IEN workshop - part 4 (PPTx 1.92 mb)

advertisement

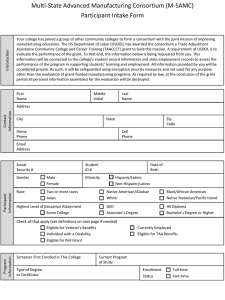

Carbon Pricing Mechanism Workshops Opt-in Scheme February 2013 Page 1 Disclaimer This presentation provides general information regarding the Opt-in Scheme. It is not intended to comprehensively cover all aspects of the scheme. Persons should refer to the relevant legislation relating to the Opt-in Scheme and in particular the Clean Energy Act 2011 (Clean Energy Act), the National Greenhouse and Energy Report Act 2007 (NGER Act), and their supporting Regulations. Changes to legislation may affect the information in this presentation. This presentation is not intended to provide legal advice. If persons have concerns or questions about the application of the Opt-in Scheme in their particular circumstances, they should seek professional advice. February 2013 Page 2 Overview of presentation • Summary of Opt-In Scheme • Eligibility process • Consent and the opt-in amount • Liable entity status • Key dates February 2013 Page 3 What is the Opt-in Scheme? • Users of large volumes of eligible liquid fuel can manage their carbon liability for emissions generated by this fuel use by participating in the Scheme. • This is instead of the payment of an equivalent carbon price through the fuel tax system. • Opt-in Scheme applies many of the concepts used by the ATO for fuel tax credits. February 2013 Page 4 Key points to note • Applications to opt-in for the 2013-14 financial year close on 2 April 2013. • The Opt-in Scheme is a 12-month commitment by participants. • Opting-in doesn’t affect liability for direct emissions. • Liability established under the Opt-in Scheme cannot be transferred (e.g. through an LTC). February 2013 Page 5 Legislative basis of Opt-in Scheme • Section 92A of the Clean Energy Act 2011 provides for the formulation of the Opt-in Scheme by the regulations. Under the Opt-in Scheme if a person is declared a designated opt-in person (DOIP) in relation to an amount of fuel and meets the other requirements of the Opt- in Scheme the person will be liable under the Act for the emissions embodied in that fuel. • The Clean Energy Regulations 2011 formulate the Opt-in Scheme and establish the conditions under which a person may be declared a DOIP and the administrative arrangements for opting-in and opting-out under the Opt-in Scheme. Page 6 Definition - eligible fuels • • Eligible fuels are petroleum-based and subject to excise or duty, and include: • Petrol • Diesel • Kerosene • Aviation kerosene • Aviation gasoline • Fuel oil • Heating oil • Diesel blends. An entity opts-in for all eligible fuel. February 2013 Page 7 Aviation Fuel and Fuel Tax Credits • Excise duty for aviation fuel is increased to take account of effective carbon price. • Entities who have opted in will receive a fuel tax credit for an amount equal to the carbon charge. • Users will need to register for fuel tax credits before 1 July 2013 in order to claim fuel tax credits for aviation fuel. February 2013 Page 8 Management of carbon liability – before Opt-in* *The fuel tax credit rates listed below and in the following slide are approximate rates only from 1 July 2013. February 2013 Page 9 Management of carbon liability – after Opt-in* *The fuel tax credit rates listed below and in the following slide are approximate rates only from 1 July 2013. February 2013 Page 10 Current status • The application form is available from the Clean Energy Regulator website. • Department of Climate Change and Energy Efficiency (DCCEE) is intending to release exposure draft regulations to amend National Greenhouse and Energy Reporting (NGER) Regulations for reporting of fuels covered by the Opt-in Scheme in early 2013. February 2013 Page 11 Application to be declared a DOIP • Application types • Application and eligibility requirements • Evidence requirements • Declaration by applicant’s executive officer (or equivalent) February 2013 Page 12 Application types Applications to be declared a DOIP may be received from: Single entity Representative member of a GST group GST group member as single entity, or GST joint venture operator of a GST joint venture. February 2013 Page 13 Application requirements • Valid applicant • Eligibility test • Threshold test February 2013 Page 14 Valid applicant • Applicant not a foreign person • Applicant not an individual • Other criteria: Applicant is the appropriate party as required by regulations Consent has been provided as and where required by regulations February 2013 Page 15 Eligibility Test Registered for fuel tax credits Acquiring, manufacturing or importing eligible fuel for use, not supply Eligible for fuel tax credit in respect of that fuel use Evidence requirements February 2013 Page 16 Eligible for fuel tax credit • For entities applying on their own behalf: Applicant (or DOIP) was entitled to a fuel tax credit in respect of fuel acquired, manufactured or imported for use at the start of the financial year February 2013 Page 17 Eligible for fuel tax credit • For GST Group Applicant (or DOIP) was the representative member of a GST group or a GST group member at the start of the financial year and Entity entitled to a fuel tax credit in respect of fuel acquired, manufactured or imported for use at the start of the financial year was the GST group and Fuel was acquired, manufactured or imported for use by a person who was a member of the GST group at the start of the financial year February 2013 Page 18 Impacts for GST groups – single member opt-in • The representative member of the GST group will still claim the fuel tax credits on behalf of the entire group, including the individual member that has opted-in. • The representative member will need to be able to ascertain what fuel was acquired by the individual member who has opted in, in order to apply the full fuel tax credit rate to that fuel. • The remaining fuel within the GST group will be subject to the rate reduced by the carbon charge as no other member has opted in. February 2013 Page 19 Eligible for fuel tax credit • For GST joint venture (GST JV) Applicant (or DOIP) was the operator of a GST JV at the start of the financial year and Entity entitled to a fuel tax credit in respect of fuel acquired, manufactured or imported for use at the start of the financial year was a participant in the GST JV or the operator of the GST JV and Fuel was acquired, manufactured or imported for use by a person who was a participant of the GST JV at the start of the financial year February 2013 Page 20 Threshold Test • Existing liable entity (or likelihood of becoming a future liable entity) OR • Eligible fuel(s) that if combusted would produce greenhouse gas emissions in excess of 25,000 tonnes CO2-e in an eligible financial year • Evidence requirements February 2013 Page 21 Existing liable entities • Applicant can pass Threshold Test where they are: On the Liable Entity Public Information Database (LEPID) in financial year before they apply or at the time they apply OR Likely to be liable entities in 2013-14 OR Would be a liable entity except for the transfer of liability through use of a liability transfer certificate February 2013 Page 22 Fuel use over the threshold • Eligible threshold fuel used for eligible purposes has potential greenhouse gas emissions of 25,000 tonnes CO2-e In previous 2 financial years prior to application for participation in Opt-In Scheme OR Likely use in financial year for which application to participate in Opt-In Scheme is intended • Eligible purposes or uses do NOT include on-road transport, agriculture, fisheries or forestry February 2013 Page 23 Calculating fuel use • GST group All eligible uses of eligible fuel by all GST group members • GST joint venture (GST JV) All eligible uses of eligible fuel by all GST JV participants February 2013 Page 24 Consent • Consent is effectively ‘consent and guarantee’. • The consenter is both: consenting to the application by the prospective DOIP, and providing a guarantee of payment for the carbon charge liability that might arise under the Opt-in Scheme. • If the DOIP fails to acquit this liability, the parties that gave consent to the application for declaration become jointly and severally liable for any outstanding charges. February 2013 Page 25 Eligibility assessment DOIP on own behalf: Regulator checks: Valid applicant Legal Personality Eligibility Test + Entitlement to fuel tax credit Threshold Test + Emissions Threshold • Not a foreign person • Registered for fuel tax credit • CPM liable entity, or • Not an individual • Acquired, manufactured or imported eligible fuel in relevant financial year • Eligible fuel(s) that if combusted would produce greenhouse emissions in excess of 25,000 tonnes CO2 –e ALL OTHER APPLICANTS: Legal Personality + Entitlement to fuel tax credit + Emissions Threshold February 2013 + Consents Page 26 Opt-in amount • The opt-in amount is the total quantity of eligible fuel manufactured, acquired or imported for use by all members or participants at the start of the financial year. • Only a GST group can submit a request for variation of the opt-in amount and only where this is caused by the departure of a group member. February 2013 Page 27 Liable entity status • A DOIP becomes a liable entity under the Clean Energy Act 2011 and will have a reporting obligation under the NGER Act 2007 • There are registration requirements under the NGER Act • The entity will be placed on the LEPID • As a new liable entity, the DOIP will need to apply for an Australian National Registry of Emissions Units (ANREU) account February 2013 Page 28 Administrative duties • Advise the Clean Energy Regulator of changes to membership • Provide annual confirmation of status and eligibility to participate in the Scheme (14 July) • All record-keeping in respect of claims made under the Opt-in Scheme; records are to be kept for 5 years February 2013 Page 29 Reporting duties • The DOIP is responsible for providing reports to the Clean Energy Regulator in accordance with sections: 22AA of the NGER Act – by 15 June, and 22A of the NGER Act – by 31 October. • Additional regulations for reporting will be available in early 2013 February 2013 Page 30 Opting out • A DOIP can notify the Clean Energy Regulator its intention to opt out by 31 May each year. • The Clean Energy Regulator can also opt out a DOIP under certain circumstances including: No longer meeting eligibility or threshold tests Failure to report as required February 2013 Page 31 Event Scheme Development & Initial Application Late Jan 2013 Opt-in Scheme application form available Early 2013 National Greenhouse and Energy Reporting (NGER) Regulations will be made to establish reporting obligations of DOIPs (Designated Opt-In Persons) 02 April 2013 Deadline for DOIP applications for FY 2013-14 – midnight AEDT 01 July 2013 Opt-in Scheme commences 31 May 2014 Last day to opt-out of Scheme for 2014-15 15 June 2014 NGER reporting deadline – Interim Emissions Number and surrender of eligible emissions units for interim liability 14 July 2014 Deadline for Annual Notification by DOIP of eligibility and ongoing participation in Scheme for 2014-15 31 Oct 2014 NGER reporting deadline including Opt-in reporting obligations for FY 2013-14 01 Feb 2015 Deadline for surrender of eligible emissions units for final liability for FY 2013-14 First Acquittal Period Date First Year of Opt-In Scheme Key Dates – First Year of Opt-In February 2013 Page 32 Useful URLs and other information For Information on URL Carbon Pricing Mechanism www.cleanenergyregulator.gov.au Click the appropriate tab or search for specific term Fuel Tax Credits www.ato.gov.au Search for “Fuel Tax Credits” Call Centre 1 300 553 542 February 2013 Page 33