Uploaded by

Beverly Ann Martinez

Applied Economics Assessment: Entrepreneurship & Investment

advertisement

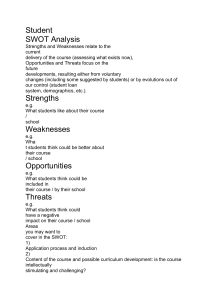

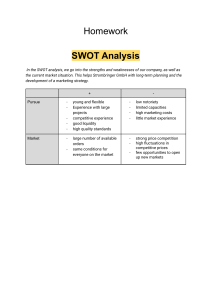

BUHAWEN NATIONAL HIGH SCHOOL FOURTH QUARTER ASSESSMENT, SY 2024-2025 APPLIED ECONOMICS Name: ________________________________________________________ Grade & Section: _____________________ I. MULTIPLE CHOICE Directions: Read very carefully the questions below and choose the letter that corresponds to your answer. Write your answer in the space provided. _____1. It is the ability to know what products and services are needed by people and to be able to provide these things at the right time, at the right place and to the right people and at the right price. a. Entrepreneurship b. Entrepreneur c. Investment d. Products _____2. Who organizes his own business, assumes all the risk and returns on his investment, decides on what, how and how much of a food or service will be provided and monitors and controls all the activities of the business. a. Debtor b. Creditor c. Entrepreneur d. Lender _____3. It is an asset or item acquired with the goal of generating income. a. Investment b. Rate c. Minimum Wage d. Rentals _____4. These are assets of the company which include stocks, bonds and real estate. This kind of investments are assets that a company intends to hold for more than a year. a. Long term investment b. short term investment c. Rentals d. Rate _____5. It is the amount a lender charges for the use of assets expresses as a percentage of the principal. a. Interest rate b. Minimum wage c. Rentals d. Taxes _____6. A mandatory financial charge or some other type of levy imposed upon a taxpayer by a governmental organization to fund various expenditures. a. Taxes b. Rentas c. Rate d. Minimum wage c. Rentals d. Rate _____7. These are investments that must be readily convertible to cash. a. Long term investment b. short term investment _____8. This law establishes a minimum amount that an employer can pay a worker for one day of labor. a. b. c. d. Benefits-Received Tax Principle Ability to Pay Tax Principle Minimum Wage Law Minimum Wage _____9. It becomes an issue to starting entrepreneurs because doing a business does not guarantee you a very big sale right away, so if you don’t make a sale and you still must pay a rent, it will really cause problem. a. Interest rate b. Rentals c. Taxes d. Minimum wage _____10. It is required for certain documents, transactions or instruments specified in the tax code. a. b. c. d. Indirect Taxes Excise Taxes Documentary Stamp Tax Corporate Income Taxes _____11. These are taxes that are imposed on the following: alcohol, tobacco, petroleum products, automobiles, mineral products, and non-essential goods such as jewelry and precious stones, perfumes, yachts and other sport vessels. a. Community Tax b. Excise Taxes c. Vat d. Documentary Stamp _____12. The regular ________________ is 30% on net taxable income. a. Corporate Income Tax b. documentary Stamp Tax c. Community Tax d. Value Added Tax _____13. It refers to purchasing shares of corporate stock hoping to earn a return. a. Investment b. Taxes c. Rentals d. Minimum Wage _____14. A 12% VAT is imposed on the gross selling price on the sale, barter or exchange of goods and properties. a. Community Tax b. Indirect Taxes c. Value added Tax d. Excise Tax _____15. Taxes on income subject to the RCIT are creditable against the calculated liability is called? a. Withholding Taxes b. Corporate Income Taxes c. Indirect Taxes d. Excise Tax _____16. What is the importance of SWOT analysis? a. It will be helpful in assessing new ventures / business opportunities b. It will be of big importance since it can analyze the rivalry within the market c. It will be helpful since it will give us the changes that we need to adjust in the market d. None of the above _____17. It is one of the tools used in creating a business designed to help you establish if all of your business activities are aligned to your strategy. a. SWOT b. TOWS c. VMOST d. PESTLE _____18. It is a tool used as an analytical framework that can help a company meet its challenges and identify new markets. a. SWOT b. TOWS c. VMOST d. PESTLE _____19. SWOT analysis consists of _______________________. a. Internal factors b. External factors c. Internal & external factor d. PESTLE _____20. It is a strategic management tool that businesses use to identify macro-economic factors that it needs to consider. a. Internal factors b. External factors c. Internal & external factor d. PESTLE True or False II. Directions: Write TRUE if the statement is TRUE and write FALSE if the statement is FALSE. Write your answers in your notebook. ____________ 21. In creating a business, it is necessary to do a comprehensive study or research. ____________ 22. PESTLE analysis requires a study of the internal and External factors. ____________ 23. One of the tools and techniques used in creating a business is to identify strength and to overcome weaknesses. ____________ 24. PESTLE analysis stands for Political, Environmental, Social, Technological, Legal and Energy. ____________ 25. The creator of TOWS analysis is Michael Porter. ____________ 26. VMOST stands for Mission, Vision, Opportunities, Strength and Tactic ____________ 27. Tactics in the VMOST analysis represents what Methodology will be used to achieve those Goals. ____________ 28. Strength and Weaknesses in a SWOT analysis represents the Internal factors while Opportunities and Threats represents external factors. ____________29. Sample of strengths in a SWOT analysis are possible pollution problems, lack of training of workers. ____________ 30. Strengths/Opportunities combination of the four TOWS analysis represents the strategies that use strengths to maximize opportunities. ____________ 31. Weaknesses/Threats combination of the four TOWS analysis represents Strategies that minimize weaknesses and avoid threats. ____________ 32. Weaknesses/Opportunities combination of the four TOWS analysis represents strategies that use strengths to minimize threats. IDENTIFICATION III. Directions: Identify which type of business industry is mentioned in the statements. ____________33. This refers to the processing of raw materials (ex. Ore, wood, and foodstuff) into finished products and into something more useful ____________34. It is company engaged in the business of dealing with financial and monetary transactions such as deposits, loans, investments, and currency exchange. ____________35. These consist of establishments that purchase products from other businesses or manufacturers and sell them to customers. ____________36. The Philippines has predominantly always been an agrarian economy. ____________37. __________ industry in the Philippines is very well known since our country has a very rich biodiversity of tourist attraction. From beaches, heritage towns, monuments, mountains, resorts, rainforest, island and diving spots. ____________38. The exchange of products and services between countries. ____________39. Business Process Outsourcing or BPOs have been one of the fast paced and rapidly expanding industries in the Philippines. ____________40. The Department of Trade and Industry (DTI) has recently stated that the Filipino Government is opening up the __________industry to foreign investors with the idea that these investors can potentially become local contractors by providing them construction permits. ESSAY: (5 points) IV. Directions: Explain the effects of the various socio-economic factors affecting business and industry. Cite at least 2. Scoring Rubric: Prepared by: BEVERLY ANN C. MARTINEZ Teacher I Noted: ANA L. VIADO School Principal I