4-450 CFE-More Than Just a Credential

advertisement

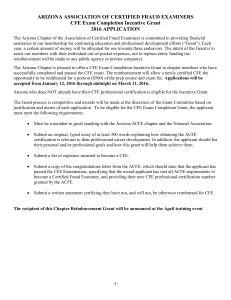

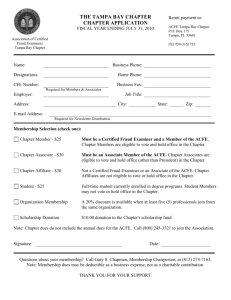

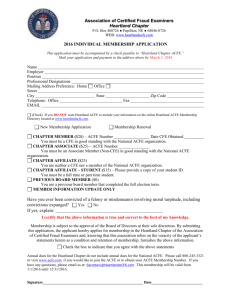

The CFE More than just a Credential Sixth Biennial National Fraud Awareness Conference Transportation Infrastructure Programs July 28, 2010 Goals for This Session The Credential Career Impacts Getting Certified Post-Certification Association of Certified Fraud Examiners Association of Certified Fraud Examiners formed, in part, by Joseph T. Wells, CFE, CPA in 1988 Wells’ Vision: Like-minded professionals who collaborate and work toward a common goal ACFE Goal: Reduce WCC & instances of fraud Worldwide provider of anti-fraud training Multi-disciplinary, globally recognized professional designation Certified Fraud Examiner (CFE) CFE’s posses expertise in all aspects of the anti-fraud profession and have the proven ability to detect, prevent, and investigate a wide range of fraud. A CFE might perform any of the following functions: Resolve allegations of fraud from inception to disposition Gather evidence Take Statements Write Reports Testify to findings CFE’s are Found in Many Fields Jobs Law Enforcement Accountants Auditors (internal and external) Investigators Loss Prevention Specialists Where CPA firms Consulting Firms Government Agencies Law Firms College and University Scholars Others Interested in Anti-Fraud Efforts Core Technical Knowledge of a CFE Criminology Financial Transactions Fraud Investigation Legal Elements of Fraud Other Useful Knowledge & Skills Attention to Detail Analysis of Large Volumes of Data Business Function Computer Systems & Applications Interview Techniques Government Structure & Function Other Useful Personal Traits Adapts to stressful situations Critical thinker Takes ownership and accountable High integrity, sound judgment Flexible Communication: Oral, Written Able to Develop Rapport CFE’s in the Federal Government: Examples of What We Do Financial Statement Analysis Efficiency assessments Regulation compliance Budget development Financial data examination Internal control assessments Report preparation Who Can Become A CFE? Academic Requirement Professional Requirement References Attest to High Moral Character Abide by ACFE Bylaws and Code of Professional Ethics Associate ACFE Member in good standing Recommended Path of Study CFE Exam Prep Course ($815 / $1,268): CD-ROM study guide Fraud Examiners Manual Practice Exam Exam study discussion forum Exam preparation e-Newsletter Live Coaching CFE Exam Exam is administered on a CD-ROM and contains 500 questions, consisting of four parts: Criminology and Ethics Financial Transactions Fraud Investigation Legal Elements of Fraud CFE Exam Each section has 125 questions which must be completed in the 2.5 hours allotted Each question has a maximum time limit of 75 seconds Test is multiple choice and true/false Passing score is 75 percent on each section You’ve passed!! Now what? Having a CFE credential does not make you a CFE, it enables you to become a CFE Increase your vigilance The bar is raised Apply what you learn – formally and informally Give back to your profession Mentoring new CFE’s “Great power & great responsibility” Continuing education Adherence to Code of Ethics & Professional Standards “Do a Great Job and Make a Difference” Maintaining your CFE Credential Required annual Continuing Education: The minimum required is 20 credits per year At least 10 credits directly related to detection and deterrence Keep records of your CE for at least three years Adherence with Code of Ethics Observe Professional Standards What Does It Mean To Be a CFE ? Professional Growth / Development Networking & Knowledge Sharing Recognized leader in detection, deterrence and investigation of fraud Salary Enhancement Getting Involved National level membership Local level membership: Metro-DC Chapter Mutually exclusive; several member categories: Certified Fraud Examiner Associate member Educator Associate member Student Associate member Participation at the Local Level Quality, affordable training Networking opportunities Leadership skills development Mentoring potential Community Involvement CFE exam study support Active Involvement at the Local Level Serve on a committee or support a committee Programs & Training Community & Membership Outreach Speakers’ Bureau Regular attendance at events Speak on behalf of the chapter Promote the Chapter in the Community Join the Board of Directors Example ACFE Certification Q&A’s Blue, a fraud offender, had no known history of criminality. One theory of crime causation suggests that people are not inherently bad, but rather are taught to commit crime through life's experiences. This is called the: a. social causation theory b. trait theory c. social learning theory d. none of the above Example ACFE Certification Q&A’s According to research, most embezzlers decide to commit their crimes because: a. they are essentially dishonest b. they are living beyond their means c. they have drug problems d. none of the above Example ACFE Certification Q&A’s Given all of the following fraud prevention methods within organizations, which one is probably the most effective? a. reducing rationalization b. having an open-door policy c. increasing the perception of detection d. screening employees Example ACFE Certification Q&A’s White, an employee of ABC Corporation, intentionally issued two payments for the same invoice. After the disbursements had been mailed, White called the vendor and explained that a double payment had been made by mistake. She asked the vendor to return one of the checks to her attention. When the vendor returned the check, White took it and cashed it. According to Occupational Fraud and Abuse, this is an example of: a. a shell company scheme b. pass-through scheme c. a receivables skimming scheme d. a pay-and-return scheme Example ACFE Certification Q&A’s The statute that specifically outlaws the giving or receiving of anything of value for the purpose of improperly obtaining or receiving favorable treatment in connection with U.S. government contracts is a. the Foreign Corrupt Practices Act b. the Anti-Kickback Act of 1986 c. the Civil False Claims Act d. the "Honest Services" Join Us, Won’t You? Metro-DC Chapter of ACFE – Events Provide more than 28 CPE’s per year covering topics from FCPA, AML/Virtual Currency, to Legal Updates Five 4 CPE Training Opportunities One 8 CPE Training Opportunity 4-5 Networking Events Find Us on Facebook & Linked In Find Us at www.acfedc.org Questions? Metro-DC Chapter of ACFE 2121 Eisenhower Avenue, Suite 200 Alexandria, VA 22314 (888) 825-8021 (888) 868-4320 (f) GA.Smith@acfedc.org Cheryl.Hyder@acfedc.org Chapter@acfedc.org