I

-''lqJ$i$

/

{

,fif ," :GwaPrrffi

'il

:r

'l ; I

.

f

Reugnl,,c-

and

,

glp:t en diiur e -' Cy rl'e Ap plic atio ns

t.

I]

T

t:

'LEAENING oBlEsrlYE?.

,C-aref.r! stuil),.of this chaPtei

t'i!,! enable you to;

"f

.tr, Disqribe the major featutes and operations in a sales orc.ier

SPPlication sYstent'

- E Descdbe the rnajqS- featpres and eperations'

in ao accounts

receivable aPPlication sYst-em'

I Describe tho major'features antl operations in a purc[rasi-ng

199!$1!ionsYstem'

:

in a payroll application

E Descrihe the major teatures and operatione

System.

ti

und 3r sepP a'LE

t'dctions be

a$ei-Tfi'e

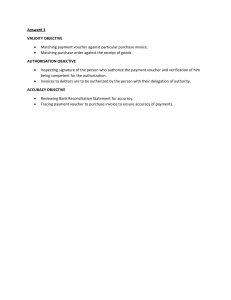

1'rvr-Yffi;;';;ffiEffie-@tqffi A;Thffirinls

applications prL$::nte(

ffi fl

ia---,.:^- -+ r^;J Trka.r ore hhu

an .anqfvst maYpontral! a pro=

H-||;:if#:;;ffi ;i"'"fd;"+ains.tur|!ch

'

.

'i'

fo..ti.tirrgsystem.

'

"Ttlli';,,1i;";"Jn"'it*"iiolulh;ut1lTry:*:-n::1"il:i;*""'o**qChrrlptBgs z

The data flow diagrams and docume4t'nqwchqrt$presented

thanlion

-t

unaa'il;i;,'G-lbficalnecessitieso[a;399]1p!',9rt^:.yj':5

ano u tocus ult LIrtr ruEreur

these

sy.mbol,in

t.y theld<lcu.msnt

:

posed or existing sYs *9m-

taa

calli a^oomputer or,.!ailS!e data

teir-m'u'Glgphone

diagrams may bd, p;po

physical features The,infonlation rePt€s€n

iJ

i

'

,

I

''.:

,ltr;.1 --r..

-.

j

:.

.:

:-.::,:

-1.i:,.. :t.i:.! :i 1-..j _: .

..t,

,t

I

254 PART ! lntroduction toAccounting lnformatiofl Syster\.

REVEI.I U E.CYCLE APPLICATIO NS

An organization's r.9y9_4,U_e_:yqle_iqe.U.d.gll!g ftigclr!$-3_eqg!_r-qd tq q.Lgl

products or seryices with customers. Common funct6nJlnituiie ci.Adii

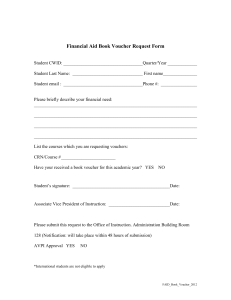

figure 7.1 illustrates a data flow diagrarn of a sales order application system

'sales order.application system comprises the procedures involved in

i;: ,:i t' .-'.: .-' 'a

,-

\,'

I

I

t

T

hrP

I

!i

.f

I

il

t

fl

g,

J

,j

{

*

tc

it

2

g

{

I

l-

DATAFIOWXEY

t.Otder. .

:'

g:Shipment i

@:ider

Packinli5ip,

6. Bilfing Memo

12JoumalVoubher

.

.9.56ippi1g$&'icei

Z&lesOder. ' .

&4pproYed.Sahs Order lo-tnvoice

4- Sirpping

'5.

7 Shlppin! Advice

17. Posting Memo

13. Canttollotal

FIGURE 7.1 Data Flow Diagram: Sales Ordery'pplication System5

,t.#,

.CHAPTdR 7 Revenue- and Expenditure-CycleApplicatjons

255

('9!' or: t.

' ,1 -. -':

tuiis

lro

#l-g

F

tpoo Ccdrt

Apprcral

'

-l Fhlsh€d

I oo"as

l C.opy a

-l to

I Srxbprhs

klqlo*ladg.P{n

@v

(

-,rffi1-g

I s.ro al

l"H

l-/-

ffil_g

,, gfl

FIGURE'7.2 Sales Order Application System'

:,

and shipping customer orders and itr preparing invoices that describe_Products'

servicei'anJassessments. Figure 7.2 illustrates an analytic flowchart-of a model

sales order application system. The chart illustrates a qgparate order ?nd billing

t_gu_s,to.!q9lq{49r.

iiiFrgure

fuaptions are $ales order, credit, finished goods, shipPing, billing ac-

grldgr funcliolEritiates the plocessing of customer orders with the

Si.ies o:der.,fi1e sale

ordeib"t"i"i q4-esc4p!iells_ e|plgg"$ oring -thl customer, suCE-as-..=u.e,

i[nipd6{iue @_qdai11,

eggtvn.The invoice will be prenotice.of this event.is forwarded to

r

256 PART I lntroduction toAccounting lnfornration Systems

I uaw 1s99PY.t

.l C"rr':-s r-oples

I Pe;are shiPPing

,---l uamentation

iI lsh,p'6;ri,;

I Customer

Fml

Sa/es l-

hdd t

&?ntbr

Goads

$1$ o? LaDLr

tz

o*r\'1ry -Li

'z afvP

c-ulf

3

ni

A --,Wd. :,':/,1'r'

q- ff)-o6;t''i

FIGURE 7.2 (continueQ

lri :

!^,1

i:

,'

Credit

A customer's credit standing shonlclUx ygd-g4 p-Ilqf t-o-t-h-q l[pfngn!-o-f gos{g.

For.regular customerq, the,credit check involves determining that the total amoqnt

.of creijt glanted does not exceed management's general or specific authorization.

For new..SstomerE a credit check is necfssary to establi.sh the terms of sale to the.

customeill{s-Frgure 72 illustrateq the sales ordel&[9tio-sihquld be'subjeetlqthe

oiarilndependentcreditfu nctiootogalq.tain-tbes-ep-an-tiau-a[4ud9s.

been approved, the sales order function distributes the sales

=n3..n:-i+-qq

:

$::

iordef set,as sholvo in Eigur;'72. One copy of each sales"of,tlgt'i^c forwardd to

uilfing Tbese are:trteo as.-sp9s-q-rdqrq atloy[4g th.q bi[bettqdgq fo-4qticipatq the

receipt of $atcUig&shipping_adviges frqll llq-4pping fu,nction. One copy-usually

torwarde!. tq qhipping. This copy qu-thorizes shipthe i.a:dcins sh

pinflo-fglglv9_gg,g$ from fi+lllld goods for shipping. Another copy-_usually

*py:i"

Ndthe:slgck-@gl-isfoqyar.{edtqf; qilhed.gaodsft iscopyauthanzes$isheJ

soods E-&!g-ggg'$ from i$ custody fgr shippent to cxrstomers.

In sqEC cases, a customer's orddr may ieQuiie thif a production order be is-

-sued to produce thti goods, because the goods are not in stock. $irch situations

ariitt when the order is.for a special nonstock item. They also may arise as standard-company practice due tci either the customized nature of the product or a

CHAPTER 7 Revenue' and

-.

Expenditure-CycleApplications 257

\"

..:

)

- lnvoi

ca-

I . U'/JI

Z , zi U{'t

4 -h/e

FIGU RE 7'2 (cunr:;iued)

for an-inventory of finished good* - . a'

short production cycle,n",'ilifi'"3J,hL o""a

are oot-of-sto"k and must be back ordeted"/

Such situations also occur when items

order is srgnifi-

If the time betrveen r"r"ioi"iU" 91-der-*an4 e9!u4!-SlIrngg!91-the

6 tne eustoirie-r1ir

:"-:;;;:;iil;;;";;;;;;il;"i";,t;;iar*s orae-rnffiiint

ecei*d-al4.ip-bqingprocessed'

int-o-r_r-r..-,hegqqlome,tf,"ttniiriae:hasbeen'f

Finished Goods

,.,tt

,

-

_

Finishedgoodspickstheorderasdes-gp[sboitl'"tt..:lcopyofthesales

@-!s'-Ueorder (copy f). Stocfl riio-rdsele updat"d=to

.not"a on the'stock copy of the sales

Aii"iiqd;dtitt

&nryar-4e4:to *ippioE

tue goods to shipping. As n-oted h Hgwittr"ii

order, which is.then iorwaraea

-acknowledgL

"torrg

receipt of the quantito

ureT.Z,shipping .frouia rig, ttre stoI5 copy

ties noied th"r"on from finished goods:

:

Shipping

Shippingacceptstheorderforshipmentaftermatchingthepackingslipmpy

prepared according

;";;Io order. shipping documeltad:"

ir.

to rhe stock copy

a

of

"f

lili of ledllg (see Frgto the situation' F*q;Jry,;it 'eq'i'"i ih"'p'"putution

exchanged -b-etrvpen a shipp-e5. a4{ 1

ure 7.4). A bill .f hi;;;',r'"_anrr*u4!ai;

HARECOMPANY

SALES ORDER

Order Numben

Date:

Sokl To:

Ship To:

Shipping lnstruction:

Salesperson:

Customer Order #:

QuantiV

Description UnitPrice

FIGURE 7.3 Sales Order.

ISHIPPER,S

STRAIGHT BILL oF t-ADtNG-sHoRT FoBM-oRtctNAL-Not Nesotiabte I

R€CCI\ED,s6ldttolh..ra$l66lioo.idt rlrlrhr{r.dm$.d.t dtlls.ott&gf

aUa:m-

ffi

G.&bk

KrctrPrcUGE ffi4ffilqE@tgs'&ffi

a

NO. ICARR|ER,S No.

l-^""-^'''"'

qliif?*fd_.l:!1E3l11

**::a*i9iai"Fd

ffdFftffi;drffi

ha*fldi!&rdfud

Effituffidtjrh

dJokHdqE

te!-ebEM6t

dakqTobhFa.

rir;.iln6;;ii

a

a_e @

M M

rF

EilE rcr-tu

frdtuffi.

tu tdaffi&dtu

ffi.tr.ldbyhdipFbbdffi

h p6t...*

h ft lffi

FoFrybti*,

l, e,

6 q

hhmr-U

t*r-lnffi

6OCEE

ff lsffit

b d qd,E.ryr-&r

*

L U;.z

h .ilj{;&

t.rbhfrdbE

drhtrdffi5&ffi

qbhnh#.tu

!qdlfrtud

& ai dft |hfi.rff

hdrSCtuffik

frlailffi.

lsipdrlryhhhdtud.

HcHcb.dbit;t*6kffi-

kiio-

CHAPTER7 Revenue-and Expenditure-CycleApplications

2Sg

charges and

garlel Sffch -45 ?-t-ru98i+&qomp4lly:The bill of lading'documents freight company'

the transfer of gooasTrtm ttre itripping collpany_ to !L: transportation

to the customer on the

Frequently, freight charges are paid UV tfit shippeibut billed

sales invoice.The packing slip copy of the sui"sorder is^usuaily

customer's order when it is shipped. as shown in Figure 7'2:

included with the

Billing

billing function'

Shipping forwards documentation of the shipment to the

tbesjqqLqqpy-of

u!-uatly

is

\.r This documentaiion is termed the5h!pp!4ga4]r99-ind puttiltre related open order

cepy ![ qhe uiUi["6ne. nitiing

."ry

;;d% ttren prJpa'"' tf,i..i"uoice tiv extending the

any)' and taxes (if any)'

charges for actual quantities shipped, ft"tgry="Elg-ej-Jit

in the sales journal and

reiora6a

r"volcei-are

Invoices ur"miiiaiia

"usiarnz-r..

a journal voucher is

posting copies are sent to accounts receivable. Periodically'

for

Posting to the general

prepared and forwarded to the general ledger function

'l* ;#,;;r;#;;t,

:i:;#A;;-,il;;#ih"

ledger.

Accounts Receivable and General Ledger

:'\..-'-i..'f

is importalt- t9

The distinction between billing and accounrs-_receivable

gil-!!ag:s

invoicing

resp--o4qi-b[q fq1

lndividual '':

maintain ,"p-ulion of functions.

informa-

-qales !r-an94-cliqgC

'

and acppqqt!.!qceiy--4-b--l-9 main-tii5r5-gg5togr-9t:-asounts

BiililedQ-e*E.-nQt"-h4Ye

{61and sends p-erioaic-si4epintfotec;Uflt t-o -c}$log1grs

ti."ptOs (tG reiJiviUieJtiager;' A$ tqntt*gial records

-asEerslo-t!-e-E;;!eiaf

fiu;i"m! gpgrqtion. Note inFigure,.2 that.the control toC_ilEfft'*i6'1*

sent to'the general.ledger

tal of postings io the accounts riieivaUte tedggl th3t is

j6urnai

v-oucher sglt flgrl billing to

br;;dr:"t.?""iuuUle is compared to the

di"dnction trevalidate postisg5 to the g"n"rul ledger. In ihe same'fushroq;'rthe

of accountestablishmenr

ir*".-"'rippini"u"i finistied goods ii important to the

ability;,or the rqlease of finished goods from inventory'

Types 6rf Sales Ooder SYstems

arg feal!,le-,.,

Various relationships between the order, billing and shipping functions

prepara{94.9{ the, t '

aeoending on the circurqstances.The major consideration is the

.

csmplele fnyoice is- preafis;* 7.5). In a 99lnp&!e-pf+-ittiftg -s5'stem, thethe

shipping order is usu- i

a. iri. t-tffifr[ oioerltn ttris case,

t#;;

'' ;;;;itttiqrne-iinp

invoicejs released

allv a coPY ot tfre invoice IfuSSf'Gqbgli4qgt p?.p-q5y91!'The

all invoicing

,iirr.i"'gr;la *",r,ippeA.a6-pretJpi"Ulii"El,stim req*.res.thatorder

set.This

U"tno*o .oricr to tt ir"put"tion otitr. lnvoice/ihipping

other

and

"

inu"t ioty problems. Also, freight

few back-ortlers or other

ce-ntsJor

thtseller 6r it"ttd"tdir"d (e.g.,"add.50

i+ti-i*$artil:i.

and as':itiffiy

A;d**between rhe-customer order as pr"*itt"n

i9voi99' If such sitttre Jgstrggg-o!

#;;Ud,

;;;;;

,'**.*Ji1i*Toiuq,"i";irn"r;;&ilt

shipped requgq{algtv.byoice Ana

. uations ure

"!1!g-9!gtlal

cd;;,;miiete preUiUtng is vEry i;ffcient.

--

l

As indifeJ ireniously,'Figure 7.2 illustrates a sep4-r3!q9-rde13$$ !!Lli3gfrom the

systesn. Th"rUipp,"grnOu, fi +tl tvpe of svsler.n is-pegiry-d^1iqra'tslv'

are-di&er.lLego.e-dqhaYspg?lP:r:-P:nf :!p*s"t'

a--slg9!fica-rtt

{itterA separate ora;iinETiriing ststd ii ft;il?ry ytrerr-itre:e 19

(in1ernl!

o.1a9i

1q the seller) and

on

the

thippfnf

egqg--bsttu99g,-the inf-orulation

shipping order may not be

the invoice. Foi exampre, technical rp.iin"uii"ns in the

and ourof-stock condirequired br desired on the inuoi"". E*""ssive back-order

liuld-i"".t';ffi

'

?6CI PART I lntroduction toAccouoting tnformation Systems

ctrRUS Suppt-v co.

SOLD 146TCLAYSTREET

TO:

Burroughs O

PETERSBURG. WSCONSTN

CITRUS SUPPLY CO.

SHIP 146TCLAYSTREET

TO: PETERSBUHG, WISCONSIN

44444

CUTTINGIPTT-3

.00

SCREWDRIVER 6'

WELDING GLOVE#10

DSK

.38

.15

.00

5.0o/o

FIGURE 7.5 lnvoice.

tions also warrant this approach,, because

vw4sre the

ure final

rrtlat content

lul.il,Ellt of

ul the

tIIg invci

lnvclcg cann

be determined'until the goods are read5r for shipment. In many industries,

alte

r

diqsr-o-r-s.bsriiuli-qL;ffioilfi;:1'-].:Tu'#?"3;Tril#:U?1X'jTHll'Ja

pr!

In reeailing, for exampie, rtiffereni'ii.vi"i6i".i"rs *.y U.;dr;i;r;;;;;;;;

an

for clothing. The changed speciications frop the cr1,s1i.os1's ora", *urt

be

on the invoice' In other instances, severallhlprnelltsjue_ngadq_tg_lhg*samg

custpl!_q! over 4 ,spegific lime pg;ig$_under r single U11rrtgt .rd"rj1 rt

is

is 89--o-ne:to-or-19 qgrrgqpgndqn-ce-betw-gell*tfrg custo-iler o,rder and

"u.",-tt "."

the subsequent

invqlqe--q. Typically, one blanket s16s1 rJquires sevel-2[ ssparaie

each shipment made under the blanket order-

invoicir-o.r" f*

Both separate order and bitling and incomplete billing are posrbillin&-Qy_s:

in manual systemq as only oni aocube prepared. This reduces

e9!!1n-1g.qlselsy**qg.

i1

tion and thUs_iqg&ea E9f9_ ef!

CHAPTER 7 Revenue- and ExPendure-CycleApplicati'ons

251

d^ocument' The invoice' on

Note that the sales order is primarily an internal

formaliotification of the amount due for the

the other hand, ir th" ;;*"r',

and bill canbe used interchangeably' A

shipment. Note also that the terms invoice

order and billing might

bill of lading i, un in"ol"* for freight charges. separate

also be called setrtarate order and invoicing'

Accounts Receivable SYstem

the. mongy- ow--e-q!ly^gls-t'o'lqrq lplrngI-clqqqiqe

approii-mai"t, gO% of U'S' business is done on

dqcglu1Ue,gglvab[e reg19;-e41s

geiiuse

fra-o;r"*t""r;;a;r"E

the m4i9n!L9t 4q-grgagization'1

credit, accounts receivable oftel Ieplesents'

customql -q--e!r!ggd pAyfggltt

wqrklAg-cepltaf- eccounts recelvabfeiiso'malq!44!

administration of company

history _inforqqtion, which-is useful it ttioJ"tall

credit policiesptg"tg"t:.:s straightforward' A subConceptualty, the accounts receivable

i"di;;d*l accounts is maintained, wiih a conrrol account in the

sidiary ledger

\,, i

.,i

"f

generalledger.R"*itiu',""?dyl-":'Telout.qltrqlglbg-s4qhI999!p!rfung_tio-n;

#Eroutea to ttie accounts receivable

credit memos@G

Ebits ind iredii are pbsted to the indep,qrtment tlgg ltre gil!.9gl.9!1rtm:*

are prepared.and sent to customers'

dividual accounts; perioafif-fy-didtements

lr uy-produit oi sending statements' special

Aging schedutes #il;;r#

"

may also be prepared'

"rldiit"potts

There are two U*lt

openivable aooli

* t"-a" rscgUBlqIgeql..ab-lq3pPlis4llon:

"pp-""t

item and batance-forw

?:.:ri$*1:liffi:

jffi

,"r"""i,iui".ilt","r*ui"tremecustomsr'sunpaid

ir#;:;;fi

ffi,ffi cus-tomer-rernittap.ges

aft

\

thuy arg*gatcneA-to jtrg *4p-arg

.r_9ceiv-e.g,

invoices-. As

iuitgnrr'J iernittances are applied

processing,

balance;fonn*ur,.

In

invoices_.

i

against a cu9!9p9rlr'i#i;;&;l;;u"'iu""E

r"tt

"r

than againstir*gggtomeit !n-

dividual invoices'

' rable can be tedious because of the volData processing of accounts recel\

may exrtI A large insurance

that

accounts

of

number

transactionslnd

of

urne

companyorbank*uyt,,u"closetoa-millionseparate.accounts.Evenwithcom.

end'may be impossible' Many

puter processing, maiiing all statements.at month's

file is subdioir., in which rhe Srouqgi-re-ceivable

businesses ,r" u

the r"epatatio' or

"yJf"'fffiru

vided by atphuug!-gt: ufiuniit'*u"t 6iae1-1@b'I"

to H

tor eximPle'

'\have

statements-qlelth; Y/-oitilg A3V-{ 9i ttre monttr;

a

often

p

andlso on. These plans

'ffiunti

may be billed on ttr-e ibtn, t io An t-ht2gth,

pay

bills

cash flow, because'@nsumers generally

beneficial effect on-"

""t"puny's

shortly after receiving them'

receivable procedures in

Ledgerless b.";k;;i"g may be used to +trealligg

question is whether copies of sales

certain situations a" i.i.rir"i:ptqc.f.d*al

statLment' This practice is increasingly

slips are to be incluilJ tiiit ttre monitrly

itemized on the staternent' with

uncommo* Usuatty, indiriJoU transactibns are

or invoice number'A company is

supporting documentJ;;;;;Uy eittreicode

at the customer's request; this deobligated to producJ;ftprft*q dq".u-3"tr

filing source.documents Owing to the

mands careful attenioln't[ thJtetails of

rqqeivab!-q e! a

preceding procedural aspects,seruelQl[panreiseulhgilSgtltu!

-Ire;;iE

recotdaYoids

ragsqas

rn"

discoun!-lq--selleclit:l

"auea

she

uL mnsidered bythe analyst,but he or

cuson

negative'effects of factoring

must atso carefully ;;;rtd;;A;-foientiat

tomer relations.

ffieitrouta

fi;Ji

252 PART I lntroducrion to Accounting lnformation Sysrems

DATAFLOWKEY

7. Remittaneldvroes g. Joumal Voucher

2 Conttol Total

tO. CottttolTotat

3. SaIes Retam Memo tl. Wotthtess Accoufi Lisl

4. Sa/es Retum Advice lZ Statements

5. Credit Memo

lS. Totat Write-Otts

6. Writ*Otf Memo

7 Write-Off Advice

& Agted Trial Balanib

14. Write-Otf Coafirmation

lS. Write-Olf Memo

FIGURE 7.6 Data Flow Diagram: Accounts Receivable System-

Transaction Flows in an Accounts Receivable System

Figure 7.6 illustrates a data flow diagram of an 36:sorults receivable application

system- Egure 7.7 illustrates a document

flowchart of the flow of transactions in

an accounts receivable apDli€tion system.The main feature in

oiit

trati,o-qs 1he separation of the following functions..

"u"t

";;iii;

Cash Receipts

Customer remittance slips are forwarded to accounts receivable for posting

fr.om- calh receiPt& Accounts riceivable does not have access to

checks that accompany customer remittances

the cash or

Billing

Invoices, -credit memos, and other invoise adjustments are routed to accounts

for-posting to the cuito-"t r*unt*This maintains a separation of iuno

:9*t":-b-f

tions Billing,does not have direct access to the accounts reeivable records

CHAPTERT Revenue-and Expenditure-CycleApplicarions 263

Customer

Billing

Accounb Receivabli Geoetal Ledger

["-*;

I Rari"".

L-t-'

I

Approve Sales

Accept sa/es

rctums upon

approval of

the credit

manager

Prepare aN janalize credit

memo upon receipt of

approved saies retum metno

Customer

statements

mailed directly

FIGURE 7.7 .lccounts ReceivableApplication System"

;-.:.:.ji:,i*,". Accourts Receivable

.dccounts receivable is responsible for maintaining the subsidiary accounts

receivable ledger. A control account is maintained in the general ledger department. Debits and credits are posted to the customer ariounts from the posting

media-remittance advices, invoiceg and so oR-received from billing und .usf,

receipts. This maintains separation of functions Periodically, customer statements

are mailed directly to customers by the accounts receivable department. Periodic

processing also includes the preparation of an aged trial balance of the accounts

receivable subsidiary ledger for review by the credit department. Other types of

customer credit reports may be prepared based on the needs of the company.

Such reports are often preparqd as a by-product of the processing required to

send customers their statements.

264

PART

I lntroduction to Accounting lnformation Systems

Credit

Credit department functions in an accounts receivable application system include the approval of sales returns and allowances and other a-djustments to customer accounts, the revierv and approval of the aged trial balance to ascertain

customer's creditworthiness, and the initiation of write-off memos to charge accounts to bad-debt expense. These functions are discussed in what tbllowsGeneral Ledger

General ledger maintains the accounts receivable control account. Debits

and credits are posted to the accounts receivable control account from the journal

vouchers/control totals received from billing and cash receipts These amounts are

reconciled to the control totals sent to the general ledger directly from accounts

receivable. This reconciliation is an important control in the accounts receivable

appiication systemSales Returns and Allowances

Sales returns and allowances typically require careful control. Allowances occur

''

-i

when, because of damaged merchandise, shortages, clerical errors, or the like, the

customer and the seller agree to reduce the amount owed by the customer. Generally, the merchandise is retained or destroyed by the customer. The amount of

an allowance is negotiated between the customer and the sales order department

(or salesperson).The allowance should be rqu.eued-a-nd*-appfeyqd-bJa-a1r-,r-n-{ep-e-lwhen attthorized, billing issues a credit

_d.e_n_t pa.flY (usually.the credit department);

memorandum to document the reduction to the custome{:-g.g99glrt.As Figure 7.7

illustrates, s?1". .gt,rtnp.o."Art".1

Eooas i.t"a:ly iet*"ed, usually for

full credit) are typically initiatdd by the receiving department- Once goods are received and returned to inventory for proper control (this would be evidenced by

documentation), the credit manager authorizes billing to issue a credit memorandum. Note that for both returns and allowances, two independent parties are required to approve the transaction, and a third party maintains the records. This is

another example of organizational independence in the design of application

systems.

Write-Off of Accounts Receivable

Ttre principle of organizational independence also applies in the write-off of ac-

-r! counts receivable-procedure- Thqcent'ral feature in a writ'g:o'.ff procedure Q an

' . ' ag-alysis of past due accoun6 usu4l!y;-doqq-y-i!h eq aggd-trial balance. Numerous

1

I

[ ::-I

I

i

1

-i

=i

techniques are available to collect past.due accounts (e.g-, follow-up letters, collection agencies), but some accounts are'uftirnately worthle-ss In this case (as Figure 7.8 shows), the credit manager initiates a write-off, which is approved by the

'

treasurer. On approval accounts receivable is authorized to write off the account'

A copy of the authorization is also sent to an independeht third party (internal

audit in Figure 7.8) for purposes of record keeping.This is necessary because after

the write-off, accounts receivable no longer has an active record of the account.

figure 7.8 details the role of the independent third party. Note that internal audit

:. confirms write-offs directly with-the customer to ensure that no collections have

''.,: , been made on written-off accounts. An employee might intercept a customer's

,. palme[t on account and then arrange for the account to be written off, so that

the'customer does not,continue to be billed for the amount.

CHAPTER 7 Revenue- and Expendiure-CycleApplications

TteastJtbr

265

::li,iin:.::

cigdrr,

tnteiat Audit

Follow-up

r--Tl

I Write-Off

cn stow and

doubtful accounts

I lr4".no.

IL-/' --J

I

I

Periodically

'confirm posting

of worthless

accountlist

Write-Off

Memo

lndependent

agpaval

Confirmation cf

wite-off sent

directly to

customer

.

FIGURE 7.8 Write-Off of Accounts ReceivableApplication System.

Other Revenue-Cycle Application Systems

Every organization defines its own unique application systems A large organization probably has several specialized application subsystems within its overall

sales and accounts receivable application systems F:br example, a sales or orderentry application system might include a separate pricing or quotation subsystem-a'{€t of fileq documentg and procedures used to price complex produtts

silch as electrical generating equipment. Another specialiubsystem migirt maintaiq firm's product or.service catalog. The shipping ipplication might-include a

?

warehouse subsystem condeTribd with converaing so o*r rnto the Jxact storage

locations that need to be picked. An automatCd warehouse syslem might a6o

generate an optimal path for pickers to take through the warehouse to minimize

travel distance in picking the order. The shipping application might include a

shippe-r-ordering subsystem concerned with selecting strippers, grouping individual shipments to minimize freight costq and controlling aU sfripmentJThe finished goods function would maintain several inventory fileq and billing would

need its own files and procedures

Basic transaction processing systems are the source of important tactical and

strategic control information. Data for sales analyses such as product sales by territory, product sales by salesperson, sales forecasting customer credit analysii and

266 PART I lntroduction to Accounting lnformation Systems

processing apother such summarized reports are accumulated by the transaction

routine

in a compii"ution systems. Such reports an{ analyses are common and

of uppertypes

to realize that these

iuterized accounting system. It is important

data oil

the

ie'el management reports cannot be more a..urate or reliable than

which they*are based. The application'systems presented in. this chapter and in

accuChapter 8 illustrate the typei bf controd necessary to provide reliable and

rate data.

EXPENDITURE-CYCLE APPLICATIONS

required to acquire

* An organization's expenditure cycle includes the functions

its operain

conducting

" L""ai?"a services that are utilized by the organization

use in

or

fions. The expenditure cycle inclucles the acquisition of.goods f91 ysall

ihe icquisition of personnel services, and the acquisition of property

;;;";ii"",

lnd equipmenr- Co'rnmon functions include ygBdqls-e-lpcJion, reqg!gi!!!lgg!8, PP-r:

chasing, r-gceiying, aggggalq. paYable, andlgryroll 499o319ting'

This sectio; dit""d t*" important expenditure-rycle applications: purdiscussed in

chasing and payroll. Cash disbursements and iccounts payable are

Chapter 8.

Purchasing

In some companies all prrrchas'-s of goods and services are channeled through

authority to

and controlted by a centialized purchaiing department. In others, the

decentralized

a

compa-qy

the

throughout

is

dispersed

ftu". o.a"rs wit( vendors

a

approach. eg4ralize4--pul9!4ling 1nqy_Vjg!d* iqqpqseii'g-uagtity discounts'.

- U."g"rnar}-".1-positt9ill tgt;-sgt.trpl,^b-ul-elsP-e--eializ3t!ot;a-4d the'

thei.!e1eesed.

ee.p_eee4raj1a!p;is]r_1.-t!s-ryX:iefeliug.tgF"l.{i:?gq-luseof

decentrarized buvers

5!n9qs!ffi9;-p14i;q".94'rh-9-Eiq,-aQ lis-eil Fol eianiple, of the desired goods

specifications

*e

ind

tt"t

.f

may have greater'kno;i;li#

_f

' and thereb"y maintain opti;l inventory leveh As in."ny organizational decision,

the choice is largely one of management style and philosophl''

A purchase application system includes five basic functions:

1. Someone outside the purchasing department determines that materials are needed;

a

requisition is prepared and approved2. Bids are requestg{-a vendor selected, and a purchase order issued by the purchasing department-

,

3. Wben the materials are rereived, a receiving report is prepared,by the receiving departthe ngtement- [n many caseq only a person with technical ability can adequately inspect

cases, it

In

unusual

department':';'- rials and gi.r"

the requisitioning or using

payment

is

"ssrr"rr"e-to

before

tested

received

may be disirable to have the quality of materials

part

the

as

a

of

purpose,

either

this

for

be

established

miy

made. An inspection function

i: . .i:.

',

':

'

receiving department or as a separate department'

to the purchased order and

. 4. Details of the invoice submiited by the vendor are comPared

accuracy. If everything is

mathematical

for

checked

is

invoice

to the receiving reporlThe

in order, the invoice is approvedJor payment'

A check is prepared and sent to the vendor, and all the previous documents are canciled

S.

to avoid the possibiiity of duplicate Payments

Figure 7.9 illustrates a data flow diagram of a-purchase application system'

Egure 7.10 illustrates an analytic flowchart of the flow of transactions in a pura

I

I

It

!I

i

_1.

-!

CHAPTER 7 Revenue-and Expenditure-CycleApplications 257

lir.d-€i.-

!,,ri, "1;-3 fe,

DATA FLOW KEY

l. Requisitioo

2 Acknowl@meat

APwt,ra*Oder

4-PudaseNv*n

i-ReccltvingMvi@

6. Shipinent

7. Receivittgldtice

S,Aeividg Rqrl

g' rrot*:6 oiRdeipt *

l[hw<itE

ll.Afirwedhwoie

l2iottdter-Package

13 Pryment

FIGURE 7.9 Data Flow Diagram: PurchaseApplication System.

chasing application system. The main feature in each of these illustrations is the

separation of the following functions.

i 71

v/'\

Requisitioning (Stores)

---J Requests for purchases, originate outside the purchasing department. In Fig-

originate in the stores department. Purchase req"I9 ?.10,jgglr9-ttg;sggisitlglq

uisitions

might also originate in other departments within the6-rm. Purchase reqttisitions ShoUld begpptg:y.Z!.ig-tlre_aqglea[tUg--depaglmenr.

a-1.

Purchasing

s originats it i, thlhn"tic,npffU"

glgb@-d:eg{g-elt tp elqc-!.-aJerdsr ane! artaqgb feJ. Je rms. d-delrvsry.

How this is done will depend on the rblative degree of centralization in the iomPany's purchasing function. Purchasing may at tisres override a purchase requisition due to insufficient budget,lack of authorization, or so(ne other reason. Purchase requisitions might also be altered or returned-to- the originating department

for modification.

Purchasing selects a vendor, then prepares and distributei a purchase ordef

(Figure 7.11) for the requisition. Copies are distributed to the vendor, a@ounts

268 PART I lntroduction toAccounting lnformation Syscems

fl.ffi'ffi'

Y:ijsro,'i

Review Reorder

Points ot ltems

fulupqt

R*iptof

Alrdp*Order

-t

[s,g,, to

--lr'r/otowwge-

leerx;rtot

Icooas

Furcftase

Drdq

l-"***1 [;",*zl

ww*,

I *'--";

n".*nt"

[I "".t.1/

L

u--[{

I

/

lPayabre/

tnventory

\Y.",

Bvl

Numbxl-

FIGURE 7. I 0 PurchaseApplication Systern

payablq the originating/requesting department (stores), and receiving. As indicated in Figure 7.1O the vendor may return a copy of the purchase order to the

customer to acknowledge receipt of the order. The copy of the purchase order

that is sent to the originating/requesting departrnent should be reviewed there to

verify the appropriatenes! of the purchase order.for satisfying the needs identi.

fied in the purchase requisition.

Receiving

Receiving is separate and inlependent -g! E-e-S!91ss-lg!9don. The copy of

the purchase order sent to receiving authorizes the recbiving department to ac-

I

CHAPTER 7 Revenue- 2nd F;<penditure.CycleApplications

269

I [*''

\I 4/

ti

. 1,r,.,t

Forward lo

Accounts

FIGURE 7.1 O (continued)

cept the shipment from the vendor when it

should catt for an independent count of the

receiving report.

is delivered. Receiving procedures

,rri;;;;;;

f*iil; preparation of.a

pllld pg,tol of a shipment may be obtained by not

ng_f allow-

n9.99uqg9rs-.

99uq ter-s-. tg,

39ep.qs_.tqjh.e_qqarlllqies_ghgylr.

-r!g_th-e_

to _bayq

_[ayq 3ga-eqc.

to_

ttrE prich"se

_ellgy

order. r

-o..n

5U-p€Lvlsol_c!

s-r+-4o_sv_!4.r-r,H.sre!-!r!el{!I!Llr!!QgE-f9_s9lre_o_u.lthluQre_!hQw!!-gJuh-e_p-utqhele

der audlhe-n p-r_ep-arc-s.ar_ecpiuing_rrpo" f;;

_o^r-

th{dffiG-=r.EiGa.

ived.A

e copy ofiF,e

of rhe

receiving,.ililii;;i;ffifi ffi HJlli;i,#t?Tl.lT;',"i:1:.,::,::"xJ";'JT;

Figure 7.10.

774 PART I lntroductiontoAccounting lnformationSptems

s

IF,wa

-\

E

]-'ltu**irg

Rrcfiae

I

Order

-.-

P Yz

/ lqy&f',bc

lhnuorln

--lo"*vev

[aaz verr w

R rfi6.

Paeki e€lb

n*

Count and

lnsflect

Onder

l*i**u

rbfl/

tl,tt

I art*rase

I or*rtu

I

I

I

&C"

Becelving

king Slip

Ieadrrgsr,p

r

I Reeort I

Lr

l

*.;+ig:iry, i':tli':i*+

e*"t"""a1 l-e""r xng

tuer I

---JI

I

t

Sli

ReceivlA

Report

Bvl

Nunbet

:

Pr€pare

o&xrl&r

!

-

--lm' 'r'oll

I

GooG

r ;: irr:i,:!r.,;

!El:r"

.-'-'a_

4

Good s wflfi

l-

-\.;

(

To. I - -

Stores I

I

I

I

H

i__t,

l-

leurausinS

:-

FIGURE 7. I 0 (continued)

-l"-

Stores

The stores department acknowledges receipt of the goods from receiving by

srgning the receiving report and thert forwarding the receivjng report to accounts

payable. If goods are delivered directly to,the requisitioning deprrl+cent rather

than to stores, a supervisor in the.requesting department snould acknowlerigc receipt on the receiving reoort and then scnd the.receiving report to payables- This

independent verificatiun of receiot of the purchase is a-central feature of thc purchasing applicatio: sisi;;:i illmr;1:,! !; .triorrre 7 I o

CHAPTER 7'Revenue- and ExPenditure-CycleApplicatlons 27 I

':j:: .

.!-..-.+- li,!!$:.l:i;

a ii:i.

Cairtr DisourSdjfi-entq

VenSor

9--{**""

--l

i

1r-,

Accounts

I e"yrw"

o

.--[I lvecessaa

c'/t*

uJr"or adn

,fro{ Pfotg'

Po t t+^

t

'i.

FIGURE 7. I 0 (continued)

Accounts Payable

Accounts payable is responsi ir: for.initiating-Payments torendom Four

aer"v

ror*t--pnrsfuleieEu$rlien,purshale-older"eqe$ls:Pg"I1fl9Pry*;^fl:

:

'r-*._

trarsagien- a m{or 11!1 ol over purchasin$',

i6euireaE'ffiE p!,rclias'

;

systeT.++*hryI"P

amrrmaritatinn.

er SVStem. .A. VOUChgf SVstg.m.-iigii

^^r!.,1+-, i- ;t*+ainai,t .+1,*nrrch rhe .rrca,nf a ,vrurelre-r

tron rs asdocumen'y.94prtp.'_t_q?r!s4eel_-Tr.il3l;5vieu10f

ihatdocumen-tationevidqnces

t"-J-l""EAttdthqEp.hliiitrisseli;dils'ffiin Frgure7.L0.

lttust.ated

of tt

it ;

-

;ffi

"."""ti*

"@ffii.Gpi

-, -r -rt

----a-?i6+a

*)

272 PART I lntroduction roAccounting lnformation Systems

Acrrx,titseayable

lr*^

--larr*,rsi,g

{r,o,

--leur"nuing

Match

and

Verify

raatcning

- -l Process

I

--l

l r.roro

Accounts Payabte

FiSure 8.tO

lin

FIGURE 7.1 O (contiouedl

, Approved vouctrers ar€ forwarded to cash disbursements for

voucher systems are discussed in detafl-in tire discussion of the cash

ments application system in Chapter B.

Several other fedttiics to note in rTgure 7.10 include the following:

' Purchasing.de4s,not,contpr th€ actuar gpodp nor does purchasing have comprete

. o'ier the documentation that is requfued,for Bayment.

*eceivingissiparate fronr snal cuitody6fguodsAckncwledgrnent from both recei

and custody is required before pa5rmentji authorized-

. Accounts payab[e handtes onty docrme.ntsand is not able to obtain merchandise or

,indqpendently.. ','

.-,.,'

I

t-

Y!

Iit'

|I

t:

l!

r:rPurchase r_?qukiti6ns:s!o{a_ue indepefrir6ntly reviewed outside

of purchasing This

*z

\ \ shown on the requisition and:also ensures that requisitions do noi originate in pu"rchasi

i

I

I

I

)

CHAPTERT Revenue- and Expenditure-CycleApplications

DATF

273

19-

FOR

HOWSHIP.

TERMS

T]TAXABLE ERESALE _ PERM]T No.

SHIP TO ADDRESS

ADDRESS

IMPORTANT

PtfASE IIoITFY US IMMEDIAIELY IF YOIJ ARE I'',IIAEIE TO SHIP

(srtulEl'M61

utcYEs..au

FIGURE 7.1 I rurchase Order.

. Invoices should be routed to purchasing for review and approval prior to being se..t to

accounts payable. This is particularly important if purchasing expertise is necessary to

evaluate the propriety of the invoice. Purchase terms should be reviewed for propriety orrtside the purchasing department.

This is done by accounts payable in Figure 7.L0-

.

. Inventory records should be updated to reflect the receipt of goods'

-

lntegrity of the Purchasing Application Systern

Purchase documentation simply ensures that individual orders are received as

udpected. Purchase orders, reieiving reports, ancl ttre like control individual plrchaseg but not the purchasing application itself. Control of the purghlsing apPlirelalio-l]-shiP' Bribery-kick-cation centers-s!-t[e-ilrlgg.rty-ol-lhg-bfiygLyggdbr

a ieiiiive-.or friend) are

fro."

ilUuying

brd a"d *"flr"tr-oi-i"6fiaG".h

'Duyer-vendor

that

the purchase order aprelationships

examptes of improper

plication systern must addiess Blryer=,ycndoE:elatie[ELils-el9-J,ngrq 4-mat!gr q{

tbqn p-tp.ggdure. Most comPanies have found it desirable and often neces"Lgliry

r".yA ii-uu"To.rnat *ritten policy and procedure manuals covering the purchas-

furO@Lq-s9q,e9!itjv9-Urddi!&-q!ul!y-trgP-leor-quotationtolms.

-@&iffie5dr-ir,r""gh-qeqqest-f

ing tunction.

.Eertlqqthlolgh_-qlq-ot-Legq9$:-f -oi.gUql{t-ql{9lgs-

Copies of theslformi are filedg.nd.-r-eylcyled-b1lpllrlhaq[g-11r-anagelrlent' Selectt"g tf* Lo*"st-"o.t bid ir not always an acceptable basis for selecting a vendor.

Mithods of evaluating and selecting bids based on vendor attributes (vendor rating plans) may be formalized, with decisions subject to revierv by a higher author-

77 4

PART.

I lntroduction to Accounting information Systems

ity- A policy oi rotating a buyer's responsibilities weakens buyer-vencior re

tionships but reduces possibilities for buyer specialization. Approved vendor lis

prepared by an independent function, may be used to restrict a buyer's options

those vendors rrrhc have been found rciiabie, f;nancially sound, and free of c<

flicts cf inierest.These examples are not exhaustive, but they indicate the types

controls that may be used to ensure the integrity of purchasing personnel.

Th e Attribute Rating Approach to Vendor Selection

The_ettribgJ_e ratgg.4pplo3ch to ye1dol

9ele".!.lql il appropriate whenever

a.u-obiective-,evaluation of the opinions of ieveral iiAilpgnaent evaluators is del

sired: tha! is, an amalgagnation of evpluations of the sarne system. The followin!

i

steps are involved: -t i

. . Identify and list the attributes to be included in the evaluation.

. Assign a weight to each attributg baseci on relative importance and objectivity.

. Have individual evaluators rank each vendor on each attribute, giving a numerical

on a range of 1 to 10 or some other scale-

. Total the individual evaluations by multiplying each attribute's numerical ranking by i

weight; then total all evaluations by adding the scores together.

Given that the relevant costg such as a vendor's prices or a system's

have been identified, a benefit-cost ratio can be computed for comparisons.

though this method appears to be objectivq both assignment of weights and

merical ranking are very subjective processes. Accordingly, attribute eval

techniques are most useful for screening proposals, and identifying those vr

or systems that should be subject to final considerations.

Payroll

'

.. -ii:*i-,..

;-:

'.

A payrolvpersonnel system involves all phases of payroll processing and persc

nelreporting.@Ar-r_s_o_f

p_{9_rlplly--qgdggcur4tety-payi

paylg[Iqporrs, and S_qpplying 1nqtag_eglql

Lnf_oq!4!io n. fte_p rocessiag s.ho q l!_. UrctUdq_

-C_!0pl9y_e-es, gqlg1-ating thp_UecS:Sary

with t he re qui rq d _e_1qp!gy9e_!&L[t

ttr

\.i

i

n ,'' ,-.a

.'U

.'1

r

L

;

c!: r=

ts-

8,.,

_

d,eduetion .I-ar wi_thhal-ding _.taxes-_sp.p-sia-lizBd dc-dustl_ojrs, ggyernmen! r-ep-qti

and_lllefnal p_-e,gsgnngl-I9_qUireme=qts. An efficient system is necessary to establi

and maintain good employer-employee relationships

Payroll processing is extremely complex. In a large organization, it is often

the-most-eomplex-pioEeaureln oF-enritm-ffiis-is-because of the social significance payroils have assumed over the last few decades All levels oflgovernment

impose payroll taxes of one sort or another; regulations and rates are constantly

changed, with the result that a payroll system usually has a relatively short life.

Tle strategy here is to provide an overview of a typicai'pifrou procedure and discuss factors influencing the actual calculation of payroll. No attempt is made to

provide current rates: tax laws are arbitrary and change quite rapidly. payroil processing is one area in which the law imposes not only a fine but i

lait senten"j fot

willful negligence in maintaining adequate records As with any liw, ignorance is

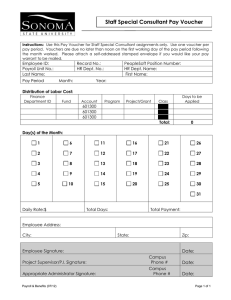

no excuse.The responsibility is on the systems analyst to keep current in this areaFigure 7.12 illustrates a data flow's diagram of a payroil application systemFigure 7.13 illustrates a document flowchart of the flow of tranlictions in a payroll application system. The main feature in each of these illustrations is the separation of the follorving functions.

,

CHAPTER 7 Revenue- and Expenditure-Cycle Applications 27 S

DATA FLOW KEY

l. Authorizations

2 Job Time Surnmary '

3.Time Cards

4. Job Time Report

5. Paytoll Register

& Paychecks '.

9. Voucber

9. .,lauma!'tfoucher

1O. PaYehecks

11. Voucher Ch*k

12 Canceled Checks

13. Bank Statement

7-VoucherCheck

FIGURE 7.12 Data Flow Diagram: PayrollApplication System-

Personnel

The personnel (employment) office is responsible for placing people on the

company's payroll, specifying rates of pay, and authorizing all deductions tiom

pay. Atl changes, such as adding-or-#eting employeeg'sh2nging pay rbics5 or

ihanging levels of deductions from pay,must be authori-*d by the personnel office. 'lle_pepq!-Be!_Ign9!iqlr- is-g[lEinct -tgEllllnekdg}|il13 ag5!.^f1om. tlg_payroll

,pn}.P3latlgr-r{grrpJion.

- I rmekeePlng

n and control of

The limeke-qplqg-iUngtlg iq r-eqpgnsible=fgl tle p a

time reports-ana-iob Eme tigkels ln a manufacturing nrrn;an tiouily eqrploy;e

job. At the end o{ a pay period, the employee,s

time caid (or time report) indicates the amount of time that the employee.was on

the job and the time that he or she-ery-ecls to'receive pay for- Timekeeping is responsible for collecting and maintainin! time cards or time reports, and reloncil-

o>r

L6

l-E

NE

o,

10

Ic

eo

c

o

o

t6

[?

EA

-o,E

tt

E

i," ::",9

ir'o

..:6

.o

r':()

!

,'F

tr

o

tr

at

e

a

.a

E

co

os

:

{

.a E

C

o-

3

s

i'*Q

.EiESg

oso-<

276

gl

G

f

o

rL

CHAPTER 7 Revenue- and Expenditure-CycleApplications

277

ing iirese data to job time summary rcports iliat are received from production'

to in

Job time summary reports indicate thelobs that employees were assigned

job

summary

time

related

the

pioauction.ltimekeeping reconciles time reports to

deieport receive,J from prlduction and then for'-1;ards time cards to the payroll

partrnent.

E ---

?t Lt

Salaried emplqy-e--e-9 typlga.Uy .{o {'ol clock ,o.4- 41{ trff the

job in the same

.mannffiIfnoaccountingtortimejsrequired,asupervisor's

employees

ippr"rii ii "iuuify friiiied to initiate payroll processing- If salaried

is

straightforward'

7'13

uiJi"quir"a to sutmit'time reports, the inalogyto Figure

Payroll

and

qrepa:

The pavrolldgpq:lfne1rt iq-rs9po-4pip-1-9-tgt the.actu-A! -cpr4pglatioq

preparation of

the

of

i"aependent

pJyioit

ii

pi"piri"g

ut

it

N6t"

rqlion oddr-oi|

data' PersonitJi"prt?iii on which payis based, the-.li*9-r-epqrts and pgrsoq4el

are received from

nel data are received frtm the pet.o.,.t"l offiie; time reports

(gross pay

timekeeping.The payroll register details the computation of net Pay

for sier1l

less deductions froni p"V). fuy9!998q-gl9-l9glloi3!!r (lgbursgments

accounts

to

register is sent

iqtl, reri"*, 4qg!ilt-gb"ii"*;e "apy;mn" payrollpavroll'

piiiuii to iniiiaitth;;;oiding of a voucher for the

.

Several other features to iote in Egure 7.13 include the following:

rr

. The use of a separate imprest payroll account for paycheck* to facilitate reconciliations

. An independent reconciliation of the payroll account bank statement

. The use of an independent paymastec The person who d,istribute; the pay is independelt

office, the

of personnel, timJteeping, ai-rd payro, pieparation. Neither the personnel

once

timekecp;.3 dep"rt*"nt,-,ror ttre payrolidepartmen'h".Tt9:,:t:.,the Palehecks

I

they havc been drawn-

'j

Payrotl Processing Requirements

employee informaNdmerous files must be maintained in a payroll system. Basic

to prepare a

necessary

is

deductions,

pay,

and

tion, such as name, address, rate of

actu,al paydocument

to

maintained

be

payioff.$ pgytolfggt:11t o1joq1-ai niust

penprocesing'

in

tables-used

;n;ltsfXaa}erdfiing tb government reports,tai

information

of

examples

are

plans

fi"rpii"rir?riori plans, and similar

#;;i;,

required to support a payroll procedure' .

tax legislation impose four taxes based on nayrolls:

Social selurity uiJ'",t

"i

'i'

(F-r.c.A.)

1. Fed"rjrtli:Jj), ,,r*i.,rorr', disability, and hospital insurance

2. Federal unemployment insurance

3. State une'rploYment insurance

4. Income t.D.es withheld

employees

rhele&la!]$gtg"ce Q+Jributigll! 49t (E I:C'.1"1 P.rovides that

to fu"as foi'oitl uge, t[-*iuors', disability, and hospital insurcontribuie

families' The contribu"q*ffy

ance benefits for certain individuats aid rnembers of their

tion

---- is based on a tax rate applied to gross wages'amount of E'I'C'A' tax from each

ft" employer ir: i"q"it"O to dEduct thJ

reQuired to match these

employee,s puv Lu.n-puv period. The emoloyer is then

depository. A penalty

deductions and deposit the entire u*o,rrrf in u government

when

is levied for failure, without reasonable cuus"Jo make-required'deposits

claim credit on the record of federal tax deposits for

due.Thxpayers who

wilily

278

PART

I lntroduction toAccounting lnformation Systems

deposit act made are subject to fine and/or other criminal penalties. The employer is responsible for the full amount of the tax even when he or she fails to

withhold contributions from employees.

lltre Federal Social Secuyity A ct and the Federal Urrernployment Thx zrct

provide for the establishrrent of unemployment insurance plans. Employers with

covered workers employeci in each of 20 weeks during a ialendar yeais are affected. Payment to the federal government is required qua.terly. unlmployment

benefits are provided by the systems created by the individual states. Revenles of

the federal government under the acts are used to rneet the cost of administering

state and federal unemployment plans as well as to provide supplemental uneml

ployment benefits.

Unemployment comPensation laws are not the same in all states, but all

states participate in the federal-state unemployment insurance program.In most

stateq laws provide for taxes only on employers The federal tegiilati,on applies to

allemployers of one oI more employees.Thx payment is generilly required on or

before the last day of the month following Lath calenJar quaiter. Most states

have a merirrating plan that permits a reduction in the tax rate for employers

who establish a record of stable employment.

Federal income taxes on wages of an individual are collected in the period in

*li"h the wages are paid. our "pay-as-you-go" system requires

to

withhold a portion of the earnings of their employies. The amount"*pl,oy"r,

wiitrtrlta aepends on the amount of the earnings and on the number of exemptions allowed

the employee. A withholding exemption ceriificate must be prepared by each empioyee.The certificate states the number of exemptions to which the employ:e is

entitled. This certificate is given to the employer io that she or Fre rvill Ue at te to

compute the.prgpe!_4rnounr qf tax Jq,. be wi th h eld.

- curreniresut{'&*ri rrovide?[iaar:ated system of withhotding designed to

make the amount of tax withheld closely approximate the rates ,..? in c"ompur

ing the individual's tax liability at the end of the year.

Emplqyers engaged in interstate commerce are required by the Federal Fair

Labor Standards Act (also known as the wages and Hours I.aw) to pay overtime

at a minimum rate of one and one-half times the regular rate for hours-worked in

exc€ss of 40 per week. Many compa-nies also pay overtime premium rates for

night shifts and for work on Sundays and holidays.

Employers must take care to deduct payroll taxes from all employees. A distinction is drawn between employees and independent contractors. irublic accountants' architectE attorncys, and other people who renrlel services to a_business for a

fee but are not controlled or directed by the client.are not employeei brt independent contractorg and the amounts paid to thernare not subject to payroll taxes

At the close of

quarter an employ,.-eLj: requireo to nt" a quarterly re-e1ch

turn of Form 941 or 94LE

and pay the baldnCEtf undepositeci taxes. If the taxes

were deposited in full, 10 additional days are allowed. This return covers income

tax withheld and EI.CA. tax for aII employees.

on or before January 31, each employer is required to give each employee a

completed Form w-2 wage and rhx statement. Th; employir is required to

for_

ward a copy ofthesew-2 forms with a Form w-3 on or befJre February 2g

to the

government. AIso on or before January 31, employers must file Form 940, Employer's Annual Federal Unemployment Thx Return.

The basic information about.what ,n" g.5.:government requiies with respect

to payroll is outlined in the Department of Tieasury Internal -Revenues Service

publication Circular E Employers Tax Guide. This publication contains all the lat-

F,:-.

k+-<_-

CHAPTER 7 Renenue-and Expenditure-CycleApplications 279

Evenl

January 31

January 31

Form W-2 (Wage andTir-x Statement) to be furnished to employees

Form 941 (Employer's Quarterly Federal Tax Retum) due for 4th quarter of

preceding calendar year

January 31

Form 1099-Misc. (U.S. InformationReturn for Recipiens of Miscellaneous

Income) to be furnished to consultants paid directly

Form W-3 (Tiansmittal of Wage and Tax Statements) due with Copy' A of each

Form W-2; Form 1096 (Tiansmittal) with each 1099-Misc.

Duplicate of Form 1096 due with State Copy of Form 1099-Misc.

Frle Form 1120 or 1120-5 (Federal Corporate IncomeThx Return for calendar

year)

Form 941 due for 1st quarter

Form 941 due for2nd quarter

Form 941 drre for 3rd quarter

February 28

February 28

March L5

April30

July 31

October 31

est information on new laws and detailed information for employers. It tells how

to fill out aU the forms and reports required, how to compute employment taxes,

how and when to make deposits and payments, and lists the invaluable tax tables

If an employer does not have this publication or access to the information contained in-it, ihe or he will sooner or later make an error in payroll procedure that

will cost a penalty.

Thble-7.l contains a schedule of payroll-related deadlines that illustrates some

qf thg processi-ng and infor:nation that a typical payroll system must provide.

Other Expenditure-Cycle Application Systems

A large organization will have many specialized application subsystems in its ex-

-ycleEach of these subsystems processes data against files, uses forms

pendiiure

and other documer,tation, and requires'segregation of duties and other controls

to ensure reliable operation. Examples of expenditurti-cycle subsystems that are

specialized in most organizations include the fgllowing:

Vendor se_l_e_ctio_n

Receiving

-B@:!lrg:$ne

Monitorsandconsolidqle!,qs,qf .1-e,qq,e--qts

for purchases.

Accep6evaluates, selectt an-d reviews lhe

firm's approved vendor list.

Identifiessoods received and conducts

ingpgction procedgrc+

Cversees capital budgeting systems' major

maintenance accounting, research and

develropment accounting and computer

system project accounting.

aq-.organized lirting of all j,ob

-Maintainl

pesds$3gIi!&4-e-[ry-

Employee profile

ustrtatseierydiEllltlgr{i9l o n

Fr!g-!Sg"!E administration

Maintains the required files to administer

Insurance and/or accident claims

Processes data relevant to such claims

9r{rpl_oygel

@-

'I

1

,tl

, -It

280 PART I lntroduction toAccounting lnformation Systems

Each of these subsystems provides data relevant to the strategic and tacti

management of the firrn. The discussion of the purchasing and payroll applica

systems has been directed at basic internal control considerations Such consid

ations must be included in anv expenditure-cycle subsystem to ensure that d

prwided to upper-level managernent and outsiders are accurate and reliable.

SUMMARY

Sales order processing is a common revenue-cycle application system. A sales

der application system comprises the procedures invoived in accepting and shi

ping customer orders and in preparing invoices that describe products,

and assessments. A model sales order application system includes a separation

the following functions: sales order processing, credit 4uthorizations, custody

fiaished goodg shipping, billing, aeeounts receivable, and the general ledger.

Accounts receivable processing is another common revenue-cycle applicati

system. An accounts receivable application system is conceptually strai

Debits and credits are posted to customer accounts; statements are periodically

pared and mailed to customersA model accounts receivable application system i

cludes a separation of the following functions: cash receiptg credit authorizati

billing, accounts receivablg and the general ledger. Procedures that handle sales

turns and-allowances and procedures used to write off accounts receivable requi

careful design and control.

Purchasing is a common expenditure-cy-cJe application system. A purchasi

application system comprises the proceduibs'involvbd in vendor selection, req

sitioning, purchasing, receiving, and authorizi_4g psyrrent to riendcii.s. A rn,

purchasing application system includes a sepaiation of the following functi

requisitioning purchasing, receiving, stores, accounts pqyable, and the gene

ledger. Adequate vendor selection procedures are an important factor in t

overall integrity of a purchasing application system. '"

Payroll is another common expenditure-cycle application system. A

rolupersonnel application system comprises the procedures involved in promp

and accurately paying employeeg generating the necessary payroll reportq i

supplying management with the required employee skills information. A

payrolUpersonnel application system includes a separation of the following fur

tions: personnel (employment), timekeeping, payroll accounting, and the ge

,e.;al ledger An independent bank reconciliation is an important contrcrl inpayrolupersonnel application system, as it is in any expenditure-cycle applicati

system.

apprcved vendor list a list of .vendors approved

for use by the purchasing function.

attribute rating: an approach to vendor selection

that identifieq listq and evaluates several different aspects concerning a vendor.

balance-forward processing: a customer,s remittances are applied.against a customer,s outstanding

balance rather than against individual invoices

I

E_

bill: a synonym for invoice.

bill of lading: the invoice received from a

for shipments.

blanket.order: a single order that calls for seve

shipments to the same customer over a

time period.

blind count counters in receiving do not have

cess to quantities shown on purchase orders.

CHAPTERT Revenue- and Expenditure-CycleApplications 28 I

complete prebilling: the complete invoice is prepared at the same time as the shipping order.

credit memorandum: a foim used to document

reductions to a customer's accourt due to sales

returns or sales allowances.

eyele billing: the processing of accounts receivable

is subdivided by alphabet or account number in

order to distribute the preparation of statements

over the working daYs of the monthfactoring: the selling of accounts receivable at a

discount to atollection agency.

incomplete prebilling: the invoice is not completed until thc goods are ready for shipmgn-tindependent paymaster: the person who distributes pay is independent of the payroll preparation process.

invoics the document that informs a customer of

charges for goods or services rendered.

matching pnocess: the review of purc{rasing documentation prior to authorizing payment to vendors

open-item processing: a customer's remittances

are applied against irdividua! invoices rather

organizatlonal independence: the separation of

functions in the design of application systems.

partiat billing: synonym for incomplete billing.

postbilling: the invoice is prepared or completed

after shipment.

purchase order: form issued to a vendor to initiate

a purchase.

purchase requisition: form used to document a request for a purchasereceiving repore a form prepared to document the

receipt of shipments from vendors.

request-forquotation: forms used to request competitive bids &om vendors

sales orden a document prepared to initiate the

shipment of goods to a customer.

separate order and billing: both a sales order and

an invoice are used in a sales order application

system.

shipping advice: documentation that is forwarded

to the billing function to evidence a shipment to a

cusiomer.

than a eustomer's orrtstanding balance.

Cbaptr Quiz

Answers to the chapter quiz appear on page 300'

1. Which of the following documents is used to post sales on a8count to customers in the

accounts receivable ledger?

(a) purchase orders

,(b)-invoices

(c) remittance advices

(d) bills of lading

2. Which of the following departments should _ryralrch slUpElng*{q.}ryilt. with open

sale-s orders and prepare daily sales summarie6?

gf ainiry

'(b) sales order

(c) accounareceivable

(d) shipping

":-::'--,

3. In an incomplete prebilling sales order system, the invoice iS

(a) -completld when payment is received from the customer-

l)lf comoleted when ihe goods have been shipped'("i co-'pl"ted when the iales order is approved by the credit manager.

(d) completed when the customer has acknowledged receipt of the shipment.

4. h9 billing function should normally report to which of the follorving?

f'{) conttoller

(b) treasurer

(c) Airector of internal auditing

(d) vice president of sales

I

i

781 PART I lntroducdon to Accounting lnformation Systems

:. Which of the following departments should normally be responsible for the

upon the receipt of 4p_proved.sales[on ana journatizingof cre

memos to authorize a reduction in customer account balances because of re

goods?

(a) receiving

(b) accounts receivable

(c) credit

"

Ji) bitting

6. In a purchase application system, which of the following departments should

be responsible for the preparation of pJrrc_hggr lggqigll1-ons?

(a) cash disbursements

(b) purchasing

(c)- ieceiving

JdI stores

7 . Ia a purchasg application system, urhich of the following departments should

be responsibie for the preparation of Brrchase olders?

(a) cash disbursements

..(b) purchasing

(c) accountspayable

(d) stores

8. In order to provide accountability for purchasing,

should be sent to

(a) the vendor.

(b) cash disbursements"

:

llf accounts payable.

, (d) receiving.

9. [n a payroll applicatibn,system., which of the followrng should be responsible for

oreoaration of the navriili'rccister /

(d) timekeepingdepartment

10. In a payroll application system, which of the following should be responsible for

of oav rates for emnlorrees?

personnel department

(b) payrolt department '

(c) cash disbursements department

(d) timekeeping department

You have been engaged by the maq4gement of .rriden, Inc. to review its internal

trol over the purchase, receipt, stdiii,eiand issue of rzw materials You have prel

the following comments that describe Alden's procedures

Raw nraterialq which consist mainly of high-cost electronic componentq

kept in a locked storeroom. Storeroom personnel include a supervisor and four cle

All are well trained, competent, and adequately bonded. Raw materials are re

from the storeroom only upon written or oral authorization of one of the p

foremenNo perpetual inventory records are kept; hence, the storeroom clerks do

keep records of goods received or issued- To compensate for the lack of perpe

records, a physical inventory count is taken monthly by the storeroom cterks,

are well supervised. Appropriate procedures are followed in taking the inven

count.

I

ft-u

1-

284

PART

I lntroduccion toAccounting lnformation Systems

Raw Materials

{9:l'lr:

'P,odrt&fii'

DATA FLOW KEY

1. Written or Oral Authoriation

2 Monthly Physic.al Count

3- Reotder Levels

4. Mateials Requisition Ust

5. Purchase Order

6. Bill of Lading

7. Receiving Repofis

Key

L lssue materials uPon writtan

verbal request of foreman-

Suoer.isor

'iiems

point-

ccfiipares count d

to o'edetirmine reonls

C. Prepare purchase order for

item lor the predetermined

reorder quantity.

D. Select the vendot froin w

item was last purchased.

E. Count the shipment and i

count to the bill of lading.

the bill of lading, date it, and

as a receiving'report.

FIGURE 7.14 Solution to Review Problem.

The accountipayable clerk handles both

the purchasing function and payment of

invoicesThis is not a satisfactory separation of duties

Raw materials are always purchased from

the same vendor.

There is no receiving department or receiving report. For proper separation of

dutieq the individuals responsible for

receiving should be separate from the

storeroom clerks

...

h,F

i

!1 :

!:- ,

l.

F.

L

5;

The purchasiag functioa should be centr

lized in a separate department. Prenumbered purchase orders should originate

from and be controlled by this department.A copy of the purchas6-o..,gder

should be sent to the accounting and

receiving departments Consideration

should be given to whether the receiving

copy should show quantities

The purchasingdepartment should be required to obtain competitive bids on all

purchases over a sPecified amount.

6. A receiving department should be estabblished. Personnel in this department

should count or weigh all goods received

and prepare a prenumbered receiving

report.These reports should be signed,

CHAPTER 7 Revenue- and Expenditure-CycleApplicadons 285

7. There is no inspection department' Be- are

cause high-cost electronic components

usually rlquired to meet certarn specifications, ihey should be tested for these requirements when received'

dated, and controlled. A copy should be

sent to the accounting department'

purchasing department, and storeroom.

7. An inspection department should be established to inspect goods as they are received. Prenumbered inspection report:

should be prepared and accounted for. A

copy of these reports should be sent to the

accountiug department-

Reoiew Questions

consideration in the

1. what are several factors that make internal control an important

design of business Procedures?

production order

2. In what circumstances might a customer order require the use of a

prior to a sliiPPing order?

in a sales order pro3. Distinguish between the bilting and accounts receivable functions

cedure.

procedures:

4. Briefly describe and contrast the foltowing types of sales order

(a) seParate order and billing

fU) iniomPtete Prebilling

(c) comPlete Prebilling

activities of a sales-order

s. ,irirat uoouniing jourial entry or entries summarize the

procedure?

cycle billing'

O. Uffrat is cycle billing? State two advantages of using

l

7. When is ii desirable to use an acknowledgment copy of a sales

proceallr;wance

and

in a sales return

the major f119;ts of inlunaf

order?

B. Outline

.gontral

dure.

9. What functions are seryed by periodic staternents of account?

10. Identify the two major aspects of a purchasing application

system'

the issuance of a purchase order?

11. What accounting entry if any, is necessitated by

12. Define and indicate the purpose of the following forms:

(a) requisition

(b) purchase order

(c) invoice

(d) receiving rePort

13. What is the matching Process?

of the procuf,emprt^function'

14. ldentify several controls directed at ensuring th-e integrity

function? Give spepurchasing

the

over

L5. How might budgetary control be exercised

. t_

cific examPles.

the irnplementation of an ap16. What factors or qualifications might be considered in

proved vendors'list?

"

L7. What are the objectives of a payroll system?

requirements with respect

1g. What is the basic source of information concerning federal

tc paYroll Processing?

tS. laeniify the major controls in a payroll procedure'

20. tdentify each of the following forms:

(a) Form 941

(b) Form W-2

(c) Form W-3

(d) Form i099-Misc(e) Earnings statement

>rt'*eR

CHAPTER 8

P ro duction - and F inal4ce -CYcle

Applications

LEARNTNG OBJECTIVES

Careful study of this chapter will enable you to:

IDescribethemajorfeaturesofaproductioncontrolsystem.

I Describe the major features of a property accounting application

sYstem-

IDescribethemajorfeaturesandcontrolsinacashreceipts

aPPlication system.

I Describe the major features and controls in a cash disbursements

aPPlication system.

':

:<--

,"

*=

---,Y-

:*

"

in an organizaThis chapter discusses accounting application systems found

applicaillustrated

of

the

feature

tion's production and finance cycles. The tintral

independence'

organizational

iio"tii the segregation of dutiei to achieve

PRODUCTION-CYCLE APP LICATIONS

accounting @

Produciion control, inventory control, cost accounting, and property

l9w il anv

are typical functions in the iroduction cycle,of manufacturiug,firms'

in nonmanufacturing firms,

froAuttion-cycle activities eiist ", sepuritt -!gnc1!g-ns

sor'ne

but to some extent, most organizatio-ns hold fomC inventories and manage

pri4g.1pte1of

the

;-:. 1,-,,,,typ€ of productive activity, sich as selling goods or services.Thus'

' ' ptlaua:ion control

r"i"uunt to most organizationl

' This section provides

"r"

an overview of the.transaction flows necessary to support

control, inventory control, and cost accounting within a

the functions

nim.me discussiog pf produdiotr-cycle applications also includes an

manufacturing"6;;r"ii.n

systems'

overview of tt U"ri" factors relevant tb pppErty accgunting application

"

\:tlt Production Control Q

fo"u, on the mahlse1nelt 9f T1'ulT:liTi]'1":t^"j1."-':

"*. fwr;, and finishld goods'

J"!.":'l':s^:: l,It T::.",9::

requires a

in which costs are aiririirl,ia to iarticular jobs ir productig{gfders

o)

production order control system.

301

;il;;;;fr'i-p'.""*

f.

'1"

d

jj-:

r'

i

$.

*..

t

;-.

E:

*f.

&

E ._,-

302 PARr

\i

I

I

lntroducdon to Accounting Information Sptems ' .t

process or department accounts by

In pro""r, costingr costs are

"l/rrr.oin

periods (day, week, or month). At the end of each period, the cost of each process

is divided by the uniB produced to determine the average cost per unit. Process

costing is uied where ii is not possible or desirable to identify successive jobs or

produition lots. A classification of processes or departments may be set up for

toth cost distribution and production reporting Purposes This classification

serves the purposes of process cost accounting and repctitive order production

control. Coits in either job or process costing may be actual costs or predetermined (i.e., standard) costs

Figure 8.1 is a iata florv diagram of a production control application system.

Figure 5.2 i. u document flos,chart of the transaction flows essential to a manufactuiing company. Cost accounting systems encompass b6th produq"T.""g inventory lontroi; Uottr are closely related to order-entry, billing, payroll, shipping' and

,-ourchasins orocedures

n \ Inte.-nat control over inventories and pro{uction is based on separation of

and basic records and documentatioly'such as production orders, mater\]drnctions

'-ial requisition

forms, and labor time cards. Pro,/ection of inventories from physical

theft involves security and access provisions as well as periodic physical counts

and tests against independent records

1. Production Ocder

2 Production Order

7. Completed Production

8-Completed Prcduction Orders

3. Material Authorizations 9. Materfal Costs

4 Material lssuances 10. Cost of Goods Completed

5. Material Requisitions ll. Cost of Ptoduction Repod

6. JobTime Cards

FIGURE 8.1 Daa Flow Diagram: Production ControlApplication.

.-

8 Production- and Fimnce-CycleApplications 303

Prcduction

@ntol

Ptoduction

Depaftments

i,F*,ffiiianto,v

;;dax";cp!t/'g,

ry

f l"r".t

Status

RaYv Materials

FrxshedGoods

Post to

WtPRe@in.ds

Jounal

Voucier

Matillals Placed

h Paduction

:. .,r:1;;;a:;a'ijsatit*,lik'ti.i.:,i..1.j

FIGURE 8.2 Transaction Flow in a Producti'on ControlApplication'

304 PART I lntroduction toAciounting lnformation $ystems

Files and

Reports

:.

.: .

Production control involves planning which products to produce and sched-,--r

uling production to make optimal use of resources Basic production requirdq l.,

ments are provided by thc bill of materials and master operations list Detailed

material specific4tions for a product are recorded on the bill of materials The bill

of materials lists all required parts and their descriptions in subassembly order.

The bill can be used as a ready reference for replacement parts as an aid in troubleshooting subassemblies, or as a parts list for the end user. Bv distributing copies

of bills to all affected departmentq management can ensure uniform access to

accurate, up-to-date information at every operational level. A master operations

Iist is similar to a bill of materials Detailed labor operationg their sequencing, and

their related machine requirements are specified in the master operations list

for a product. The bill of materials and the master operations list are used extensively in the production control function- In a standard-cost s!'stem, the standard

material and labor costs might be included on the bill of materials and master operations list.

Determining what products to manufacture requires an integration of the

demand for a product, the product requirementq and the production resources

available to the firm- Resources available for production are communicated to the