项目4: 信用证

advertisement

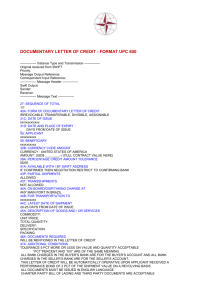

英文单证 项目教学四 课题:Letter of Credit 学习目标: 1. Understand the exact meaning of terms and conditions in an L/C 2.English used in formal L/C 3. Structure of an L/C 学习内容: (一)What is letter of Credit? It’s a kind of written document issued by a bank on application of the importer in which the bank promises to pay on certain conditions. (二)What is the relationship between L/C and the Contract? L/C is opened against a contract. Upon it is accepted, it becomes an independent document and will not be subject to the contract any more. (三)Kinds of L/C 信用证的种类 revocable L/C/irrevocable L/C 可撤销信用证/不可撤销信用证 confirmed L/C/unconfirmed L/C 保兑信用证/不保兑信用证 sight L/C/usance L/C 即期信用证/远期信用证 Banker’s acceptance credit 银行承兑信用证 Deferred payment credit 延期付款信用证 transferable L/C(or)assignable L/C(or)transmissible L/C /non-transferable L/C 可转让信用证/不可转让信用证 divisible L/C/indivisible L/C 可分割信用证/不可分割信用证 revolving L/C 循环信用证 L/C with T/T reimbursement clause 带电汇条款信用证 L/C without recourse / L/C with recourse 无追索权信用证/有追索权信用证 documentary L/C/clean L/C 跟单信用证/光票信用证 deferred payment L/C/anticipatory L/C 延期付款信用证/预支信用证 back to back L/Reciprocal L/C 对背信用证/对开信用证 Usance L/C payable at sight or Buyer’s usance L/C 假远期L/C或买方远期L/C (四)Basic content of an L/C 信用证的基本内容 1. Parties concerned in an L/C 1) applicant/for account of/accountee orderer / opener/in the name of /at request of/you are authorized to draw on 2) issuing/establishing/opening bank advising bank 通知行 notifying bank 通知行 advised through…bank 通过……银行通知 advised by airmail/cable through…bank 通过……银行航空信/电通知 be advised through/transmitted through negotiating bank/available with 通知行一般为议付行 (一般是开证行的correspondent bank往来行) 3) beneficiary/in favor of/in one’s favor/favoring 4) reimbursement bank/reimbursing bank 5) paying bank/accepting bank 2. Details of the L/C itself 1) Categories/form/kinds of the L/C: irrevocable /documentary/sight L/C 2) L/C No./Our Ref. No 3) Amount of the L/C 信用证金额 4) … L/C dated/ Date /issuing date/ issuing date and place/date and place of issue Issuing date and place 5) Validity of L/C 6) Drawn clause 7) About Shipping Documents 8) About description of goods 9) About shipment/shipment clause 10) About banking charges 11) Discrepancy clause 12) Reimbursement clause 13) Soft conditions 14) Type of payment availability (五)L/C verification & notification What should the advising bank check? 1)Whether the background of the issuing bank is sound or not; 2)Whether the credit standing of the issuing bank is sound or not; 3)Whether there is the undertaking clause or whether it is clear and definite; 4)Whether the credit has become effective or not. 5)Whether it bears the date and place of expiry and date or period of presenting the documents to the relevant bank. 6)Check some special clauses. (六) 外贸公司负责审证要点 The key points relating to the checking of an L/C : 1) the kind of L/C required, e.g. whether it is “Confirmed” or “Uncomfirmed”, “ transferable” or “Non-transferable”; 2) the latest date of negotiation or the expiry date of the L/C, whether it is sufficient to present the documents and draft to the bank. 3) the latest day of shipment, whether it is sufficient to dispatch the shipment. 4) the amount of the L/C, whether it is sufficient to cover the shipment. 5) the names and addresses are complete and spelled correctly. 6) the description of goods is correct. 7) the unit price of goods stated in the L/C conforms to the contract price. 8) the port of loading and the destination are correct. 9) partial shipment and transshipment are allowed or prohibited. 10) The type of risk and the amount of insurance coverage, if necessary. 1.根据UCP600的规定,信用证有效期适逢银行法定节假日或银行休息日,受益人 可顺延到下个银行工作日交单。 2.根据“UCP600”对修改信用证的规定的解释,对不可撤销信用证内容的修改应注意以下 问题: 1)一份信用证如有多处需要修改,应集中一次通知开证申请人办理修改,避免费用增加。 2)不可撤销信用证未经开证行、保兑行(如有的话)及受益人同意,既不能修改也 不能取消。 3)对同一信用证修改书的内容,受益人要么全部接受,要么全部拒绝,倘若仅接受部分 内容,视作无效。 能力拓展 实训操作: 根据所给合同内容修改信用证。