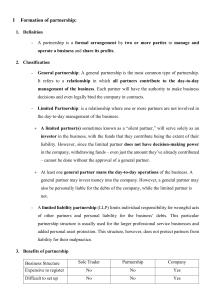

CHAPTER 1: GENERAL PROVISIONS Art. 1767-1783 1. Nature and Definition of a Partnership (Art. 17671769) A partnership is an agreement where two or more people contribute money, property, or industry to a common fund to share profits. It may also be formed for the practice of a profession. A partnership has a separate legal personality from its members. o Kung di siya legal, void na siya. Guidelines to determine the existence of a partnership: o Co-ownership or shared gross returns does not necessarily mean a partnership. o Sharing of profits is prima facie evidence of a partnership unless the profits are received as debt payments, wages, rent, annuities, interest, or sale of goodwill. Requirements: there must be a valid contract; parties must have the legal capacity to enter a contract; have a mutual contribution of money, property, or common fund; prestation or object must be legal; and the primary purpose is to earn a profit o Industry – services may also be contributed Rules that apply o People who are partners to each other are partners to the people they engage with (this is in alignment with the right and power of each partner to represent the business and conduct business with third persons on behalf of the partnership) o Co-ownership (or co-possession) of an item does not signal a partnership instantly, even if it does generate profits. 2 people can be co-owners of the same property but are not in a partnership. They just reap the benefits. o Sharing profits does not signal a partnership instantly. 2. Legality and Formalities of a Partnership (Art. 1770-1775) The partnership must have a lawful purpose; otherwise, profits are confiscated by the State. o All property, capital, and/or profits that were reaped or used in the illegal operation will be confiscated by the state. However, if it wasn’t, it would not be confiscated, rather ibabalik siya to the partners. It can generally be constituted in any form, except when involving immovable property, which requires a public instrument. Partnerships with a capital of ₱3,000 or more must be in a public instrument and registered with the SEC. o If the partners do not register their business, they can still be held liable to third persons (sometimes people use their unregistered status to escape responsibilities tied to being in a partnership ex. Paying taxes) If immovable property is contributed, a signed inventory must be attached, or the partnership is void. The partnership can acquire and hold immovable property in its name. o However, remember: yes, there are cases wherein the partnership owns the property, but there can also be cases wherein the partnership only has the right to use it and no absolute ownership. Secret associations, whose articles are kept secret from its members and wherein any one of its members contracts to third parties in their own name, lack juridical personality and are governed by co-ownership laws. o Typically, partners should only work exclusively for the partnership (lalo na kung industrial partner ka) because you should be working for the benefit and growth of the partnership. o Being in a partnership connotes that partners TRUST one another. In the event that there are documents being kept secret from other members, this implies that there is a lack of trust amongst the members. 3. Classification of Partnerships (Art. 1776-1783) By Scope: Universal Partnership – Covers either all present property or all profits acquired during the partnership’s existence. Magkaiba ang “of all present property” sa “all profits” These are sub-types of universal partnership Kung walang specifications on what type of partnership, it is assumed that it is a universal partnership of profits o Particular Partnership – Limited to specific property, a particular business activity, or a profession. Partners come together not to be partners for so long but only until their common goal is fulfilled. They may choose to continue their partnership after the completion of the undertaking, however. By Liability of Partners: o General Partnership – All partners share liability. o Limited Partnership – Some partners have limited liability. There are general partners in a limited partnership, but for those limited partners, their o liability extends to the point of their contribution Universal Partnerships: o Of Present Property (Art. 1778-1779): Partners contribute all current assets and share profits, but future inheritances and gifts are excluded. Emphasis on the word “ALL” kasi literal na ALL dapat ibibigay sa partnership All succeeding properties, though, acquired outside of the partnership is personal unless stipulated otherwise. o Of Profits (Art. 1780-1781): Partners share only profits acquired from work or industry, while personal property remains theirs. While properties remain exclusively theirs, the use of the property passes onto the partnership (technical term: the usufruct) Future property remains as their own. Any Legal Restrictions: o People prohibited from donating to each other cannot form a universal partnership. CHAPTER 2: OBLIGATIONS OF THE PARTNERS Section 1 (Art 1784-1809): Obligations of Partners Among Themselves o If a partner fails to contribute money, they owe interest and damages (Art. 1. Formation and Continuation of the Partnership A partnership begins upon the execution of the 1788). contract unless stated otherwise (Art. 1784). o Demand is not needed in such cases. It If a fixed-term partnership continues without goes without saying. a new agreement, it operates as a partnership at Capitalist partners contribute equally, unless will (Art. 1785). agreed otherwise (Art. 1790). o If the partner wants to dissolve the o When no stipulation is made regarding partnership, they may do so on their capital division, ASSUMING equal own, BUT they must do it in good faith sharing is the last resort. Industrial partners (who contribute labor) cannot engage in similar businesses unless 2. Contributions and Responsibilities of Partners Each partner is responsible for their promised permitted (Art. 1789). contributions (money, property, or industry) Capitalist partners are not allowed to also (Art. 1786). engage in the same line of business with another business, unless stipulated otherwise. 3. Risk, Liability, and Financial Duties In cases of imminent loss, partners are compelled to contribute more shares to save the venture. In cases wherein they o If a partner contributes goods, the value and/or quality will be assessed as stated in the contract. In the absence of such details, it will be assessed by an experts don’t want to contribute more, they shall be obliged to sell their share. o This does not apply to industrial partners. o Refusal must be deliberate (not due to other reasons) o All partners collectively believe that additional funding will save the business. Liability for partnership debts: A partner collecting money owed to both them and the partnership must apply it proportionally (Art. 1792). o If the sum was only applied to the partnership (even if may debt yun debtor sa partner), the whole sum will be given to the partnership. Kunwari, the debtor gave the money to the partner first but the partner instead forwarded that money to the partnership. The money may not be revoked by then. The payment goes to the partnership not the partner despite it being given to the partner first. o REQUISITE: debts should both be demandable (past the due date). If not, mauuna muna yung demandable debt. If a partner receives payment before others and the debtor later becomes insolvent, they must return the amount (Art. 1793). o The amount received must be divided amongst the partners, depending on how much is due to them. Partners are liable for damages caused by their fault but courts may reduce liability if extraordinary efforts benefit the partnership (Art. 1794). Partner cannot compensate it with profits or benefits he has earned the partnership in the past through his service (di niya pwede sabihin na dahil nakalikom siya nang gantong amount, he should be excused from his liability. This is part of his responsibility as a partner) Risk of contributed property: o If only the use and fruits of an asset are contributed, the partner bears the risk (Art. 1795). o If fungible goods or assets intended for sale are contributed, the partnership bears the risk (Art. 1795). Or if the item deteriorates, risks shall be borne by the partnership The partnership is obliged to carry the expenses, obligations, and risks associated with any business dealing done by the partner in behalf of the partnership. o Therefore, if a partner spends personal money on the business dealing, it must be reimbursed. 4. Sharing of Profits and Losses Profit and loss sharing follows the partnership agreement (Art. 1797). o If only profit shares are specified, losses follow the same ratio (Art. 1797). If no agreement exists, profit/losses are shared based on contributions, except industrial partners do not share in losses (Art. 1797). o If contribution isn’t specified, the next assumption is equal sharing of profits and losses. o Industrial partners no longer share in the losses because 1 – work done cannot be reversed; 2 – partnership failure equals the labor done in vain, kaya parang nagloss na rin siya in a way. A stipulation excluding a partner from all profits or losses is void (Art. 1799). o RECALL: a legal reason for opening a partnership is to pursue profit; therefore, withholding such goes against this. o Only an industrial partner is exempted from losses. o This doesn’t mean the partnership stops. The partnership continues, but only the stipulation does not. If partners made a third person decide on each partner's profit and loss designation, it can only be challenged when it is unfair. o They should challenge the designation within 3 months of execution o No argument done is as good as saying the division is good amongst the partners. 7. Right to a Formal Accounting A partner may request an official accounting in cases of: 1. Wrongful exclusion from the business. 2. A contractual right to an accounting. 3. Misuse of partnership assets by another partner. 4. Other reasonable circumstances (Art. 1809). 5. Management and Decision-Making A designated managing partner’s authority is irrevocable without just cause (Art. 1800). If multiple partners are managers: o If duties aren’t specified, any may act unless another objects, in which case the majority decision prevails (Art. 1801). o If unanimous consent is required, all must agree unless urgent action is needed (Art. 1802). Without a management agreement, all partners can act as agents, but major property changes require consent (Art. 1803). 6. Rights of Partners A partner may associate another person with their share, but the associate does not become a partner without everyone’s consent (Art. 1804). Partners have the right to inspect partnership books at reasonable times (Art. 1805). Partners must disclose all relevant information and account for any benefits gained from partnership transactions (Arts. 1806–1807). Capitalist partners cannot compete with the partnership’s business unless permitted (Art. 1808). CHAPTER 2: OBLIGATIONS OF THE PARTNERS Section 2 (Art 1810-1814): Property Rights of A Partner 1. Fundamental Property Rights of a Partner (Art. 1810) A partner has three primary property rights: 1. Rights in specific partnership property – Coownership with other partners. 1. Partner may still own the property but give the partnership the right to use it 2. The partnership shall own property acquired by partnership funds 2. Interest in the partnership – The partner’s share of profits and surplus. 3. Right to participate in management – Involvement in decision-making. 2. Co-Ownership of Specific Partnership Property (Art. 1811) Equal right to use partnership property for business purposes, but personal use requires consent. o If ginamit yun property for personal purposes, the fruits gained from the property must be shares witht the other partners. Cannot assign ownership of specific partnership property unless all partners agree. Not subject to personal attachment or execution unless the debt is against the partnership. Not liable for legal support claims (e.g., family support obligations). 3. Interest in the Partnership (Art. 1812) A partner’s interest is limited to their share of profits and surplus—not specific partnership assets. o Surplus refers to the assets after debts and liabilities are paid 4. Assignment of a Partner’s Interest (Art. 1813) A partner can transfer their interest, but this does not dissolve the partnership or give the assignee management rights. The assignee is only entitled to receive profits that the assigning partner would have received. o In short, the assignee is not entitled to the rights a partner would usually have; instead, he/she is only a representative to receive profits (he/she does not have the fundamental rights of a partner) o They can only step in in cases of fraud. If the partnership dissolves, the assignee can claim the assignor’s share and request an account of assets. 5. Rights of Creditors Over a Partner’s Interest (Art. 1814) Creditors can charge a partner’s interest to satisfy debts with court intervention. o Interest refers to the share in profits and surplus A receiver may be appointed to collect the debtor partner’s profits. The interest can be redeemed before foreclosure or purchased by: o Another partner using personal assets o The partnership, with unanimous consent This does not automatically dissolve the partnership. CHAPTER 2: OBLIGATIONS OF THE PARTNERS Section 3 (Art 1815-1823): Obligations in Regards to third persons o In cases wherein there is debt to third persons, ALL partners are responsible, 1. Firm Name & Liability (Art. 1815-1817) UNLESS stipulated otherwise. A partnership must operate under a firm name. Anyone who falsely includes their name in the 2. Authority of Partners (Art. 1818-1819) firm name assumes liability as a partner. Each partner is an agent of the partnership and o This does not mean that the partner’s their actions bind the business, unless name included in the firm name is a unauthorized. partner; they don’t get a share in the o Kung unauthorized siya, it does not bind profits nor have a stake in the decisionthe partnership. making BUT meron silang share sa liability Certain major decisions require unanimous consent, like selling assets or confessing a o In short, don’t put your name in a judgment (check the book for more). partnership you are not part of!!! o Unless the partners are ABANDONING Habulin ka pa ng creditor. the business, they cannot decide shit on All partners are personally liable for their own. partnership debts after assets are exhausted. o Included dito ang industrial partner A partner can transfer real property, but the o Pwede habulin na personal property ng partnership may reclaim it if the transfer my partners after exhausting partnership exceeded authority. assets. o Pro-rata ang sharing (means equal not 3. Legal Implications of Partner Actions (Art. 1820proportional in this case) 1821) o Partners may agree to carry certain debts Statements or admissions by a partner to avoid touching partnership assets. regarding partnership affairs serve as evidence That means, sila muna hahabulin ni against the firm. creditor. Notice to one partner is considered notice to Agreements limiting partner liability only apply the entire partnership, except in cases of fraud. among partners, not to thirdn parties. o “WHAT’S URS IS MINE!” vibes 4. Liability for Wrongful Acts (Art. 1822-1824) The partnership is liable for any wrongful acts by a partner in business dealings. o Kung may kasalanan ang isang partner sa isang third person, the whole partnership will be at fault as well. If a partner misuses money or property of a third party, the partnership must compensate for the loss. All partners share solidary liability, meaning creditors can go after any partner for full repayment. o Ang responsabilidad ng isa, responsabilidad ng lahat! 5. Misrepresentation & Partner Admission (Art. 1825-1826) If someone falsely claims to be a partner, they can be held liable as if they were one. New partners are responsible for past partnership debts, but only using partnership property (unless agreed otherwise). In short, a new partner is not only part of the present-future but also part of the present-past. They are obligated to address debts incurred in the past as if they were there when it happened. 6. Creditors’ Rights (Art. 1827) Partnership creditors have priority over personal creditors when claiming partnership assets. Personal creditors of a partner can sell that partner’s share in the partnership to recover debts.