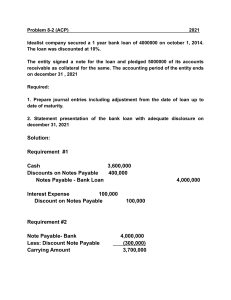

Asset Acquisitions Case 2: Equipment Purchase Case Your analysis convinced Hoo’s Got Game? that LaserEdge Technology, Inc. offered the best deal for purchasing the laser cutting machines. The new machines were going to be delivered July 1, 20X2, and Hoo’s Got Game? was scheduled to receive the cash from the loan proceeds from the Texas National Bank at that time so they could purchase the machines from LaserEdge. To help her understand the effects of this non-cash acquisition, Rose Wescott has asked you to prepare a repayment schedule over the life of the bank loan. Specifically, she wants to see an amortization table that shows how each payment is split between paying the accumulated interest and paying down the principal of the loan. She also wants to understand how the loan will affect income for its second year of operations and beyond, as well as how the balance sheet would be affected by the loan each year. Further discussions with Rose helped you learn that Hoo’s Got Game? will depreciate the laser cutting equipment to the nearest full month for book purposes, and the estimated useful life of the machines is 10 years. Rose also informed you that the Company incurred transportation costs of $575 and installation costs of $2,000 related to the laser cutting equipment purchase, and these costs have already been paid in cash. With this information, you are ready to begin preparing the repayment schedule and an analysis of the impact of the loan and equipment on income. Case deliverable: Using the attached tables, Prepare the amortization table for the bank loan that was used to finance the purchase of the laser cutting machines. Decide how the transportation and installation costs should be treated and prepare a schedule showing the Income Statement effects of the machines and note payable (i.e., interest expense from the loan and the depreciation expense from the laser cutting machines). Show the Balance Sheet effects of the note payable over the life of the loan (i.e., interest payable, current portion of long-term debt and non-current portion of long-term debt) for December 31st of each year the loan has an outstanding balance. 1 Texas National Bank Hoo’s Got Game?, Inc. Amortization Schedule Loan Number: Date Loan Made: Secured by: Stated Interest Rate: Years Total Loan Amount: 54757 7/01/2X02 Machines 9% 6 $95,000 Loan amortization schedule: Repayme Payment nt period date 7/1/2X03 1 2 7/1/2X04 3 7/1/2X05 4 7/1/2X06 5 7/1/2X07 6 7/1/2X08 Balance at beginning of period $95,000 Amount paid Interest Paid Principal Paid Balance at end of period Total payments: 2 Income Statement effects of Machines and Note Payable (each fiscal year ends 12/31) Fiscal Year Depreciation Expense Interest Expense Total Current portion of Note Payable Noncurrent portion of Note Payable 2X02 2X03 2X04 2X05 2X06 2X07 2X08 2X09 2X10 2X11 2X12 Totals Balance Sheet effects of Note Payable At Fiscal Year-end Interest Payable 2X02 2X03 2X04 2X05 2X06 2X07 2X08 3 Solution – Analysis of Bids (In-Class exercise) Hoo's Got Game? Laser Cutting Machine Purchase Options Lasers!, Inc. Machine Price Total Price of 2 Machines Financing Years Stated Interest Rate Value at end of financing Annual Payment Present Value of cash flows at the market interest rate, i = 9% LaserEdge Technology, Inc. 62,500 125,000 Lasers!, Inc. 5 0.00% ($25,000.00) 47,500 95,000 Bank 6 9.00% ($21,177.38) ($97,241.28) ($95,000.00) LaserEdge Technology, Inc. has the best offer for Hoo's Got Game?. 4