PowerPoint: CHAPTER 2 – Business Cycles

advertisement

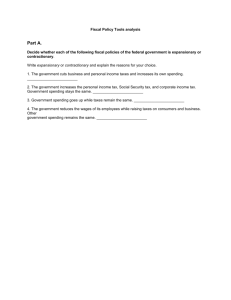

A time series that shows what happens to the value of the domestic output (GDP) of the economy over time. 2 schools of thought: Exogenous Endogenous • • • • Classical Economists – 19th century market economies are inherently stable Exogenous factors cause business cycle William Jevons sunspot theory – business cycle was caused by periodic changes in solar radiation Other exogenous variables • changes in the money supply, • government policies • technology – railways 19th century – radio communication in the 1920 – Internet in the1990s • John Maynard Keynes – Keynesian Theory • inherently unstable - caused by endogenous e.g. change in total spending. • An increase in total spending • period of expansion • reinforced by the multiplier • economy reaches its capacity (full employment) • firms decrease their investment spending • multiplier process goes into reverse • output of the economy to decline Followers of the endogenous theory believe that gov. SHOULD intervene to minimise effects of cycle. • Answer Activity 1 - pg 49 Q 1.1 – 1.4 • Answer Activity 2 - pg 52 Q 1.1 – 1.3 SA’s economic system based on Keynesian view so government intervenes. They apply policies to affect business cycles to ensure that: • economic growth (increase in real GDP) is maintained • inflation and unemployment are as low as possible • periods of expansion last as long as possible • periods of contraction last as short as possible • the troughs and peaks are smoothed out (the economy is more stable). Instruments at the gov’s disposal are… Fiscal policy: how the government’s budget is used to raise and spend money to influence economic activity. Contractionary Fiscal Policy Economy expanding too quickly increase taxation (leakage) decrease expenditure (injection) Consumption & Gov Spending fall Opposite is true for an expansionary fiscal policy Decreasing AD slows economy Monetary policy: policy of central bank regarding money supply and interest rates to influence economic activity. Supply of money influenced by… • Interest rates • Buying and selling of gov bonds • Increase/decrease cash reserve requirements of commercial banks • SARB governor can persuade commercial banks to lend less in booms and more in recessions. Expansionary Monetary Policy SARB decreases repo rate -interest rate follows More money is available Spending increases Demand increases Supply increases Economic activity increases Opposite is true for a contractionary monetary policy New economic paradigm: government focuses less on fine-tuning and more on eliminating uncertainties with regard to fiscal and monetary policy. WHY??? Fine tuning requires precise knowledge at the right time – not always possible. Instead… • Create ec stability • Encourage high rates of ec growth without inflation • Combine demand and supply-side policies Demand-side policies Supply-side policies Monetary policy Providing infrastructure Fiscal Policy Decreasing red tape Subsidies to firms Decrease corporate tax Improve quality and mobility of labour force Free business advisory services Review competition policy Answer Activity 3 – pg 56 Q 1.1 – 1.3 Leading indicators: change before the economy changes. • Warn of what we can expect in the future - economists use them to forecast. • Reach peaks/troughs a few months before the business cycle reaches Examples • volume of mining production • total number of new cars sold • share prices • number of new businesses registered Lagging indicators: change only after the economy has changed. • Indicate what has already happened in the economy. • Confirm direction of the economy. • Used to estimate whether individual indicators gave false signals. • Reach a peak/trough months after the business cycle Examples… • hours worked in construction • Employment • investment in capital goods Coincident indicators: change at the same time as the economy. • Information about the current situation of the economy. • Move simultaneously with the economy. • Reach peak/trough at the same time as the business cycle • Used to compile business cycle. Examples … • real GDP • Unemployment • volume of manufacturing • production Done using quantitative or qualitative scientific methods Quantitative method based on mathematical models, statistics and historical time series data. By using moving averages (purple line), we can smooth out volatile data (blue line) and identify the trend more easily. This allows for more accurate extrapolation of the trend (red line). Answer Activity 4 – pg 60 Q 1 – 3