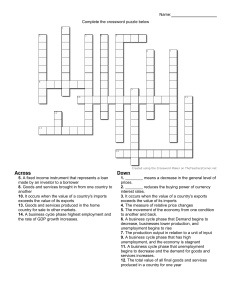

Terms for OCR A-Level Economics:

1. Crowding Out Effect – This occurs when increased government borrowing leads to higher

interest rates, which in turn reduces private sector investment. It happens because government

borrowing competes with businesses and consumers for available funds in financial markets.

2. Crowding In Effect – The opposite of crowding out, this effect suggests that government

spending can stimulate private sector investment by boosting demand and business confidence,

leading to increased economic activity.

3. Quantitative Easing (QE) – A monetary policy tool where a central bank purchases financial

assets (such as government bonds) from banks to increase the money supply and encourage

lending and investment. It is used to combat low inflation and stimulate economic growth.

4. Narrow and Broad Money in Terms of Liquidity –

Narrow Money refers to the most liquid forms of money, such as cash and demand

deposits (e.g., money in checking accounts).

Broad Money includes narrow money plus less liquid assets like savings deposits and

money market instruments, which take more time to convert into cash.

5. Fisher Equation of Exchange – Expressed as MV = PT, where:

M = Money supply

V = Velocity of money (how frequently money is spent)

P = Price level

T = Volume of transactions/output

This equation shows the relationship between money supply and inflation, assuming

velocity and output remain stable.

6. Harrod-Domar Model – A growth model that suggests economic growth depends on the levels

of saving and capital investment. It argues that higher savings lead to more investment, which

drives economic growth, but also highlights potential problems like insufficient savings leading

to low growth, particularly in developing countries.

7. Absolute and Comparative Advantage

Absolute Advantage: A country has an absolute advantage when it can produce a good or

service using fewer resources than another country. This concept, introduced by Adam Smith,

suggests that countries should specialize in goods where they are most efficient.

Comparative Advantage: A country has a comparative advantage when it can produce a good at

a lower opportunity cost than another country. Even if a country lacks absolute advantage in

any good, it can still benefit from trade by specializing in goods where it has the lowest relative

cost.

Example:

Country A can produce 10 cars or 20 computers.

Country B can produce 8 cars or 10 computers.

Country A has an absolute advantage in both goods but has a comparative advantage in

computers (lower opportunity cost).

1

Country B has a comparative advantage in cars and should specialize in them.

8. Terms of Trade (ToT)

Terms of Trade measure the relative price of exports to imports, expressed as:

ToT=(Index of export pricesIndex of import prices)×100\text{ToT} = \left( \frac{\text{Index of

export prices}}{\text{Index of import prices}} \right) \times

100ToT=(Index of import pricesIndex of export prices)×100

If ToT rises, a country can buy more imports for the same amount of exports, improving its trade

position.

If ToT falls, the country needs to export more to afford the same level of imports, worsening its

position.

9.

Marshall-Lerner Condition

This condition states that a depreciation (or devaluation) of a currency will improve the trade

balance if the sum of the price elasticities of demand for exports and imports is greater than 1

(elastic demand).

If demand for exports and imports is inelastic (<1), a weaker currency may worsen the trade

balance initially because the price change does not lead to a significant volume change.

Formula:

∣Ex∣+∣Em∣>1|E_x| + |E_m| > 1∣Ex∣+∣Em∣>1

Where:

ExE_xEx = Price elasticity of demand for exports

EmE_mEm = Price elasticity of demand for imports

10. J-Curve

The J-Curve effect explains how a currency depreciation affects the trade balance over time.

Initially, after a depreciation, the trade deficit worsens because:

o Imports become more expensive immediately.

o Exports take time to respond due to contracts and production lags.

Over time, as demand for exports increases and import demand falls, the trade balance

improves, forming a J-shaped curve on a graph.

2

The Money Supply, Narrow Money & Broad Money

Money supply refers to the total financial assets functioning as money within an

economy

The money supply is broken into different types of money

o Demand deposits are funds held in a checking account that account

holders can withdraw at any time without prior notice

o Near money assets are savings deposits, money market funds, and other

financial instruments that, while not directly functioning as currency, are

highly liquid and easily convertible into cash or used for transactions

o M0 includes physical currency and central bank reserves

o M1 encompasses currency in circulation and demand deposits

o M2 consists of M1 plus savings deposits and similar near-money assets

o M3 includes M2 along with large time deposits and institutional money

market funds

The distinction between narrow money and broad money

Narrow money

Is part of the money supply made up of cash and liquid assets from banks and

building society deposits

o Its primary role is to function as a means of payment

Broad money

It is part of the money supply, comprising of cash, liquid assets from banks

and building society deposits, and also [popover id="6aic1Am7Z87QoU8V"

label="illiquid assets"]

Liquidity measures the ease in which an asset can be converted into cash

o An example of an illiquid asset is a house, which requires a considerable

amount of time to be transformed into cash

o Shares are illiquid but are more easily sold

o Cash is the most liquid of all assets

Role of Financial Markets

Financial markets are any place or system that provides buyers and sellers the

means to exchange goods/services and trade financial instruments

o These include bonds, equities, international currencies and derivatives

1. They facilitate saving: storing money for future use is essential for households

& firms. It also provides a pool of money that financial institutions can lend, i.e.

one person's savings is another person's borrowing

2. They lend to businesses & individuals: access to credit is a key requirement

for economic growth & development. Being able to borrow money speeds

up consumption by households & investment by firms. It also allows

households or firms to purchase assets & pay them off over an extended period

of time, e.g. mortgages on home purchases

3

3. They facilitate the exchange of goods & services: each purchase of

goods/services requires the movement of money between at least two parties.

Financial markets provide multiple ways for this exchange to happen, including

phone apps (Google Pay), debit cards, credit cards & bank transfers

4. They provide forward markets in currencies & commodities: forward

markets are also called futures markets. They provide some price stability in

commodity markets and enable investors to make a profit by speculating on

future prices

5. They provide a market for equities: equities are shares in public companies

that are listed on stock exchanges around the world. Financial markets facilitate

both long term investment and speculation by providing platforms which

connect buyers and sellers e.g. E-Trade

An Introduction to Macroeconomic Objectives

Macroeconomic Objectives are goals set by the government aimed at improving

the overall economic performance of a country as well as the quality of life of

its citizens

4

Diagram: The Macroeconomic Objectives

The government aims to achieve these objectives through the use

of macroeconomic policies

It can be difficult to achieve some outcomes simultaneously

o E.g. High economic growth and stable price levels can be in conflict with

one another

Economic Growth

Economic growth is a central macroeconomic aim of most governments

Many developed nations (UK included) have an annual target rate of 2–3%

o This is considered to be sustainable growth

o Growth at this rate is less likely to cause excessive demand pull

inflation

Politicians often use it as a metric of the effectiveness of their policies and

leadership

Economic growth has positive impacts on confidence, consumption,

investment, employment, incomes, living standards and government budgets

5

Strong economic growth means higher incomes, lower unemployment rates and

better government budgets

Sustainable economic growth will have less demand-pull inflationary pressures

or excessive environmental pressure

Price Stability

The UK has a target inflation rate of 2% using the Consumer Price Index (CPI)

A low rate of inflation is desirable, as it is a symptom of economic growth

The different causes of inflation (cost push or demand pull) require different

policy responses from the Government

o Demand-side policies ease demand pull inflation

o Supply-side policies ease cost push inflation

Minimising Unemployment Levels

The target unemployment rate for the UK is 4–5%

This is close to the full employment level of labour (YFE)

o There will always be a level of frictional unemployment

o This makes it impossible to achieve 100% employment

Within the broader unemployment rate, there is an increased emphasis on the

unemployment rate within different sections of the population

o E.g. youth unemployment, ethnic/racial unemployment by group

In 2021, black unemployment in the UK was 11% and white

unemployment was 4.1%

Low levels of unemployment are a sign of a strongly performing economy and

are inversely linked to real GDP growth

o When real GDP increases, unemployment falls

o When real GDP decreases, unemployment rises

Stable Balance of Payments on Current Account

The Balance of Payments (BoP) for a country is a record of all the financial

transactions that occur between it and the rest of the world

o The current account focuses mainly on the financial transactions related to

exports and imports of goods and services

Governments aim for Balance of Payments equilibrium on the Current Account

o If exports > imports, it will create a current account surplus

o If imports > exports, it will create a current account deficit

Each one of these conditions has advantages and disadvantages

associated with it

However, a current account deficit is more problematic in the longrun

The UK has traditionally run a small deficit

o As a percentage of GDP, the UK current account deficit is insignificant so

has not been problematic

6

Balancing the Government Budget

The Government Budget is presented annually and includes the forecasted

revenue and expenditure

Examples of Government Revenue and Expenditure

Revenue

Expenditure

Sale of state assets; water, electricity

Taxes: VAT, corporation tax, carbon tax

Sales revenue from goods or services, e.g. train tickets

The UK Government aims to run a balanced budget

o If expenditure > revenue, there is a budget deficit

o Any deficit has to be financed through public-sector borrowing

o Any borrowing is added to the public sector debt(Government debt)

If the UK government's debt becomes too high (expressed as a % of GDP),

then lenders begin to lose confidence in the Government's ability to repay the

debt

o The Government then has to raise the interest rate it offers to lenders,

which makes borrowing more expensive

The UK Government has worked extremely hard recently to reduce the budget

deficit and run a balanced budget

o COVID-19 expenditure has eroded the progress they made

Government spending, such as public sect

Unemployment benefits

Spending on public and merit goods

Environmental Protection

The UK government aims to ensure sustainable economic development and

reduce adverse impacts on the environment

In April 2021, the UK Government stated that their environmental aim was to

reduce emissions by 78% by 2035

o This reduction is based on the emission levels of 1990

o It is one of the most ambitious climate change targets globally

o It includes the UK’s share of international aviation and shipping emissions

Broader environmental aims include

o A focus on sustainability

o The reduction of negative externalities of production

o 100% energy from renewable sources by 2035

Equity in the Distribution of Income

Equitable distribution ensures fairness and allows the same opportunities for

everyone

The aim is not equality of distribution as it removes the incentive to work and

study

High levels of income inequality can create social unrest

Income inequality is measured using the Gini Coefficient

7

8