Union Budget 2012-13:

Direct Tax amendments

Impact on the Real Estate sector

© Walker, Chandiok & Co. All rights reserved.

Union Budget 2012-13 | Impact on the Real Estate sector

2

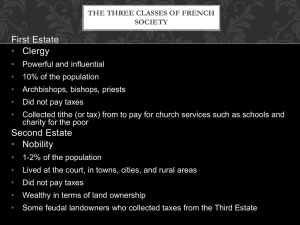

Tax rates - Personal

• Personal income-tax slabs proposed to be revised as under:

Existing Slab

(Rs)

Revised Slab

(Rs)

Tax rate (%)

Upto 180,000

Upto 200,000

NIL

180,001 to 500,000

200,001 to 500,000

10

500,001 to 800,000

500,001 to 1,000,000

20

Above 800,000

Above 1,000,000

30

• Minimum exemption limit for women changed from Rs 190,000 to Rs 200,000

(the category of women below the age of 60 years has been removed)

• Limits remain unchanged for senior citizens (age of 60 years and above but less

than 80 years) at Rs 250,000

• Limits remain unchanged for very senior citizen (age of 80 years and above) at

Rs 500,000

• Education Cess and Secondary and Higher Education Cess at 2% and 1%

respectively to continue

Union Budget 2012-13 | Impact on the Real Estate sector

Corporate Tax rates & GAAR

• No change in corporate tax rate

• No change in Minimum Alternate Tax ('MAT') rate (18.5%)

• No change in surcharge for domestic companies (5%)

• No change in surcharge on foreign companies (2%)

• Education Cess and Secondary and Higher Education Cess at 2% and 1%,

respectively to continue

• Concessional rate of 15% for dividend received from foreign subsidiary has been

extended by 1 more year

General Anti-Avoidance Rule (GAAR) introduced

• 'Impermissible avoidance arrangement' whose main purpose is to obtain a tax

benefit

• Onus lies with the tax payer to prove that the main purpose of the arrangement

was not to obtain tax benefit

• This will take effect from AY 2013-14 (FY 2012-13)

3

Union Budget 2012-13 | Impact on the Real Estate sector

Transfer Pricing provisions on domestic transactions

• Transfer Pricing guidelines proposed on "specified domestic transaction"

• Concept of "specified domestic transaction" proposed vide section 92BA

• Transfer Pricing applicable only when aggregate of "specified domestic

transactions" exceeds Rs 5 crores in the previous year

• Specified domestic transactions will be required to adhere to arms length price

• Following additional compliance will be required:

1. Maintenance and keeping of information and document

2. Certificate from CA in Form 3CEB

4

Union Budget 2012-13 | Impact on the Real Estate sector

Fair Market Value to be considered as “full value of

consideration”

• A new section 50D proposed to be inserted under capital gains provision

• Transactions where sales consideration is not ascertainable/indeterminate –

Fair Market Value (FMV) of capital asset on the date of transfer considered as

“full value of consideration”

• Transactions that may be effected

• Exchange

• Collaboration with land owners

5

Union Budget 2012-13 | Impact on the Real Estate sector

Transfer of certain immovable properties under Tax

Deducted at Source (TDS) net

• New section 194LAA is proposed – To deduct tax by way of TDS @ 1% on

consideration for transfer of immovable property (other than agricultural

land)

• Provision applicable (from 1 Oct 12) to any person transacting with resident

transferor

• Higher of actual consideration paid or stamp duty valuation would form the

basis for TDS

• TDS would get triggered where the consideration exceeds-

- Rs 50 lakhs if the property is situated in specified areas

- Rs 20 lakhs in case of other areas

6

Union Budget 2012-13 | Impact on the Real Estate sector

7

Amendment to Section 35AD – Investment based

deduction

Affordable Housing Project

Hotel owners/ operators

• Amendment to section 35AD where

weighted deduction of 150% of

capital expenditure is proposed in

affordable housing

• Currently deduction under section

35AD available to hotel owners

only if such owner himself

operates the same

• Proposed to be effective from

FY 2012-13

• Now proposed that hotel owners of

two star and above categories, will

get deduction of capital expenditure

even if such hotel owner transfers

the operations of hotel to

franchisee/hotel operator

• Amendment inserted

retrospectively with effect from 1

April 2011

Union Budget 2012-13 | Impact on the Real Estate sector

Clarification in connection with 'cost to previous owner'

• Amendment in Section 49 to define the cost of assets (“COA”)

• COA to company will be the cost to previous owner in the following cases:

Conversion of sole proprietor into company

Conversion of Firm into company

• Amendment to take effect retrospectively from assessment year 1999- 2000

8

Union Budget 2012-13 | Impact on the Real Estate sector

9

Direct tax proposals – Interplay of section 47 and 49

Firm merges with company

Third Party

Company records Capital

Asset in its books - Rs. 150

Sale of Capital asset @ 175

Company

Transfer between Firm to

Company – Not taxable

vide 47(v).

Firm

COA of Capital Asset is

books of Firm - Rs. 100

Capital Gain computation in the

hands of Company for sale of

Capital Asset

Sale consideration –

Rs. 175

Less: COA (section 49) – Rs. 100

Capital Gain

Rs. 75

Union Budget 2012-13 | Impact on the Real Estate sector

Beneficial tax rate for funding affordable housing projects

• Foreign currency loan to an Indian company

- in the business of developing and building a notified affordable housing

project

- loan taken between 1 July of 2012 and 2015

• TDS on interest at the beneficial rate of 5% (plus applicable surcharge and

cess)

• ECB to be allowed for funding notified affordable housing projects

10

Union Budget 2012-13 | Impact on the Real Estate sector

Clarification in relation to amalgamation and demerger

involving subsidiary

• Merger of subsidiary company into holding company - For tax neutrality,

consideration shares have to be issued to shareholders of the amalgamating

company

• Demerger of subsidiary company into holding company - Similarly for

demerger to be tax neutral, resultant entity has to issue shares to the

shareholders of the demerging entity

• The above conditions are impossible to achieve as the holding company could

not issue shares to itself

• The condition to issue shares in the above circumstances have been

dispensed with amendments proposed in Finance Bill 2012

11

Union Budget 2012-13 | Impact on the Real Estate sector

Removal of cascading effect of Dividend Distribution Tax

(DDT) in multi-tier structure

• Amendment to Section 115-O to remove the cascading effect of DDT in multitier corporate structure

• The condition of being “ultimate holding” removed for computing DDT to be

paid

• Amendment effective from 1 July 2012

• However for claiming the benefit the holding company is required to hold more

than 50% equity share in subsidiary company

12

Union Budget 2012-13 | Impact on the Real Estate sector

13

Removal of cascading effect of DDT in multi-tier

structure

Present situation

Proposed situation

Holding co.

Holding co.

Intermediate co.

Dividend – Rs. 100

DDT – Rs. 16.225

Intermediate co.

Subsidiary co.

Dividend – Rs. 100

DDT – Rs. 16.225

Subsidiary co.

DDT cost for the Group

– Rs. 32.45

DDT cost for the Group

– Rs. 16.225

Dividend – Rs. 100

DDT – NIL

Dividend – Rs. 100

DDT – Rs. 16.225

Union Budget 2012-13 | Impact on the Real Estate sector

14

Thank you

Our offices:

NEW DELHI

National Office

Outer Circle

L 41 Connaught Circus

New Delhi 110 001

T +91 11 4278 7070

CHENNAI

Arihant Nitco Park, 6th floor

No.90, Dr. Radhakrishnan Salai

Mylapore

Chennai 600 004

T +91 44 4294 0000

MUMBAI

16th floor, Indiabulls Finance Centre

Elphinstone Mill Compound

612/ 613, Senapati Bapat Marg

Elphinstone Road, Mumbai 400013

T +91 22 6626 2600

BENGALURU

“Wings”, First Floor

16/1 Cambridge Road

Halasuru

Bangalore 560 008

T +91 80 4243 0700

GURGAON

21st Floor, DLF Square

Jacaranda Marg

DLF Phase II

Gurgaon 122 002

T +91 124 462 8000

CHANDIGARH

SCO 17

2nd Floor

Sector 17 E

Chandigarh 160 017

T +91 172 4338 000

HYDERABAD

7th Floor, Block III

White House, Kundan Bagh

Begumpet

Hyderabad 500 016

T +91 40 6630 8200

PUNE

401 Century Arcade

Narangi Baug Road

Off Boat Club Road

Pune 411 001

T +91 20 4105 7000

© Walker, Chandiok & Co. All rights reserved.

Disclaimer:

This document is prepared for information purposes only. No reader should act on the basis of any statement contained herein without seeking

professional advice. The firm expressly disclaims all and any liability to any person who has read this, document or otherwise, in respect of anything,

and of consequences of anything done, or omitted to be done by any such person in reliance upon the contents of this document.