Uploaded by

EVELYN CHUNG

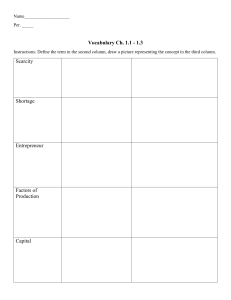

Microeconomics: Taxes, Supply, Demand, and Excise Tax Effects