STUDY PACK

CHAPTER 1

Economic activity and the problem of choice

Introduction

We live in a world of great wealth and great scarcity of resources. It should

be clear to us all that there are insufficient goods and services to satisfy all

our needs and wants at any given time.

However it is the purpose of any economic activity to provide as many of our

wants as possible yet we are still left wanting more. This shortage of products

and the resources needed to make them lead to us all to make choices.

As we cannot satisfy all our wants then we must choose which we will satisfy

now and which will forgo. If we are careful and rational we will choose those

that will give us the greatest benefit leaving those things with less value to

us.

This need to choose is not exclusive to people as consumers but to all

economic units such as the government, businesses, workers and charities.

Business exists to provide goods and services.

All businesses whatever their objectives they have to make products and

provide services that satisfy consumer needs and wants.

Goods and Services

Consumer goods are physical and tangible goods sold to the general public.

They include durable consumer goods such as cars TV’s e.t.c. None durable

consumer goods include food drinks e.g.

Consumer Services

These are non tangible products which are sold to the public and the service

itself is not physical it’s something done for you.eg. Insurance, hair cut e.t.c.

Capital or Producer Goods

These are physical goods used by industry to help in the production of other

goods and services such as machinery, equipment and commercial vehicles.

Classification of Business Activity

Business activity is classified into primary, secondary, tertiary and quaternary

sectors. Primary sector business activities are those firms engaged in

extraction of natural resources so that they can be used that by other firms.

Such activities involve mining, quarrying and fishing for eg.The secondary

sector on the other hand involves firms that manufacture and process

products from natural resources to finished goods. More so the tertiary sector

involves those activities that involve trade and aids to trade.

Needs and Wants

Needs is a state of deprivation of basic satisfaction such as food, shelter,

clothing and education. However wants are unlimited as these are the desires

for specific products for enjoyment and comfort. e.g. cell phones, cars, games

e.t.c.

Scarce Resources

Resources in business can be regarded as any feature of our environment that

helps to support our well being. In any society resources are scarce relative to

the number of uses for which they could be put. There are too many types of

resources i.e physical and human resources.

Factors of Production

Land-includes all natural resources such as forestry, minerals, water etc.

Labour -it includes all physical and mental effort in production for which a payment

is made.

Capital- includes machinery and other items that go into further production.

Enterprise-is the art of combining three factors of production, it provides

management decision making and the coordination role.

Opportunity Cost-Because resources are scarce to meet everyone’s insatiable wants

people are supposed to make choices. What one does not choose is known as an

opportunity cost. It is therefore the next best alternative forgone in carrying out an

alternative activity.

Forms of Business Ownership

1. Sole Traders

Is a one man concern business, all business decisions are made by the owner. In

most cases the is no separation of ownership and control of the business. The owner

has no legal formalities required by him to start his business and capital raised is

from personal savings and family members leading the business with no room for

expansion.

Advantages

The owner has freedom of flexibility in decision making.

Decision making is faster.

Owner has total control of his business.

Has personal contacts with customers

There is personal enjoyment of all profits generated.

Less hectic since no legal requirements are needed to set up the business.

There is personal satisfaction of good performance

Disadvantages

There are limited sources of finance.

The owner bears the burden of all losses made by the business.

There is unlimited liability since personal assets are vulnerable to takeover in

the event the business fails to pay creditors.

There is restricted growth of the business because of lack of finance and

management.

There is limited scope of economies of scale.

There is lack of continuity of existence.

2. Partnerships

Is the amalgamation of 2-20 partners with a common view of making a profit except

a professional partnership which has no limit e.g. auditor’s solicitors and

accountants. However the business is governed by the Partnership Deed and Act.

Contents of the Partnership Agreement

Objectives to make profit

Amount of capital to be contributed by each partner

Duties of each partner

Responsibilities and rights of each partner.

Interest to be paid on their capital

Interest on drawings

Salaries and bonuses paid to each partner managing the business.

H.I.V status of partners

Advantages of Partnership

Management of business is shared amongst the partners.

More capital is raised which allows for the expansion of the business.

Wider experience/more skills are brought to the partnership, this allows for

some degree of specialization.

Decision making is consultative i.e shared so as to reduce the burden on

management.

More ideas and initiative creates greater efficiency.

There are few legal formalities required to set this form of business.

Losses are shared by the partners

Disadvantages

Disputes may lead to the partnership dissolution.

Consultative decision making delays implementation of ideas.

There is no continuity of existence of this form of business due to change and

even death of partners.

Decision made by one partner is binding to all partners this can be costly to

the organization.

Sharing of profits with lazy partners might discourage honest, resourceful and

hard workers.

There is unlimited liability for members.

Partners can be sued severally.

Profits generated are shared.

3. LIMITED COMPANIES

Characteristics

Liability of members is limited

Capital is raised by selling shares to the external world.

There is separation of ownership and control of the business.

The company is a legal person on its own which can sue or be sued on its

own rights.

The day to day activities of the firm is in the hands of the board of directors

of the business.

The board of directors of the business is elected by the shareholders at an

annual general meeting.

The company prepares the memorandum of association together with the

articles of association and submits them to the registrar of companies for

approval.

The registrar of companies then issues a certificate of incorporation.

a. PRIVATE LIMITED COMPANIES

Characteristics

Is formed between 2-20 members.

It is governed by the companies act.

Involves complex legal formalities required to set up the business.

Must be registered through the issue of certificate of incorporation by the

registrar of companies.

Name of the company ends with PVT LTD.

The business is a separate legal entity i.e.it exists as a legal person

independent of its owners.

It is owned by shareholders.

CONTROL AND MANAGEMENT

It is controlled and managed by the board of directors elected by shareholders

at an annual general meeting. The managing director is elected from the

board of directors

Directors report back to shareholders at least once per year by statements of

accounts and Directors reports. Ordinary shareholders vote at the annual

general meeting.

Annual accounts of the private company are not published to the public but

are filed with the registrar of companies for tax purposes.

There is strictness on the transfer of company shares. However the company

may or may not appoint an auditor.

Board of Directors

Managing Director

Production

Finance

manager

manager

Marketing

Human resources

manager

manager

Liability

All shareholders enjoy limited liability that is shareholders only lose their

capital they have invested in the business and not their personal property.

Raising of capital and sources of finance

This done through the following ways:

Selling of shares privately to invite individuals

Ploughing back profits from the business.

Obtaining loans and overdrafts from banks

Obtaining mortgage finance

Obtaining trade credits

Buying on higher purchase from finance houses

Leasing of assets

Debt factoring.

Advantages

There is enjoyment of limited liability

Can raise more capital compared to Sole traders and Partnerships

There is continuity of existence

Founder members can retain control of the company by holding a majority of

its shares.

Financial affairs are not published.

There is efficiency in operations.

Disadvantages

Too many legal formalities are required for set up of the business activity.

Shares cannot be traded on the Zimbabwean stock of exchange

Can be expensive to set up

There is a lot of inefficiency

Inefficient or not flexible.

PUBLIC LIMITED COMPANIES

Characteristics

Formation

Membership is open to the public; membership is by invitation through a

prospectus. It is formed by at least 2 people and no upper limit.

However governance is done as per the stipulation of the companies act.

Promoters of the company draft and submit to the registrar of companies the

prospectus , Articles of Association and Memorandum of Association.

The registrar of companies having approved the documents will issue a

certificate of incorporation.

After the company issue of shares the company is granted a certification of

incorperation.

Raising of capital

It is done through the selling of shares to the general public

Issuing of debentures to members of the public.

Loans overdrafts mortgage finance from banks

Hire purchase and ploughing back of profits.

Factoring /selling debts to finance houses.

Leasing of equipment

Buying of goods on credit for resale.

Control and Management

It is controlled or regulated by the board of directors elected at an Annual

General meeting. The board of directors decides on the company’s policy and

also chooses a Managing Director.

Managing Director is in charge of the day to day running of the business.

Joint Ventures

These occur when two businesses agree to work closely together on a particular

project and create a separate business division to do so.

This is not the same as merger, but can lead to mergers of businesses if their joint

interest coincide and if the Joint Venture is successful.

Reasons for Joint Ventures

Costs and risks of a new business are shared-this is a major consideration

when the cost of developing new products is rising rapidly.

Different companies may have different strengths and experiences and they

fit well together.

They might have their major markets in different countries and they could

exploit these with newly introduced products than if they decide to go it

alone.

Risks Involved

Styles of management and culture might be so different that the two teams

do not blend well together.

Errors and mistakes might lead to one blaming the other for mistakes

Business failure of one of the partners would put the whole project at risk.

Holding Companies

This is not a different legal form of business organization, but it is an

increasingly common way for businesses to be owned.

A holding company is one that owns and controls a number of separate

businesses, yet does not unite them into one unified company.

Diversified interests will be achieved

Businesses are independent of each other for major decisions or policy

changes.

Public Corporations

Are organizations owned by the central or local government

Have no profit objective

Are in the public sector

Advantages

they are managed with social objectives rather than solely with profit

objectives

loss making services might still be kept operating if the social benefit is great

enough

finance raised mainly from the government

Disadvantages

tendency towards inefficiency due to lack of strict profit targets

subsidies from government can also encourage inefficiencies.

Government may interfere in business decisions for political reasons, e.g.

opening a new branch in a certain area to gain popularity.

PRIVATISATION

Involves the selling of state owned and controlled business organizations to

investors in the private sector.

The main aspect of privatization is the transfer of ownership of nationalized

(state owned) industries into the private sector by creating private limited

companies

It also involves features like forcing schools, hospitals and local authorities to

‘contract out’ many services to private business.

It involves denationalization, deregulation and contracting out as the road

map to privatization.

Denationalisation

It involves selling government owned enterprises to the private sector. In Zimbabwe

this is done by selling shares to private individuals. This is done so that the business

can be run on a profit basis eg DMB, CMB Dairy Board in Zimbabwe.

Deregulation

This involves lifting restrictions that prevent private sector competition. It is the

removal of government regulations

Arguments for Privatization

profit motive of private sector businesses will lead to much greater efficiency

than when a business is supported and subsidized by the state.

decision making in state bodies can be slow and bureaucratic

it puts responsibility for success firmly in the hands of the managers and staff

who work in the organization. This leads to strong motivation as they have direct

involvement in the running of the organization and greater sense of

empowerment.

Market forces will be allowed to operate; failing businesses will be forced to

change or die and successful ones will expand, unconstrained by government

limits on growth.

There is always a temptation for governments to run state industry for political

reasons or as a means of influencing the national economy eg keeping electricity

prices artificially low, thus decisions may be taken for commercial reasons.

Sale of nationalized industries can raise finance for government which can be

spent on other state projects.

Regulatory bodies set up by government eg CCZ can be used to ensure free

competition and no consumer protection.

Private businesses will have access to the private capital markets and this will

lead to increased investment in these industries.

Arguments against Privatisation

The state should take decisions about essential industries e.g. based on the

need of the society and not just on the interest of shareholders. This may

involve keeping open business activities that private companies would

consider unprofitable.

With competing privately run businesses it will be much more difficult to

achieve a coherent and coordinated policy for the benefit of the nation at

large e.g. railway systems, electricity grid and bus services.

Through state ownership an industry can be made accountable to the

country i.e. by means of a responsible minister and direct accountability to

parliament.

Many strategic industries could be operated as ‘private monopolies’ if

privatized and could exploit consumers with high prices.

Breaking up nationalized industries, perhaps into several competing units, will

reduce the opportunities for cost saving through economies of scale.

Qn Evaluate the reasons why government should privatise business

organizations [25]

BUSINESS ACTIVITY AND ECONOMIC STRUCTURE

INTRODUCTION

The nature and level of development in an economy depends on the type of

economic system. The growing power and influence of multinational

cooperation’s is having a significant impact on all economic systems apart from

centrally planned economies.

Economic problem

An economy is faced with the problem of scarcity of resources; an economy

will make a choice of what to produce in an attempt to tackle the economic

problem.

Economic Systems

Are a way of tackling economic problems

A system is a complex whole made from a set of connecting parts. A system

processes inputs e.g. labour to produce outputs. All societies must produce a

system for dealing with three interrelated problems i.e. what should be

produced? How it will be produced? For whom will it be produced?

Market Economies (Free Market Economy) practised in USA, Taiwan

Features of free market economy

There is private ownership of all economic resources.

Resources are allocated towards making products consumers wish to buy

Market information is obtained from price levels and price changes

Firms operate in order to make profit

Free entrance and free exit of players in the economy(no barriers to entry)

Consumers decide for a certain pattern of output and the way in which they

distribute their spending, therefore resources are allocated towards those

products that consumers wish to buy.

Forces of demand and supply determine the quantity demanded and quality

supplied.

The role of the government in such economies is very restricted to the extent

of only providing defense and police forces.

Advantages

Products reflect what the consumers want.

The system is flexible, in the way it can respond to supply and demand.

Individuals have greater freedom to make their own demand and supply

decisions.

There is competition which leads to efficiency therefore there are low prices

and high quality products.

Disadvantages

Negative externalities are over produced. e.g. pollution.

It does not guarantee everyone to get what they want as only those who can

afford are able to buy, leaving the sick, the poor and the elderly vulnerable.

It leads to great inequalities.

Some goods for the community might not be produced at all e.g. education.

Successful businesses might takeover small business and control major shares

of the market. This reduces competition and monopolies might crop up

leading to the charging of exorbitant prices not to the reach of many.

NB -The role of the government in such countries is very restricted. It is usually

limited to providing defense forces, internal police and justice systems, controlling

the money supply to prevent serious inflation and taking measures to limit extreme

monopoly power of businesses.

Mixed Economies

Characteristics

This system involves some private business activity driven by profit motive and some

state owned and controlled organisations often operating for non-profit reasons.

Features of Mixed Economies

Many products and services are provided by private business not state.

Most essential (public goods) e.g. police, defense and social services are only

provided by state and the private sector e.g. schools, health and broadcasting

Tax is paid to the government in order to finance state operated services.

The government sets penalties’ to control negative externalities and reducing

/restricting monopoly powers of some firms.

Centrally Planned Economies

Are associated with communist political systems.

Features of Planned Economies

There is state ownership and or control of most of the economic resources

Central state decides what should be produced and the production methods

to be adopted

No consumer sovereignty since consumers have little influence over what is

produced

Use of prices to indicate a consumer preference is unimportant.

EVALUATION OF ECONOMIC SYSTEMS

Understanding the advantages and disadvantages of the different economic

systems will help provide the foundation for grasping the reasons behind

government action and how to respond to it.

Economic system

a)Free market system

Private property

Profit motive

Price system

b)Planned system

State

ownership

and

control

of

resources

and

means

of

production

Very little private

sector

business

activity

Mixed Economies

Private

sector

business

is

encouraged

State

controls

resources

and

supply of goods and

services

Taxes

used

to

collect revenue

Advantages

Profit motive makes

firms

operate

efficiently

Competition helps to

keep prices low and

lead to release of new

products

Consumers

have

choice

Work is encouraged

as taxes are very low

and there is no state

support

for

non

workers

Prevents duplication

and

wasteful

competition

eg

supplies

of

bus

services

Production decisions

are based on states

assessment

of

people’s needs not

consumer

spending

patterns

Allows

long-term

planning not short

term profits

State

provides

essential services for

the society (rich or

poor)

Competition improves

efficiency

Consumer

choice

exists

and

work

incentives

Inefficient

business

behavior is controlled

Disadvantages

Monopolies erupt as

owners see the gains to

be made from reducing

competition.

No state support for the

elderly unemployed

No government control

on pollution

Income differences are

not reduced by taxes

No consumer choice

No

competition

to

improve product design

and keep costs and

prices low

Workers

are

poorly

motivated since there

are no gains from

working harder

Very

slow

and

bureaucratic

decision

making

Taxes may be heavy to

pay for sales of goods

and

services(reduces

incentives to work hard)

State organisations are

less efficient than private

firms

Excessive control might

discourage business

INTERNATIONAL TRADING

All countries, engage in international trade with other countries. This is true no

matter which economic system is in place

Benefits of trading

Consumers are offered wider choice of goods and services by buying products

from other nations

Additional competition is created for domestic industries as this encouraged

them to keep costs low and prices down and make their goods well designed

and as of high quality as possible

Countries specialize in those products they are best at making and import

those they are less efficient from other countries (comparative advantage)

Countries may build good political ties and links and these help resolve

differences amongst themselves

Drawbacks of international trade

Loss of output and jobs from those domestic firms that cannot compete

effectively with imported goods

Decline in domestic industries might be witnessed especially when they

produce strategic goods

Newly established businesses may find it impossible to survive against

competition from existing importers

Dumping of goods might be witnessed

Loss of foreign exchange (imports>exports)

Free Trade and Globalisation

Free trade means that no restrictions or trade barriers exists which might

prevent or limit trade between countries

Common forms of trade Barriers

i. Tarriffs – taxes imposed on imported goods to make them more expensive than

they would otherwise be.

ii. Quotas – limits on the physical quantity or value of certain goods that may be

imported.

iii. Embargoes – a complete barn of imported goods into the country.

MULTINATIONAL BUSINESS ORGANISATIONS

These are business organisations that have their headquarters in one country but

operating branches in other countries.

Why become a multinational

Nearness to markets

Lower costs of production use of cheap local labour.

Avoid import restrictions.

Access to local resources

Benefits of Multinational Cooperation’s

More foreign currency is generated

Leads to creation of employment thereby reducing the unemployment pool.

Tax revenues for the government will be boosted

More expertise will be imported on the locals

Total national output (GDP) is raised

Standards of living are improved.

Drawbacks of multinational businesses

Exploitation of local workforce since there will be absence of strict labour

,health and safety rules

Pollution might affect local people(Negative Externalities)

Local competition might be squeezed due to inferior equipment than those

provided by multinationals.

Leads to reduction of cultural identity

Repatriation of profits

Extensive depletion of local natural resources

How government assists or constrain business activities

Business has a great beneficial impact for society by producing goods and

services providing employment and paying taxes.

If businesses are not controlled serious problems for society could occur thus

the government want to encourage the positive impact of businesses but to

reduce to the minimum the negative impact

Government assistance for business

Training programmes-organized through local colleges or supported through

government subsidies. Well trained workforce increases productivity and

profitability of business.

Development area grants- government provide assistance to firms operating

in rural areas and growth points also allowing tax exemptions

Support for exporters- selling of goods abroad is risky because of lack of

information about a market and chances of non-payment from customers.

Government support involves advice services based on information from

embassies

Forms of government intervention

Consumer

Protection

Monopolies

Government Control

of Business Activities

Unfair

competition

Location of

industry

Environmental

Protection

Employee

protection

Evaluation on government control

Not all businesses will behave in socially undesirable ways even if there were no

government controls. Some managers and business owners have such high ethical

and moral standards that even without government restrictions would treat staff well

but some firms will not.

This requires intervention by the government in the form of legal controls.

Arguments against government intervention

Government controls add to business costs e.g. increasing wage rates to the

legal minimum level, purchase of pollution control equipment and health and

safety facilities at workplace

Administrative burden is imposed by government which will be characterised

by ‘red tape’ which acts as a disincentive to firms

Other countries with no government control may gain unfair competitive

advantage

ESSAYS

1. A) Examine the ways in which the government in your country

i) Controls business activities

ii) Assist business activities [10]

b) Discuss whether business activity should be more firmly controlled by

government [15]

2.To what extent should the government of your country positively encourage

multinational business to establish in your country? [25]

FORMAL AND INFORMAL BUSINESS ORGANISATIONS

Formal organisational structure

It is defined as the network of official communication channels in the enterprise and

can be shown on an organizational chart.

They are social units deliberately created by some members of the community in any

society for specific purposes

Social Units- dealing with people.

Deliberately created- formed for a specific purpose

Informal organization structure

They usually spring spontaneously from formal groups as employees interact at tea

break, lunch and going home. They constitute social relationships that develop as

people interact with one another. Such relationships cannot be presented on an

organizational chart although management may officially recognize them.

Features of formal Structures

Have a well defined structure with clear lines of authority.

Well defined lines of communication

Objectives clearly stated

Tangible pay remuneration and benefits are known.

Durable and well planned life span

Relatively flexible due to order

Convenient and can be shown on an organizational chart.

Characteristics of formal organizations

They are social units- mainly composed of people as actors

They have origins-they are born, they grow and they die, they have historical

context.

Almost all organizations have written rules, regulations and procedures.

They have structures- the structure gives hierarchy of authority.

All organizations have positions and position holders- these are full time paid

officials.

All organizations have specific leaders at various levels.

They operate as social systems- they depend on operations of each other.

There is a separation between work and private life.

There are formal relations-social capacities.

Ownership is normally not in the hands of the workers.

Features of Informal Organizations

Undefined structure with no clear power,

responsibility and reporting relationships.

Undefined and ever changing for example grapevines

Objective are ambiguous and ever changing

No financial benefit benefits usually social and emotional

Non durable and unplanned life span.

Flexible and ever changing

Since they are ever changing they are difficult to be expressed on a graphical

structure.

authority,

accountability,

Advantages of Informal Organizations

Help members to communicate.

Develop secondary channel of communication opposed to the first one used

by management

Managers may use the channel to transform information secretly

Informal groups perpetrate commonly held social and cultural values as

members are likely to share common norms and values.

They provide social satisfaction, status and security as employees are given

opportunity to share jokes, eat and socialize after work this gives them a

sense of fulfillment which reduces labour turnover and absenteeism

There is a sense of security by the members in the group.

They help members solve personal problems

A business can benefit when lazy and careless employees are told what do by

fellow workers.

BUSINESS SIZE AND BUSINESS GROWTH

Businesses vary in size from sole traders to established multinationals.

Information on business size is of importance to both investors and the

government.

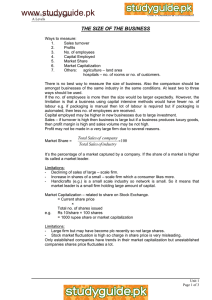

Measuring the size of business

There are several different ways of measuring and comparing the size of

business, however a firm might appear large by one measure but quite small

by another.

a) Number of employees

A firm that employs many staff is likely to be large and one that employs few

staff is likely to be small.

Problems crops up when a large firm employs few people because of highly

automated machines that will be in use.

b) Sales Turnover

Is also often used as a measure of size in business structure especially when

comparing firms in the same industry.

It is less effective when comparing firms in different industries since some

might be engaged in high value production and the other in low value

production e.g. jewel production and cleaning services.

c) Capital employed

This measure the total value of all long term finance used in the business.

Generally the larger the business the greater the value of capital needed for

long term investments.

Misleading results are seen when two firms employ the same number of staff

but having different capital equipment needs e.g. Hairdresser and optician

(needs diagnostic and sophisticated) machines.

d) Market capitalisation

Is applicable to businesses ‘quoted’ on the stock of exchange (public co.)

Market capitalization = current share price x total number of shares issued. Share

prices tend

As share prices tend to change everyday, this form of comparison is not a very

stable one eg. A temporary but sharp drop in the share price of a company could

appear to make it much smaller than this measure would normally suggest.

e) Market share

It is equal to: Total sales of business/Total sales of industry x 100

This is a relative measure, If a firm has a high market share it must be among

the leaders in the industry and comparatively large. However when the size of

the total market is small, a high market share will not indicate a very large

firm.

Which form of measurement is best?

There is no best measure. The one used depends on what needs to be

established about the firms being compared.

This could depend on whether we are interested in absolute size or

comparative size within one industry.

Significance of small Businesses

There is no one universally accepted or agreed definition of small firms, it will

therefore be easy to identify them within your own economy

Small firms are important to all economies since they can attribute to the

following:

Many jobs are created by small firms even though they do not employ

many staff, collectively the small business sector employs a very

significant proportion of the working population in most countries.

Most small businesses are often run by dynamic entrepreneurs with

new ideas for consumer goods and services. This helps to create a

variety in the market and improved consumer choice of goods.

Competition is brought about by small firms and without competition,

larger firms could exploit consumers with high prices and poor

service.eg cost of air travel has been reduced in recent years due to

the establishment of small airlines companies.

All great businesses were small at one time. Small firms are

encouraged to become established and expand, the greater the

chances that an economy will benefit from big scale organisations in

the future.

Small firms may enjoy lower average costs than larger ones and this

benefit could be passed on to the consumer too. Costs could be lower

because wage rates paid to staff may not approach the salaries paid in

large organisations.

Government assistance for small businesses

Reduced rate of profits tax (corporation tax) – this will allow a small company

the chance to retain more profits in the business for expansion.

Loan guarantee schemes – are government funded schemes which

guarantees the repayment of a certain percentage of a bank loan should the

business fail. This makes banks more likely to lend to newly formed

businesses

Providing information, advice and management support through government

departments and agencies.

In economically deprived areas such as cities with high unemployment, the

government finances the establishment of small workshops which are rented

to small firms at reasonable rents.

Problems faced by Small Firms

Lack of specialist management expertise – often the owner has to undertake

all management functions such as marketing, operations management,

keeping accounts and dealing with staff matters- because the business

cannot afford to employ specialist in each of these areas.

Problems in raising both short term and long term finances – Small firms

have little security to offer banks in exchange for loans and this makes

obtaining finance more difficult than for most larger firms. In addition,

suppliers may be reluctant to sell goods on credit if the business has been

operating for a short time.

Marketing risks from a limited product range – Many small firms produce

just one type of a good or service

Difficulty in securing suitable and reasonably priced premises. The best

location tends to be expensive and often only affordable by large firms.

Business Growth

Chapter 2

HUMAN RESOURCES MANAGEMENT

Introduction

Human Resources Management is the strategic approach to the effective

management of organisations workers so that they help the business gain a

competitive advantage.

It aims to recruit capable, flexible and committed people, managing and

rewarding their performance and developing their skills to the benefit of the

organisation.

The main human resources task is to recruit, train and utilize the

organizations personnel in the most productive manner in order to achieve

company’s objectives. It mainly focuses on the following:

Planning workforce needs of the business

Recruiting and selecting appropriate staff

Appraising training and development of staff at all levels of the organization

Developing appropriate pay systems for different groups of people

Measuring and monitoring performance

Involving all managers and their departmental staff

Establishing appropriate payment systems

Role of Personnel Officer

Maintaining employee records up to date.

Processing salaries of workers

Attending disciplinary hearing

Carrying out salary surveys

Preparing job descriptions for various employees

Recruitment and selection of employees

Designing, implementing and evaluating training

Importance of Personnel Management

Analyzing jobs to gather information that can be used in selection

Training and development of employee skills

Recruiting and selecting skilled employees

Administering systematic and fair programs for compensation

Interacting with employees unions

Designing and administering employee benefits such as retirement and

insurance programs

Planning for organizational needs for various employees

Improving motivation of the work force.

Differences between Personnel Management

Personnel Management

-Quantitative in nature

-Grievances of employees are

solved through workers committees

-view workers as liabilities

-Advisory and administrative

-not central to the organization

-mediating role between managers and

workforce

-there are specialists

-emphasizes on written rules and

procedures

-collective bargaining and negotiations

-employees must be monitored

-controlled access to training

Human Resources management

-Qualitative in nature

-grievances are solved through trade

unions

-Views workers as valued assets

-It is strategic

-seen as essential

-a central management role

-all managers are HR managers

-stress on flexibility

-consultation and participation

-they must be nurtured

-the learning organization

Human Resources Management can be divided into two broad categories namely:

1. Management of entry which focuses on Human resources planning, Job

analysis, recruitment and selection

2. Management of stay which focuses on orientation, induction, training and

development, promotions, transfers, compensation, performance appraisals

and redundancy planning.

Human Resources or Manpower Planning

The Human Resources Management must determine the organizational need and the

number of employees needed or required. The number of employees required in the

future will depend on

Future demand of the product

Objectives of the firm

If the firm plans to expand then more employees would be required for the

expansion of the business. The firm that requires increase in service

satisfaction, short term profits will increase workers. Therefore the number of

staff required in future depends on:

Productivity levels of staff

Predicted labour turnover rate and absenteeism rate-the higher the rate the

greater will be the need to recruit replacement staff to insure adequate

number of employees available.

Changes in laws regarding workers rights-the government might set up a

minimum wage which is high thus causing firms to employ fewer workers and

substitute them with machines were possible.

Skills of staff available-this depends on complexity of machinery

Production methods used and the need for flexible, multi skilled staff thus

most firms need to recruit, train staff with more than one skill.

Why organizations undertake HR planning

To be able to attract and retain staff in sufficient number with appropriate

skills, to be able to ensure that employees receive all the training

development necessary for effective performance in the their current role and

develop the flexibility to be able undertake other roles as the need arises.

To anticipate and meet changes in the demand for its services or in the

labour supply

To be able to meet future HR requirements/ events from its own internal

resources such as resignations and death of employees.

Ensures that equal opportunities for promotion and development are availed

to staff.

To keep control of human resources costs and effectively anticipate the

staffing costs of new initiatives.

For succession planning

However

Resources are needed in carrying out HR planning that is material, financial

and human resources. Therefore it is costly to the organization.

Finance department might not avail funds in accordance with HR plans.

Some workers can absent or leave themselves unexpectedly

HR plans might be too rigid

The plans might be based on wrong forecasts.

Production time is lost trying to gather the information

HR planning follows a systematic model which comprises three elements

i.

ii.

iii.

Forecasting

Supply analysis

Balancing supply and demand considerations

Forecasting

Is the activity of predicting/estimating in advance the number of and type of

personnel needed to meet organizational objectives?

The requirements should be both in quantitative and qualitative terms e.g.

there can be an increase in the number of employees but a decrease in a

particular type of skills or grade. It uses 2 approaches that is

1. Quantitative approach- which involves statistical or mathematical techniques

like trend analysis to predict HR needs.

2. Qualitative approach- which aims to reconcile the interests, abilities and

aspirations with the current and future staffing needs of the organization.

The skills of staff required are dependent on:

1. Pace of technological change in the industry eg production methods and

complexity of machinery used. This left traditional typists being rarely

required but computer or photocopier operators.

2. Need for flexible and multi skilled staff as the business tries to avoid

excessive specialization. Most businesses therefore need to recruit staff or

train them with more than one skill that can be applied in a variety of

different ways. The firm will be more adaptable to changing market

conditions.

Supply Analysis

Involves determining whether there are sufficient numbers and type of

employees available to staff and the anticipated job vacancies.

It involves looking internally or from external sources

Full time and Part time employees

Some firms employ staff on a temporary basis and also outsourcing from

other firms or self employ people.

Part time contracts

Advantages

Staff required to work during busy periods and slack times this reduces

overhead costs.

Staff can be assessed before they are given full time employment

More staff available to be called upon should there be sickness or some sort

of absenteeism.

Disadvantages

Low motivation since part time employees feel less involved

It would be difficult to establish i.e. teaching them to start

Effective communication would be more difficult i.e. meeting with all staff

since the firm will be forced to use written communication.

The company may lose valuable workers to other firms.

Recruitment and Selection

This function ensures that company’s objectives are met and new ideas are

brought into the organization through appointing the appropriate,

experienced and qualified personnel.

Recruitment is the process of identifying the need for a new employee,

defining the job to be filled and the type of person needed to fill it, attracting

suitable candidates for the job to be filled and selecting the best

It can be defined as a process of locating and encouraging potential

employees to apply for existing job vacancies.

Selection is the process of determining the most suitable candidate for the job

among which would have been attracted through the recruitment exercises.

Steps in the Recruitment Process

Establish the precise nature of the vacancy

Draw up a job description which includes the following

Job title

Details of task

Responsibility involved

Place in the hierarchical structure

Working conditions

How the job will be assessed and performance measured.

NB The job description should attract the right type of people.

Job Specification

It is a profile for the ideal candidate and covers the knowledge, experience physical

characteristics, age and personality of the candidate and qualification.

Steps in the Recruitment Process

1. Defining requirements –establish the exact nature of the job vacancy, Ask if

there is a vacancy since recruitment involves filling up the gap in an

organization. The organization must look at the job analysis and job description

as well as person’s specification. This helps to understand the requirements of

the job and skills of the vacancy.

2. Attracting candidates- This is the process of identifying, evaluating and using

the most appropriate sources of applicants and sources of recruitment.

Vacancies can either be filled through internal or external recruitment

3. Selecting candidates

Advantages of Internal Recruitment

Applicants are already aware of the organizational structure.

Those selecting the candidates already know the applicants strengths and

weaknesses.

Faster than external recruitment

Saves on costs as it is cheaper than external advertising.

Applicant is familiarized with the norm ethic and values of the organization.

It give internal staff hope of carreer and chances of progressing and thereby

motivating staff.

It boost morale of employees

Disadvantages

Expensive to train staff

No new ideas or practices are brought into the organization.ie There is

stagnation (no new thinking) by ignoring new initiatives.

They may be some resentment from those who do not get the job.

Number of applicant will be lower than if it was externally advertised.

Because the applicant will be known by the selectors it can result in a less

qualified person being recruited.

It demoralizes those that are not promoted.

There is infighting for promotion, tension and enemity.

May encourage complacency because if new entrants are not invited,

employees may assume that there is automatic promotion.

Advantages of External Recruitment

New ideas are brought into the business

Cheaper than to train existing staff.

No resentments from internal staff.

Qualified and experienced staff is recruited from the pool of applicants.

Disadvantages

The organization can recruit a misfit.

There is possibility of that person demoralizing those in the organization.

It takes longer to adjust since there will be a longer orientation time to fully

equip the applicant.

There is danger that new recruitment may bring in attitude ie this is not the

way things used to be done.

Its slower than internal recruitment

It is expensive

When Human resources policy is of external recruitment internal workers who

qualify would be demotivated.

SELECTION

It involves the picking of candidates from a group of applicants. The selection

method used within the company is important as it should not be relatively

expensive compared to the importance of the job.

It should be non discriminatory in terms of ability, personality intelligent, race

and other factors.

Labour Management Relations

In a business there are likely to be conflicts between employees and the

employer due to conflicting opinion and interests for example the owner of a

business simply want to make profits whilst keeping wages bill low as possible

but workers demanding pay rises.

To this effect the owner might also want to change location of his business

but workers view this move negatively as the might fear job losses

Broad Categories to Labour Management Relations

1. Autocratic Management style-management has a take or leave attitude to

workers. Workers might be employed for very short term contracts even on a

daily basis offering no security. However if workers objects to the conditions

of work the attitude of management is seek and replace him with another.

This is common in countries with no labour protection, legislation and where

there is high unemployment rate.

2. Collective Bargaining-this is when representatives of unions and not

employers negotiate wage levels and working conditions for the whole

industry. This collective bargaining make it leader powerful because they can

call for a national strike and members obey. Collective bargaining can be

defined as the process whereby procedures are jointly agreed and wages and

conditions of employment are settled by negotiations between employer and

associations for worker organizations.

Rationale Argument for Collective Bargaining

Individual workers are in a weak position and unable to negotiate on basis of

equality. The collective bargaining deals with procedural agreements and

substantive issues can be negotiated procedural; agreements are open ended

subject to a period of notice

Coordination between labour and Management

Recent management thinking has not sought to oppose workers suggestions

and those of their union leader but to actively involve them in important

decision making and operational issues.

It means the following will not happen-less confrontation, few strikes and

harmony is improved.

Trade Unions

Are defined as all organizations of employees which include among the

functions of negotiating with employees with the object of regulating

conditions of employment and pay.

Trade Unions act as a channel of communication between employees and

employers. They also provide assistance to individual members for example a

worker with grievances pertaining disciplinary matters.

Motivation

Of special note is Abraham Maslow’s Hierarchy of needs, Herzberg’s Two Factor

Theory and Vroom’s Expectancy Theory

2.4.1 Maslow’s Hierarchy of needs

The hierarchy is usually shown ranging through five levels. The diagram below

shows

Maslow’s

Hierarchy of need

SelfActualisation

Esteem

Love

Safety

Physiological needs

According to Abraham Maslow,s Hierarchy of needs theory, employees are motivated

by a variety of driving forces at any given time and these forces can be categorized

based on Physiological needs, safety, belonging, esteem and self acqualisation.

Maslow propounded that employees must first meet their basic physiological needs

such as food and shelter. Once all basic physiological needs are met safety concerns

become the next most important set of motivational forces. This means that when

basic needs are provided through work then employees will become aware of their

work environment. Rural schools, therefore, should provide teachers with

accommodation as shelter is a physiological need essential in life. If shelter is

provided, teachers may be retained in rural schools.

Once employees feel safe within their work site other factors such as belonging to

the group become motivational consideration. Esteem is the next threshold that has

to be met for an individual to reach fulfillment. The final level of motivation is called

self actualisation, which is when an individual reaches his or her full potential, at this

level, employees are completely motivated to do their best, as all of the

psychological and physical needs are met (Maslow, 1943).

Additionally, employees retort constructively to recognition for job performance. In

this way employees feel that the work they are doing is recognised by the

organisation that they work for. If the service that they are providing an organisation

is beneficial then the employee can feel connected to the overall operations of the

organisation. Conversely employees will not strive towards productivity in their work

environment if they feel that the organisation only responds to negative aspects of

their job performance. In this regard, contribution made by rural teachers should be

recognized by the Ministry of Education, Sport, Arts and Culture. Recognition of rural

teachers’ contribution can be in the form of awards/prizes for long serving rural

teachers. This may help in retaining teachers to rural schools.

The relationship developed between direct care staff and supervisory staff can

either increase or reduce employee morale. Therefore, there is need to create good

relations between heads and teachers serving in rural schools this may help teachers

to feel a sense of belonging to their organization and they will be motivated and may

be retained in rural schools. The more connected a person feels to the work they are

doing the closer they become to self-actualization and fulfillment. Belonging to an

organisation and feeling a connection to the service provided are chief

characteristics of motivation in organisations and this assists in employee retention.

2.4.2 Herzberg’s Two Factor Theory

According to Shultz (2006), Fredrick Herzeberg was interested in the factors that

made employees feel good about their jobs. The factors that need to be in place if

employees are to feel dissatisfaction but do not lead to job satisfaction are called

hygiene factors. The factors that lead to job satisfaction and motivate employees are

called motivators. Hygiene factors are external (extrinsic) to the employee, such as

the quality of supervision, pay, company policies and working conditions. Motivators

are internal to the employee (intrinsic) and include factors such as responsibility,

achievement and opportunities for growth. Most employees would be dissatisfied in

jobs lacking hygiene factors and if hygiene factors are addressed, most employees

would be satisfied and productive if motivators are present (Shultz 2006). Thus

some qualified teachers see opportunities for carrier development in rural areas in

terms of chances for promotion and they are attracted to rural areas and are

retained there.

2.4.3 Vroom’s Expectancy Theory

Employee expectations of the organization play a key role in motivating employees.

Victor Vroom’s theory of employee motivation is referred to as expectancy theory.

Vroom argues that individuals make conscious decisions to maximize pleasure and

minimise pain in every aspect of their lives. Therefore, working conditions in rural

areas should be such that they maximise pleasure and minimise pain to the rural

teachers in order to retain them in rural schools. Issues such as poor

accommodation and transport problems should be addressed so that working

conditions for rural teachers become presurable. He further states that the way an

individual responds to work is unique to a given individual and for that reason,

motivation is much more complex than earlier theories indicate.

Vroom states that an individual’s performance is linked to many factors, such as

skills and experience, as well as their personality and desire to accomplish

organisational objectives. Teachers may be attracted and retained to rural schools

due their personality. Some individuals have the desire to impart knowledge and

contribute to nation building not withstanding the environment they operate in. The

tenants of Vroom’s theory are that people perform better if there is a desirable

outcome or reward. Borkowsky (2005) is of the opinion that the reward must be

something that is not only desirable but also something that will make the effort

exerted worthwhile. Rural teachers, therefore need to be given worthwhile rewards

for their work and effort of enduring hardships such as traveling long distances in

uncomfortable roads and at times on foot in order to provide education to rural

communities. Worthwhile rewards may assist as a retention strategy for rural

teachers.

The organisation must first understand what will motivate their staff because what

works for one individual may not be the reward that is desirable to another

individual. The organisation must understand many aspects of individual employee

personalities in order to see what types of benefits will motivate their work force and

this helps in retaining them in the organisation. For example, some individuals may

be motivated by recognition from their supervisors while others are motivated

primarily by bonuses or benefits. In the Ministry of Education, Sport, Arts and

Culture teachers may seek to transfers from rural schools due to lack of monetary

benefits. For example, teachers in urban areas get meaningful monetary benefits in

terms of incentives.

Expectancy theory further posits that employees have a multiplicity of expectations

and that management needs to certify that employees feel confident in the jobs they

are performing. Employees presume that management will provide them with

information regarding their job and will train them amply so that they can perform

their role within an organisation. Rural teachers similarly expect to be compensated

for the job they are performing under difficult conditions. Qualified teachers,

therefore, are attracted to rural schools that pay better incentives and these are

normally urban and boarding schools. Essentially, for the Ministry of Education,

Sport, Arts and Culture to get best results from rural teachers, the Ministry must first

understand what their expectations are and ensure these expectations are met.

Expectance Theory proposes that a person will resolve to behave or act in a certain

way because they are motivated to select a specific conduct over other behaviours

due to what they expect the result of that selected behaviour will be (Stone and

Henry 1998).Locke (1975) criticizes the expectance theory by arguing that

expectance theory is little more than an attempt at understanding human behaviour

by assuming that all actions are hedonistic. Locke (1975) further explains that if all

actions were strictly made on the basis of what outcome would provide the most

amount of pleasure, then all employees would be happy in their jobs as they chose

them based on the pleasure that they would receive from the position. Locke (1975)

argues that hedonism is not the only basis for decision making and motivation based

simply on pleasurably expected outcomes is a very limiting observation of human

nature. However, there are teachers who may remain in rural areas simply because

they were deployed there and not because of benefits they get there.

Locke further refutes expectancy theory by noting that not all decisions are made

consciously. In other words, individuals are sometimes impulsive and make choices

based on emotions, not their values or beliefs about pleasure or pain that they will

receive from their actions. For example, if an employee does something against an

organisation policy based upon their anger toward a co-worker, the given act may

not have been thoroughly thought through and would result in punitive action rather

than the pleasure they may have thought that they would receive from their

behaviour (Locke 1975). Increasing instrumentality in an organisation will be part of

maintaining effective reward systems for the attainment of specific goals. Therefore,

the reward system for rural teachers should include rural hardship allowances as a

retention strategy.

2.5 Other Employee retention strategies

2.5.1 Money/pay/incentives/ and rewards

According to Swanepoel (2001) money and incentives reduce turnover, promote

team work increases productivity, organisational morale, efficiency and objective

achievement. He also states that, to encourage valuable staff to remain, the

remuneration system must provide ample rewards for those employees to feel

satisfied when they compare their rewards with those received by individuals

performing identical jobs in other organisations. The assertion is buttressed by

Davies (2003) who approves that part of the strategy of pay decision is determining

on the level of pay relative to the market, to attract, retain and motivate suitable

employees. In the Ministry of Education, Sport, Arts and Culture, urban teachers

generally get better monetary rewards in terms of teacher incentives that are paid

from 10% of the total levies collected. On the contrary most rural schools are unable

to pay any incentives due to failure by parents to pay fees for the children. Poor

incentives lead to rural teachers seeking transfers to urban schools with the capacity

to pay fees which will in turn enable them to pay teachers incentives thus the overall

package in urban areas is attractive. Mullins 2005 is of the opinion that pay

continues to be central in determining motivation to perform thus pay is a retention

tool.

Schultz (2006) theorises that in order to motivate workers, organisations must

ensure that they pay close attention to the individual development needs of the

person. Money is equally significant as a motivator. Mullins (2005) has the same

opinion when he articulates, that for infinite majority of people, money is clearly

important and a motivator but the extent and how important money is, depends

upon their personal circumstances and other job satisfactions they drive from work.

Teachers in rural areas need to be well compensated for the challenges they face.

However, their individual needs also need to be taken into consideration for

compensation to be complete so as to elicit desired performance. For example one’s

desire to further studies, desire for promotion and access to health facilities should

be enshrined in the entire package because money may not be a motivator for other

people, if this is done teachers will be motivated and they are retained in rural

schools. Horwtz (2004) is of the opinion that seeking to use money as the main

means of motivating and retaining staff is a waste of time. This is also echoed by

Booth and Hammer (2007) who say money as a motivator is short lived once it is

spent or living expenses swell to meet the raise, the reward and its motivational

values become history. Schultz (2006), Davies (2003), Taylor (2002) and Mullins

(2005) totally agree with Swanepoel (2001) in that money is seen as a sense of

accomplishment and recognition hence it can be used for the motivation of

employees.

2.5.2 Job satisfaction

Job satisfaction is a collective of attitudes of an employee to a number of aspects

related to his other job, which include work itself, workplace relationships, rewards

and incentives (Swanepoel 2001). He further state that by compensating employees

objectively,

providing

bonuses

for

high

performers,

providing

promotion

opportunities, communicating regularly, linking pay to performance and providing

opportunities for work, employees will remain in an organisation for long. This is

supported by Jubernkanda (2004) who states that job satisfaction results when a job

fulfils or helps to attain an individual’s values, expectations and standards and one

likes to stay. In order to retain teachers in rural areas, it is imperative for the

Ministry of Education, Sport, Arts and Culture to ensure that all aspects of job

satisfaction for rural teachers are addressed. These aspects include a facet of issues

such as conducive school infrastructure in terms of buildings, teachers’ houses,

sanitation, teaching and learning resources among other issues. The working

conditions and environment in rural schools can lead to job satisfaction which will in

turn lead to retention of teachers in rural schools. Evans (2001) concurs when he

looks at job satisfaction as a state of mind encompassing all those feelings

determined by the extent to which the individual perceives his or her related job

needs to be met. Pilbeam and Corbridge (2002) are further more in agreement when

they say job dissatisfaction creates a work force that is more likely to exhibit higher

turnover, higher absenteeism, lower corporate citizenship, more grievance, strike,

sabotage, and vandalism.

According to Mullins (2005), job satisfaction is the internal state and can be

associated with personal feeling of achievement either quantitative or qualitative.

Mullins (2005) further posits that job satisfaction is affected by such valuables like

individual factors, social factors, environmental factors, organisational factors and

cultural factors. Individual factors include education, age and abilities, social factors

embrace size of organisation and nature and finally cultural factors include beliefs

and values. These factors are bound to have diverse levels of job satisfaction for

different people. The Ministry of Education, Sport, Arts and Culture, should conduct

a scan of factors of job satisfaction for rural teachers in order to ensure job

satisfaction and retention of rural teachers.

Job dissatisfaction does not help in the motivation of workforce. Pilbeam and

Corbridge (2002) say job dissatisfaction creates a workforce that is more likely to

exhibit higher absenteeism, lower corporate citizenship, more grievance, strike,

sabotage and vandalism. Employee dissatisfaction amongst rural teachers is a

product of poor compensation, poor working conditions and poor benefits. These

poor working conditions in rural schools may force rural teachers to seek transfers to

urban areas. Employee satisfaction can be brought about by providing employees

with recognition, advancement, personal growth, feedback support and leadership,

this is crucial in employee retention.

2.5.3 Empowerment

Empowerment supplies people with power, strength and energy to tackle changes.

Swanepoel (2001) states that empowerment provides employees with a sense of

autonomy, which increase job satisfaction and employees make decision that benefit

the organisation. He also postulates that they need to be supported, respected, and

listened to. Odums (2007) agrees with Swanepoel (2001) when he defines

empowerment as sharing varying degree of power with lower level employees to

better produce good results. Schultz (2006) compliments on to say empowerment is

the sharing of influence and control with employees. Good leadership should allow

employees to share developing goals and strategies and the satisfaction derived

from reaching these goals. As a way of motivating retaining teachers in rural

schools, the Ministry of Education, Sport, Arts and Culture should involve rural

teachers in decision making and strategic planning. This could be done through

consulting rural teachers on policy issues pertaining to rural schools. Schultz (2006)

further agrees with Swanepoel (2001) by saying, people in contemporary

organisations want to have greater say in the workplace, henceforth feel secured.

Rural teachers should also be given the opportunity to have a say in the way rural

schools are managed.

Empowerment also entails flexibility on the part of the employer. Taylor (2002) is of

the opinion that an organisation wanting to retain their employees must be governed

by principles of flexibility, autonomy and variety of responsiveness. Taylor (2002)

further states that flexibility should apply to hours of work, recruitment and selection

and effective supervision. Flexibility on working hours of rural teachers especially on

Fridays to enable them to travel if they would like to do their business in urban

centers may be a good retention strategy for rural teachers considering transport

problems they encounter and the distances they travel to nearby towns.

Professional supervision is critical when it comes to empowerment of rural teachers.

Taylor (2002) says unscrupulous supervisors are those who abuse their positions,

who show undue favouritism to some staff, who fail to appreciate their subordinates

and those who fail to deliver their promise. It is important for education inspectors

and school heads to be professional when supervising rural teachers as this may

assist in rural teacher retention. Rural teachers also need to be treated with respect

and be guided professionally during the supervision process. If conceivable the

Ministry of Education should empower its rural teachers by, for example, an

advantageous working environment, being transparent, showing integrity and

showing commitment to its workforce. When this is done, the rural teacher possibly

will be motivated, thus can be retained in rural schools.

2.5.4 Career Development

Career Development is viewed as one of the most important drivers of engagement

and retention. Swanepoel (2001) states that one key factor in employee motivation

is giving them the opportunity to grow and develop enhancing skills. According to

Swanepoel (2001) enhancing employee’s current job performance, enables the

individual to take advantage of future opportunities, therefore, the employee will not

leave the organization as a career means security, commitment, loyalty and

performance, and this is what many employees aspire for in order to remain in the

job. Rural teachers could be given a better quarter when it comes to manpower

development programmes of the Ministry. Study leave could also be designed in

such a way that rural teachers get a fair share considering the fact that they are

located in areas that do not have resources that enable them to further their studies

as compared to their counterparts in urban areas. This may minimize the rural

teachers’ desire to transfer to urban areas. Individuals will be motivated if an

organisation clearly considers and cares for their career priorities. In the education

sector, career development can be done by providing opportunities for advancement

through promotion and the requirement for promotion should be such that those

who serve in rural schools are given the first priority when it comes to their areas.

Swanepoel (2001) and Oakland (2001) concur in that career development is all

about caring and nurturing talent in an organisation, keeping employees informed,

interested and fulfilled to prevent high turnover rates as employees take ownership

of their careers and recognise the need to continuously refine and upgrade their

skills. From the above, the irony is that the more employees feel that they are able

to grow in an organisation, the more they can be retained in that organisation. To

upsurge rural teacher commitment, loyalty, and effectiveness, the Ministry of

education, Sport, Arts and Culture must manage career development meritoriously.

The advancement of the rural teacher in training and development provides an

opportunity promotion thus career development will help in retaining valuable

employees. Taylor (2002) ropes the argument with regard to training and

development in that investment in training paid by the government or any employer

appears to reduce the desire to quit the job by employees. Training is a symbol of

employer’s commitment to staff. It has increasingly come to be recognised as an

important part of a retention tool. It appears normally factual that persistent training

tends to retain employees in an organisation. Teachers in rural schools, therefore,

can be given the opportunity for career development through various programmes

such as staff development and a higher quota when it comes to study leave for them

be retained in rural areas.

2.5.5 Job Enrichment

Swanepoel (2001) states that job enrichment means improvement in the quality of a

job such that employees are more satisfied and fulfilled through recognition,

responsibility and are stimulated to work. He correspondingly states that the

objective of job enrichment is to generate jobs employees will enjoy henceforth this

leads to employee retention. Job enrichment methods endeavour to modify the

nature of the job. The rural teachers’ job can be enriched by broadening

responsibilities, giving more autonomy for decision making, creating employee

satisfaction and direct feedback systems and generally enlarging scope of jobs.

Heads of rural schools can solicit feed back from teachers by having an open door

policy which encourage the sharing of ideas and quickens problem solving. Rural

teachers should be given the opportunity to experience achievement, recognition,

stimulating work, responsibility and advancement.

Swanepoel (2001) states that

through job enrichment employees perceive their work as treasured and worthy

while, employees feel personally responsible for the quality of their work and

ultimately they will be motivated and retained to contribute to the organisation.

Enriched will meet the requirements of progressively educated employees such as

teachers employed by the Ministry of Education, Sport, Arts and Culture.

2.6 Conclusion

The chapter reviewed literature and established from research on qualified teacher

distribution that in general qualified teachers tend to be concentrated in urban areas

due to a number of factors. These are the factors that make teachers shun rural

schools for instance; lack of decent accommodation , desire to take up further

studies, shortage of teaching and learning materials, lack of transport and

communication related problems. The chapter also discussed motivation theories

associated with employee retention which include Maslow’s Hierarchy of Needs,

Herzberg’s Two factor theory and Vroom’s Expectancy theory. The next chapter

discusses research methodology used to solve the research problem.

2.3 Causes of Low Morale

2.3.1 Poor/Inflexible working conditions