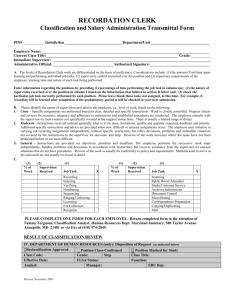

FINANCIAL SUPERVISION

advertisement

FINANCIAL SUPERVISION HISTORY Financial Services Action Plan (1999) Internal Market Financial Services. 43 regulations. García-Margallo Report EP (2000) 3 targets Divorce Integration Supervision Harmonization Speed Intensity Pan European Institutions National Supervisors CRISIS Following Reports: Van den Burg on prudential supervision, Van den Burg on financial services policy, Van den Burg & Daianu recommendations to the Commission on Lamfalussy follow-up… Crisis: Larosière Report and Turner Review. Commission: Driving European Recovery (4/04/2009), European Financial Supervision (27/05/2009). European Council (12/2009): Single Rule Book. Individual Decision. Safeguards. European Parliament: Coordinators Declaration (2010). INTERNATIONAL DOCUMENTS “A Fair and Substancial Contribution by the Financial Sector” (IMF 4/16/2010): Financial Supervision Commission. USA – Obama. Europe 2020 A European strategy for smart, sustainable and inclusive growth (3/03/2010): crisis management and responsibility of the financial sector. European Council (25-26/03/2010): Systemic Institutions. EUROPEAN SYSTEM (Art. 1a) Composition of the European System for Financial Supervision: National Authorities. Systemic Risk Board. 3 European Authorities: Banking, Insurance and Occupational Pensions and Securities and Markets Joint Committee. Commission. Strong idea: reinforce the idea of a system. ONE SUPERVISOR National Authorities accountable to the European Parliament. RISKY TRANSACTIONS (Art. 6.2(fb)) Temporary prohibition. Decision reviewed. EUROPEAN SINGLE RULEBOOK (Art. 7-8) Regulatory Standards EBA strong and responsible to the EP. Open consultation. Impact study. The Commission has limited power to modify proposals. Disagreement between EBA and Commission: control by the EP and the Council. Implementing acts (Art. 291 TFEU). Orientations and recommendations (ex. Bonus): accountability. INDIVIDUAL DECISIONS (Art. 9-10-11) When?: To whom?: non-fulfillment of European Law; emergency situations; disagreements within Colleges of Supervisor. National Supervisor. Financial Institutions. Review: Board of Appeal (legality). Appeal to the Council: Safeguard Clause. SUPERVISION OF CROSSBORDER INSTITUTIONS (Art. 12-12a,b,c,d) Theoretical approach (Turner Review): Current mechanisms do not work. Only two solutions: more protectionism or more Europe. National Solution: more power for the supervisor of the hosting country = market blow up. European Solution: EBA leadership in the Colleges of Supervisors: Regulatory and implementing standards. binding mediation. Reinforced supervision of Institutions that may pose a systemic risk (yellow alarm). Banking Resolution Unit (red alarm). European Funds: European Deposit Guarantee Skims. European Stability Fund. INTERNATIONAL RELATIONS (Art. 18) Europe single voice. Supervisor arrangament with third countries authorities. Administrative arrangaments and equivalent decisions. STAKEHOLDER GROUP: SME (Art. 22) SAFEGUARDS (Art. 23) Direct and significant impact. Impact study. Ratification of the Authority's decision: by simple majority. Revocation of the Authority's decision: by qualified majority. JOINT COMMITTEE (Art. 40-43) REVISION CLAUSE (Art. 66) Proposals to implement Art. 12: 6 months. Proposals to evaluate experience acquared: Conversion in supervisory standards practices reached by National Authorities; the functioning of the Colleges of Supervisors; the role of the Authority on the supervision of Systemic Institutions; the application of the Safeguard Clause established in Art. 23.