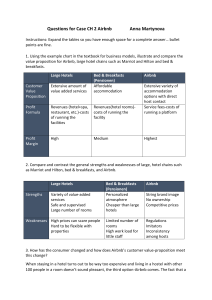

IBDP Business Management HL IA Research Question: To what extent has the growing popularity of Airbnb caused a change in Intercontinental Hotel Group’s market share and growth strategy in the American Market? Key Concept: Change Figure 1 - Company Logo [IHG Logo] Word Count: 1793 1 Table of Contents 1.0 – Introduction ................................................................................................ 3 1.1 – Methodology ............................................................................................. 3 2.0 - Findings & Analysis .................................................................................... 4 2.1 – Market Share............................................................................................. 4 2.2 – Ansoff Matrix ........................................................................................... 6 2.3 – Financial Considerations .......................................................................... 9 3.0 – Conclusion................................................................................................. 10 3.1 – Limitations .............................................................................................. 11 Works Cited ......................................................................................................... 12 Appendix ............................................................................................................. 13 2 1.0 – Introduction Intercontinental Hotel Group PLC. or better known as IHG is one of the leading hotel companies that has over 6200 hotels worldwide (Supporting Document 1). They are set up as a private limited company meaning that shareholders are a select group of individuals. In recent years, changes have occurred in the organization where they have expanded on such a profile to improve market share, opening premium brands such as VOCO or expanding through other companies like Regent (Supporting Document 4). The aggressive expansion and emphasis on business growth strategies are possibly as a result in the rise in popularity of Airbnb inc. The online application starting in 2008 is a service allowing customers to rent out spaces like homes from “hosts” (Supporting Document 2). Since 2021, the home rental application has gained traction with possibly cheaper rates and extensive number of listings through a simple app (Supporting Document 3). It has caused a change in perception within the market as to where travellers should stay on holiday and how to book those trips. The difference in service creates competition and lets the question of which model is more successful arise. Therefore, this research essay will investigate IHG’s changes to counter Airbnb through the research question: “How did the growing popularity of Airbnb cause a change in Intercontinental Hotel Group’s market share and growth strategy?” 1.1 – Methodology The supporting documents selected allow for both an internal and external outlook on the question. Internally, the annual reports in 2022 published for both IHG PLC and Airbnb inc. will be investigated which provides reliable information from the organization directly. Externally, an article each was selected speaking on the overall market share and growth of the respective company and a general YouTube video speaking on Airbnbs disruption to the market. These articles use statistics and provide both quantitative and qualitative information. 3 List of Supporting Documents. Title of Supporting Documents 1. 2022 Annual Reports of IHG PLC. 2. 2022 Annual Reports of Airbnb inc. 3. “Is Airbnb’s Growth and Expansion Strategy Paying Off in 2023?” 4. “IHG to expand global portfolio by nearly a third” (2023) 5. “Why Airbnb Fails to Disrupt the Hotel Industry” (2022) Source Website Hyperlink IHG https://www.ihgplc.com/en/ihg/annualreports/2022/annu al-report-2022 Airbnb https://news.airbnb.com/airbnb-q4-2022-and-full-yearfinancial-results/ RentalScaleUp https://www.rentalscaleup.com/is-airbnbs-growth-andexpansion-strategy-paying-off-in2023/ TopHotel News https://tophotel.news/ihg-to-expand-global-portfolio-bynearly-a-third/ ModernMBA (YouTube) https://www.youtube.com/watch?v=-IdQ0sXCbxE Syllabus Unit 1.3 Business Objectives Business Tool & Theories Ansoff Matrix 3.4 Final Accounts & 3.5 Ratio Analysis 4.1 Introduction to Marketing Balance Sheet & Profitability Ratios Analysis Market Share Purpose of Use To analyse IHG’s growth strategies that it has employed because of the shift in the market due to Airbnb’s development and whether the newfound aggression is translating to success. Understand how IHG & Airbnb operates in terms of finances and compare different years net profit to establish how they have improved. To calculate the market share based on value and volume determining the effect the market strategy of IHG has on the overall market position for the company and how they have reacted due to Airbnb’s market share statistics. 2.0 - Findings & Analysis 2.1 – Market Share Calculation 1: IHG (Based on Volume of Rooms) Calculation 2: IHG (Based on Revenue Value) Calculation 3: Airbnb (Based on Volume of Rooms) Calculation 4: Airbnb (Based on Revenue Value) 911,627 × 100 = 3.29% 27,700,000 3,892,000,000 × 100 = 1.10% 355,300,000,000 6,600,000 × 100 = 23.8% 27,700,000 8,400,000,000 × 100 = 2.36% 355,300,000,000 Figure 2 - Market Share Calculations in USD$ from 2022 (Data gathered from Supporting Doc 1 & 2 and Value for Total Revenue of Hotels gathered from Statista), made by Candidate, 2023 4 Pie Chart demonstrating market share of companies of interest based on volume of rooms. Pie Chart demonstrating market share of companies of interest based on revenue 3.29% 1.10% 2.36% 23.80% 72.91% IHG AirBnB Other Companies IHG 96.54% Airbnb Other Companies Figure 3 & 4 - Pie Chart representing Market Share Data Worldwide, made by Candidate using Excel 2023 Market Share is the percentage of one’s firm’s shares in comparison to the total sales made in the market ((Lominé et al., 2022)). The worldwide data rather than market specific data was utilized to interpret better how the companies are viewed in comparison to their competition. In terms of volume, Airbnb holds a large portion of the market share, nearing a quarter of the industry rooms listed as available in 2022. Meanwhile, with under a million hotels, IHG cannot keep up with Airbnb’s high number of listings. This is due to two different changes. The first change is that possible hotel owners don’t want to wait for the long average time it takes to establish a hotel being 2-3 years (Supporting Document 5) and the large cost incurred as a result. The second, is the change in market strategy that Airbnb follows, with a convenience-based product. The company’s USP is pushing as many listings as possible, made possible because of a great reliance on handling and tracking of all activities using a smart device (Supporting Document 2). This is a new change for users, simplifying the selection of residence on trips and variety for where they can stay, rather than the typical hotel like IHG offers. Airbnb reinforcing user assistance as a priority ensures trust with stakeholders considering the change, they have caused in hospitality perception (Supporting Document 3). This unorthodox reliance on 5 technology has become Airbnb’s USP providing the ability to tap into multiple markets, spreading risk. This change in tactic leaning onto tech compared to IHG is successful and reflects in the revenue market share, with the 8.4 billion dollars being generated resulting in a 2.36% market share of the hotel industries total. This is not the cause of concern for IHG, as their revenue market share remains respectable, with their 3.8 billion dollars generated being nearly half of Airbnb. Airbnb posts 7 times the number of available rooms in 2022 meaning that IHG are more successful at consistently generating revenue per room citing a lack of need for change. Meanwhile Airbnb may have more supply than demand for their product. This further shows that IHG sees no need for change because of market share but possibly due to other factors such as perception (Supporting Document 1) 2.2 – Ansoff Matrix Figure 6 - Composition of Hotel Ownership Allocation in 2022 (Supporting Document 1) Figure 5 - Ansoff Matrix of IHG created by Candidate using EDraw a) Market Development Strategy Market development is the growth strategy where a business uses an established product, to enter new markets ((Lominé et al., 2022)). Leveraging the well-known product helps the 6 initial start-up become competitive sooner. Although there is the common perception that hotels own these properties, majority of the industry have changed into an “asset light business” (Supporting Document 5). This matches Airbnb’s model and ability to expand despite the long set up period for hotels (Supporting Document 5). IHG cites this change as the most profitable method (Supporting Document 1). The newfound focus on achieving market development via the franchising model is shown with IHG’s 72% of hotels under such management (refer to figure 6). Franchising is an external growth method, where the franchisor provides the brand name and company issued items to the franchisee. Meanwhile they handle the operations, management and the costs that come with such. The effectiveness of this method and changing to it has allowed IHG to enter markets once thought to be unavailable. The brand name and category it is placed within (Premium, Essential etc.) is encouraging to possible franchisors as opposed to becoming a host for Airbnb, due to recognition the hotel names provide (Supporting Document 4). However, due to the time it takes to establish a hotel, Airbnb can start generating revenue off hosts more quickly than IHG in new markets, giving them the first mover advantage. b) Product Development Product development is the growth strategy where a business uses an established market to enter a new product ((Lominé et al., 2022)). IHG has ensured to change their approach for this type of development, to remain a main stay in the tourism industry with Airbnb’s popularity. Much like market development, an aggressive change to open more products are reflected in the annual report as it was published that there have been plans to open 281,468 more rooms Figure 7 - Rendering of Gardner Hotels (Supporting Document 4) 7 within IHG’s pipeline (Supporting Document 1). If all signings are completed within the next 2 years, this will improve IHG’s total system size to surpass the million marks. This directly combats the greater rise of competitors including Airbnb, demonstrating that IHG’s product development approach is the correct change they needed. Furthermore, it has been reported that the signing rate for new hotels has been 11% higher than the 2022 Q2 publications (Supporting Document 4). Of these signings it has been reported that new hotel brand in company has been opened, named Garner Hotels (Figure 4) which hopes to establish itself within the American market. These possible new hotels with IHG are an alternative plan to form an advantage over Airbnb which is reliant on the properties of its hosts to have variety. c) Other Growth Strategies Airbnb has prided itself with ultra convenience and customer experience with a service that is only a device away. As consumers interests are becoming more reliant on digital advertising, IHG recognize this change as Airbnb’s greatest advantage with campaigns like “Airbnb it” being ultra successful (Supporting Document 3). To counteract, IHG has changed to become more promotionally driven of their loyalty program named IHG One Rewards ensuring benefits worldwide under the umbrella of brands that IHG owns. With 18 hotel brands and another on the way, the consumer does not lack choice (Supporting Document 1). Changing to the Airbnb strategy, an application for IHG was developed with the embedded One Rewards program and can show bookings, offers and benefits. It can be said that the USP of Airbnb has been eliminated by IHG’s changed priority due to a 58% digital booking made following the applications launch and 12.2 million new members (Supporting Document 1 & 4). Also, in relation to IHG’s portfolio, the listings are separated to cater to different market segments a consumer preference. This is seen in Figure 8 with the categories being split into the likes of premium and essentials (Supporting Document 4). 8 Figure 8 - IHG Portfolio (Supporting Document 1) 2.3 – Financial and Market Considerations Calculation 5: Net Profit Margin of IHG in 2021 Calculation 6: Net Profit Margin of IHG in 2022 Calculation 7: Net Profit Margin of Airbnb in 2021 Calculation 8: Net Profit Margin of Airbnb in 2022 494,000,000 × 100 = 16.9% 2,907,000,000 628,000,000 × 100 = 16.1% 3,892,000,000 (352,000,000) × 100 = (5.87) % 5,992,000,000 1,989,000,000 × 100 = 23.7% 8,399,000,000 Figure 9 – Net Profit Margin Calculations in USD$ from 2022 gathered from Supporting Document 1 & 2), made by Candidate Refer to Appendix 1 & 2 IHG has had stable growth and ensured consistent revenue between 2021 and 2022 with a 33.9% increase in revenue and 41.9$ million profits made (Supporting Document 1). Similar numbers are seen for Airbnb showing that the industry changed for the better upon transition into 2022. 2023 appears to share a similar trajectory although not as dramatic. However, the greatest change is that 2022 was Airbnb’s first year becoming profitable, as since inception, profit has not been reached (Supporting Document 2). This shows that despite a lesser profit 9 recuperated, IHG has been able to remain sustainable for the longer period and remain selfsufficient. Evidence for such is also backed by the Net Profit Margin, with IHG in both 2021 and 2022 boasting numbers that remain relatively unchanged while Airbnb has immense changes. This gives reason for IHG to not fear the change in perception towards Airbnb and technological advancement in the market for their model has remained consistently profitable even in times of distraught and struggle (Supporting Document 5). The contrasting narrative of whether to change to Airbnb versus sticking to a traditional hotel booking boils down to preference, whether a standardized stay or an individualized experience pushed by social media (Atkinson) 3.0 – Conclusion Evaluating the market share, it showed that Airbnb is the most successful at scale in comparison to other hotel giants, including IHG. This growth strategy however is not what incentivised change within IHG, as in in terms of value, IHG is not too far behind. What is causing fear within the IHG organization is the consumers attraction to technology-based trends and it’s easy to use style, which is Airbnbs USP. This can be cited as the change that IHG wants to counteract based on their actions. These actions are seen using the Ansoff matrix, where IHG has been utilizing multiple growth strategies to spread risk. For example, Market Development via the franchising model means they are asset light to keep up Airbnbs number of listings; but also, through Product Development through unorthodox moves such as creating new homegrown companies. IHG has directly challenged Airbnb’s change in the industry, by utilizing their own rewards program via an online application. Considering the financial aspects of the business it is clear to see that IHG has the more stable model, posting numbers of profitability in both 2021 and 2022, whilst Airbnb were 10 only able to successfully generate profits in 2022. This instability in business is unadmirable to customers and shareholders in comparison to IHG, showing that traditional hotels don’t feel pressured to change right away but instead change towards some tactics from Airbnb. In conclusion, the overall question can be answered by stating that IHG has had some changes because of Airbnbs growing popularity but also recognizes some aspects that does not need change. IHG’s hotel business model is more stable in the long term and can withstand pressure more successfully while generating streamline revenue despite the lack of market share in comparison. But Airbnb has forced IHG to adapt to the digital market and become more aggressive in growth. In future, IHG should continue to seek new pathways of growth and continue to emphasize importance in the digital landscape. 3.1 – Limitations As a result of gathering only secondary data, there may be bias present as well as questions about credibility about the information. As previously stated in the methodology, the supporting documents chosen were utilized with the hope that the balance in internal and external resources will eliminate these problems. 11 Works Cited • Supporting Document 1 IHGPLC. “Annual-Report-2022.” Annual Report and Form 20-F 2022, Mar. 2023, https://www.ihgplc.com/en/-/media/ihg/annualreports/2022/annual-report2022.pdf?la=en&hash=167797C0C5A95078FBBF51E91CB0A7AE • Supporting Document 2 airbnb Inc. “AirBnB Airbnb Q4 2022 and Full-Year Financial Results.” Airbnb Q4 2022 and Full-Year Financial Results, Feb. 2023, s26.q4cdn.com/656283129/files/doc_financials/2022/q4/Airbnb_Q4-2022Shareholder-Letter_Final.pdf. • Supporting Document 3 Wahi, Uvika. “Is Airbnb’s Growth and Expansion Strategy Paying off in 2023?: Rental Scale.” Up, 15 Aug. 2023, https://www.rentalscaleup.com/is-airbnbs-growthand-expansion-strategy-paying-off-in-2023/ • Supporting Document 4 Nicholls, Clare. “IHG to Expand Global Portfolio by Nearly a Third.” THP News, 22 Aug. 2023, https://tophotel.news/ihg-to-expand-global-portfolio-by-nearly-a-third/ • Supporting Document 5 Modern MBA, director. Why AirBnB Fails to Disrupt the Hotel Industry. YouTube, YouTube, 9 Apr. 2022, https://www.youtube.com/watch?v=-IdQ0sXCbxE Other Sources Atikinson, Elaine. “Disruptive Innovation or Industry Evolution: Examining Airbnb’s Impact.” Bost Innovation, Aug. 2023, bostinnovation.com/disruptive-innovation-orindustry-evolution-examining-airbnbs-impact/ EDRAW. “Ansoff Matrix.” Ansoff Matrix | EdrawMax Template, 2023, www.edrawmax.com/templates/1002457/. “Hotels - Worldwide: Statista Market Forecast.” Statista, June 2023, www.statista.com/outlook/mmo/travel-tourism/hotels/worldwide#revenue. Lominé, L., Muchena, M. and Pierce, R.A. (2022) Business management. Oxford: Oxford University Press. 12 Appendix Appendix 1 –Income Statement of IHG for 2021 & 2022 from Supporting Document 1 Appendix 2 – Profit and Loss Account of Airbnb for 2021 & 2022 from Supporting Document 2 13