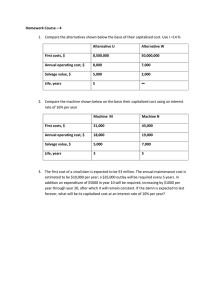

BASIC METHODS FOR MAKING ECONOMY STUDIES Rate of Return (ROR) Method Annual Worth (AW) Method Present Worth (PW) Method Future Worth (FW) Method Payback (Payout) Period Method Rate of Return (ROR) Method Rate of return is a measure of the effectiveness of an investment of capital. A rate of return equivalent from 20% to 25% of the investment is adequate to justify the investment. 𝒏𝒆𝒕 𝒂𝒏𝒏𝒖𝒂𝒍 𝒑𝒓𝒐𝒇𝒊𝒕 𝑹𝒂𝒕𝒆 𝒐𝒇 𝒓𝒆𝒕𝒖𝒓𝒏 = 𝒄𝒂𝒑𝒊𝒕𝒂𝒍 𝒊𝒏𝒗𝒆𝒔𝒕𝒆𝒅 Annual Worth (AW) Method Interest on the original investment (minimum required profit) is included as a cost. If the excess of annual cash inflows over annual cash outflows is not less than zero, the proposed investment is justified (valid). Present Worth (PW) Method If the present worth of the net cash flows is equal to or greater than zero, the project is justified economically. Future Worth (FW) Method All cash inflows and outflows are compounded forward to a reference point in time called future. If the future worth of the net cash flows is equal to or greater than zero, the project is justified economically. Payback (Payout) Period Method The payback period is defined as the length of time required to recover the first cost of an investment from the net cash flow produced by that investment for an interest rate of zero. 𝑖𝑛𝑣𝑒𝑠𝑡𝑚𝑒𝑛𝑡 − 𝑠𝑎𝑙𝑣𝑎𝑔𝑒 𝑣𝑎𝑙𝑢𝑒 𝑃𝑎𝑦𝑜𝑢𝑡 𝑝𝑒𝑟𝑖𝑜𝑑(𝑦𝑒𝑎𝑟𝑠) = 𝑛𝑒𝑡 𝑎𝑛𝑛𝑢𝑎𝑙 𝑐𝑎𝑠ℎ 𝑓𝑙𝑜𝑤 EXAMPLES: 1. An investment of P270,000 can be made in a project that will produce a uniform annual revenue of P185,400 for 5 years and then have a salvage value of 10% of the investment. Out of pocket costs for operation and maintenance will be P81,000 per year. Taxes and insurance will be 4% of the first cost per year. The company expects capital to earn not less than 25% before income taxes. Is this a desirable investment? What is the payback period of the investment? 2. A project is estimated to cost P100,000, lasts 8 years, and have a P10,000 salvage value. The annual gross income is expected to average P24,000 and annual expenses, excluding depreciation, will total P6,000. If capital is earning 10% before income taxes, determine if this is a desirable investment using (a) ROR, (b)AWM, (c) PWM, and (d) FWM. Page 1|4 COMPARISON OF ALTERNATIVES Fundamental Principle: The alternative that requires the minimum investment of capital and will produce satisfactory functional result will always be used unless there are definite reasons why an alternative requiring a larger investment should be adopted. Methods or Patterns in Comparing Alternatives Rate of Return on Additional Investment Method Annual Cost (AC) Method Equivalent Uniform Annual Cost (EUAC) Method Present Worth Cost (PWC) Method Capitalized Method Payback (Payout) Period Method Rate of Return on Additional Investment Method If the rate of return on the additional investment exceeds the current rate of return on the capital, the more expensive alternative should be chosen. 𝑹𝒂𝒕𝒆 𝒐𝒇 𝒓𝒆𝒕𝒖𝒓𝒏 𝒐𝒏 𝒂𝒅𝒅𝒊𝒕𝒊𝒐𝒏𝒂𝒍 𝒊𝒏𝒗𝒆𝒔𝒕𝒎𝒆𝒏𝒕 𝒂𝒏𝒏𝒖𝒂𝒍 𝒏𝒆𝒕 𝒔𝒂𝒗𝒊𝒏𝒈𝒔 = 𝒂𝒅𝒅𝒊𝒕𝒊𝒐𝒏𝒂𝒍 𝒊𝒏𝒗𝒆𝒔𝒕𝒎𝒆𝒏𝒕 Annual Cost (AC) Method The annual cost of the alternatives including interest on investment is determined. The alternative with the least annual cost is chosen. Equivalent Uniform Annual Cost (EUAC) Method All cash flows (irregular and uniform) must be converted to an equivalent uniform annual cost, that is, a year end amount which is the same each year. The alternative with the least equivalent uniform annual cost is preferred. Present Worth Cost (PWC) Method Determine the present worth of the net cash outflows for each alternative for the same period of time. The alternative with the least present worth of cost is selected. Capitalized Method Determine the capitalized cost of all the alternatives and choose that one with the least capitalized cost. Payback (Payout) Period Method The alternative with the shortest payback period is adopted. EXAMPLES: 1. A highway contractor needs some heavy duty trucks for his construction jobs. Suppliers of two trucks, T and Z, have furnished the following data: If the contractor requires a minimum rate of return of 18% on his investment, which truck should he buy? Page 2|4 Truck T Truck Z First cost P1,200,000 P2,000,000 Life 4 years 8 years Salvage value at end of life P100,000 P180,000 Annual out of pocket costs P180,000 P120,000 2. A company is considering two types of equipment for its manufacturing plant. Pertinent data are as follows: Type A Type B First cost P200,000 P300,000 Annual Operating Cost P32,000 P24,000 Annual Labor Cost P50,000 P32,000 Insurance and Property Taxes 3% 3% Payroll Taxes 4% 4% Estimated Life 10 10 If the minimum required rate of return is 15%, which equipment should be selected? 3. A gasoline driven pump and an electric power pump are being considered for use in a mine for a period of 10 years. The data available are: If the minimum required rate of return is 15%, what would you recommend? Gasoline Electric First cost P12,000 P25,000 Life in years 5 years 10 years Salvage value P1,000 P2,000 Annual operating cost P3,200 P1,800 Annual repairs P600 P400 Annual taxes (% of first cost) 3% 3% 4. Based on estimates the data for two types of bridges with different lives are as follows. If the minimum attractive rate of return is 9%, determine which project is more desirable. Timber Bridge Steel Bridge First cost P50,000 P140,000 Salvage value P2,000 P10,000 Life in years 12 years 36 years Annual maintenance P6,000 P2,5000 Page 3|4 COMPARISON OF ALTERNATIVES (ADDITIONAL PROBLEMS) 5. A company is going to buy a new machine for manufacturing its product. Four different machines are available. Money is worth 17% before taxes to the company. Which machine should be chosen? A B C D First cost P24,000 P30,000 P49,600 P52,000 Life in years 5 5 5 5 Power per year P1,300 P1,360 P2,400 P2,020 Labor per year P11,600 P9,320 P4,200 P2,000 Maintenance per year P2,800 P1,900 P1,300 P700 Taxes and insurance 3% 3% 3% 3% 6. A plant to provide the company’s present needs can be constructed for P2,800,000 with annual operating disbursements of P600,000. It is expected that at the end of 5 years the production requirements could be doubled, which will necessitate the addition of an extension costing P2,400,000. The disbursements after 5 years will likewise double. A plant to provide the entire expected capacity can be constructed for P4,000,000 and its operating disbursements will be P640,000 when operating on half capacity (for the first 5 years) and P900,000 on full capacity. The plants are predicted to have indeterminately long life. The required rate of return is 20%. What would you recommend? 7. To remedy the traffic situation at a busy intersection in Quezon City, two plans are being considered. Plan A is to build a complete cloverleaf costing P9,200,000 which would provide for all needs during the next 30 years. Maintenance costs are estimated to be P2,000 a month for the first 15 years and P3,500 a month for the second 15 years. Plan B is to build a partial cloverleaf at a cost of P6,500,000 which would be sufficient for the next 15 years. At the end of 15 years, the cloverleaf will be completed at an estimated cost of P7,500,000. Maintenance would cost P1,400 a month during the first 15 years and P3,500 a month for the second 15 years. If money is worth 8%, which of the two plans would you recommend? Page 4|4