Deficit Reduction Plan Guidelines CSEA (ASU, OSU

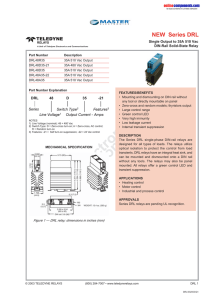

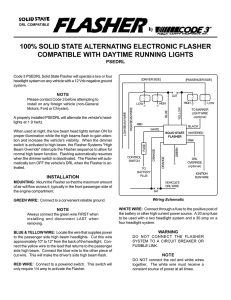

advertisement

Informational Session Presented by SUNY Canton Human Resources & Payroll August 31, 2011 First check - September 14, 2011 3.333% reduction 15 biweekly pay periods DRL (time-off) available for use 9/15/11 Credited 5 days based on work % D1C - 11-12 Deficit Reduction CSEA (automatically calculated by NYS) A1C - 11-12 Adjustment Deficit Reduction (automatically calculated by NYS i.e. inconvenience pay) D2C - 11-12 Deficit Adjustment (calculated by Payroll i.e. Holiday, Extra Service) •Longevity Payments •Lost Time •Lump Sum Payments for Accruals •Overtime Pay •Extra Service •Holiday Pay •Night Differential Pay Check City can help you get an idea what your check will look like. www.paycheckcity.com To use DRL credits you must: • provide reasonable advance notice of time-off request •use in ¼ hour units DRL credits may not be used to cover unscheduled absences such as calling in sick When completing time sheet use code DRL Employees will be repaid the value of the 4 days deducted in 2012-2013 in equal installments starting at the end of the contract term (2016) •All DRL credits must be exhausted by close of business 3/31/12 or forfeited. •Vacation balances may not exceed 45 days by 4/1/12 If you leave NYS service and have already taken the DRL time off, we are required to retrieve the money (pro-rated) The DRP provides an important part of the recurring $450 million Financial Plan savings; this savings must not be offset by additional and unanticipated overtime expenses. No general salary increases: 2011-12 2012-13 2013-14 2% 2014-15 2015-16 Performance Advances, longevity and retention payments will continue. Current employees who remain active through 2013 will earn a one time retention payment: $775 in 2013 $225 in 2014 •Grade 9 and below $32.09 individual (+$4.08) $128.08 family (+$10.34) •Grade 10 and above $42.79 individual (+$14.78) $153.00 family (+$35.26) Special Option Transfer Period ◦ 9/1/11-9/30/11 Changes in Co-pays 10/1/11 •Productivity Enhancement Program has increased to up 6 days of annual leave for $1000 to be used towards health insurance premiums. Employees electing to opt out of health insurance: $1000-individual $3000-family Proof of alternative coverage required The Actuarial Life Expectancy Table used to calculate the value of sick leave credit has been updated to effect those who retire on or after October 1, 2011 Questions?