Uploaded by

neham200118

Accounting Modules: Conceptual Framework, Adjusting Entries & Financial Statements

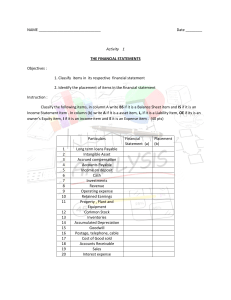

advertisement

MODULE 1 Learning Objectives 1. Awareness of the Accounting Environment 2. Know the basic structure of the Conceptual Framework 3. Know what lifetime income means and how to apply it AWARENESS OF ACCOUNTING ENVIRONMENT 3. Accrual accounting is used because a. cash flows are considered less important. b. it provides a better indication of a company’s ability to generate cash flows than the cash basis. c. it recognizes revenues when cash is received and expenses when cash is paid. d. None of the answer choices are correct. 16. In the U.S. financial reporting environment A. Financial Standards are determined by IFRS. B. Relevant information is always disclosed. C. Entities have primary responsibility for providing financial information about themselves. D. GAAP provides clear guidelines about how to handle all financial reporting issues faced by a firm. 22. The body that has the power to prescribe the accounting practices and standards to be employed by companies that fall under its jurisdiction is the a. FASB. b. AICPA. c. SEC. d. APB. 2. Know the Conceptual Framework Qualitative Characteristics of Accounting Information Decision usefulness Fundamental Characteristics Faithful representation Confirmatory Free from Enhancing Characteristics THE ASSUMPTIONS: 1. Periodicity 2. Going Concern 3. Monetary Unit 4. Economic Entiy 15. In the qualitative characteristics of accounting information the fundamental characteristic of Relevance exhibits all of the following attributes except: A. Predictive Value. B. Completeness. C. Confirmatory Value. D. Materiality. 8. The two fundamental qualities that make accounting information useful for decision making are a. comparability and timeliness. b. materiality and neutrality. c. relevance and faithful representation. d. faithful representation and comparability 3. Know what lifetime income means and how to apply it 19. A firm neglects to record depreciation on machinery it acquired. Ultimately the equipment is sold for a fraction of its original costs. After the equipment is sold A. The firm’s accumulated earnings will be understated due to the failure to recognize depreciation expense. B. A prior period adjustment will not be necessary. C. The firm’s accumulated earnings will be correctly stated. D. The firm’s current period income will be overstated. MODULE 2 Learning Objectives 1.Know what a T-account is and how to use a T-account to solve problems. 2.Know the accounting cycle and what adjusting entries do. 3.General knowledge of the role of accounting as an information system and how the accounting process works. 4.Convert values between cash basis and accrual basis recognition approaches. 1. Know what a T-account is and how to use a T-account to solve problems. 19. Mello Company, a calendar-year company specializing in miniaturization of electronic products, reported the following balances: December 31, 2010 December 31, 2009 $130,000 $145,000 37,500 25,000 Inventory Accounts payable Mello paid suppliers $245,000 during 2010. What is Mello’s 2010 cost of goods sold? a. $272,500 b. $247,500 c. $242,500 d. $217,500 Inventory A/P $145,000 Purchases $130,000 $25,000 CGS $245,000 Purchases $37,500 1. Purchases = $245,000 + $37,500 - $25,000 = $257,500 2. CGS = $257,500 + $145,000 - $130,000 = $272,500 2. Know the accounting cycle and what adjusting entries do. 14. Big-Mouth Frog Corporation had revenues of $300,000, expenses of $200,000, and dividends of $45,000. When Income Summary is closed to Retained Earnings, the amount of the debit or credit to Retained Earnings is a a. debit of $55,000. b. debit of $100,000. c. credit of $55,000. d. credit of $100,000. 24. Adjusting entries A. Often involve entries to the cash account B. Are made during the period C. May lead to crediting expense accounts D. Occur after closing entries Pappy Corporation received cash of $24,000 on September 1, 2014 for one year’s rent in advance and recorded the transaction with a credit to Unearned Rent Revenue. The December 31, 2014 adjusting entry is a. debit Rent Revenue and credit Unearned Rent Revenue, $8,000. b. debit Rent Revenue and credit Unearned Rent Revenue, $16,000. c. debit Unearned Rent Revenue and credit Rent Revenue, $8,000. d. debit Cash and credit Unearned Rent Revenue, $16,000. 3. General knowledge of the role of accounting as an information system and how the accounting process works. . A trial balance a. proves that debits and credits are equal in the ledger. b. supplies a listing of open accounts and their balances that are used in preparing financial statements. c. is normally prepared three times in the accounting cycle. d. All of these answer choices are correct. 25. Financial reporting strives to produce GAAP-consistent account values A. All of the time B. Never C. Occasionally D. At the start of the reporting period 27. Under GAAP A. Many assets are expenses waiting to happen. B. Expense recognition should occur when cash is paid. C. Unearned revenue is an asset. D. Many liabilities are expenses waiting to happen. 4. Convert values between cash basis and accrual basis recognition approaches Raintree Corporation maintains its records on a cash basis. At the end of each year the company's accountant obtains the necessary information to prepare accrual basis financial statements. The following cash flows occurred during the year ended December 31, 2011: Additional information: 1. On June 30, 2010, Raintree lent a customer $50,000. Interest at 6% is payable annually on each June 30. Principal is due in 2014. 2. The annual insurance payment is made in advance on March 31. 3. Annual rent on the company's facilities is paid in advance on September 30. Required: A. What are the correct ending balances of Prepaid Rent, Interest Receivable, and Prepaid Insurance for 2011 Prepaid Rent: $12,000*9/12 = $9,000. Interest Receivable: $50,000*6/12*6%= $1,500 Prepaid Insurance: $9,000*3/12 = $2,250 B. Assuming that the 12/31/11 pre-adjusted balances for these three accounts are unchanged from their 12/31/10 balances provide the necessary adjusting entries. Prepaid Rent Pre-Adjust Balance = $7,000 Should Equal $9,000 Entry to Get There: DR Prepaid Rent CR Rent Expense $2,000 $2,000 Interest Receivable Pre-Adjust Balance = $1,500 Should Equal $1,500 Entry to get there? No entry is needed for interest receivable Prepaid Insurance Pre-Adjust Balance = $2,000 Should Equal $2,250 DR Prepaid Insurance CR Insurance Expense $ 250 $250 C. Assume instead that the pertinent cash flow has been booked to each of these three accounts during the period so that the pre-adjusted balance reflects this cash flow. What would the adjusting entries now be? Prepaid Rent Pre-Adj Balance is $7,000 + $12,000 = $19,000, so entry is DR Rent Expense CR Prepaid Rent $ 10,000 $10,000 Interest Rec. Pre-Adj Balance is $1,500 - $3,000 = $1,500 CR, so entry is DR Interest Receivable $3,000 CR Interest Revenue $ 3,000 Prepaid Insurance Pre-Adj Balance is $2,000 + $9,000 = $11,000 DR, so entry is DR Insurance Expense CR Prepaid Insurance $ 8,750 $8,750 D. Assume instead that reversing entries are employed for all accounts? How does this simplify things? You just enter the ending balances directly as pre-adjusting balances are $0. Sales Revenue ($70,000 + $450,000 -$42,000) $478,000 CGS (Purch= $232,000 from A/P T Account) (210,000) Insurance Exp. ($2,000+$9,000-$2,250) (8,750) Depreciation Expense (15,000) Rent Exp. ($7,000+$12,000 -$9,000) (10,000) Int. Revenue ($1,500 + $3,000 - $1,500) 3,000 Salaries Expense ($180,000+$28,000-$20,000) (188,000) Net Income PPd. Ins $2,250 PPD. Rent $9,000 Interest Rec. $1,500 $ 49,250 D. Prepare an accrual basis income statement for 2011. Sales Revenue ($70,000 + $450,000 -$42,000) $478,000 CGS (Purch= $232,000 from A/P T Account) (210,000) Insurance Exp. ($2,000+$9,000-$2,250) (8,750) Depreciation Expense (15,000) Rent Exp. ($7,000+$12,000 -$9,000) (10,000) Int. Revenue ($1,500 + $3,000 - $1,500) 3,000 Salaries Expense ($180,000+$28,000-$20,000) Net Income Why is this not a good form income statement? (188,000) $ 49,250 MODULE 3 Learning Objectives 1. 2. 3. 4. 5. 6. Know how to prepare a good form balance sheet Know how to prepare a good form income statement Know how to prepare a good form statement of cash flows Know what is meant by comprehensive income Know how prior period adjustments are reported. General knowledge of issues pertinent to the construction and interpretation of financial statements. You should be able to produce any of the above 3 good form financial statements from source uncategorized and potentially irrelevant information. 1. Know how to prepare a good form balance sheet 10. The following information was extracted from the accounts of Essex Corporation at December 31, 2014: CR(DR) Total reported income since incorporation $3,200,000 Total cash dividends paid (1,600,000) Unrealized holding loss on available-for-sale securities (250,000) Prior period adjustment, recorded January 1, 2014 (250,000) What should be the balance of retained earnings at December 31, 2014? a. b. c. d. $1,100,000. $1,600,000. $1,850,000. $1,350,000. 44. All of the following as factors guiding how assets are ordered on the balance sheet except A. The dollar value of the asset. B. The length of time the asset is expected to remain on the balance sheet. C. Whether the asset is for real. D. The ease with which the asset is converted into cash. 45. In determining whether assets and liabilities are classified as current or non-current the lecture identifies two criteria: ability and intent. In this respect which of the following statements is correct A. For an asset, an absence of ability results in classification as current. B. For a liability, an absence of ability results in classification as current. C. For an asset, an absence of intent results in classification as current. D. For a liability, an absence of intent results in classification as noncurrent. 16.Long-term liabilities include a. obligations not expected to be liquidated within the operating cycle. b. obligations payable at some date beyond the operating cycle. c. deferred income taxes and most lease obligations. d. all of these answer choices are correct. For the year ended December 31, 2014, Transformers Inc. reported the following: Net income Preferred dividends declared Common dividend declared Unrealized holding loss, net of tax Retained earnings Common stock Accumulated Other Comprehensive Income, Beginning Balance $180,000 30,000 6,000 3,000 240,000 120,000 15,000 What would Transformers report as its ending balance of Accumulated Other Comprehensive Income? a. b. c. d. $18,000 $15,000 $12,000 $3,000 30. Mill Co.’s trial balance included the following account balances at December 31, 2011: Accounts Payable ........................... $15,000 Bond payable, due 2012 ................. 22,000 Dividends payable 1/31/12 ............. 8,000 Notes payable, due 2013 ................ 20,000 What amount should be included in the current liability section of Mill’s December 31, 2011, balance sheet? a. $45,000 b. $51,000 c. $65,000 d. $78,000 45. In determining whether assets and liabilities are classified as current or non-current the lecture identifies two criteria: ability and intent. In this respect which of the following statements is correct A. For an asset, an absence of ability results in classification as current. B. For a liability, an absence of ability results in classification as current. C. For an asset, an absence of intent results in classification as current. D. For a liability, an absence of intent results in classification as noncurrent. 2. Know how to prepare a good form income statement 5. The following information was extracted from the 2014 financial statements of Max Company: Income from continuing operations before income tax $470,000 Selling and administrative expenses 320,000 Income from continuing operations 329,000 Gross profit 900,000 Income from discontinued operations 290,000 The amount reported for other expenses and losses is a. b. c. d. $141,000 $39,000. $110,000. $150,000. 47. Which of the following statements is true: A. The heading of a good form income statement indicates a single date. B. Reported income tax expense includes income tax expense associated with discontinued operations. C. A good form income statement reports earnings per share numbers in the main body of the statement. D. Dividends paid by the entity are reported as a financing expense. The occurrence that most likely would have no effect on 2014 net income is the a. sale in 2014 of an office building contributed by a stockholder in 1961. b. collection in 2014 of a dividend from an investment. c. correction of an error in the financial statements of a prior period discovered subsequent to their issuance. 46. Items in the income statement items are generally ordered A. Based on how large the amounts are. B. Closeness to central operations of the entity. C. Alphabetically. D. Based on how closely related they are to cash. Palomo Corp has a tax rate of 30 percent and income before non-operating items of $1,071,000. It also has the following items (gross amounts). Unusual gain Loss from discontinued operations Dividend revenue Income increasing prior period adjustment $ 69,000 549,000 18,000 222,000 What is the amount of income tax expense Palomo would report on its income statement? a. $347,400 b. $182,700 c. $249,300 d. $326,700 35. On August 1, 2021, Rocket Retailers adopted a plan to discontinue its catalog sales division, which qualifies as a separate component of the business according to GAAP regarding discontinued operations. The disposal of the division was expected to be concluded by June 30, 2022. On January 31, 2022, Rocket's fiscal year-end, the following information relative to the discontinued division was accumulated: Operating loss February 1, 2021 Estimated operating losses, Feb. 1 to June 30, 2022 Impairment of division assets at Jan. 31, 2022 $115,000 80,000 10,000 In its income statement for the year ended January 31, 2022, Rocket would report a before-tax loss on discontinued operations of: A. $115,000. B. $195,000. C. $65,000. D. $125,000. 3. Know how to prepare a good form statement of cash flows If common stock was issued to acquire an $8,000 machine, how would the transaction appear on the statement of cash flows? a. It would depend on whether you are using the direct or the indirect method. b. It would be a positive $8,000 in the financing section and a negative $8,000 in the investing section. c. It would be a negative $8,000 in the financing section and a positive $8,000 in the investing section. d. It would not appear on the statement of cash flows but rather on a schedule of noncash investing and financing activities. 37. Cash flows from investing activities do not include: A. Proceeds from issuing bonds. B. Payment for the purchase of equipment. C. Proceeds from the sale of marketable securities. D. Cash outflows from acquiring land. Norling Corporation reports the following information: Net income Dividends on common stock Dividends on preferred stock Weighted average common shares outstanding $750,000 $210,000 $ 90,000 250,000 Norling should report earnings per share of a. $1.80. b. $2.16 c. $2.64. d. $3.00. 27. During 2014 the DLD Company had a net income of $75,000. In addition, selected accounts showed the following changes: Accounts Receivable $3,000 increase Accounts Payable 1,000 increase Buildings 4,000 decrease Depreciation Expense 1,500 increase Bonds Payable 8,000 increase What was the amount of cash provided by operating activities? a. $74,500 b. $75,000 c. $76,500 d. $84,500 42. On the cash flows statement dividends paid by the entity are treated as: A. Cash flows from operations. B. Cash flows from investing. C. Cash flows from financing. D. Excluded from the statement of cash flows since they are paid to owners. 4. Know what is meant by comprehensive income Each of the following would be reported as items of other comprehensive income except: A. Foreign currency translation gains. B. Unrealized gains on investments accounted for as securities available for sale. C. Deferred gains from derivatives. D. Gains from the sale of equipment. 48. Comprehensive income: A. Is just another name for net income. B. Is reported before tax. C. Includes items which are questionable as constituting income. D. Includes prior period adjustments. ABC Company Statement of Comprehensive Income For the Year Ended 12/31/2021 Net Income Unrealized Gain on Bond Investment (net of $3,000 taxes) Foreign Currency Translation Gain (net of $10,000 taxes) Comprehensive Income $59,200 12,000 40,000 $111,200 MODULE 4 Learning Objectives 1. Understand Accounting Implications of Alternative Revenue Recognition Alternatives. 2. Know the Five Step Process for Dealing with Revenue Recognition Challenges. (1. Identify contract; 2. Identify obligations; 3. Determine Price; 4. Allocate Price; 5. Recognize by Obligation.) 3. Know How to Account for Long Term Contracts. 4. General knowledge of issues pertinent to revenue recognition 1. Understand Accounting Implications of Alternative Revenue Recognition Alternatives. Point of Sale Recognition - As opposed to Cash Receipt Based Recognition When Point of Sale is “Complicated” Recognition - “Contract” plays out over time When Point of Sale is “Complicated” Accounting - Long Term Contract Accounting Sidebar: The sale must be a sale. If the customer has the ability and incentive to return whatever is sold or the seller has the unconditional right to reclaim it then it is potentially a lease or a secured borrowing, not a sale. 2. On January 15, 2014, Bella Vista Company enters into a contract to build custom equipment for ABC Carpet Company. The contract specified a delivery date of March 1. The equipment was not delivered until March 31. The contract required full payment of $75,000 30 days after delivery. This contract should be a. recorded on January 15, 2014. b. recorded on March 1, 2014. c. recorded on March 31, 2014. recorded on April 30, 2014. Know the Five Step Process for Dealing with Revenue Recognition Challenges. (1. Identify contract; 2. Identify obligations; 3. Determine Price; 4. Allocate Price; 5. Recognize by Obligation.) Multiple Performance Obligations Contract Revenue Must be Allocated or Assigned Across Obligations When Obligations are Separable (as in purcased in independent contracts) then simply treat as separate unrelated sales (e.g., extended warranty sold at a fair market price). When Not Separable then Allocate ContractSales Price Across Them. Most Common Allocation Base is Sales Value of Components. Example: Obligation 1 2 3 Total Contract Obligation 1 2 3 Total Contract Separate Market Price $10,000 $15,000 $25,000 Allocated revenue $40,000 Separate Market Price $10,000 $15,000 $25,000 $50,000 % 20 30 50 Allocated revenue $8,000 $12,000 $20,000 $40,000 Notes: 1. Normal (Assurance) Warranty Obligation is not a separate performance obligation. 2. In cases where the market value of one or more of the obligations is unclear then one might assign contract revenue to the known componets at based on separate market values with the residual assigned to the unlcear obligation. 20. Marle Construction enters into a contract with a customer to build a warehouse for $850,000 on March 30, 2014 with a performance bonus of $50,000 if the building is completed by July 31, 2014. The bonus is reduced by $10,000 each week that completion is delayed. Marle commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes: Completed by July 31, 2014 August 7, 2014 August 14, 2014 August 21, 2014 Probability 65% 25% 5% 5% The transaction price for this transaction is a. b. c. d. $895,000 $850,000 $552,500 $585,000 21. Bella Pool Company sells prefabricated pools that cost $80,000 to customers for $144,000. The sales price includes an installation fee, which is valued at $20,000. The fair value of the pool is $128,000. The installation is considered a separate performance obligation and is expected to take 3 months to complete. The transaction price allocated to the pool and the installation is a. $124,541 and $19,459 respectively b. $144,000 and $20,000 respectively c. $128,000 and $20,000 respectively d. $110,702 and $17,298 respectively How “Accounting For” Gets “Complicated” 1. Unearned Revenue - Customer Pays before goods are delivered. 2. Billings - Customer is billed before goods are delivered. 3. Multiple Performance Obligations – Billings, Cash Payments, and Revenue (and expense) recognition occurs over time (as in across reporting periods). 4. Long Term Contracts: Multiple Years, Single Ultimate Performance Obligation with multiple sub-obligations for billing purposes. In % of Completion treatment revenue and expense recognition based on contract cost completeness. In Completed Contract treatment revenue and expense recognition deferred to completion date. 3. Know How To Account for Long Term Contracts Recordkeeping and ReportingChallenges: 1. Billings Accounting 2. % of completion revenue recognition 3. Expense recognition 4. Balance sheet valuation of in-process projects (owned by entity, not customer) 5. Balance sheet reporting of Billings and in-process project value Shanahan Construction Company has entered into a contract beginning January 1, 2020, to build a parking complex. It has been estimated that the complex will cost $600,000 and will take 3 years to construct. The complex will be billed to the purchasing company at $900,000. The following data pertain to the construction period. Costs to date Estimated Cost Progress Billing Cash Collected To Complete to date to Date 2020 $270,000 $330,000 $270,000 $240,000 2021 $450,000 $150,000 $550,000 $500,000 2022 $610,000 $0 $900,000 $900,000 Instructions 2021 only a. Using the percentage-of-completion method, compute the cumulative % of the total contract that is estimated to have been completed at the end of each year. 2021: 450/(450+150) = 75% b. Using the percentage of completion method, determine the profit that would be recognized during each year of the construction period. 2021: Revenue = (450/(450+150)) = 75%; (75%-45%)*$900,000 = $270,000. Profit = $270,000 $180,000 = $90,000. TOTAL = $290,000 = $900,000 - $610,000 = $290,000 ITS THE LAW. c. Provide the journal entry to record contract revenue and expense: In 2021: DR Contract Expense DR CIP/Contract Asset CR Contract Revenue $180,000 90,000 $270,000 In 2022: DR Contract Expense DR CIP/Contract Asset CR Contract Revenue $160,000 65,000 $225,000 d. Billings and Collections Billings by Year 2021 = $280,000 J/E: 2021 DR A/R CR Billings $280,000 $280,000 d. Collections Cash Collections by Year: 2020 = $240,000 J/Es: 2021 DR Cash CR A/R $260,000 $260,000 2021 = $260,000 2022 = $400,000 e. Contract Cost Accounting Costs incurred each year are accumulated to the cost of the CIP asset. (Remember, Shanahan still owns it, so it hasn’t been sold yet.) During 2021: DR CIP/Contract Asset CR Various Accounts $180,000 $180,000 (A summary journal entry representation) f.. Provide the 2020 and 2021 Balance Sheet Reporting for the Long Term Contract. 12/31/20 $405,000 (270,000) $135,000 CIP-Asset Billings Cost in excess of billings 12/31/21 $675,000 (550,000) $125,000 14. The percentage-of-completion method: A. does not require that collection be reasonably assured. B. recognizes revenue as cash payments on the contract are received. C. can report period losses on profitable contracts. D. is more conservative than the completed-contract method. Generic Percentage of Completion Exercise: 3 Periods, $1M contract price Year Costs Incurred Est. Cost to Complete Est. Total Cost % Complete Cumulative Revenue Period Revenue 1 $250,000 $650,000 $900,000 27.778% $277,778 $277,778 2 $400,000 $200,000 $850,000 76.47% $764,706 $486,828 3 $320,000 $0 $970,000 100% $1M $235,294 Observation, the reported profit each year is the difference in costs incurred and period revenue. So, in year 3 a loss is reported even though an overall profit of $30,000 is made on the project. 22. Summary data for Benedict Construction Co.'s (BCC) Job 1227, which was completed in 2011, are presented below: Assuming BCC uses the percentage-of-completion method of recognition the gross profit recognized in 2011 would be (rounded to the nearest thousand): A. $6,000. B. $39,000. C. $42,000. LAW $75,000 - $33,000 D. $45,000. 23. At year-end XYZ Company has in-process construction projects with costs totaling $10,000,000. It has billed $8,000,000 on these projects and collected $6,500,000. As it employs the percentage-ofcompletion method it has also recognized a total of $1,000,000 in profit to date on these contracts. The XYZ balance sheet would report: A. Asset values totaling $4,500,000 for these projects. A/R B. Asset values totaling $3,500,000 for these projects. CIP C. Asset values totaling $1,500,000 for these projects. Billings D. Liabilities values totaling $1,000,000 for these projects. Net $1,500,000 $11,000,000 ($8,000,000) $4,500,000 24. At year-end XYZ Company has in-process construction projects with costs totaling $6,000,000. It has billed $8,000,000 on these projects and collected $6,500,000. As it employs the percentage-of-completion method it has also recognized a total of $1,000,000 in profit to date on these contracts. The XYZ balance sheet would report: A. Asset values totaling $2,000,000 for these projects. B. Asset values totaling $1,000,000 for these projects. C. Liability values totaling $2,000,000 for these projects. D. Liability values totaling $1,000,000 for these projects. A/R $1,500,000 CIP $7,000,000 Billings (8,000,000) 4. General Knowledge of Revenue Recognition Todd Sweeney is an artist who sells his work under consignment (he displays his work in local barbershops, and customers buy the work there). Sweeney recently transferred a painting to a local barbershop. 17. ADH2 constructed a new subdivision during 2008 and 2009 under contract with Cactus Development Co. Relevant data are summarized below: ADH2 uses the completed contract method to recognize revenue. In its December 31, 2008 balance sheet, ADH2 would report: A. The asset, cost and profits in excess of billings, of $500,000. B. The liability, billings in excess of cost, of $300,000. C. The asset, contract amount in excess of billings, of $1,500,000. D. The asset, deferred profit, of $ 400,000. 4. When a customer acquires goods with the unconditional right to return them then a. Rent revenue may be recorded. b. Revenue is not recognized until the level of returns can be estimated. c. Revenue is recognized in the amount that the customer is billed. d. Revenue is recognized as cash payments are received from the customer. 25. Which of the following statements is false: A. Revenue recognition/realization does not occur prior to the point of sale. B. Bad debt expense is recognized when revenue recognition/realization precedes cash collection. C. In accrual accounting systems revenue recognition/realization may depend on when cash is received. D. Revenue recognition/realization may occur after the point of sale.