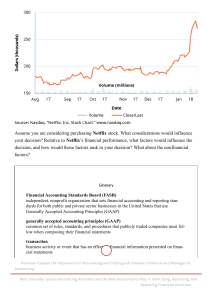

GBUS 600 Week 9 External Analysis & Digital Marketing Digital Marketing Agenda • Digital Marketing (7-8:15 pm) External Analysis • Break (8:15-8:30 pm) • External Analysis (8:30-9:25) • Wrap-up (9:25-9:30) Wrap-up Digital Marketing Nick Charrow • Director of Media at Princess Cruises • Formerly Acquisitions Manager at Sonic Electronix, Inc and Internet Marketing Strategist at Dream Products, Inc • BA in Arts and MBA from CSUN » External Analysis P E S T • Political factors: Tax policy, employment laws, environmental regulations, trade restrictions and tariffs and political stability. • Economic factors: Growth, interest rates, foreign conditions, exchange rates, and prices. • Social factors: Health consciousness, population growth rate, age distribution, career attitudes and emphasis on safety. • Technological factors: R&D, automation, technology incentives, rate of technological change. I n t e r n a l E x t e r n a l Strengths and Weaknesses Current performance • Brand power • Cost structure • Product portfolio • R&D pipeline • Technical mastery • Employee skills • Company culture Opportunities and Threats Customers • Pricing constraints • Competitors • Distribution issues • Technology • Macroeconomy • Regulation • Workstyle trends • Major uncertainties • Suppliers • Potential partners Harvard Business Review (2005). Strategy: Create and implement the best strategy for your business. Harvard Business School Press. S W O T Goal • To achieve AND sustain an above average rate of return • HOW? • Position your company where the industry is the weakest. What do others NOT do? • Exploit changes in the Five Forces (next slide) • Rearrange the forces in your favor » Porter’s Five Forces What forces are powerful and can reduce profits? What forces are weak and can be exploited? » Porter, M. E. (2008). The five competitive forces that shape strategy. Harvard Business Review, 86(1), 78–93. 1. Threat of new entrants • Supply-side: fixed costs (scale) • Demand-side: buyer loyalty (scale) • Switching costs • Capital requirements • Inventory • Financing • Distribution channels • GOVERNMENT! » As they shifted from DVD-by-mail to streaming, barriers to entry were low enough to allow new entrants like Amazon Prime and Hulu to establish themselves in the market. Even later, giants like Disney+ and Apple TV joined. The capital requirement for setting up a streaming service is significant, but not insurmountable for large tech or media companies. Hence, there's a persistent threat of new entrants in the streaming space. 2. Customer bargaining power • Number of buyers • Elasticity of demand • Large share of budget • Limited income • Quality does NOT matter much • Easy substitutes » With many streaming options available, consumers can easily switch between services. If Netflix increases its prices or if consumers feel the content isn't valuable enough, they might migrate to other platforms. This gives consumers substantial bargaining power. Recognizing this, Netflix invests heavily in original content to retain its subscriber base. 3. Supplier bargaining power • Switching costs • Limited substitutes • Forward & backward integration » Who are your suppliers? https://dealroom.net/blog/forward-integration Content creators and production houses are critical suppliers for Netflix. As Netflix grew, many of these suppliers started realizing the value of their content. For instance, Disney pulled its content from Netflix to launch its own streaming service, Disney+. This showcases the significant bargaining power that key content creators possess, which can drive up costs for Netflix or even deprive it of essential content. 4. Threat of substitutes • There is a substitute for everything! • Definition of industry matters • Switching costs? • Price-performance tradeoff » Apart from direct competitors like Disney+ or Amazon Prime Video, there are other forms of entertainment that can serve as substitutes to Netflix. This includes traditional TV, YouTube, video games, or even non-digital forms of entertainment like books or outdoor activities. The more appealing these substitutes become, the more pressure there is on Netflix to innovate and keep its audience engaged. 5. Rivalry • Numerous competitors • Slow growth • Difficult to exit • Homogeneity » The rivalry in the streaming industry is intense. Netflix competes with a range of platforms, from HBO Max and Disney+ to newer entrants like Peacock. Each of these platforms is vying for exclusive content, partnerships, and technological innovations to lure and retain subscribers. This rivalry can lead to increased marketing expenses, higher content acquisition costs, and the need for continuous innovation. SWOT example I n t e r n a l Strengths Weaknesses • Global presence • Increasing debt • Data-driven decision making • Dependence on content • Extensive content library production • Brand recognition • High subscriber churn rate • Flexible business model • Rising content costs E x t e r n a l Opportunities • Diversification (e.g., games, live events, shared viewing) • Local content, edutainment Opportunities? • Technological innovation (e.g., VR) Threats • Intense competition • Regulation (e.g., censorship) • Economic downturns Threats? • Infrastructure (networks) • Changing viewer habits Common Pitfalls • Defining the industry too broadly or too narrowly • Making lists instead of engaging in rigorous analysis • Paying equal attention to all of the forces rather than digging deeply into the most important ones • Confusing effect (price sensitivity) with cause (buyer economics) • Using static analysis that ignores industry trends • Confusing cyclical or transient changes with true structural changes • Using the framework to declare an industry attractive or unattractive rather than using it to guide strategic choices » Porter, M. E. (2008). The five competitive forces that shape strategy. Harvard Business Review, 86 (1), 78–93. STRATEGY • Any good strategy starts with a statement of where you are going! – a VISION! • Mission – why we exist, what we do. • Values – what we believe in (ethics, green, …) • Vision – what we want to be! » Your Strategy • If it is the same as any competitors, you do not have one. • GOALS – SMART • Specific, Measurable, Assessable, Reasonable, Time bound. • Scope – whom do we serve? • Benefits of a strategy? » Wrap-up Wrap-up • Next class: Business Data with Dr. Pouyan Eslami • Round 4 decisions due Saturday 10/11 • External Analysis due 10/21 • Round 5 memo due 10/21 • Key Competitors Analysis due 10/28