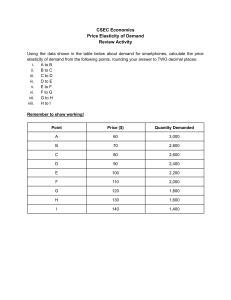

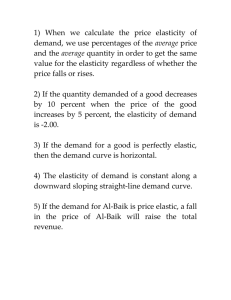

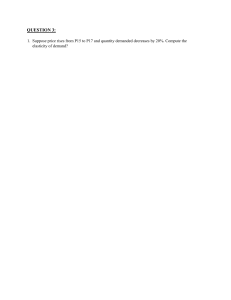

Chapter 5- Elasticity Price Elasticity of Demand Elasticity (or price elasticity of demand): measures by how much quantity demanded responds to a change in price. Think responsiveness. Inelastic Demand: small response in quantity demanded when prices rises. If the price rises enough, quantity demanded may decrease slightly as the poorest consumer attempts to get by with a smaller quantity. Elastic Demand: large response in quantity demanded when price rises. A small rise in price causes a large decrease in quantity demanded. Perfectly Inelastic Demand: price elasticity of demand equals zero; quantity demanded does not respond to a change in price. Perfectly Elastic Demand: price elasticity of demand equals infinity; quantity demanded has an infinite response to any change in price. For inelastic demand, consumers have a low willingness to shop elsewhere. The extreme case is elasticity equals to zero-perfectly inelastic demand. Consumers continue to buy, no matter how high the price goes. For elastic demand, consumers have a high willingness to shop elsewhere. The extreme case is elasticity equal to infinity- perfectly elastic demand. If the price rises by any amount, the quantity demanded drops to zero. Simple Formula: E= (% change in Quantity Demanded)/ (%Change in Price), where E= Price Elasticity of Demand This formula assumes that all of the five other factors that affect demand remain unchanged Elastic: E> 1 Inelastic: E<1 Unitary Elastic: E=1 Perfect Elastic Demand: E= Infinity Perfect Inelastic Demand: E= 0 The midpoint formula is used for measuring elasticity of demand, to accurately find the price elasticity of demand. Economists use the average of the two prices and the average of the two quantities demanded. o 𝑄 −𝑄 𝑃 −𝑃 2 2 ( 𝑄11+𝑄00 ) / ( 𝑃11+𝑃00 ) The three main factors that affect elasticity are: available substitutes, time to adjust, and proportion of income spent. o Available Substitutes: The more substitutes there are the easier it is to switch away from a product or service. There is also a difference between luxuries and necessities. People tend to give up the luxury item before the necessary one. Necessities are inelastic, while luxuries are elastic. o Time to Adjust: When prices rise, it often takes people time to adjust and find a substitute. Time allows consumers to find substitutes or find ways to decrease their demand. o Proportion of Income Spent: The greater the proportion of income spent on a product, the greater elasticity of demand. For example, a change in price of salt from $1 to $2 would do little to change the amount you consume, even though it is a 100% increase in price. Elasticity and Total Revenue Total Revenue: all money a business receives from sales o Equal to price per unit (P) multiplied by quantity sold (Q) o For elastic businesses, the percentage increase in quantity is greater than the percentage decrease in price, so total revenue (𝑃 × 𝑄) increases. o For inelastic businesses, the percentage increase in quantity is less than the percentage decrease in price, so total revenue (𝑃 × 𝑄) decreases. For businesses facing elastic demand (>1), price cuts will increase total revenue. For businesses facing inelastic demand (<1), price rises will increase total revenue. Price Elasticity of Supply Elasticity of Supply: measures by how much quantity supplied responds to a change in price. Inelastic Supply: small response in quantity supplied when price rises. Elastic Supply: large response in quantity supplied when price rises. Perfectly Inelastic Supply: price elasticity of supply equals to zero; quantity supplied does not respond to a sudden change in price. Perfectly Elastic Demand: price elasticity of supply equals infinity; quantity supplied has infinite response to a change in price. Simple Formula: E= (% change in quantity supplied)/ (% change in price), where E= Elasticity of Supply This formula assumes that all of the other six factors that can affect supply are unchanged. If the percentage change in quantity supplied is less than the percentage change in price, elasticity of supply is less than 1 and is inelastic. If the percentage change in quantity supplied is greater than the percentage change in price, elasticity of supply is greater than 1 and is elastic. The midpoint formula is used for measuring elasticity of supply, to accurately find the price elasticity of supply. Economists use the average of the two prices and the average of the two quantities supplied. o 𝑄 −𝑄 𝑃 −𝑃 2 2 ( 𝑄11+𝑄00 ) / ( 𝑃11+𝑃00 ) Elasticity of supply depends on availability of additional inputs and the time production takes. The factors that determine elasticity of supply are availability of inputs and time. o Availability of Inputs: easy availability of new inputs makes for more elastic supply, while difficult and costly availability of new inputs makes for more inelastic supply. o Time: industries with quick time to production tend to have more elastic supplies. Industries with slow time to production tend to have more inelastic supplies. Elasticity of supply allows more accurate predictions of future outputs and prices (smart choices), helping businesses avoid disappointing customers. More Elasticities of Demand Cross Elasticity of Demand: measures the responsiveness of the demand for a product or service to a change in the price of a substitute or complement. Simple Formula: Cross Elasticity of Demand= (% change in quantity demanded)/ (% change in price of a substitute or complement) o Can be a positive or a negative number. Cross elasticity of demand for substitutes is always positive and always negative for complements. As people switch from one product to another, the percentage change in quantity demanded increases (positive numerator) and the percentage change in the price of the substitute also increases (positive denominator). As the price of a complement increases, the quantity demanded decreases (negative numerator) and the percentage change in price increases (positive denominator). Larger numbers for cross elasticity of demand mean more perfect substitutes (positive cross elasticity) or more perfect complements (negative cross elasticity). A large positive number (like +3.0) indicates a large rightward shift of the demand curve. A large negative number (like -3.0) indicates a large leftward shift of the demand curve. Income Elasticity of Demand: measures the responsiveness of the demand for a product or service to a change in income. Simple Formula: Income Elasticity of Demand= (% change in quantity demanded)/ (% change in income) o Can be a positive or negative number. Positive= normal and negative=inferior. Income elasticity of demand for normal goods is positive. An increase in income will increase the demand for normal goods. Income elasticity of demand for inferior goods is negative. An increase in income will decrease the demand for inferior goods. Income Inelastic Demand: for normal goods that are necessities, the percentage change in quantity is less than the percentage change in income (beer, furniture, etc.) Income Elastic Demand: for normal goods that are luxuries, the percentage change in quantity is greater than the percentage change in income (jewellery, movies, airline travel, etc.) Tax Incidence and Government Tax Choices Tax Incidence: the division of a tax between buyers and sellers, depends on the elasticities of demand and supply. A tax on sellers shifts up the supply curve by a vertical distance equal to the amount of the tax. The more inelastic demand is, the more buyers pay of a tax. The more elastic the demand is, the more sellers pay of a tax. The more inelastic supply is, the more sellers pay of a tax. The more elastic the supply is, the more buyers pay of a tax. Tax Revenue Formula: tax per unit × units sold The more inelastic demand and supply are, the greater the tax revenue for the government.