Circular Flow, National Accounts & Multiplier - Economics

advertisement

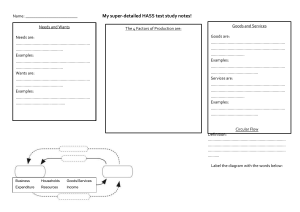

1-CIRCULAR FLOW, NATIONAL ACCOUNT AGGREGATES AND MULTIPLIER 1. Current open circular flow model 1.1 Concepts ECONOMICS AS SUBJECT AREA: A study of how individuals, businesses, governments and other organisations choose to use scarce resources to satisfy their numerous needs and wants in a manner that is efficient and equitable. MACROECONOMICS: Macroeconomics is a study of the economy as a whole.Seeks to identify strategic determinants of the levels of national income, output and expenditure. Unemployment, general price level, inflation and balance of payments. CLOSED ECONOMY: An economy that has no foreign sector. Particippants are households, firms, government and the financial sector. OPEN ECONOMY: An economy that import from and export goods and services to other countries (international trade). The paprticipants are households, firms, government, financial sector and the foreign sector. ECONOMIC MODELS A model is a simplified representation of the reality and may be iin the form of words, an illustration (diagram), graph or an equation. CIRCULAR FLOW MODEL: Shows how the economy works. The relationship between income and spending in the economy. It shows how the participants in an economy interact with one another. REAL FLOWS: Flow of goods and services between households, businesses and firms, e.g. flow of goods and services from firms to households, the flow of factors of production from households to firms and the state, flow of public goods and services from the state to households and firms. MONEY FLOWS: Flow of income and spending between households, businesses and firms, e.g. households earn income from selling factors of production to firms and the state, government spending on goods and services, taxes paid to government, money flow between the financial sector and firms and households. LEAKAGES (L = S + T + M) The removal or withdrawal of money from the economy. Savings (S), taxes payments (T), payments for imports (M). INJECTIONS (J = I + G + X) Additional money or introduction of money into the economy. Investments (I) government spending (G) and revenue from exports (X). ECONOMIC EQUITY The economy is in equity where L = J THE CIRCULAR FLOW 1.2 Participants: • Households: Is basic unit of consumption in the economic system and the primary economic participants Own the factors of production (land, labour, capital and entrepreneurial ability) Sell factors of production on the factor market to firms (e.g. labour or capital markets) In exchange for the services rendered for factors of production, households receive an income (rent, wage, interest and profit) Use income to buy consumer goods and services on productmarkets to satisfy their wants • Business sector: Is basic unit of production in the economy Businesses use the purchased factors of production to produce goods and services needed by households Firms buy factors of production on the factor market and sells finished manufactured goods on the product market Their final aim is to maximize their profits Their endeavour is to earn sufficient income to meet their operating costs. Their activities affect the volume and smoothness of the real and money flos in the economy. • Government: - Refers to local, provincial and national government - Includes all government workers (e.g. politicians and civil servants) as well as state-owned enterprises e.g. Eskom and Transnet - State provides households and firms with public goods and services e.g. defence, law and order, health care, education and infrastructure - Government participates in the economy by purchasing factors of production from households and by purchasing goods and services from firms in the goods market (G) - In return government receives revenue from households (PAYE) and firms (company tax) - Government regularly borrows from private sector (businesses and individuals) and from abroad in order to balance its budgets • Foreign sector: - Serves as a source and destination for goods, services, savings and loans - SA imports mainly machines, equipment and intermediate goods from abroad - Exports mainly minerals, primary and intermediate goods to the foreign sector - Trade between ther foreign sector and households and businesses takes place in the foreign sector in the form of imports and exports - Revenue earned from this process is foreign exchange, which is needed to pay for imports. The foreign exchange market is located in the financial system. PAGE 1 1.3 Four sector circular flow diagram Injections (J): • Investmens (I) – money spent by enterprises which they borrow or obtain from various financial institutions through past savings and loans or new issueing of shares. Invest in property and plant or equipment. • Government expenditure (G) – spends money on goods and services to deliver social and economic services and provide infrastructure e.g. roads, hospitals and schools • Export income (X) – when foreign residents buy our exports of goods and services. 1.6 Model equations e.g. Y = C + I + G + (X – M). Y = E = C + I + G + (X – M) 1.4 Real flows and money flows • • • • Transactions take place in markets. Every market transaction is a two-sided exchange – sales in terms of goods and services and purchases in terms of money Goods and services are sold on the product market; factors of production sold on factor market – constitutes real flow Consumers earn income from the sale of the services of their factors of production, used to purchase goods and services sold by producers in the product market – consumers’ income and expenditure constitute a money flow Private and public goods and services flows in the opposite direction than flows of expenditure and taxation 1.5 Leakages (L = S + T + M) and injections (J = I + G + X) - Real and money flows not always smooth and without interruptions – goods and services produced or imported do not arrive promptly, become it is part of inventories or stored somewhere in the system or exported. - Sometimes money leaks from the flow as a result of savings and taxes – new money enters the flow when businesses borrow money or earn revenue from exports - Financial system contains variety of markets such as capital (long run), money (short term) and foreign exchange market. - Deposit-taking institutions (banks) and non-deposittaking institutions (insurance companies) act as financial intermediaries in these markets, where savings from consumers, producers and government are made available as loans to others. SARB is prominent. Leakages (L): • Only part of income received by participants will be spent on products produced by domestic enterprises – the remainder will be withdrawn or leak out: • Savings (S) – income that participants choose not to spend – put aside for future use – must be net savings (savings less loans by households) • Taxes (T) – direct and indirect – no choice – receive benefits like transfer payments, cash allowances known as a negative tax. • Import expenditure (M) – consume goods manufactured with imported components – expenditure flows abroad. THE CIRCULAR FLOW Where: Y = National Income C = Total consumption expenditure (durable / semidurable / non-durable goods / services) I = Total Investment (Residential buildings / nonresidential buildings / other construction and land improvements / tansport equipment / other machinery and equipment / transport cost) G = Total government expenditure / expenditure on goods and services / expenditure on fixed capital / labour cost / net income received from sales X = Total exports M = Total imports FIG 1.3 Graphic presentation of equation E=Y X E X P E E1 N D I T U E R E C+I+G+(X-M)1 = Total expenditure S R C+I+G+(X-M) = aggregate demand 45º 45º 0 Y Y¹ INCOME (Y) 2. Markets (in circular flow context) 2.1 Product- and factor market: Factor market: • market where services of factors of production are traded (labour is hired, capital is borrowed, property is rented and entrepreneurs offer their services) • These services earn wages, interest, rent and profits respectively. • Factor market inludes labour, property and financial markets. Goods market: • Thousands of markets for goods and services called the product market. PAGE 2 X • In economics, it is called aggregation. In microeconomics, we investigate the different markets individually. 2.2 Financial (money and capital) • Funds in the financial markets (money and capital market) are channelled from units/firms/savers with excess funds, to units/firms experiencing a shortage of funds. • In SA the money market for short term and very short term (3 year and less) savings and loans. • It is not a physical market, but exists when parties (consumers and producers) make demand and shortterm deposits and borrow on short term. • In a more sophisticated form it exists when deposit and non-deposit intermediaries, businesses and Corporation for Public Deposits engage in communications that influence the prices of short-term funds and include: bankers acceptances, short-term company debentures, treasury bills, Reserve Bank debentures and short-term government bonds. • SARB as financial institution is key in the money market. • The capital market is a market for long term financial instruments. • In its simplest form it exists when consumers and producers make long-term deposits and borrow on long term such as a mortgage bond. • It exists when deposit and non-deposit intermediaries engage in communications that influence the prices of long-term funds and long-term securities. • JSE is a key institution in the capital market. Here company shares and other debts that are listed are traded. 2.3 Flows in the economy (production, income and expenditure). • • • Flows of private and public goods and services are real flows and they are accompanied by counter flows of expenditure and taxes. Factor services are real flows and they are accompanied by counter flows of income. Imports and exports are real flows and they are accompanied by counter flows of expenditure and revenue. SPENDING AND INCOME Savings Financial sector Households Savings Business sector Investment SPENDING AND INCOME Fig 1.2 Financial sector within the circular flow of income and spending 2.3 Foreign exchange market: • In an open economy foreign exchange is needed to finance transactions between countries. On the international exchange market one country’s currency is exchanged for another currency. • Rands are exchanged for dollars. The foreign exchange market is multinational inscope. Leading centres for foreign exchange dealings are London, New York and Tokyo. • In South Africa this all happens at banks. • The SA rand is exchanged or traded freely in each of these markiets and SARB has no control over it. THE CIRCULAR FLOW PAGE 3 3. Calculate national account aggregates and conversions • The circular flow model is a macroeconomic mocel used to study the economy. The model shows real and money flows. Wee need to measure these flows. Macroeconomic measurement does for the economy what private accounting does for an individual business. There is THREE methods to measure the total economic activity, i.e. production, income and expenditure methods. 3.1 Concepts: GDP and GNP, GDE, GDI GDP is the total value of all final goods and services produced within the borders of a country in a given year. GNP is the value of all final goods and services produces by the permanent residents in the country in a given year. GDE measures total expenditure on final goods and services produced within the borders of the country by the four main participants in the circular flow mode GDI is the value of the remuneration paid to all factors of production in a given year. 3.2 Deriving national account aggregates: Circular flow is a flow of income and expenditure – starting with production provoked by wants. 3.2.1 Production: • The production (output/added value method) is where the GDP at market prices is calculated by adding the final values of all goods and services produced within the borders of the country. Intermediate inputs should be subtracted from final outputs to find the value that was added by each sector – otherwise calculation would amount to double counting. Table 1.1 Shows the value added through production in the different sectors of the South African economy in 2018: VALUE ADDED THROUGH PRODUCTION 2019 R (bn) 1. Primary sector 457 2. Secondary sector 909 3. Tertiary sector 2 975 4. Gross Value Added @ basic prices 4 341 4.1 Plus – tax on products 545 4.2 Minus – subsidies on products 13 5. Gross Domestic Product @ market price 4 873 Source: SARB Quarterly Bulletin (December 2019) • • • • • If the market prices would be added in each stage of production, the final value of production would exceed the actual value of production –double counting. That is the reason why the value in each stage of production is added. By calculating the GDP using the production method, basic prices are used. Basic prices represents the amounts receivable by the producer in purchasing a unit of a good of service minus any tax payable plus any subsidy receivable. By calculating the GDP using the expenditure method, market prices are used. These are the actual prices paid by consumers for goods and services plus taxes less subsidies. By calculating the GDP using the income method, factor cost is used. Factor cost is the amount THE CIRCULAR FLOW received by the different factors of production, used in the production process. To convert basic prices to market prices, tax should be added and subsidies subtracted. 3.2.2 • Expenditure method: In the expenditure approach the expenditure by all four most important sectors are added: Consumption expenditure by private households (C) Investment spending by business sector – fixed capital formation (I) Public sector (G) Foreign sector (X-M) Table 1.3 Indicate the total expenditure on GDP at market prices. EXPENDITURE WITHIN BORDERS OF SA: 2019 1. Final consumption expenditure by households 2 921 2. Final consumption expenditure by government 1 037 3. Gross capital formation 874 4. Residual item 24 5. Gross Domestic Expenditure 4 856 6. Export of goods and services 1 458 7. Minus Imports of goods and services 1 441 8. Expenditure on GDP at market prices 4 873 Source: SARB Quarterly Bulletin (December 2019) • GDP(E) = C+G+I+(X-M) • Table 1.3 indicates that South Africa exported more goods in 2019 than goods imported. It led to an injection of R17 bn. • National figures (GNP) related to total income of production by permanent residents of a country, regardsless where the production takes place – South Africa or abroad. • Domestic figures (GDP) related to total income of production within the borders of a country, regardsless by whom. Table 1.4 shows the diversion from domestic totals to national totals. R(bn) GDP @ MARKET PRICES 4 873 PLUS : Primary income from the rest of the world 97 MINUS : Primary income to the rest of the world 251 GNP @ MARKET PRICES 4 719 Source: SARB Quarterly bulletin (December 2019) • • • 3.2.3 • GDP measures the value of production before provision for consumption of fixed capital has been made. Provision for consumption of fixed capital is the depreciation of machinery, equipment and vehicles. Net domestic product (NDP) measures the value of production after consumption of fixed capital (depreciation) is taken into account. Income method: GDP(I) at market prices is calculated by adding all income earned by the factors of production within the borders of the country. PAGE 4 Table 1.2 Indicates the gross domestic income of the South African economy for 2019. INCOME RECEIVED BY FACTORS OF 2019 PRODUCTION R(bn) 1. Compensation of employees 2 320 2. Net operating surplus 1 249 3. Consumption of fixed capital 676 4. Gross Value added at factor cost 4 246 5. Other taxes on production 102 6. Minus other subsidies on production 8 7. Gross Value Added at basic prices 4 340 8. Tax on products 546 9. Minus Subsidies on products 13 10 Gross Domestic Product at market price 4 873 Bron: Source: SARB Quarterly bulletin (December 2019) • • Consumption of employees consists mainly of gross salaries and wages earned by labour. Net operating surplus includes mainly the total value of goods and services that are produced less costs. Costs consist of cost of intermediate goods and services, cost of remuneration of employees, cost of consumption of fixed capital. Shows the profits and surpluses of enterprises before taxation. 3.3 National account conversions: 3.3.1 Basic prices Some indirect taxes and subsidies are the reason that certain goods and services enter our national account statements at basic prices. This is because the amounts that are added in the different sectors listed in the table include taxes on production and exclude other subsidies on production. Taxes on production (payroll taxes, recurring taxes on land, buildings or other structures, and business and other licences). Other subsidies on production include employment subsidies and subsidies paid to prevent pollution. 3.3.2 Factor cost Use GDP at basic prices less taxes plus subsidies to determine GDP at factor cost. 3.3.3 Market prices Different kinds of indirect taxes and subsidies other than those used above are used for the conversion of basic prices to market prices.Taxes on products (VAT, taxes and duties on imports and exports) are added, and subsidies on products such as direct subsidies payable per unit exported and product-linked subsidies on roducts used domestically are subtracted. Taxes on production are included (PAYE) and subsidies are excluded (pollution) – related to production process and not to individual products. 3.3.4 Net figures – net operating surplus after tax surplus. Net fixed capital formation after consumption of tixed capital. Net exports after deduction of imports. 3.3.5 National and domestic figures – national relates to the aggregated iincome or production by the citizens of the country wherever they may be economically active, locally or abroad. Dommmestic relates to the aggregated income or production produced within the borders of South Africa by South African and foreign citizens. THE CIRCULAR FLOW PAGE 5 THE MULTIPLIER Where k is the multiplier 4.1 DEFINITION: (a) • • • • We know that Y= C+I+G+X-Z, ie. (Y) is a function of C, I, G, X and Z. Any increase or decrease in C, I , G, X or Z will lead to a corresponding increase or decrease in Y General Explanation The multiplier describes a situation where a change in spending eg investment ultimately changes output and income by more than the initial change in investment income. One person’s spending becomes the income of another, which in turn becomes their spending. This is income for another and so on. • The basic assumption of the multiplier is that the economy starts of with unused resources (ie. there is unemployment and firms are producing below capacity) • When there is an increase in investment, new jobs are created. These people now have income to buy goods and services which increases demand. This results in higher production which creates more job, raising incomes further and increasing demand. The initial change in investment spending results from a change in real interest rates. This multiplier effect effectively means that any change in injection will lead to a larger change in GDP. The multiplier also works in the opposite direction ie. A decrease in spending will lead to a larger decrease in GDP. The initial change in spending is usually associated with investment spending because of investments volatility. But changes in consumption, net exports and government expenditure also lead to multiplier effect. • • • • • If mpc is 0.8, then mps is 0,2. Total is 0.8+ 0.2 = 1 Therefore k = 1 = 1 – mpc 1 = 1 – 0.8 1 = 5 0.2 1. With an investment of R1000 and the mpc being O,8 then the multiplier will be 5. Therefore the change in total income will be 5 x 1000 = R5000. 2. The formula for multiplier will change according to the type of the economy. 3. In a THREE sector economy which includes the state, the marginal rate of tax has to be considered. 4. In a FOUR sector economy which includes the foreign sector, the marginal propensity to import has to be considered.. 5. Therefore leakages like savings, taxes and imports reduces the value of the multiplier. Multiplier and the mpc • • • • • • K To calculate the multiplier we need to know a person’s marginal propensity to consume (mpc). The mpc tells us how much a person consumes for every additional income earned. The eventual change in income will depend on the mpc. The larger the mpc the greater is the multiplier hence the higher the change in income. mps + mpc = 1 (if the mpc is 75%(0.75), The mps will be 25% (0.25). The value of the multiplier is determined using the following formula. = ▲Y ▲J or 1 1-mpc THE CIRCULAR FLOW or 1 mps PAGE 6 Aggregate Expenditure Graphical representation E=Y AE2= 20m + 0.6 (y) 45 E2 40 P O N Q AE1 = 10m + 0.6Y 36 L M 30 20 E1 10 45◦ 0 Total income (R millions) (Y) ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ The 45◦ line shows all levels where AE (Aggregate Expenditure) = Y (Income) It represent equilibrium points where all leakages = injections The assumption is that there are TWO participants (Households and firms) The economy is in equilibrium at point E1. The autonomous consumption for AE1 is 10m and the mpc is 0.6. The multiplier is.2.5. [1 divided by 0.4 (mps) ] An increase in I (R10 million) will move the consumption function to AE2 The new equilibrium position is at E2 where Y = R45m. (2.5 x 10m). Increase in investment spending of R10m causes AE to increase to 20m. Production and therefore income increases due to excess demand. (L to M) Spending will increase by 6m (because of mpc) which increases production and income further. This process continues until E=Y at E2 where income is R45m At this point there is no need to increase production. A change in I of R10m has resulted in a change in income of R25m. (R45m – R20m) The above explanation of the multiplier is based on simplifying assumptions. i.e. Consumption of domestic output rises by the increase in income minus the increases in saving. In reality consumption increases by a lesser amount than is implied by the mps. In addition to savings money is spent on imports and taxes. This reduces the amount available for consumption spending. Therefore the multiplier effect is reduced. THE CIRCULAR FLOW PAGE 7