How to Prepare a

Proposal Budget

CReATE

CReATE ver. 5/13

© 2013 Florida State University. All rights reserved

Areas to Consider

Direct Costs

Indirect/F&A Costs or “overhead”

Defining the Base for F&A costs

Hot Topics:

Cost Sharing

Equipment/Supplies

C.A.S. exemption items

Direct Costs

Direct costs are those costs that can be

identified specifically with a particular

sponsored project, an instructional activity, or

any other institutional activity, or that can be

directly assigned to such activities relatively

easily with a high degree of accuracy.

F&A Costs

Indirect costs are those that are incurred for

common or joint objectives and, therefore,

cannot be identified readily and

specifically with a particular sponsored

project, an instructional activity, or any other

institutional activity.

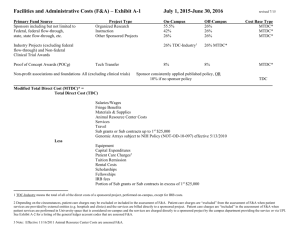

F&A - MTDC

Modified Total Direct Cost (MTDC) Base

includes all direct costs except:

equipment, capital expenditures,

charges for patient care, tuition remission,

rental costs of off-site facilities,

scholarships, fellowships,

and the portion of each subcontract in

excess of $25,000.

Primarily used for Federally-funded projects

F&A - TDC

Total Direct Cost (TDC) Base – includes all

direct costs except tuition

FSU’s policy is to exclude tuition from all

indirect costs

TDC Base primarily used for State of Florida

agencies

Also used for Local Florida Governments and

Florida Water Management Districts

F&A Rates Set by:

Type of Agency

Location of Project

(on/off

campus/Mag Lab)

Type of Project

Solicitation

Current Policy - Use FSU negotiated rate http://www.research.fsu.edu/contractsgrants/

documents/rateagreement.pdf

Types of Projects

Research: A systematic study directed toward

fuller scientific knowledge and understanding

gained of the subject studied

Instruction: The teaching and training activities

of an institution

Other Sponsored Activity: This includes

programs and projects which involve the

performance of work other than instruction or

organized research

MTDC (federal) TDC (State FL)

*OnRes –51.3% OnRes – 10%

Salaries

Equipment

Supplies

Publications

Tuition

Total Direct

MTDC Base

Indirect Costs

Total Requested

$50,000

$50,000

$10,000

$10,000

$3,000

$3,000

$2,000

$2,000

$12,529

$12,529

$77,529

$77,529

$55,000 TDC $65,000

$28,215

$6,500

$105,744

$84,029

9

Cost Sharing

Costing sharing or matching is that portion of

project costs not borne by the sponsor.

A cost sharing commitment means any cost

sharing included and quantified (e.g., % of

effort and/or dollar amount) in the proposal

budget, proposal narrative or award

document.

Project enhancement means describing

"resources that are available" for the project

but are not quantified in the proposal budget,

narrative or other documents.

10

FSU Cost Sharing Policy

• Make a cost sharing commitment only when

required by the sponsor or by the competitive

nature of the award. Cost share only to the

extent necessary to meet the specific

requirements of the sponsored project.

• If the PI requests an exception to this policy,

s/he must get the Chair, Dean and VPR

approval.

• Cost sharing is approved at the proposal

stage.

11

Personnel

Salaries & Wages

Include faculty, technicians, post-docs,

graduate students, & other personnel who are

required to work on the project

We recommend that you include a 3% salary

escalation factor each year

NOTE: On federal projects, administrative &

clerical personnel are normally treated as

indirect costs and cannot be direct charged.

Personnel

Salary

Annual Salary X %FTE

Bi-weekly salary X %FTE X No. of pay periods

OPS (Temporary employees, i.e., graduate

students*, student aides, post-docs, other staff)

Bi-weekly salary X % FTE X No. of pay periods

Pay Periods

9 mo faculty – Academic Yr 19.5 Summer 6.5

12 mo faculty & all other classifications 26.1

GA’s Health Insurance Subsidy is considered as Salary

Supplement

.50 FTE & above = $900; .25-.49 FTE = $450

Personnel

Salary Calculation

PI 9 month salary = $75,000

19.5 pay periods in academic year

6.5 pay periods in Summer Semester

$75,000 ÷ 19.5 = $3,846.15 b/w rate

PI plans to work 15% FTE on project during

summer semester

$3,846.15 X 6.5 X 15% = $3,750.00

Fringe Benefit Rates

Retirement

FRS Pension Plan

5.18%

FRS Investment Plan

5.18%

ORP

5.64%

DROP

5.44%

Social Security

6.20%

Medicare

1.45%

Workers’ Comp & Unemployment 0.7%

Terminal Leave Pool

1.3%

FB Composite Rates*

Faculty/A&P/USPS under FRS

Pension/Investment Plan

14.83%

Faculty/A&P under ORP

15.29%

Faculty/A&P/USPS under DROP

15.09%

OPS Students

0.70%

OPS Non-students & Post-Docs

2.15%

*Effective 7/01/2012

Health Insurance*

Individual

$250/bw**

$5,998/yr

Family

$532/bw**

$12,760/yr

Spouse

$303/bw**

$7,280/yr

*Rates Effective 7/01/2012

**Calculated on 24 pay periods

Note: 9 month faculty deductions for health insurance

are made during regular academic year

FB Calculation

Same PI - $75K Academic Yr / $3,846.15 b/w

Salary calculated for budget = $3,750.00

PI has ORP retirement plan and family health ins

$3,750.00 X 15.29% = $573.38

Total FBs & Health = $573.38

No health deductions during summer for 9-month

faculty

Consultants

Outside individuals with expertise and skills that will

add value to project

Normally, faculty & other FSU staff should not be

paid as consultants

Costs are usually calculated in terms of daily rate

Certain sponsors may limit the daily rate

Consultant costs should be listed in ‘Other’ category

Equipment – A-21

(2) "Equipment" means an article of

nonexpendable, tangible personal

property having a useful life of more than

one year and an acquisition cost which

equals or exceeds the lesser of the

capitalization level established by the

institution for financial statement

purposes, or $5,000.

Equipment

Items costing $5,000 or more with a useful life

of 1 year or more

Equipment should be detailed in the budget

Requests should only include those items of

equipment required to complete the project

Equipment

IT Equipment Purchases – Memorandum

from VPR – July 2012

http://www.research.fsu.edu/contractsgrants/d

ocuments/ITguide.pdf

*Federal/Federal flow-through: equipment

threshold is $5,000

All other funding sources: equipment threshold

remains at $1,000.00 per piece of equipment

Equipment – A-21

(4) "General purpose equipment” means

equipment, which is not limited to research,

medical, scientific or other technical activities.

• Examples include office equipment and

furnishings, modular offices, telephone

networks, information technology equipment

and systems, air conditioning equipment,

reproduction and printing equipment, and motor

vehicles.

• Cannot be charged as a direct cost unless

approved in advance by awarding agency

Supplies

Supplies and materials related to the project

Can be listed in budget as broad categories such as

glassware, chemicals or art supplies

Minor equipment costing < $5,000

If the equipment item costs $1,000 to $4,999 and has

a useful life of a year or more, then it is excluded from

the indirect cost base when calculating indirect costs

from non-Federal sponsors

NOTE: On Federal projects, routine office supplies are

normally treated as indirect costs and cannot be direct

charged (paper, pencils, post-it notes, etc.)

24

C.A.S. Exemptions

•

In exceptional circumstances it may be appropriate to charge F&A

costs directly to a sponsored project.

•

If the nature of a sponsored project requires an extensive amount of

administrative and/or clerical support or goods/services significantly

greater than the routine level provided by an academic department,

then the effort is deemed an exceptional circumstance and such

costs can be accounted for as direct costs.

•

An Exemption is REQUIRED to direct charge administrative and

clerical salaries and other administrative-type expenses.

•

In addition to meeting definition of exceptional circumstances, costs

must be specifically identifiable to a particular sponsored project, be

reasonable, allowable and allocable.

25

C.A.S. Exemptions

• CAS exemption must be approved at the proposal

stage. Approval allows for charges normally classified

as F&A to be charged directly to a project

• Complete CAS form w/PI, Chair & Dean signatures

• http://www.research.fsu.edu/contractsgrants/forms.html

• Submit to Sponsored Research Office

NOTE: FSU (SR) approves the C.A.S. exemption;

agency approval is not adequate - FSU is audited on

these items

26

Travel

Project-related travel may include trips

necessary to collect data, to present findings

at professional meetings, for meetings with

program officers or collaborators, etc.

Agencies require detailed estimates for the

funds requested such as airfare, hotels, car

rental, etc.

Reimbursement of costs should be consistent

with FSU’s travel policies

FSU Travel Rates

Per diem is $80 per day or

Breakfast = $6

Lunch = $11

Dinner = $19

Mileage = $.445 per mile

Allowable room rates, incidental expenses,

etc.

Subawards/Subcontracts

Represents a collaboration of work by one or more other

institutions

Contractual agreements for services or goods with an

outside party are not included in this category

Costs for subawardee is presented in a separate line item

and should include both the subawardee’s direct and F&A

costs

A subaward detailed budget should be included as part of

budget justification

Subawardee’s F&A costs are calculated in accordance

with subawardee’s negotiated F&A rate agreement

Subcontracts

If a collaboration is proposed, the

following is required:

Letter of commitment from the

institution’s Sponsored Program Office

(not PI)

Scope of work for their activities

Budget

Budget Justification

30

Other Direct Costs

This category contains all other proposal

costs, i.e., animal per diems, publication

charges, graphic fees, matriculation,

communications, shipping, consultants, etc.

Postage, local telephone, and memberships

are normally considered F&A costs and

cannot be direct charged (for Federal

projects)

Matriculation

Matriculation costs (minimum of 9 hrs/semester)

should be included for graduate assistants

supported by the project

Graduate Matriculation Rate for FY13-14 is

$464.04/cr hr or $12,529 for 27 hours (in-state)

If matriculation costs are not included in budget, an

alternate source of payment must be identified

(Waiver 2 or 3 on transmittal form)

FSU excludes matriculation from F&A calculations

in all proposals

32

Matriculation

Multiyear proposals should include an annual 15%

escalation factor in matriculation costs

Out of state matriculation is not an allowable cost in

most circumstances

College of Engineering may apply out of state rates

to their proposals

Certain training grants allow out of state

matriculation. Review sponsor guidelines

Fees are not an allowable cost unless applying for a

training grant

Recap - Budget

Calculation

Federal Sponsor - NIH

Modified Total Direct Cost Base

Research will be conducted on campus

On-campus Research negotiated F&A rate – 51.3%

F&A Calculation

Total Direct Costs = $172,529

Salaries/FBs

$97,000.00

Equipment

$10,000.00

Supplies

$ 3,000.00

Tuition

$12,529.00

Subcontract

$50,000.00

Base $97K + 3K +25K = $125,000

F&A $125,000 X 51.3% = $64,125

Total request from sponsor = $236,654

Questions