International PPt - Dublin City Schools

advertisement

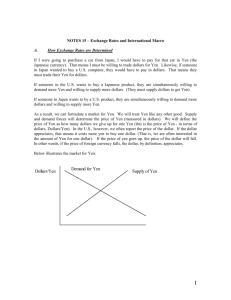

SSEIN1 The student will explain why individuals, businesses, and governments trade goods and services. a. Define and distinguish between absolute advantage and comparative advantage. b. Explain that most trade takes place because of comparative advantage in the production of a good or service. c. Explain the difference between balance of trade and balance of payments. a. Define and distinguish between absolute advantage and comparative advantage. absolute advantage The ability to produce more of a given product using a given amount of resources (not best guide for deciding who should do what; comparative advantage is better.) comparative advantage The ability to produce a product most efficiently given all the other products that could be produced- law of comparative state that the worker, firm, region, or country with the lowest opportunity cost of producing an output should specialize in that output Which country has the absolute advantage in producing each good? Sugar Fertilizer United States 80 100 Nicaragua 70 50 Total 150 150 Which country has the comparative advantage in producing each good? Sugar Fertilizer United States 80 100 Nicaragua 70 50 Total 150 150 Figuring out comparative advantage US Opportunity cost of producing sugar= ______ ?= blank is 100/80 or 10/8 ; ? is fertilizer Nicaragua Opportunity cost of producing sugar= ______? = blank is 50/70 or 5/7 ; ? is fertilizer US Opportunity cost of producing fertilizer = ______? = blank is 80/100 or 8/10 ; ? is sugar Nicaragua Opportunity cost of producing fertilizer = ______? = blank is 70/50 or 7/5 ; ? is sugar Lowest opportunity cost should specialize United States has lowest opportunity cost in producing fertilizer so they should specialize in producing that and export it so they can use the money to buy sugar Nicaragua has lowest opportunity cost in producing sugar so they should specialize in producing that and export it so they can use the money to buy fertilizer. b. Explain that most trade takes place because of comparative advantage in the production of a good or service. Each nation can use the money it earns selling the goods it produces efficiently to buy other goods it cannot produce efficiently. (more efficient and productive due to specialization) c. Explain the difference between balance of trade and balance of payments. Balance of trade is the relationship between a nation’s imports and its exports More exports than imports= trade surplus More imports than exports= trade deficit c. Explain the difference between balance of trade and balance of payments-continued. Balance of payments= the difference between the total amount of money coming into a nation and the total amount leaving Credits= Any transaction that brings money into a nation Debits= Any transaction that takes money out of a nation SSEIN2 The student will explain why countries sometimes erect trade barriers and sometimes advocate free trade. a. Define trade barriers as tariffs, quotas, embargoes, standards, and subsidies. b. Identify costs and benefits of trade barriers over time. c. List specific examples of trade barriers. d. List specific examples of trading blocks such as the EU, NAFTA, and ASEAN. e. Evaluate arguments for and against free trade. a. Define trade barriers as tariffs, quotas, embargoes, standards, and subsidies. Tariffs (ex. custom duty) A Tax on imported goods Quotas A limit on the number of any product entering the country Embargos an embargo is the prohibition of commerce and trade with a certain country. Standards something set up and established by authority as a rule for the measure of quantity, weight, extent, value, or quality Subsidies a gov’t payment that supports a business or market b. Identify costs and benefits of trade barriers over time. Costs >increased prices on foreign goods, trade wars, slows introduction of new goods and better technologies Benefits > job protection, protect infant industries, safeguard national security c. List specific examples of trade barriers. US government collects tariffs on imported steel and cars In the 1980s, the United States forced a limit on the number of cars that could be imported from Japan, in order to help American companies compete. US has maintained an embargo on imports from Cuba since 1961, after the Cuban leader, Fidel Castro, seized US property and embraced communism. The US might ban the import of fruit that has been sprayed with certain pesticides to protect the health of American consumers. The US government pays farmers to not cultivate some of their land to keep crop output low and crop prices high d. List specific examples of trading blocks such as the EU, NAFTA, and ASEAN. EU = European Union is a regional trade org made up of 27 European nations that share a currency called the euro NAFTA= North American Free Trade Agreement eliminates all tariffs and other trade barriers between Canada, Mexico, and the US ASEAN= The Association of Southeast Asian Nations or ASEAN. Now includes 10 nations: Brunei, Indonesia, Malaysia, the Philippines, Singapore, Thailand, Cambodia, Laos, Myanmar, and Vietnam. The ASEAN has eliminated most tariffs in this trading region. e. Evaluate arguments for and against free trade. Free trade Pros Free trade cons Lowers price of all goods Less Job protection Improves economic efficiency Inability to Protect infant and consumers of all nations a industries wide variety of goods introduction of new goods and Less Safeguard for national security better technologies SSEIN3 The student will explain how changes in exchange rates can have an impact on the purchasing power of individuals in the United States and in other countries. a. Define exchange rate as the price of one nation’s currency in terms of another nation’s currency. b. Locate information on exchange rates. c. Interpret exchange rate tables. d. Explain why, when exchange rates change, some groups benefit and others lose. a. Define exchange rate. the price of one nation’s currency in terms of another nation’s currency. b. Locate information on exchange rates. Consider the case of two grocery stores: Americo-store and Groceria Mexicana. Americo-store is in Brownsville, Texas, while Groceria Mexicana is right across the border in Matamoros, Mexico. Suppose a bank on the U.S. side of the border—perhaps the Apple Saving and Loan bank— published the following exchange rate table. Ex. Exchange rate table: U.S. Dollar, end of Year 1 One U.S. dollar in U.S. dollars British pound 0.49 2.06 Danish krone 5.17 0.19 Euro 0.69 1.44 Japanese yen 114.69 0.0087 Mexican peso 10.71 0.093 Swiss franc 1.17 0.86 Thai baht 31.7 0.03 c. Interpret exchange rate tables. This shows that the exchange rate between the U.S. dollar and the Mexican peso is 1:10.71, meaning one U.S. dollar translates to 10.71 Mexican pesos. The second column, “in U.S. dollars,” shows how much would be needed to purchase one Mexican peso. This rate is 1:0.093, meaning 9 American cents— or 9 and 3/10 American cents, to be precise—translates to one Mexican peso. How to interpret exchange rates? How many pesos, will you need to buy a cap in a US store that costs $24? 1 US dollar = 10.71 pesos; so 24 x 10.71= 257.04 pesos How many Japanese yen, will you need to buy a cap in a US store that costs $24? 1 US dollar = 114.69 Japanese yen; so 24 x 114.69= 2,752.56 Japanese yen How many Euro, will you need to buy a cap in a US store that costs $24? 1 US dollar = 0.69 Euro; so 24 x 0.69= 16.56 Euro How to interpret exchange rates? Continued: So if a US citizen wanted to purchase a cap worth 100 pesos, how many US dollars would he/she need? 1 peso= 0.093 USD; so 100 x 0.093 USD= $9.30 USD If a US citizen wanted to purchase a cap worth 15 Euros, how many US dollars would he/she need? 1 Euro= 1.44 USD; 15 x 1.44 USD= $21.60 USD d. Explain why, when exchange rates change, some groups benefit and others lose. Exchange rates move up and down to reflect the value of one country’s currency in comparison to another. If there is a great demand for U.S. products, people need more U.S. dollars to purchase these goods. This drives the demand for U.S. dollars up, causing the dollar to appreciate, or strengthen. At the same time, the peso (or other foreign currency) has depreciated, or weakened, relative to the dollar. Suppose the following exchange rate is published one year after the previous one (see next page): Ex. Exchange rate table: U.S. Dollar, end of Year 2 One U.S. dollar in U.S. dollars British pound 0.52 1.92 Danish krone 4.83 0.21 Euro 0.67 1.49 Japanese yen 121.3 0.0082 Mexican peso 15.02 0.067 Swiss franc 1.06 0.94 Thai baht 36.8 0.027 Interpreting new exchange rates table The new exchange rate is 1:15.02, meaning the value of an American dollar now translates to 15.02 Mexican pesos. This leads to the big question: Which grocery store benefits from the new exchange rate? If you answered Groceria Mexicana, you would be correct. The appreciated dollar makes U.S. goods more expensive relative to their Mexican counterparts. The dollar can purchase more, but it also raises the price of U.S. goods. Some U.S. customers might take advantage of the stronger dollar and cross the border to shop at Groceria Mexicana, since their dollars are now worth 15.02 pesos instead of 10.71. Similarly, anyone converting pesos to dollars needs to pay 15.02 pesos for one dollar (rather than 10.71). In this case, when a person is converting dollars to pesos, his or her purchasing power has increased due to the new exchange rate. When a person is converting pesos to dollars, however, the stronger dollar lowers his or her purchasing power. Overall, business at Groceria Mexicana would increase while the Americo-store’s business would decline as some customers cross the border to take advantage of their strengthened currency. Effects of Currency Appreciation and Depreciation: When the dollar is strong, or appreciates: Imports increase and are cheaper for consumers to buy Travel abroad is cheaper for American tourists US exports decline The US trade deficit increases When the dollar is weak, or depreciates: US exports increase Travel abroad is more expensive for American tourists US imports decline and the price of imports increases The US trade balance improves Foreign investment in US business increases Sample Question Over the course of one year, the Japanese yen depreciates relative to the British pound. Who would benefit MOST from this occurrence? A British consumers of British goods B British consumers of Japanese goods C Japanese consumers of Japanese goods D Japanese consumers of British goods Answer to Sample Question The yen has depreciated, meaning that one British pound now purchases more yen than it did previously. This would help British consumers of Japanese goods, since they now have additional purchasing power in Japanese markets due to the stronger pound. The answer is choice B. More sample questions for international economics 1. A tariff placed on foreign steel imports represents A a barrier to trade B a balance of payment deficit C a subsidy to domestic producers D an increase in domestic production Answer to 1 1. Answer: A Standard: Issues concerning international trade Tariffs are taxes on imports. They often have the effect of helping domestic industries, so they might boost domestic production. First and foremost, though, they are a barrier to trade, since the added tax makes trading with that country less profitable. The answer is choice A. Sample question 2. Those in favor of protectionist trade policies would MOST likely A support a reduction in tariffs B call for fewer import restrictions C cite the need to preserve domestic industries D believe that restrictions harm consumers Answer to 2 2. Answer: C Standard: Issues concerning international trade Tariffs can help protect domestic industries by discouraging trade with other nations. Domestic workers who could be unemployed by lower-costing imports are now able to retain employment, and “infant” industries are protected. Therefore, choice C is the answer. However, the domestic consumers will face higher prices because of the tariff, and the tariff would also patch over the fact that their domestic business is unable to compete in a world market. Sample Question 3. In the country of Balmoria, it takes 9 hours of labor to harvest a bushel of wheat and 6 hours of labor to build a wooden bookcase. In the nearby country of Dashmund, it takes 8 hours of labor to harvest a bushel of wheat and 7 hours to build a wooden bookcase. In terms of labor on these identical goods, which statement describes the situation accurately? A Dashmund has an absolute advantage in both wheat and bookcases. B Balmoria has an absolute advantage in both wheat and bookcases. C Dashmund has a comparative advantage in wheat harvesting. D Balmoria has a comparative advantage in wheat harvesting. Answer to 3 3. Answer: C Standard: Advantages of international trade To answer this question, take each good and compare the labor required to produce it in both countries. For a bushel of wheat, Dashmund requires 8 hours of labor to Balmoria’s 9, so Dashmund has the absolute advantage there. This means choice B is incorrect. For bookcases, Dashmund requires 7 hours of labor to Balmoria’s 6, so Balmoria has the absolute advantage when it comes to bookcases. This eliminates choice A as an answer, leaving only choices C and D. Since Dashmund’s 8 hours of labor for wheat harvesting is lower than Balmoria’s 9 hours, Dashmund has the comparative advantage. Choice C is the answer. 4. Use this exchange rate table to answer the question. One U.S. dollar in U.S. dollars British pound 0.49 2.06 Danish krone 5.17 0.19 Euro 0.69 1.44 Japanese yen 114.69 0.0087 Mexican peso 10.71 0.093 Swiss franc 1.17 0.86 Thai baht 31.7 0.03 Which monetary amount is the closest equivalent to having two U.S. dollars? A 64 Thai baht B 57 Japanese yen C 0.7 Euro D 0.25 British pound Answer to 4 4. Answer: A Standard: Exchange rates The first column shows how much one U.S. dollar is worth in the various currencies.Looking down the column, you can see one U.S. dollar is worth about 32 Thai baht, meaning two dollars would be twice as much, or 64 baht.