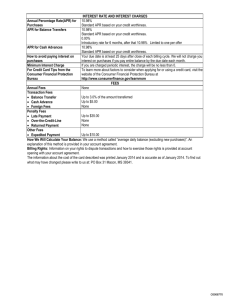

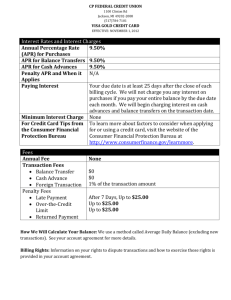

Regulation Z, 12 CFR § 226.12

advertisement

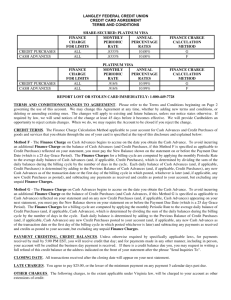

Payment Systems The Credit Card System Basic Concepts Basic Concepts Basic Concepts • Credit Card a dual purpose mechanism for: – Completing payments – Accessing credit Basic Concepts • Governing Law – Not the UCC (Article 4 excludes credit card slip from definition of item § 4-104(a)(9) ) – Common law of contracts – Truth in Lending Act • Regulates the extension of credit by making specified disclosures obligatory • Extends some rights to cardholders Basic Concepts • Issuing Bank: Issues the card in its name; extends credit up to the credit limit on the card; commits to pay charges (subject to certain rights of chargeback); bears risk of non-payment by cardholder Basic Concepts • Issuing Bank: Issues the card in its name; extends credit up to the credit limit on the card; commits to pay charges (subject to certain rights of chargeback); bears risk of non-payment by cardholder • Cardholder: Borrower from the Issuing Bank; obligated to pay charges Basic Concepts • Card Network: Visa and MasterCard; process payment slips and provide other technology for payment system function; association of banks and other participants • Merchant Bank: Bank who accepts a payment slip from a merchant, grants a credit and forwards for collection through card network • Merchant: Member of Network who accepts card as payment Basic Concepts Unauthorized Charges • TILA caps liability at $50 • Protection afforded to business use as well • Can avoid $50 if you report loss before unauthorized use • Card Network rules forgive $50 if reported within two business days • Businesses that issue cards to 10 or more employees can contract out (but can’t shift loss to employees) Problem 7-1 • Clark Consumer loaned his sister his bank charge card. She promised to charge no more than $200 worth of purchases. She ran up $1,800 so far and counting the charge slips mount each day. Issuer says Clark is liable. Is he? Basic Concepts Customer is liable for all “authorized charges.” TILA does not have any provisions for converting authorized use to unauthorized. Practical advice close down the card. • Note If the EFTA applied, §903(11) converts card use to “unauthorized” once the bank is notified. See EFTA§909(a) and Reg. E §205.6. Regulation E 12 CFR § 205.2(m). • “unauthorized” transfers (protected under Regulation E, 12 CFR § 205.6(a)) does not include any transfer initiated “[b]y a person who was furnished the access device * * * by the consumer.” Basic Concepts Who bears risk of loss for Unauthorized Charges • In face to face transactions the issuer if the merchant used right procedures • In remote (telephone, mail order, internet) the merchant Regulation Z, 12 CFR § 226.12 c) Right of cardholder to assert claims or defenses against card issuer 1) General rule. When a person who honors a credit card fails to resolve satisfactorily a dispute as to property or services purchased with the credit card in a consumer credit transaction, the cardholder may assert against the card issuer all claims (other than tort claims) and defenses arising out of the transaction and relating to the failure to resolve the dispute. The cardholder may withhold payment up to the amount of credit outstanding for the property or services that gave rise to the dispute and any finance or other charges imposed on that amount. Regulation Z, 12 CFR § 226.12 (3) Limitations. The rights stated in paragraphs (c)(l) and (2) of this section apply only if: (i) The cardholder has made a good faith attempt to resolve the dispute with the person honoring the credit card; and (ii) The amount of credit extended to obtain the property or services that result in the assertion of the claim or defense by the cardholder exceeds $50, and the disputed transaction occurred in the same state as the cardholder’s current designated address or, if not within the same state, within 100 miles from that address. Right to Withhold Payment • Consumer transaction • Dispute with the merchant unresolved after good faith attempt • Not yet paid credit card bill • 100 mile radius or sames tate Basic Concepts Billing Errors • TILA gives right to challenge billing errors • Billing error – Charge was not made or is for the wrong amount – Cardholder requests additional documentary evidence – Charge is for goods or services not accepted by or delivered to cardholder in accordance with agreement with merchant – Failure to credit a payment – Computational or accounting error – Failure to send a statement to the right address Basic Concepts Basic Concepts Basic Concepts Billing Errors Procedures • Issuer must send statement to cardholder at reported address • Cardholder must send a notice of billing error containing required information within 60 days of date statement was sent • Issuer must acknowledge within 30 days • Issuer must resolve within two billing cycles • To reject a claim as to goods or services issuer must conduct reasonable investigation to reject claim