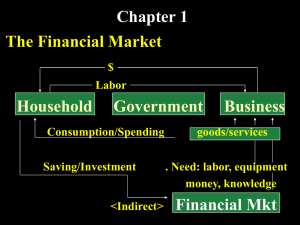

BRIEF OVERVIEW OF FINANCIAL MANAGEMENT WHAT IS FINANCE? Art and science of managing money. The art and science of managing the financial resources of a business. Study of how individuals, institutions, governments and businesses acquire, spend and manage money and other financial assets. FUNCTIONS OF BUSINESS FINANCE Allocation of financial resources Procurement of funds Efficient and effective utilization of financial resources 1. ALLOCATION OF FUNDS Is the project necessary? What is its social relevance? Are there other alternatives? How will the proposal affect our current operations? What resources of the company can be used in the project? How much is the estimated capital requirement? What is the economic life of the project? How much are the estimated cash returns? How long will it take to recover our investment or what is the payback period? What is the rate of return on investment? Is the rate of return higher than the cost of capital to be used? What are the risks involved in the proposal? 2. PROCUREMENT OF FUNDS The process of obtaining funds and the costs involved. Financing happens here. WHAT IS MANAGEMENT? It is the process of POSDCON P - PLANNING O - ORGANIZING S - STAFFING D - DIRECTING/LEADING CON – CONTROLLING WHAT IS FINANCIAL MANAGEMENT? Involves financial planning, asset management and fundraising decisions to enhance the value of businesses. GOAL OF FINANCIAL MANAGEMENT To maximize the wealth of the shareholders, to allocate funds to current and fixed assets, to obtain the best mix of financing alternatives, and to develop an appropriate dividend policy within the context of the firm’s objectives. FINANCIAL MANAGEMENT IN DIFFERENT PERSPECTIVES: GOVERNMENT FM – scary spending, no need to return excess. PRIVATE COMPANY FM – conservative because it has responsibility to the shareholders to give returns in a form of dividend (if corporation). PERSONAL FM – sustainability of financial resources. 3 FORMS OF BUSINESS ORGANIZATIONS (1) SOLE PROPRIETORSHIP (2) PARTNERSHIP (3) CORPORATION SOLE PROPRIETORSHIP A form of organization where there is only one owner/proprietor. After operating for some time, he/she invites or gets invited to form a partnership or a corporation. WHAT IS FINANCING? The process of providing funds for business activities, making purchases or investing. PARTNERSHIP An association of two or more persons who bind themselves to contribute money, property, or industry to a common fund, with the intention of dividing profits among themselves. 3. EFFICIENT AND EFFECTIVE UTILIZATION OF FINANCIAL RESOURCES Efficient – financial resources are actually being used for what they have been intended. Effective – refers to their use towards the attainment of predetermined objectives. CORPORATION It is an artificial being created by operation of law, having the right of succession and the powers, attributes and properties expressly authorized by law or incident to its existence. RIGHT OF SUCCESSION A corporation has the right to continuous existence irrespective of death, withdrawal, insolvency or incapacity of the individual members or shareholders and regardless of the transfer of their interests or shares of stock. CHAPTER 1: AN OVERVIEW OF FINANCIAL MANAGEMENT CHARACTERISTICS OF SUCCESSFUL COMPANIES successful companies have skilled people successful companies have strong relationships successful companies have enough funding 2. More Than One Owner: A Partnership - two or more persons or entities associate to conduct a noncorporate business for profit. General Partnership - a business arrangement by which two or more individuals agree to share in all assets, profits, and financial and legal liabilities of a jointly-owned business. Limited Partnership - certain partners are designated general partners and others limited partners. Limited partners can lose only the amount of their investment in the partnership, while the general partners have unlimited liability. Limited partners typically have no control—it rests solely with the general partners—and their returns are likewise limited. A Bird’s-eye View of Finance Limited Liability Partnership (LLP) and a Limited Liability Company (LLC), all partners (or members) enjoy limited liability with regard to the business’s liabilities, and their potential losses are limited to their investment in the LLP. 3. Many Owners: A Corporation - a legal entity created under state laws, and it is separate and distinct from its owners and managers. THE CORPORATE LIFE CYCLE 1. Starting Up as a Proprietorship - an unincorporated business owned by one individual Advantages: a) It is easily and inexpensively formed. b) It is subject to few government regulations. c) Its income is not subject to corporate taxation but is taxed as part of the proprietor’s personal income. Limitations: a) It may be difficult for a proprietorship to obtain the funding needed for growth. b) The proprietor has unlimited personal liability for the business’s debts, which can result in losses that exceed the money invested in the company. c) The life of a proprietorship is limited to the life of its founder. Major Advantages: a) unlimited life b) easy transferability of ownership interest c) limited liability Advantages over Partnership: a) Corporate earnings may be subject to double taxation—the earnings of the corporation are taxed at the corporate level, and then earnings paid out as dividends are taxed again as income to the stockholders. b) Setting up a corporation involves preparing a charter, writing a set of bylaws, and filing the many required state and federal reports, which is more complex and time-consuming than creating a proprietorship or a partnership. Professional Corporation (PC) or a Professional Association (PA) - wherein professionals such as doctors, lawyers, and accountants form a corporation. S corporations - corporations that meets all the requirements but elect to be taxed as if a proprietorship or partnership. 4. Growing a Corporation: Going Public - also called initial public offering (IPO) because it is the first time the company’s shares are sold to the general public. GOVERNING A CORPORATION Agency Problem - a conflict of interest that exists in any relationship in which one party is expected to act in the best interests of the other. IPOs are often aided by investment banks with brokerage firms that employs brokers who are registered with the SEC to buy and sell stocks on behalf of clients. Corporate Governance - a set of rules that control the company’s behavior toward its directors, managers, employees, shareholders, creditors, customers, competitors, and community. Seasoned Equity Offering - when public company raises more funds by selling (i.e., issuing) additional shares of stock. MAXIMIZING STOCKHOLDER WEALTH Maximizing Shareholder Wealth is a fiduciary duty for most corporations but this does not mean that managers should break laws or violate ethical considerations, or that that managers should be unmindful of employee welfare or community concerns. “Angel” or Venture Capitalists - individuals or businesses that provides funding for companies that are too risky for banks Securities and Exchange Commission (SEC) ➔ regulates stock trading, to sell shares in a public stock market ➔ where a company applies to be a listed stock on an SEC-registered stock exchange. 5. Managing a Corporation’s Value “What determines a corporation’s value?” it’s a company’s ability to generate cash flows now and in the future. THREE (3) PROPERTIES OF ITS CASH FLOWS: 1. The size of the expected future cash flows is important—bigger is better. 2. The timing of cash flows counts—cash received sooner is more valuable than cash that comes later. 3. The risk of the cash flows matters—safer cash flows are worth more than uncertain cash flows. Benefit corporation (B-Corp) - a corporate form that expands directors’ fiduciary responsibilities to include interests other than shareholders’ interests. INTRINSIC STOCK VALUE MAXIMIZATION AND SOCIAL WELFARE Illegal Actions: Fraudulent accounting Exploiting monopoly power Violating safety codes Failing environmental standards ORDINARY CITIZENS AND THE STOCK MARKET Households own mutual funds, directly or indirectly owns stocks through pension funds. When managers increase intrinsic value of stocks, they improve people’s quality of life. CONSUMERS AND COMPETITIVE MARKETS Value maximization requires efficient, low-cost businesses that produce high-quality goods and services at the lowest possible cost. Companies that maximize their stock price must generate growth in sales by creating value for customers in the form of efficient and courteous service, adequate stocks of merchandise, and well-located business establishments. EMPLOYEES AT VALUE-MAXIMIZING COMPANIES In general, companies that successfully increase stock prices also grow and add more employees, thus benefiting society. Moreover, studies show that newly privatized companies tend to grow and thus require more employees when they are managed with the goal of stock Managers increase the firm’s value by increasing the size of the expected cash flows, by speeding up their receipt, and by reducing their risk. Free Cash Flows (FCF) - they are available (or free) for distribution to all of the company’s investors, including creditors and stockholders Weighted Average Cost of Capital (WACC) - the rate of return required by investors, a cost from the company’s point of view Market Price - the price that we observe in the financial markets, should be equal to the intrinsic value. price maximization. ETHICS AND INTRINSIC STOCK VALUE MAXIMIZATION There are very few, if any, legal and ethical shortcuts making significant improvements in the stream of future cash flows. Managers at some companies have taken illegal and unethical actions to make estimated future cash flows appear better than truly warranted, which can drive the market stock price up above its intrinsic value. 3. The activities occur in a variety of financial markets. THE DETERMINANTS OF INTRINSIC VALUE Sarbanes-Oxley (SOX) Act of 2002 and the DoddFrank Wall Street Reform and Consumer Protection Act of 2010 strengthened protection for whistleblowers who report financial wrongdoing. AN OVERVIEW OF FINANCIAL MARKETS The Net Providers and Users of Capital Net Savers Public / Individuals Net Borrowers Nonfinancial corporations Financial corporations Government THE CAPITAL ALLOCATION PROCESS Capital - an essential component of starting and maintaining a successful business. In the most basic sense, it’s the money and assets needed by a business to produce the products or services it offers. Transfers of capital from savers to users: 1. Direct Transfers 2. Indirect Transfers through an Investment Bank 3. Indirect Transfers through a Financial Intermediary CHAPTER 2: NATURE, PURPOSE & SCOPE OF FINANCIAL MANAGEMENT Any company's financial health is crucial. Finances, like most other resources, are, however, finite. Wants, on the other hand, are often limitless. As a result, it is important for a company to effectively control its finances. It is important for any company to invest the funds it receives in such a way that the investment yields a higher return than the cost of capital. Financial management, in a nutshell – Endeavours to reduce the cost of finance Ensures sufficient availability of funds Deals with the planning, organizing, and controlling of financial activities like the procurement and utilization of funds DEFINITIONS OF FINANCIAL MANAGEMENT “Financial management is the activity concerned with planning, raising, controlling and administering of funds used in the business.” – Guthman and Dougal “Financial management is that area of business management devoted to a judicious use of capital and a careful selection of the source of capital in order to enable a spending unit to move in the direction of reaching the goals.” – J.F. Brandley There are three important features of the capital allocation process: 1. New financial securities are created. 2. Different types of financial institutions often act as intermediaries between providers and users. “Financial management is the operational activity of a business that is responsible for obtaining and effectively utilizing the funds necessary for efficient operations.” – Massie NATURE, SIGNIFICANCE, AND SCOPE OF FINANCIAL MANAGEMENT Any company's financial management is a natural part of its operation. To procure physical resources, carry out manufacturing activities and other business operations, pay compensation to vendors, and so on, every company requires funds. There are several financial accounting theories: Core Financial Management Decisions Managers of companies make the following decisions in order to reduce the costs of obtaining finance and to use it in the most efficient way possible: 1. Some experts believe that financial management is all about getting a company the money it needs on the most attractive terms possible while keeping its goals in mind. As a result, this strategy is mainly concerned with the acquisition of assets, which can include instruments, institutions, and fundraising activities. It also looks after the legal and accounting aspects of a company's relationship with its funding source. ❖ Investment Decisions: Managers must determine the amount of investment available from existing funds, both long- and short-term. 2. Another group of experts believes that money is all in finance. Since all business transactions, whether directly or indirectly, include cash, finance is concerned with everything the company does. 3. The third and most commonly held viewpoint is that financial management encompasses both the acquisition and effective use of funds. In the case of a manufacturing company, for example, financial managers must ensure that funds are sufficient for the installation of the manufacturing plant and machinery. It must also ensure that earnings are sufficient to cover the costs and risks faced by the company. Many companies can easily raise capital in a developed market. The real issue, however, is maximizing capital use through successful financial planning and control. Furthermore, the company must ensure that it handles activities such as allocating funds, handling them, investing them, controlling expenses, predicting financial needs, preparing income and calculating returns on investment, evaluating working capital, and so on. THE SCOPE OF FINANCIAL MANAGEMENT Investment Decisions Financing Decisions Dividend Decisions There are two kinds of them: Capital Budgeting, also known as Long-term investment decisions, imply committing funds for a long time, similar to fixed assets. These decisions are normally irreversible and involve those involving the purchase of a building and/or property, the acquisition of new plants/machinery or the replacement of old ones, and so on. These choices influence a company's financial goals and results. Working capital management, also known as short-term investment decisions, refers to committing funds for a short period of time, such as current assets. These decisions include cash, bank deposits, and other short-term investments, as well as inventory investment. They have a direct impact on a company's liquidity and profitability. ❖ Financing Decisions: Managers must also make decisions on raising funds from long-term (Capital Structure) and short-term sources (called Working Capital). There are two kinds of them: Financial Planning Decisions that include estimating the origins and applications of funds. It entails anticipating a company's financial needs in order to ensure that sufficient funds are available. The primary goal of financial planning is to prepare ahead of time to ensure that funds are available when needed. Capital Structure Decisions that include locating funding sources. They also include decisions on whether to raise funds from external sources such as selling shares, bonds, or borrowing from banks, or from internal sources such as retained earnings. ❖ Dividend Decisions: These are decisions over how much of a company's earnings will be paid as dividends. Shareholders often seek a higher dividend, while management prefers to keep income for operational purposes. As a result, this is a difficult managerial decision. One issue that the financial manager faces is meeting the goals of many stakeholders at the same time. Reducing salaries, for example, will increase profits and please shareholders, but it is unlikely to satisfy workers. As a result, a distinction between maximising and satisfying must be made in practice. CHAPTER 3: RELATIONSHIP OF FINANCIAL OBJECTIVES TO ORG STRATEGY & OTHER ORG OBJECTIVES A. Maximising – seeking the best possible outcome B. Satisfying – finding a merely adequate outcome. FINANCIAL OBJECTIVES AND ORGANIZATIONAL STRATEGY OBJECTIVES IN NOT-FOR-PROFIT ORGANIZATIONS Not-for-profit organisations include charities, state health services, and police forces, which are run for the purpose of providing a service rather than profit. Despite the importance of good financial management in these organisations, it is not possible to set financial goals in the same way as businesses do. As a result, these organizations place a premium on value for money, or trying to get the most benefits for the least amount of money. Value for money is described as obtaining the best possible combination of services by using the fewest resources possible, i.e., maximizing benefits at the lowest possible cost. This is commonly understood to necessitate the use of economy, effectiveness and efficiency. SHAREHOLDER WEALTH MAXIMIZATION I. Most companies are owned by shareholders and originally set up to make money for those shareholders. The primary objective of most companies is thus to maximize shareholder wealth. (This could involve increasing the share price and/or dividend payout.) II. Shareholder wealth maximization is a fundamental principle of financial management. Many other objectives are also suggested for companies including: A. profit maximization B. growth C. market share D. social responsibilities To achieve a certain amount of outputs, the economy must obtain the required quantity and quality of inputs at the lowest possible cost. For example, the economy in which a school purchases equipment can be calculated by comparing real costs to budgets, previous year's costs, government/local authority requirements, or other schools' spending. The degree to which stated objectives/goals are met is referred to as effectiveness. The proportion of students who go on to higher or further education, for example, may be used to assess the efficacy of a school's goal of producing quality teaching. The relationship between inputs and outputs is known as efficiency. The efficiency in which a school's IT laboratory is used, for example, may be calculated in terms of the percentage of the school week that it is used. STAKEHOLDERS While a private sector corporation's theoretical goal may be to increase its shareholders' wealth, other individuals and organizations are interested in what the company does and may be able to influence its corporate goals. Stakeholders are people who are interested in a company's operations or success because they have a stake or an interest in what happens. It's common to divide stakeholders into groups, each with its own set of priorities and concerns. The following are the most common types of stakeholder groups in an organization: Internal: a) Directors b) Employees Connected: a) Shareholders b) Leaders c) Customers d) Suppliers e) Labour union External: a) Government b) Society as a whole Goal incongruence between stakeholders For example, bondholders seek a steady stream of income in the form of interest and the assurance that their principal will be repaid. Shareholders, on the other hand, seek rising dividends and, as a result, rising stock prices. Risky projects are avoided by the former, while risky projects are welcomed by the latter because the higher the risk, the higher the return. This exemplifies the goal inconsistency between bondholders and stockholders. AGENCY PROBLEM The conflict of interests between different stakeholders of a corporation, such as shareholders and bondholders or employees and shareholders, is referred to as an agency issue. They can appear in a variety of ways. Moral hazard – A boss has a vested interest in reaping the rewards of his or her job. All of the perks that come with status, such as a company vehicle, use of a company plane, lunches, and so on, are included. Effort level – Managers could put in less effort than if they were the company's owners. In a large corporation, the issue would occur at both the middle and senior management levels. Earnings retention – Rather than earnings, the size of the business is also used to determine the remuneration of directors and senior managers. Rather than paying out dividends, management is more likely to want to reinvest profits in order to grow the business. Risk aversion - Executive directors and senior managers typically receive the majority of their profits from the organization for which they work. As a result, they care about the company's stability because it will secure their job and future earnings. This may indicate that management is risk averse and unable to invest in higher-risk ventures. Time horizon - Shareholders are concerned about their company's longterm financial prospects because the value of their shares is based on long-term assumptions. Managers, on the other hand, could be only concerned with the short term. This is partly due to the fact that they may be paid annual bonuses based on short-term results, and partly due to the fact that they may not plan to stay with the organization for more than a few years. Agency costs include direct and indirect costs. Direct costs include remuneration and audit fees. Indirect costs include the cost of lost opportunity because of agency problems. Reducing the agency problem Several methods of reducing the agency problem have been suggested. These include: A. Creating a compensation plan for executive directors and senior managers that encourages them to behave in the best interests of the company's shareholders. Offering managers share options, for example, is one way to motivate them to behave in ways that maximize shareholder capital. Managers will be enticed to make choices that are likely to result in higher share prices (such as investing in projects with positive net present values), as this will increase their share option incentives. B. Having a sufficient number of qualified nonexecutive directors on the board. They are not full-time workers and do not hold any executive positions in the company. They have the ability to behave in the shareholders' best interests. C. Where there is (or may be) a conflict of interest between executive directors and the company's best interests, independent non-executive directors may also make decisions. Nonexecutive officers, for example, may be in charge of remuneration arrangements for executive directors and other senior managers. D. The possibility of a hostile takeover. If a company is poorly run, the stock price would be low in comparison to its future value. When the stock price is poor, competing management teams are more likely to launch a hostile takeover. In most cases, the current management will be dismissed. As a result, managers are compelled to optimize share prices. INCENTIVE SCHEMES A remuneration package for executive directors or senior managers may have a variety of structures, but most remuneration packages have at least three components. 1. A basic salary – it needs to be high enough to attract and retain individuals with the required skills and talent. 2. Annual performance incentives – The performance target might be stated as profit or earnings growth, EPS growth, achieving a profit target, etc. Some managers might also have a non-financial performance target. 3. Long-term performance incentives – Which are linked in some way to share price growth. Long term incentives are usually provided in the form of share awards or share options of the company. CORPORATE GOVERNANCE The collection of procedures, customs, rules, laws, and institutions that regulate how a corporation (or company) is guided, managed, or regulated is known as corporate governance. The relationships between the stakeholders and the purposes for which the company is regulated are discussed in corporate governance. There are a number of key elements in corporate governance: a) Risk management and mitigation is a central theme in all conceptions of good governance, whether specifically specified or implicitly. b) Most concepts are based on the idea that good organizational frameworks and management practice within set best practice guidelines improve overall efficiency. c) From the perspective of all stakeholder groups affected, good governance provides a basis for an organization to execute its policy in an ethical and efficient way, as well as protections against the misuse of physical or intellectual capital. d) Good governance necessitates not only the application of externally defined laws, but also the ability to apply both the spirit and the letter of the law. e) Accountability is generally a major theme in all governance frameworks. Corporate governance codes of good practice generally cover the following areas: A. The board should be responsible for taking major policy and strategic decisions. B. Directors should have a mix of skills and their performance should be assessed regularly. C. Appointments should be conducted by formal procedures administered by a nomination committee (or selection committee). D. Division of responsibilities at the head of an organisation is most simply achieved by separating the roles of chairman and chief executive. E. Independent non-executive directors have a key role in governance. Their number and status should mean that their views carry significant weight. F. Directors' remuneration should be set by a remuneration committee consisting of independent non-executive directors. G. Remuneration should be dependent upon organisation and individual performance. H. Accounts should disclose remuneration policy and (in detail) the packages of individual directors. I. Boards should regularly review risk management and internal control, and carry out a wider review annually, the results of which should be disclosed in the accounts. J. Audit committees of independent nonexecutive directors should liaise with external auditors, supervise internal audit, and review the annual accounts and internal controls. K. The board should maintain a regular dialogue with shareholders, particularly institutional shareholders. The annual general meeting is a significant forum for communication. L. Annual reports must convey a fair and balanced view of the organisation. This might include whether the organisation has complied with governance regulations and codes, and give specific disclosures about the board, internal control reviews, going concern status and relations with stakeholders. CHAPTER 4: FUNCTIONS OF FINANCIAL MANAGEMENT Financial management, or the art and science of handling a company's resources in order to achieve its objectives, is not solely the domain of the finance department. Any business decision has a monetary impact. Financial workers must work closely with managers in all departments. Sales of the company's goods should be the primary source of funding. However, sales revenue does not always arrive when it is required to pay the bills. Financial managers must keep track of how money enters and exits the company. They collaborate with the firm's other department heads to decide how funds will be allocated and how much money is needed. Then they decide on the best ways to get the capital they need. A financial manager, for example, would keep track of daily operating details including cash collections and disbursements to ensure that the organization has enough cash to fulfill its obligations. The manager will research whether and when the organization can open a new manufacturing plant over a longer time period. The project manager will also recommend the best way to fund the project, collect the necessary funds, and oversee its implementation and execution. Accounting and financial reporting are inextricably linked. In most companies, the vice president of finance or CFO is in charge of both regions. However, the accountant's primary responsibility is to gather and present financial data. Financial managers make financial decisions based on financial statements and other details prepared by accountants. They prepare and monitor the company's cash flows to ensure that cash is allocated when it's needed. The Financial Manager’s Responsibilities and Activities Financial managers have a difficult and dynamic role. They examine financial details prepared by accountants, keep track of the company's finances, and develop and execute financial strategies. They could be working on a better way to automate cash collections one day and reviewing a potential acquisition the next. The financial include: manager's main responsibilities Financial planning: Preparing the financial plan, which projects revenues, expenditures, and financing needs over a given period. Investment (spending money): Investing the firm’s funds in projects and securities that provide high returns in relation to their risks. Financing (raising money): Obtaining funding for the firm’s operations and investments and seeking the best balance between debt (borrowed funds) and equity (funds raised through the sale of ownership in the business). The Goal of the Financial Manager The financial manager's key aim is to optimize the firm's value to its owners. The share price of a publicly traded corporation's stock is used to determine its worth. The value of a private corporation is determined by the price at which it may be sold. The financial manager must weigh both the short- and long-term ramifications of the firm's decisions in order to maximize the firm's worth. Profit maximization is one strategy, but it should not be the only one. Short-term benefits are prioritized over longterm objectives in this strategy. What if a company in a highly technical and competitive industry didn't invest in R&D? Profits will be high in the short term due to the high cost of research and development. However, the company's ability to compete could be harmed in the long run due to a lack of new products. This is valid regardless of the scale or stage of a company's life cycle. 2. The INCOME STATEMENT reports the results of operations over a period of time, and it shows earnings per share as its “bottom line.” 3. The STATEMENT OF STOCKHOLDERS’ EQUITY shows the change in retained earnings between balance sheet dates. Retained earnings represent a claim against assets, not assets per se. 4. The STATEMENT OF CASH FLOWS reports the effect of operating, investing, and financing activities on cash flows over an accounting period. BALANCE SHEET CHAPTER 5: FINANCIAL STATEMENTS, CASH FLOW, TAXES INCOME STATEMENT FINANCIAL STATEMENTS The four basic statements contained in the annual report are the balance sheet, the income statement, the statement of stockholders’ equity, and the statement of cash flows. 1. The BALANCE SHEET shows assets on the left-hand side and liabilities and equity, or claims against assets, on the right-hand side. (Sometimes assets are shown at the top and claims at the bottom of the balance sheet.) The balance sheet may be thought of as a snapshot of the firm’s financial position at a particular point in time. STATEMENT OF STOCKHOLDER’S EQUITY STATEMENT OF CASH FLOWS TOTAL NET OPERATING CAPITAL (which means the same as operating capital and net operating assets) is the sum of net operating working capital and operating long-term assets. It is the total amount of capital needed to run the business. NOPAT is NET OPERATING PROFIT AFTER TAXES. It is the after-tax profit a company would have if it had no debt and no investments in non-operating assets. Because it excludes the effects of financial decisions, it is a better measure of operating performance than is net income. NET CASH FLOW differs from accounting profit because some of the revenues and expenses reflected in accounting profits may not have been received or paid out in cash during the year. Depreciation is typically the largest non-cash item, so net cash flow is often expressed as net income plus depreciation. OPERATING CURRENT ASSETS are the current assets that are used to support operations, such as cash, inventory, and accounts receivable. They do not include short-term investments. OPERATING CURRENT LIABILITIES are the current liabilities that occur as a natural consequence of operations, such as accounts payable and accruals. They do not include notes payable or any other short-term debts that charge interest. FREE CASH FLOW (FCF) is the amount of cash flow remaining after a company makes the asset investments necessary to support operations. In other words, FCF is the amount of cash flow available for distribution to investors, so the value of a company is directly related to its ability to generate free cash flow. FCF is defined as NOPAT minus the net investment in operating capital. NET OPERATING WORKING CAPITAL is the difference between operating current assets and operating current liabilities. Thus, it is the working capital acquired with investor-supplied funds. OPERATING LONG-TERM ASSETS are the longterm assets used to support operations, such as net plant and equipment. They do not include any long-term investments that pay interest or dividends. Uses of Free cash flow (FCF) 1. Pay interest to debtholders, keeping in mind that the net cost to the company is the after-tax interest expense. 2. Repay debt holders; that is, pay off some of the debt. 3. Pay dividends to shareholders. 4. Repurchase stock from shareholders. 5. Buy short-term investments or other nonoperating assets. FCF is the cash flow available for distribution to investors. Therefore, a company’s fundamental value depends primarily on its expected future FCF. Is negative FCF bad? Not necessarily; it depends on why the free cash flow is negative. It’s a bad sign if FCF is negative because NOPAT is negative, which probably means the company is experiencing operating problems. However, many high-growth companies have positive NOPAT but negative FCF because they are making large investments in operating assets to support growth. Return On Invested Capital - shows how much NOPAT is generated by each dollar of operating capital Intrinsic Value, MVA, and EVA There is a relationship between MVA and EVA, but it is not a direct one. If a company has a history of negative EVAs, then its MVA will probably be negative; conversely, its MVA probably will be positive if the company has a history of positive EVAs. The stock price, which is the key ingredient in the MVA calculation, depends more on expected future performance than on historical performance. A company with a history of negative EVAs could have a positive MVA, provided investors expect a turnaround in the future Operating Profitability ratio (OP) - measures the percentage operating profit per dollar of sales Capital Requirement ratio (CR) - measures how much operating capital is tied up in generating a dollar of sales Market Value Added (MVA) represents the difference between the total market value of a firm and the total amount of investor-supplied capital. If the market values of debt and preferred stock equal their values as reported on the financial statements, then MVA is the difference between the market value of a firm’s stock and the amount of equity its shareholders have supplied. MVA measures the effects of managerial actions since the inception of a company. Economic Value Added (EVA) is the difference between after-tax operating profit and the total dollar cost of capital, including the cost of equity capital. EVA differs substantially from accounting profit because no charge for the use of equity capital is reflected in accounting profit. EVA represents the residual income that remains after the cost of all capital, including equity capital, has been deducted. Economic Value Added measures the extent to which the firm has increased shareholder value. EVAs or MVAs are used to evaluate managerial performance as part of an incentive compensation program, EVA is the measure that is typically used. The reasons are: 1. EVA shows the value added during a given year, whereas MVA reflects performance over the company’s entire life, perhaps even including times before the current managers were born. 2. EVA can be applied to individual divisions or other units of a large corporation, whereas MVA must be applied to the entire corporation. by: eca .