Zilber Board Report: Financial Performance & Acquisition Analysis

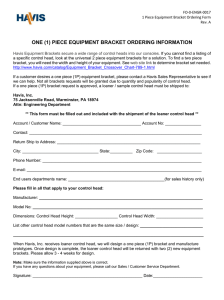

advertisement

Extract of board report Financial aspect of performance revenue the revenue seems to have increased from the previous year from 121701 to 131072. It has also exceeded the budget by 1725. This increase seems to be due to the increase in occupancy rates of Zilber accompanied by the increase in room rates from 145 to 150. This seems to give a good picture of Zilbers financial performance, however looking at revenue in isolation can be misleading. Revenue after discounts is 3.4% higher than the previous year however it is 2.4% lower than the budget. This would seem to be because of the huge number of discounts offered to encourage an increase in occupancy rates but ultimately leads to a decline in revenue. Furthermore, it has be highlighted that demand from customers has been declining as a result of tough economic conditions, this would make the decision to increase room rate to 150 seem unwarranted. This might have led to the increase in discount offers to help maintain and or attract customers. In light of all of this, additional revenue has become an important source of income as it could help recover the loss from offering higher discounts on the rooms. In fact, the other revenue has exceeded the budget by 1.3% and has successfully exceed last year’s results. Zilber could use this additional stream of revenue to their advantage by encouraging the customers to indulge in these additional activities. Operating profit and margin Despite the increase in revenue the operating profit margin has declined by 1.6% compared to last year and is 3.5% below the budget. The main reason would be because of the large discounts offered however an increase in operating costs have contributed to this. Operating costs have increased by 5.3% as compared to last year and are almost 2% above the budget. It should be the priority of Zilber to control costs especially in the current economic downturn. According the board of Zilber Operating profit margin is a key performance indicator and according to the results, Zilber does not seem to be doing too well. ROCE The ROCE has declined from 48.3% last year to 42.8% this year and is 8% below the budget. A major contribution to this decline would be the falling in operating profits. Furthermore, the fact the Zilber has yet to invest in its refurbishment which will bring the ROCE down is further should be considered. Non-financial indicators Customer satisfaction scores According to the board of Zilber, customer satisfaction scores is another key performance indicator and would be just as important as operating margins. Customer satisfaction scores declined from 8.9 to 8.5 effectively moving Zilber from the top 10% of hotel to the top 25%. This is a detrimental declining considering the period was 1 year. Zilber cannot afford to lose their position and reputation especially in light of current economic conditions. According the customer, the comfort of rooms, convivences of hotel locations, and the quality and efficiency of the customer services are the most important to the customer. Considering this, there having been customer complaints and in particular many customers complained on the decline in the standard of service as compared to previous visits. They have also stated that the rooms would benefit from redecorating, however this is an issue for Zilber as they lack the necessary capital for such investment. It is important that Zilber not lose focus on the customer satisfaction as it would lead to loss of market share and a contraction of customer base. Furthermore, it would mean that the customers might not recommend Zilber to others and in fact spread negative reviews which would be detrimental to Zilber. FAO Finance Director Suitability The acquisition of Havis might seem to be a decision that is beneficial to Zilber as it would enhance Zilber’s growth. Furthermore, Havis has a 4* rating, similar to that of Zilber. However, there are other considerations that must be taken into account before the acquisition of Havis can be considered to be in the best interests of Zilber. Different customers. Havis has a different target market compared to Zilber. Where Zilber caters to business customers, Havis caters to leisure customers. As such 6 out of the 10 hotels of Havis are located in rural areas, areas where it would not be in the convenience of Zilber’s business customers. Furthermore, the design of Havis hotels is different to Zilber’s. This can be an issue for Zilber as all of its hotels have the same specification and facilities to ensure business customers know what to expect. The different designs may be disruptive to Zilber’s customers. Additionally, Zilber’s main reason for this acquisition is that they were not able to find any suitable buildings to be able to grow organically as they have in the past. Hence this acquiring is a substitute to growing organically, which would not be a valid reason for acquisition. Considering the above reasons, it would not seem strategically sound for Zilber to acquire Havis, unless Zilber aims to obtain a diversified market. Feasibility To be able to acquire Havis, Zilber would need to have access to sufficient funds to be able to buy Havis, but not only that, they would need funds for extra expenditure on Havis’s hotels. It has been stated that the conditions of these hotels are in relatively poor condition and would require expenditure. Also, since the designs of the hotels are different to Zilber’s, increased expenditure may be required in order to standardize its design. The fact that Zilber has delayed its own refurbishment due to lack of capital should be noted. Up till now, Zilber has grown organically and this would be the first time it would be endeavoring in acquisition. For an acquisition to be successful, there must be previous experience and the lack of this increases the risk of such a transaction. The risk appetite of Zilber’s board would have to be considered. Acceptability It is in the shareholders interest to grow as they have increasingly become vocal about it. In this context it is acceptable however if more information was available a better shareholder response would be able to be analyzed.