Illinois County School Facility Tax - Stewardson

advertisement

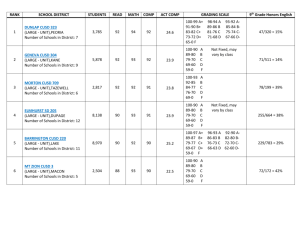

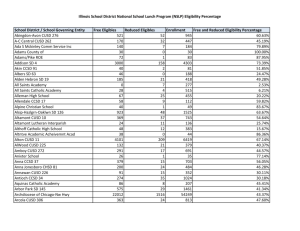

ILLINOIS SCHOOL FACILITIES OCCUPATION TAX On the March 18, 2014 Election Ballot In Shelby County WHAT IS THE SHELBY COUNTY SCHOOL FACILITY OCCUPATION TAX? Shelby County has placed on the March 18, 2014 ballot a question requesting implementation of a 1% sales tax for funding to be used exclusively for school facility purposes. New approach for Illinois to fund school facility needs Allows county voters to approve a sales tax to fund school facility costs rather than property tax HOW DID IT GET ON THE BALLOT? State law passed in 2007 and amended in 2011 As a result of resolutions to the Shelby County Board by School Boards representing more than 51% of the student residents of Shelby County Resolutions were adopted by Central A & M Beecher City Cowden – Herrick Neoga Okaw Valley Pana Stewardson – Strasburg Shelbyville WHAT IS TAXED OR NOT TAXED? Tax is imposed on the same general merchandise as state sales tax with exceptions Exceptions Include Personal Property that is titled or registered (Cars, Trucks, Boats, Motorcycles, Trailers, Snowmobiles, RVs, Aircrafts, Etc.) Farm Equipment, Parts, and Inputs like fertilizer and seed, etc. Unprepared Food intended for home consumption Prescription & Non-Prescription Medicines, Drugs, Medical Supplies It doesn’t tax anything that isn’t currently taxed WHAT CAN REVENUES BE USED FOR? School Facility Purposes Ongoing Maintenance, Demolition, Additions, & Renovations Land Acquisition, Architectural Planning, Non-Moveable Equipment Fire Prevention and Life Safety Projects Disabled Access & Security New Facilities Section 17-2.11 of the School Code Abatement of Property Taxes Levied to Pay Bonds Issued for Capital Purposes REVENUES MAY NOT BE USED FOR … Operating Costs, utilities, supplies Salaries, Benefits Buses, Trucks, Mowers etc. Detached Furniture & Fixtures, Computers Moveable Equipment WHAT COUNTIES HAVE PASSED THIS TAX? 18 Counties have already passed CSFT 10 Counties are considering placing it on the ballot Nearby Counties with CSFT: Macon Champaign County where the CSFT has been passed Douglas Christian County where the CSFT is being discussed Spring 2011 Voted Against in Shelby County 47%Yes 53% No WHAT ARE AREA SALES TAX RATES? City Sales Tax Rate (Illinois Base Rate is 6.25%) Additional Notes Bloomington 7.75% ChampaignUrbana 9.00% Charleston 6.75% Decatur 9.00% CSFT Effingham 6.5% 7.5% in Business District Forsyth 8.5% CSFT Mattoon 6.75% 7.75% in Business District Shelbyville 6.25% 7.25% in Business District Springfield 8.25% 9.25% in Business District Taylorville 7.00% CSFT Tuscola 7.75% CSFT CSFT HOW IS THE MONEY DISBURSED? The money follows the students. If voter approved the tax would generate slightly over 1 million dollars county-wide. The Department of Revenue collects the tax. The Regional Office of education disburses the proceeds to each district in Shelby County based on the number of students residing in Shelby County. ESTIMATED REVENUE FOR SCHOOLS # of Students in Shelby Co. % of total Shelby Co. Students Est. District share of School Facility Sales Tax Beecher City CUSD #20 20 .59% $6,159 Central A&M CUSD #21 474 14.02% $145,972 Cowden-Herrick CUSD #3A 347 10.26% $106,861 1 0.03% $308 Neoga CUSD #3 142 4.20% $43,730 Okaw Valley CUSD #302 173 5.12% $53,277 Pana CUSD #8 217 6.42% $66,827 Ramsey CUSD #204 4 0.12% $1,232 Shelbyville CUSD #4 1,276 37.73% $392,954 361 10.67% $111,173 Sullivan CUSD #300 1 0.03% $308 Teutopolis CUSD #50 20 0.59% $6,159 346 10.23% $106,553 District Name Mattoon CUSD #2 Stewardson-Strasburg Windsor CUSD #1 HOW WILL THE STEWARDSON-STRASBURG SCHOOL DISTRICT USE THE REVENUE? Abate a portion of the revenue back to district tax payers through lowering tax rate for Bonds and Interest Maintain facility and complete updates to increase energy efficiency Tuck point brick Replace entrance doors and update security and safety of building Michele Lindenmeyer 217-682-3355 ext. 221 mlindenmeyer@stew-stras.org QUESTIONS?