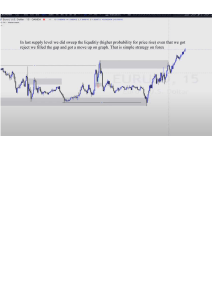

Gloryytrades Forex strategy Straight to the point this is my own strategy found by myself thru market experience and smc learnings. Just a disclaimer that if you see someone who is using the same strategy doesn t mean i copied him or he copied me. Forex market is just the biggest nance market itw so here you go: Main con uences: I use 2 very simple main con uences to see if market is even looking attractive to me. I only use these 2 con uences but does it mean that you become a pro table trader just because of using these con uences ,,my strategy’’ ? No, absolutely not because there is sooo much to do wrong and you might do wrong if i don t tell you. And still even if i tell you, things will go wrong but thats good so you gure out how to improve. If i tell you my strategy now you will think ,,huhh thats it?‘‘ But if it were so, everyone using smc would be pro table and this is not the case. All depends on how you use it. quick example: Some make money with their phone, ipad laptop and some waste their time scrolling on tiktok or instagram reels all day. Time is money. 15 min Liquiditiy sweep On the 15m timeframe i wait for a liquidity sweep. De ne liquidity wrong, probably lose the trade. De ne the sweep wrong, probably lose the trade. You won‘t believe me when i tell you how much di erence it can make if you don‘t know what liquidity is and if you can‘t spot it good enough. Thats something which never can be good enough. The skill of spotting liquidity and its sweep. As you know in the discord we will be backtesting together live so i will show you how i exactly do it on chart. fi fi fi fi fl fl fi fl fl fi ff this sellside liquidity (ssl) sweep looks clean af. If other things align a long position after sweep if possible would ve been a great win. If you look closely i have alerts on two buyside liquidity (bsl) to look for shorts after maybe. Here you can see 3 other examples of nice liq sweeps one of them on the right i even took a short and won. Your view on Trading charts will change when you once gure out price is doing nothing but sweeping liquidity in market. We don‘t go against market we go with it. Fair value gap (fvg) The second main con uence are fair value gaps. Immediately after the 15m liquidity sweep we want to see a displacement on the 1m chart which creates a fair value gap and proves selling or buying pressure. A displacement is a small fast move in a speci c direction (if ssl sweep look for bullish displacement, if bsl sweep look for bearish displacement. 15m liquidity sweep, 1m displacement with fair value gap and then you normally enter right wenn price runs into the fair value gap. If there was one perfect entry setup then it‘s this one. The sweep looks so fckn intentionall as market was designed to manipulate price. Look how exact it is. The displacement A+, The fair value gap size nice and then just entered on the fvg. over 1:3 RR. Stop loss on previous liquidity and target 1m lows or highs. fi fi fl I only use this strategy on EurUsd and GbpUsd and cutted all the other pairs i used to trade because of bad data long term Now all what matters and could question your pro tability is if you really stick to these rules: Pay attention (rules) 1. 2. 3. 4. 5. 6. Only use this in london session and new york session. If spread is high do not enter. If high impact news is in less than 45 minutes before you want to enter do not enter. If fair value gap is too big don‘t take it . It is better to use this wenn 15m is going sideways. Do not use this when 15m or even higher timeframes are too agressive in a trend against your possible position. 7. If fvg is too small don t enter right on fvg maybe after reaction o of it 8. If fvg was created too late and too far away from sweep don not use it cause it will hurt your RR and winning probability. 9. I would not recommend looking for a RR higher than 1:3 cause you might get reversals before hitting your TP 10. Test the strategy on demo until becoming really good then use a small funded acc (raw spread) There are still so many things which are important to pay attention to but if you are in the discord you will get to see me backtesting it live and recapping my trades where i will tell you more. Just so you know how important these rules are: Make too big RRs —> Decrease winrate and get unpro table Enter long when 15m and higher timeframe is too bearish —> Get stopped out in 10 seconds to 5 minutes (no joke) Enter on high spreads —> price may not react to your actual SL and TP and messes up the whole trade —> losing and getting unpro table If you do not not stay consistent —> you will not gure out your true potential and fail ff fi fi fi fi Write down and save your questions for some upcoming live streams. I won‘t answering questions about the strategy in private so you all join the live. 😁