Relocation Expenses - University of Georgia

advertisement

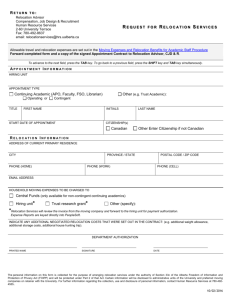

Mark Kent Policy Background Eligibility Relocation Package Payment/Reimbursement Guidelines Common Mistakes Adequate Documentation Year-End Reporting Resources Board of Regents (BOR) - September 2007 University of Georgia - February 2008 BOR policy added to BPM – July 2008 FAPP ◦ Controller’s Division ◦ Relocation and Moving Expenses http://www.policies.uga.edu/FA/nodes/view/1051/ This link includes: Policy Procedure Forms and Documents Frequently Asked Questions Helpful Tips IRS Publication 521 http://www.irs.gov/publications/p521/ix01.html Move related to start of work Time Distance ◦ Within one year after report to work unless extenuating circumstances ◦ work full-time in the area of the new workplace for at least 39 weeks during the 12 months immediately after the move ◦ Academic payroll : full-time equals Fall and Spring semesters (one academic year) ◦ new work >50 miles farther from former home than the old workplace Professor X worked 25 miles from his old home. The former home is 225 miles from the new work place. 1. 2. 3. Enter the number of miles from your old home to your new workplace: 225 miles Enter the number of miles from your old home to your old workplace: 25 miles Subtract line 2 from line 1: 200 miles (If zero or less, enter -0-) Is line 3 at least 50 miles? □ Yes. You meet this test. □ No. You do not meet this test. You cannot deduct your moving expenses. Original offer letter ◦ Must contain formal, specific amount for relocation ◦ Post-offer negotiated amounts will be considered a violation of the Gratuities clause of the Constitution of the State of Georgia Full-time salaried position ◦ 1 year Original with specific amount for relocation and/or house hunting Show acceptance by new employee with an original signature and date of signature Moving agreement should be sent at the same time as offer letter to be signed Date of letter and acceptance must be PRIOR to any expenses related to relocation Lab and office must be listed as separate amount 1. 2. Letter of Offer ◦ Specific dollar amount for relocation in original offer Relocation and Moving Expense Agreement ◦ Must be signed by employee, department head, and Dean/Vice President ◦ If $15,000 or more – must be signed by Senior VP 3. Relocation Expense Authority (REA) ◦ Contains pre-printed control number for tracking payments ◦ Funding source/authorization of funds **No expenses may be incurred prior to the signature dates of the offer letter and relocation agreement ** Departmental funds must be approved by Department Head with budgetary responsibility for the State Account, UGA Foundation funds and Arch Foundation funds must be approved by the appropriate Dean or Vice-President as required by the respective fund agreement and then sent to the External Affairs Office of Financial Services for approval. UGA Research Foundation funds must be approved by the Office of the Vice President for Research Director of Fiscal Affairs. Funds provided through the Office of the Senior Vice President for Academic Affairs must be approved by the Provost. Grant funds must be approved by the project’s Principal Investigator (PI), the Department Head, and the Contracts & Grants department. Relocation Package to encumber funds Pink Check Request ONLY ◦ E-check request will be rejected Request for Reimbursement of Relocation Expenses form Non-taxable Expenses ◦ Processed through Accounts Payable ◦ Encumbrance will automatically be reduced Taxable Expenses ◦ Processed through Payroll Email will be sent with taxable amount to department Department will complete monthly personnel ◦ Encumbrance will be manually reduced ◦ Amount will be on monthly paycheck with federal, state, and FICA taxes withheld. Travel & Lodging: ◦ one (1) trip per household member ◦ Travel begins day that family leaves former home to day of arrival at new home ◦ shortest, most direct route available by conventional transportation 1. 2. 3. 4. 5. Airfare (coach only) Lodging (per diem limit) Mileage or fuel Rental Car Tolls, taxis, shuttle, etc… Transporting Household Goods: Common Carrier Less than $25000 Direct bill Less than $10,000 – recommended that quote is obtained before services rendered $10,000 - $$24,999 – Three quotes are preferred from moving companies prior to services rendered Everify for Payments over $2500 http://www.busfin.uga.edu/procurement/PDF/EVerifyForm.pdf Greater than $25000 Must be contracted for through the Procurement Office. It is recommended that you contact the Procurement Office prior to submitting a purchase requisition in UGAmart for the expenditure. ***The University of Georgia presently does not have contracts with any 3rd party moving companies*** Transporting Household Goods (cont): Self-Move a. b. c. d. Vehicle Rental & Accessories* Fuel/Oil Labor (up to $500) Temporary Storage (up to 30 days) *Accessories that are purchased and become the personal property of the employee are not reimbursable Effective January 1, 2013: .235 per mile driven for moving purposes is non taxable .325 per mile driven for moving purposes is taxable Example: Professor X and his family drive the family car 500 miles from the former home to the new home. Nontaxable Amount: 500 miles * $0.235 = $117.50 Taxable Amount: 500 miles * $0.325 = $182.50 Pre-Move Travel/House hunting trips: a. b. c. d. e. f. Airfare (coach only) Lodging (per diem limit) Mileage or fuel Rental Car Tolls, taxis, shuttle, etc… Meals (per diem limits) Note : pre-move trips are limited to 5 days Temporary Living Quarters (up to 6 months) Temporary Storage (over 30 days) Meals during final move (per diem limits) Other Charges Original documents/receipts required Credit card statements may serve as supporting documentation but are not acceptable as the primary document Documents should contain the following: ◦ ◦ ◦ ◦ ◦ Name of payee Date Amount Details of purchase/expense Amount Paid ◦ ◦ ◦ ◦ ◦ ◦ ◦ ◦ Moving Company Bill of lading; detailed receipt Proof of payment i.e. cancelled check or credit card statement Airfare airline ticket “receipt” coupon and/or equivalent printed receipt for e-tickets; boarding pass Mileage MapQuest or odometer reading Lodging itemized hotel bill Meals detailed receipt unless claiming per diem identify number of household members traveling Alcohol is not permitted on institutional funds Vehicle Rental ◦ Rental agreement; detailed receipt Temporary Living ◦ ◦ original hotel bill or short-term lease agreement for temporary lodging and proof of payment brief explanation stating the purpose for temporary living Auto fuel and oil ◦ ◦ original receipts for fuel and/or oil Fuel and oil expenses are not reimbursable if the employee is claiming reimbursement for mileage Labor ◦ receipt from the business employed to provide labor including: Signature tax identification number (individual) amount paid ◦ maximum total payment of $500 ◦ labor provided by the employee or the employee’s immediate family member(s) is not reimbursable Incomplete relocation package Missing signatures Original Offer letter does not contain a specific dollar amount for relocation Expenses incurred prior to signing offer letter and moving agreement Inadequate documentation Receipts not submitted within 60 days after incurred or paid Expenses for members other than for those in the household i.e. airfare or meals for friend helping move Relocation expenses that are paid via payroll will be reported on the employee’s W-2 as part of Federal and State wages. Relocation expenses that are paid via accounts payable will be reported on the employee’s W-2 in box 12 Questions & Answers Contact Information: Mark Kent (mkent@uga.edu) Andre Simmons (asimmons@uga.edu)