports averaged 1.074 million b/d from July

2012 through October 2013

2500

2000

Other

S. Africa

'000 b/d

1500

IEA Eur.

Turkey

1000

S. Korea

Japan

India

500

China

0

nov dec jan feb mar apr mayjune july aug sept oct nov dec jan feb mar apr may jun jul aug sept oct nov dec jan feb mar

2011

2012

2013

(c) Foreign Reports Inc.

2014

3

The Post-November Perspective

"Big Six" Q1 2014 imports average 1.356 million b/d,

or 1/3 higher than six-month period before JPOA signing (1.018 million b/d)

1600

1400

1200

'000 b/d

1000

Taiwan

Turkey

800

South Korea

600

Japan

India

400

China

200

0

jan

feb

mar

apr

may

jun

jul

aug

sept

oct

2013

nov

dec

jan

feb

mar

2014

Foreign Reports

(c) Foreign Reports Inc.

4

The Post-November Issues

White House Fact sheet insisted that during the JPOA period, the six authorized

import jurisdictions would be held to their average levels of around 1 million b/d of

“oil” purchases prior to November 2013. In Q1, imports by these countries were 1/3

higher than average levels prior to the agreement.

•

•

•

•

If a “good” nuclear agreement is reached, it won’t matter if Iran was allowed to

export more.

If a “gray” agreement is reached, Administration will have a more difficult time

convincing Congress that it isn’t hiding something.

If no agreement is reached, it will be harder for Administration to come down “like

a ton of bricks” on Iran’s oil sales if core architecture of oil sanctions has already

been eroded.

Will Iran’s Supreme Leader conclude that Iran’s sitting at the negotiating table is

and will continue to be the best way to erode sanctions? Dilatory tactics have been

a staple of Iranian nuclear diplomacy for 11 years.

(c) Foreign Reports Inc.

5

Denials and Excuses

As the import data began to show that Iran’s sales were going up

sharply, the Obama Administration:

• Denied that the import data was accurate;

• Insisted that normal seasonal fluctuations were to blame; sharp

fluctuations are normal, but follow no seasonal pattern; and finally:

• Claimed that “technically” condensate, a type of crude oil, doesn’t

count as crude oil. This claim may have been based on memo from

State’s Legal Adviser.

• The net result: The U.S. has okayed a significant increase in Iranian

oil sales while insisting it hasn’t done so. End-May reports on April

imports could show some downward fluctuations in import levels,

but it’s best to wait for the final tallies. Early reports have proven to

be misleading. Ditto for end-June reports.

(c) Foreign Reports Inc.

6

Actual Total Volumes Officially Reported

(including condensates)

"Big Six" Q1 2014 imports average 1.356 million b/d. May-October 2013 average was 1.018 million b/d.

1,471

1700

1,246

1,142

1,118

1,007

894

jun

jul

762

810

900

898

1100

1,361

1,269

1,283

1,281

1,089

'000 b/d

1300

1,238

1500

700

500

jan

feb

mar

apr

may

aug

sept

2013

(c) Foreign Reports Inc.

oct

nov

dec

jan

feb

mar

2014

7

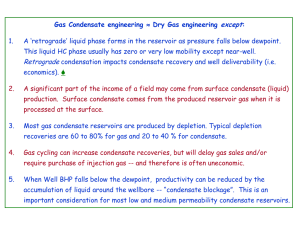

Condensates Don’t Count?

• State first said publicly on April 11 that condensates

don’t count. Did the Legal Adviser make this

determination? When and why? Was “L” being

sensitive to policy objectives?

• State counted condensates before—otherwise

average imports prior to November would be closer

to 800,000 b/d than 1 million b/d.

• Only Japan’s METI reports crude imports by grade—

and includes S Pars C as crude.

(For a number of reasons, UAE condensate imports of

about 100-120,000 b/d have never been counted.)

(c) Foreign Reports Inc.

8

What are condensates?

Condensates are byproducts of crude oil production

(lease condensates) and of natural gas processing

(plant condensates). They are gaseous at elevated

temperatures, liquids at normal temperatures. U.S.

producers can’t export them because they are

considered a kind of crude oil. They can be used to

supplement a crude oil stream, or sold as separate

products. They are mostly pentanes and heavier

hydrocarbons. They sell at rough parity to crude oil

and are processed at splitters, refineries and in

petrochemical plants.

(c) Foreign Reports Inc.

9

Condensates and LPG matter

Increase in condensate exports even sharper in Nov.-March period

Iran's "Non-Oil" Exports H1 and H2 of Iranian year ending on 3-20-2014

9

8

7

Value in $ billions

6

5

LPG

4

Condensate

3

2

1

0

Mar-Sep

Sep-Mar

Iran Customs Administration April 2014 Report

(c) Foreign Reports Inc.

10

Is Condensate Crude Oil under the

NDAA?

• The U.S. statute which imposed the core oil

sanctions—the National Defense Authorization Act

(2012)—requires that countries which import

petroleum or petroleum products from Iran be

sanctioned. NDAA 2012, Section 1245 (c)

• But it provides for the granting of 180-day exceptions

for countries which significantly reduce their purchases

of Iranian crude oil. NDAA 2012, Section 1245 (d)

• What, in practice, does this anomaly in the legislative

language mean? Could this anomaly be the legal basis

for saying that condensates don’t count?

(c) Foreign Reports Inc.

11

Reducing crude, increasing

condensate?

• Did Congress mean that Country X could make

significant reductions in its purchases of crude oil

while simultaneously increasing its purchases of

condensate and thus qualify for an exception?

• Condensate is often blended into a crude oil

stream to fetch a higher price, but it can just as

well be sold separately.

• Iran has said that it has increased its sales of

condensate (as a separate product) by 300,000

b/d since November.

(c) Foreign Reports Inc.

12

Waivers and Exceptions

• Exceptions to the NDAA were first granted to EU countries and

Japan in March 2012.

• State Department granted exceptions to China, India, South Korea,

Taiwan and Turkey in June 2012, and every 180 days thereafter.

• State exercised discretion allowed by NDAA in granting these

exceptions. State decided what constituted “significant reduction”

and gave effective latitude to a number of jurisdictions.

• National Security waivers were granted to Japan, China, India, South

Korea, Taiwan and Turkey on January 20, 2014 for a period of 120

days.

• The waivers “obviated” the need for more exceptions.

• The current waivers expire on May 20.

(c) Foreign Reports Inc.

13

Value of additional sanctions relief

The total estimated value of the relief is between $6

and $7 billion during JPOA period according to White

House Jan. 16 Summary:

• $4.2 billion by unfreezing assets in installments.

• Balance is estimate of auto parts, petrochemical,

etc. relief.

But 300,000 b/d of additional exports x 180

days x $100 = $5.4 billion. Did a memo from the

Legal Adviser give an extra $5.4 billion during

the JPOA period?

(c) Foreign Reports Inc.

14

What’s $5.4 billion mean for Iran and

for Ali Khamenei?

• The Rouhani government aims to save $5.5

billion per year by cutting cash subsidies to

better-off Iranians and increasing prices of

subsidized goods.

• $5.4 billion is value of 300,000 b/d additional oil

sales over six month period.

• Might this encourage Supreme Leader to believe

that sitting at the negotiating table is and will be

the best way to erode sanctions?

(c) Foreign Reports Inc.

15

What’s in it for Iran if it sells more oil and/or condensate, but the

money is still frozen in foreign banks?

No one can say for sure that all additional revenues will

be frozen*, but if so:

1. The oil is still monetized—better frozen assets than no

assets, and probably better than oil left in the ground.

2. Frozen funds can be freely used to buy products from

oil-importing countries.

3. Increased volumes give Iran a jump-start now on

securing more market share.

4. Iran also gets a jump-start in raising production.

*If condensate doesn’t count as crude, are revenues from its sale frozen?

How about revenues from export of pistachios?

(c) Foreign Reports Inc.

16

Possible motivation for permitting

higher oil sales?

• Create goodwill with Rouhani government and

nuclear negotiating team. Iran in turn may

give a little more than promised on the

nuclear side.

• Nuclear Agreement with Iran would be Obama

Administration’s most important foreign policy

triumph—if it is a sound one, without secret

concessions to Iran.

(c) Foreign Reports Inc.

17

Will Administration Need Congressional

approval for nuclear deal?

CHAIRMAN MENENDEZ: “Does the Administration intend to come back to the

Congress, if you have a final deal, for ultimately lifting some of the elements

that would be needed to be lifted under law?”

SECRETARY KERRY: “Well, of course. We would be obligated to under the law,

Mr. Chairman. We would absolutely have to. And so clearly, what we do will

have to pass muster with Congress. We well understand that.”

{April 8 testimony before Senate Foreign Relations Committee}

Possible Ways to Bypass Congress

•

•

•

Pure Executive Agreement with Iran would have to conform with Case Act plus rely on

existing 120-day national security waivers.

Short 120-day waivers would impose substantial burdens on Iran and never be

permanent.

Youngstown Sheet & Tube Co. v. Sawyer (1952) effectively limits president’s executive

authority if it clearly contravenes Congressional intent.

(c) Foreign Reports Inc.

18

Final Agreement—neither black nor white?

More transparency will be needed now.

• If there are gray areas in any final agreement, the

Administration will need credibility on key nuclear

issues in order “to pass muster with Congress.”

• A track record of obfuscating material facts about the

extent of sanctions relief could undermine

Administration’s credibility when it might need it most.

• Administration must renew waivers by May 20. It

would be a good time to be more transparent about

sanctions relief to date. If not, it could undermine

Congressional confidence that it won’t also try to

sweep material facts about the nuclear program under

the rug.

(c) Foreign Reports Inc.

19