Demographic Transition, Aging & Economic Growth in Asia-Pacific

advertisement

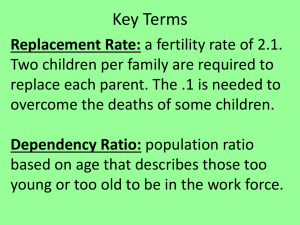

ECON3320 AsiaPacific Economies Demographic Transition, Aging Population and Economic Growth Demographic Transition and Economic Miracles in Asia Bloom, David E., and Jeffrey G. Williamson. "Demographic transitions and economic miracles in emerging Asia." The World Bank Economic Review 12.3 (1998): 419-455. 2 Demographic Transition 3 4 • The demographic transition describes the change from preindustrial high fertility and mortality to postindustrial low fertility and mortality. • The demographic transition must be accompanied by a cycle in population growth and in the age structure. • The crude birth rate fell much more rapidly in East Asia than in Southeast or South Asia, the timing was not so different. • In most countries, like Korea, Malaysia, and Singapore, fertility began to decline about 15 years after the drop in child mortality. • In other countries, like Thailand, the delay was closer to 25 years. 5 • The ratio of workingage population (those age between 15 and 64) to nonworking- age population has been rising in Asia since 1970, but this increase was especially dramatic in East Asia between 1975 and 1990. http://unstats.un.org/unsd/methods/m49/m49regin.htm 7 Three phases of demographic transition in Asia • Throughout the 1950s and 1960s, the dominant trend was a large increase in the number of children. 8 • The second phase emerged in the 1970s, when the increase in the number of people of working age exceeded the increase in the number of young people in a growing number of countries. 9 • According to the projection, the change in the 60 and older population will dominate changes in other age groups in 34 countries. 10 Demographic Transition and Economic Growth 11 • In the early stages of the demographic transition, rising youth dependency burdens and falling shares of working-age adults diminish the growth of per capita income. • As the transition proceeds, falling youth dependency burdens and rising shares of working-age adults promote the growth of per capita income. • The early burden of having few workers and savers becomes a potential gift: a disproportionately high share of working-age adults. • Later, the economic gift dissipates, as the share of elderly rises. 12 78 Asian and non-Asian countries Sample years from 1965 to 1990 13 14 Statistically insignificant Statistically significant 15 Statistically significant • The growth rate of the economically active population exceeds that of the overall population, higher growth rates of GDP per capita have appeared • If the population is growing more rapidly than the work force, the estimates provide evidence of slower growth. 16 • The coefficient on the population under the age of 15 is negative and significant in both specifications: thus an increase of 1 percentage point in growth of the population about 0.4 percentage point (column b). • A small, statistically insignificant, but positive, coefficient emerges for the elderly population. • Economic growth is less rapid when the growth rate of the working-age population falls short of that of the population as a whole before 1970. • Economic growth is more rapid when the growth rate of the working-age population exceeds that of the population as a whole after 1970. • Economic growth is somewhat less rapid when the growth rate of the working-age population once again falls short of that of the entire population (an aging phenomenon in the next quarter century). Explaining the East Asian Miracle 19 • Population dynamics can explain between 1.37 and 1.87 percentage points of growth in GDP per capita in East Asia or as much as one-third of the miracle (1.9 / 6.11 = 0.31). 20 • Suppose the steady state of economic growth (i.e., stable population growth) is 2%, then the miracle growth is defined as 4.11%. • Population dynamics explains almost half of the miracle (1.9 / [6.11 - 2] = 0.46). AGING POPULATION AND ECONOMIC GROWTH Park, D and Shin, K. 2011. Impact of Population aging on Asia’s Future Growth. ADB Economics Working Paper Series No. 281, Asian Development Bank, Manila. 22 Examine the impact of the demographic transition on the economic growth of 12 developing Asian economies from 2011 to 2020 and from 2021 to 2030 using projections of age structures readily available from the United Nations (UN) population database. Introduction The 12 economies in the sample are the People’s Republic of China (PRC); Hong Kong; India; Indonesia; the Republic of Korea; Malaysia; Pakistan; the Philippines; Singapore; Taipei; Thailand; and Viet Nam. 23 • Old-age ratio—the ratio of those aged 65 or older to the working-age population (people aged 15–64). • Youth dependency ratio—the ratio of those aged 0–14 to the working-age population. 24 25 26 Sources of Growth • The first demographic dividend refers to the accelerated economic growth associated with a rise in the share of people of working age in the total population. • 𝑌/𝑃 = 𝑌/𝐿 × 𝐿/𝑃 i.e. GDP per capita = GDP per worker × (number of workers/total population) • Use the Cobb-Douglas production function: 𝑌 = 𝐴𝐾 𝛼 (ℎ𝐿)(1−𝛼) where ℎ is human capital, ℎ𝐿 is total labor input, A is total factor productivity,𝛼 is the share of capital in income. • The per-worker production function is: 𝑦 = 𝑓 𝑘 = 𝐴𝑘 𝛼 ℎ 1−𝛼 • GDP per capita = (𝐿/𝑃) 𝐴𝑘 𝛼 ℎ(1−𝛼) 27 • Growth rate of GDP per capita: • Δln(𝑌/𝑃) = Δln 𝐿/𝑃 + Δln(𝑌/𝐿)…… (1) • Growth rate of GDP per worker: • Δln(𝑌/𝑃) = Δln(𝐴) + 𝛼 Δln(𝑘) + (1 − 𝛼)Δ ln(ℎ)…… (2) • Combining (1) & (2) gives: • Δln(𝑌/𝑃) = Δln 𝐿/𝑃 + Δln(𝐴) + 𝛼Δln(𝑘) + (1 − 𝛼)Δ ln(ℎ) • The growth rate of per capita GDP is made up of four components: the growth rates of (i) per capita labor, (ii) TFP, (iii) per labor physical capital, and (iv) human capital. ln(Y/P)= ln(L/P)+ ln(A) + αln(k) + (1-α)ln(h) 28 Impact of Demographic Change on Growth Labor force participation (L/P) Old-age ratio—the ratio of those aged 65 or older to the working-age population (people aged 15–64). Youth dependency ratio—the ratio of those aged 0–14 to the working-age population. Old-age dependency Youth dependency Productivity growth (A) Growth of capital accumulation (K/L) Growth rate of GDP per capita: Δln(𝑌/𝑃) = Δln 𝐿/𝑃 + Δln(𝐴) + 𝛼Δln(𝑘) + (1 − 𝛼)Δ ln(ℎ) 29 • The independent variables are old-age dependency, youth dependency, per capita GDP, and per capita GDP squared. • The squared term captures possible nonlinear effects. • Both dependent and explanatory variables are 10-year average values. • If the old-age dependency ratio increased by 10%, the growth rate of per capita labor would decrease either by 0.56% (random effects) or by 0.68% (fixed effects). 30 Table 4:Estimation Result TFP Growth Initial TFP Years of schooling • Age structure of the labor forces affects labor productivity and the productivity of all productive inputs. • Demographic change does not exert a direct effect on capital accumulation, but indirectly through its negative effect on the savings rate. Initial population Research and development stock growth [1] -0.020*** [0.003] 0.050*** [0.0120 0 [0.001] 0.001*** [0.020] 0.064*** [0.020] [2] -0.018*** [0.003] -0.006 [0.015] 0 [0.001] 0 [0.001] 0.031 [0.021] -0.068*** [0.024] -0.061*** [0.011] -0.023*** [0.003] 0.022*** [0.006] 0.680*** [0.254] -0.447* [0.025] 0.122*** [0.025] 0 [0.003] 0.000*** [0.000] -0.027*** [0.003] 0.01 [0.009] -0.046 [0.570] 0.001 [0.002] 0.268*** [0.060] 2.479*** [0.786] 0.109*** [0.018] -0.638*** [0.154] -0.294*** [0.107] 170 0.003* [0.002] 0.261*** [0.060] 2.619*** [0.838] 0.109*** [0.018] -0.597*** [0.160] -0.199* [0.113] 170 Old-age dependency Youth dependency K/L growth Initial per labor physical capital Initial TFP Growth rates of TFP Growth rates of population Saving rate Openness Property rights Old-age dependency Youth dependency Saving Rate Life expectancy Elderly participation GDP growth Initial per capita GDP Old-age dependency Youth dependency Observations 0.141*** [0.030] 0 [0.003] 0.000*** [0.000] 0.062 [0.059] -0.044 [0.049] 31 Impact of Demographic Change on Growth Labor force participation (L/P) Old-age dependency Savings rate Youth dependency Productivity growth (A) Growth of capital accumulation(K/L) • Growth rate of GDP per capita: • ln(Y/P)= ln(L/P)+ ln(A) + αln(k) + (1-α)ln(h) 32 Impact of Demographic Change on Growth Labor force participation (L/P) High old-age dependency ratio (aged 65 or older to population aged 15-64) Productivity growth (A) Savings rate Growth of capital accumulation(K/L) • Growth rate of GDP per capita: GROWTH ↓ • ln(Y/P)= ln(L/P)+ ln(A) + αln(k) + (1-α)ln(h) 33 Impact of Demographic Change on Growth Labor force participation (L/P) Lower youth dependency ratio (aged 0-14 to population aged 15-64) Productivity growth (A) Savings rate Growth of capital accumulation(K/L) GROWTH ↑ • Growth rate of GDP per capita: • ln(Y/P)= ln(L/P)+ ln(A) + αln(k) + (1-α)ln(h) 34 • From 2001 to 2020: youth dependency ratio: 0.328 to 0.273; old-age dependency ratio: 0.106 to 0.137. • Combining the three channels, the collective impact of the change in the youth dependency ratio is to increase the PRC’s growth rate of per capita GDP by 0.605% (=0.087%+0.334%+0.072%+0.112%)while the total impact of the change in the old-age dependency ratio is to decrease it by 0.449%. • Overall, demographic change raises the growth rate of per capita GDP by 0.156%. 35 Table 5: Impact of Aging on Economic Growth Projections for 12 Asian Economies 2011-2020 (%) Aggregate Physical Capital/Labor Force China. Peoples Rep. cf Hong Kong. China India Indonesia Korea Rep. of Malaysia Pakistan Philippines Singapore Taipei,.China Thailand Variable Labor Total Indirect (Dependency Force/ Factor (through Population Productivity saving) Ratio) Direct Total Youth Old-age 0.087 -0.209 0334 -0206 0.072 -0.121 0.112 0.089 0.605 -0.449 Youth Old-age 0.085 -0.519 0327 -0318 0.070 -0.185 0.110 0.136 0.592 -0.686 Youth Old-age 0.159 -0.072 0615 -0.071 0.132 -0.041 0.206 0.030 1.113 -0.154 Youth Old-age 0.117 -0.1 25 0.453 -0.124 0.098 -0.072 0.152 0.053 0.819 -0.268 Youth Old-age 0.112 -0.407 0.431 -0.405 0.093 -0235 0.145 0.173 0.780 -0874 Youth Old-age 0.142 -0.162 0349 -0.161 0.118 -0.094 0.184 0.069 0.994 -0.349 Youth Old-age 0.169 -0.048 0631 -0.048 0.140 -0.028 0.218 0.021 1.178 -0.104 Youth Old-age 0.157 -0.117 0606 -0.117 0.131 -0.068 0.203 0.050 1.097 -0.252 Youth Old-age 0.152 -0.540 0386 -0337 0.126 -0.312 0.197 0.229 1.061 -1.160 Youth Old-age 0.140 -0.323 0339 -0321 0.116 -0.187 0.181 0.137 0.976 -0.694 Youth Old-age 0.068 -0.184 0262 -0.183 0.057 -0.107 0.088 0.078 0.475 -0.396 Youth Old-age 0.214 -0.014 0826 -0.014 0.178 -0.008 0.277 0.006 1.494 -0.030 Viet Nam 36 K/L = aggregate physical capital/labor force Source: Authors' calculation 37 Declining positive impact of demography on economic growth in the next two decades. Prepare for the ageing population: More and better child care Raise the legal retirement age Provide adequate income support and health care to the elderly Conclusions SUPPORT SYSTEM IN ASIA • Lee, Sang-Hyop, Andrew Mason, and Donghyun Park. Why Does Population Aging Matter So Much for Asia?: Population Aging, Economic Growth and Economic Security in Asia. No. 284. Asian Development Bank, 2011. • Lee, S.- H. and N. Ogawa (2011), ‘The economic lifecycle and support systems in Asia’, in D. Park, S.-H. Lee and A. Mason (eds), Aging, Economic Growth , and Old-Age Security in Asia. Cheltenham, UK and Northampton, MA, USA: Edward Elgar Publishing. Introduction Table 5.1 Ratio of labor income to per capita consumption of children and young adults in eight Asian economies in various years Age Group 0-19 15-19 20-24 25-29 PRC (2002) India (2004—05) Indonesia (2005) Japan (2004) Republic of Korea (2000) Philippines (1909) Taipei, China (1998) 0.1 1 0.09 0.09 0.25 0.24 0.96 0.63 0.65 0.50 0.73 0.59 0.65 1.99 1.09 0.93 1.05 1.33 1.03 1.30 Thailand (2004) 0.07 0.01 0.05 0.07 0.03 0.28 0.03 0.14 0.18 0.10 0.20 0.65 1.11 Note: These are synthetic cohort values that are calculated using recent data on survival weights of the United States. Values are the ratio of the stun of per capita labor income at each single year of age and the sum of per capita consumption at each single year of age within the age group. Source: National Transfer Accounts database, accessed 1 July 2011 . • In Japan, those in their early twenties contribute the least to their own support. • Labor income is especially high relative to consumption among Chinese workers in their twenties. 40 • In all eight economies, there is a relatively rapid transition to low incomes at older ages. Labor income drops below consumption at age 55 in Taiwan, followed by Korea at 56 and Indonesia and Thailand at 58. • 60-year-olds do not produce more than they consume. • How to reduce the dependency of older adults? 41 42 The Economic Lifecycle • The gaps between consumption and labor income is called the lifecycle deficit 3 Components of Age Reallocation System • Public transfers, i.e., education, public pensions, and healthcare. • Private transfers: transfers among family members • asset- based reallocations, i.e., pension funds or personal saving. 43 Asset-based public transfers • The lifecycle deficit – consumption greater than labor income – must equal net public transfers plus net private transfers plus asset- based reallocations. • Familial transfers fund about 45 percent of the lifecycle deficit for the elderly in Taiwan, 33 percent in Thailand, and slightly under 20 percent in the PRC and Korea. 44 public transfers • Compared with European and Latin American countries, the public sector is generally less important to the elderly in Asia. • In the Philippines and Thailand, net public transfers are zero 45 Asset-based public or private transfers • Assets are an important source of support in all Asian countries except the PRC and Taiwan, where transfers are more important. In Indonesia and the Philippines, the elderly rely almost entirely on assets. 46 • The elderly of Asia rely much more on familial transfers as age increases; at the oldest ages, familial transfers are quite important in filling the gap between the lifecycle deficit and decreasing asset- based reallocation. • In the US, public transfers rise in importance for the older elderly. Net familial transfers to the elderly are quite small. • In each of the East Asian economies, public transfers and asset- based reallocations have increased in importance as familial transfers have decreased 47 Fiscal Effect of Population Age Structure Fiscal support ratio is defined as the ratio of aggregate taxes to aggregate benefits • Population aging combined with the current tax and benefit policies would lead to a 26% decline in the fiscal support ratio by 2050 in Japan. • Taxes increase, benefits decrease, deficits increase, or some combination of the three 48 49 Low-income countries High-income countries • If the needs of a growing elderly population are met through greater reliance on lifecycle saving, population aging will lead to an increase in assets, with favorable implications for economic growth. 50 The End