Economic Growth, Business

Cycles, Unemployment, and

Inflation

Chapter 6 – Part 1

McGraw-Hill/Irwin

© 2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

Laugher Curve

An Indian-born economist once explained

his personal theory of reincarnation to his

graduate economics class.

McGraw-Hill/Irwin

© 2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

Laugher Curve

“If you are a good economist, a virtuous

economist,” he said, “you are reborn as a

physicist.”

“But if you are an evil, wicked economist,

you are reborn as a sociologist.”

McGraw-Hill/Irwin

© 2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

Introduction

Macroeconomics is the study of the

aggregate states of the economy.

The four central problems are growth,

business cycles, unemployment, and

inflation.

McGraw-Hill/Irwin

© 2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

Two Frameworks: The Long

Run and the Short Run

Issues of growth are considered in a longrun framework.

Business cycles are generally considered

in a short-run framework.

Inflation and unemployment fall within both

frameworks.

McGraw-Hill/Irwin

© 2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

Growth

The primary measurement of growth is

changes in real gross domestic product.

Real gross domestic product (real GDP)

– the market value of final goods and

services produced in the economy stated

in the prices of a given year.

McGraw-Hill/Irwin

© 2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

Growth

The U.S. historical or secular growth rate

is between 2.5 to 3.5 percent per year.

Per capita real output is real GDP divided

by the total population.

The U.S. capita real output growth has

been 1.5 to 2.5 percent per year since

1950.

McGraw-Hill/Irwin

© 2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

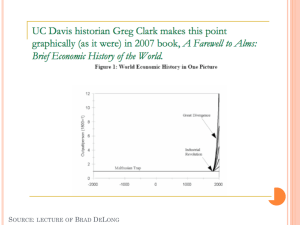

Global Experience with

Growth

Today's growth rates are high by historical

standards.

The range of growth rates among nations

is wide.

African countries have consistently grown

below the world average.

McGraw-Hill/Irwin

© 2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

Global Experience with

Growth

The growth trend we now take for granted

started at the end of the of the18th century.

At about the same time, markets and

democracies became the primary

organizing structures of society.

McGraw-Hill/Irwin

© 2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

The Benefits and Costs of

Growth

Per capita economic growth allows

everyone in society, on average, to have

more.

Growth, or predictions of growth, allows

governments to avoid hard questions.

The costs of growth include pollution,

resource exhaustion, and destruction of

natural habitat.

McGraw-Hill/Irwin

© 2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

Business Cycles

The business cycle is the upward and

downward movement of economic activity

or real GDP that occurs around the growth

trend.

See Figure 6.1 for the U.S. historical

experience.

McGraw-Hill/Irwin

© 2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

U. S. Business Cycles

20

Recovery

of 1895

Civil

10 War

World War I

World War II

Korean

War Vietnam War

0

Panic

of 1893

–10

Panic

of 1907

Great

Depression

–20

1860 ‘70

McGraw-Hill/Irwin

‘80

‘90

1900

‘10

‘20

‘30 ‘40 ‘50 ‘60

‘70 ‘80 ‘90 2000 ‘10

© 2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

Business Cycles

There are a number of policies regarding

business cycles.

Classical economists generally favor

laissez-faire or noninterventionist policies.

Keynesians generally favor activist or

interventionist policies.

McGraw-Hill/Irwin

© 2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

The Phases of the Business

Cycle

A peak is the top of the business cycle.

A trough is the bottom of the business

cycle.

A boom is a very high peak.

A downturn is when economic activity

starts to fall from a peak.

A upturn is when economic activity starts

to rise from a trough.

McGraw-Hill/Irwin

© 2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

The Phases of the Business

Cycle

A recession is a decline in output that

persists for more than two consecutive

quarters in a year.

A depression is a large recession.

A trough is also the bottom of the

recession or depression.

An expansion is an upturn that lasts at

least two consecutive quarters of a year.

McGraw-Hill/Irwin

© 2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

The Phases of the Business

Cycle

Expansion

Recession

Expansion

Total Output

Peak

0

McGraw-Hill/Irwin

Trough

Secular

growth

trend

Jan.- Apr.- July- Oct.- Jan.- Apr.- July- Oct.- Jan.- Apr.Mar June Sept. Dec. Mar June Sept. Dec. Mar June

© 2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

Why Do Business Cycles Occur

Recessions and expansions are caused

primarily by demand-side of the economy.

A debate exists about whether these

fluctuations can and should be reduced.

Most economists believe that potential

depressions can and should be offset by

economic policy.

McGraw-Hill/Irwin

© 2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

Why Do Business Cycles Occur

Since the late 1940s, compared to prior

years:

Downturns and panics have generally been

less severe.

The duration of business cycles has increased.

The average length of expansions has

increased while the average length of

contractions has decreased.

McGraw-Hill/Irwin

© 2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

Why Do Business Cycles Occur

Most economists believe that business

fluctuations have become less severe

because of the stronger role of government

in the economy.

McGraw-Hill/Irwin

© 2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

Leading Indicators

Leading indicators tell us what's likely to

happen in the economy 12 to 15 months

from now.

The are indicators rather than predictors

because they are only rough approximations

of what’s likely to happen in the future.

McGraw-Hill/Irwin

© 2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

Leading Indicators

Leading indicators include the following:

Average workweek for production workers in

manufacturing.

Unemployment claims.

New orders for consumer goods and

materials.

McGraw-Hill/Irwin

© 2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

Leading Indicators

Leading indicators include the following:

Vendor performance, measured as a

percentage of companies reporting slower

deliveries from suppliers.

Index of consumer expectations.

New orders for plant and equipment.

McGraw-Hill/Irwin

© 2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

Leading Indicators

Leading indicators include the following:

Number of new building permits issued for

private housing units.

Change in stock prices.

Interest rate spread.

Changes in the money supply.

McGraw-Hill/Irwin

© 2004 The McGraw-Hill Companies, Inc., All Rights Reserved.