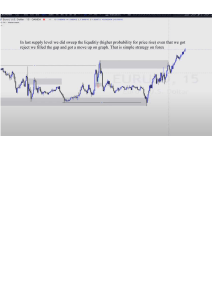

The Ultimate Forex Edge – 2 Bar Reversal Play THE ULTIMATE FOREX EDGE 2 Bar Reversal Play Brought to you by Page 1 The Ultimate Forex Edge – 2 Bar Reversal Play DISCLAIMER While all attempts have been made to verify information provided in this publication, neither the author nor the Publisher assumes any responsibility for errors, omissions or contrary interpretations of the subject matter herein. The publication is not intended for use as a source of legal or financial advice. The Publisher wants to stress that the information contained herein may be subject to varying state and/or local laws or regulations. All users are advised to retain competent counsel to determine what state and/or local laws or regulations may apply to the user’s particular business or personal circumstances. The purchaser or reader of this publication assumes responsibility for the use of these materials and information. Adherence of all applicable laws and regulations, both federal, state and local, governing investing in financial markets, professional licensing, business practices, advertising and all other aspects of doing business in any jurisdiction is the sole responsibility or liability whatsoever on behalf of any purchaser or reader of these materials. We expressly do not guarantee any result you may or may not get as a result of following our recommendations. You must test everything for yourself. Any perceived slight of specific people or organizations is unintentional. Before making an investment or trading decision based on the advice or material hereon, the recipient should consider carefully the appropriateness of the advice in light of his or her financial circumstances. This material is for informational & educational purposes only. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. All market prices, data and other information are not warranted as to completeness or accuracy and are subject to change without notice. Page 2 The Ultimate Forex Edge – 2 Bar Reversal Play TABLE OF CONTENTS INTRODUCTION....................................................................................................4 PRICE FORMATIONS ............................................................................................5 2 Bar Reversal Play Formation ..............................................................................6 Pivot Formation ....................................................................................................8 TRADE SETUP ..................................................................................................... 12 TRADE ENTRY .................................................................................................... 13 Long Setup ......................................................................................................... 13 Long Entry: ........................................................................................................ 13 Short Setup ......................................................................................................... 14 Short Entry: ........................................................................................................ 14 Long Stop Loss: ................................................................................................. 15 Short Stop Loss: ................................................................................................. 15 TRADE MANAGEMENT ..................................................................................... 16 Long Trade Management: ................................................................................... 16 Short Trade Management: ................................................................................... 17 TRADE OVERVIEW............................................................................................. 18 Long Trade Overview: ........................................................................................ 18 Short Trade Overview:........................................................................................ 19 TRADING RULES ................................................................................................ 20 Change of Bar .................................................................................................... 20 Valid Break of Entry Price .................................................................................. 21 Trend Consideration When Setup Occurs ............................................................ 23 TRADE EXAMPLES ............................................................................................. 27 Long Trade Examples ......................................................................................... 27 Short Trade Examples ......................................................................................... 32 FINAL THOUGHTS .............................................................................................. 36 Page 3 The Ultimate Forex Edge – 2 Bar Reversal Play INTRODUCTION I’ve always been looking out for new strategies that I can add to my trading arsenal, but nowadays I never really see anything that I haven’t come across before. Now I normally create my own strategies by combining my experience and knowledge of the markets, and can now “tweak” any strategies I come across. This strategy here is something that is very underrated. It is a very simple strategy, but probably one of the most powerful. What I love about this strategy is that it yields great risk reward, and is one of those strategies that is so simple that it normally goes “under the radar” when people are trying to discover new trading strategies. I have noticed that not many forex traders talk about this strategy, and I’m not sure why this is. Maybe because it is used more in other markets, but I have found it to work extremely well in forex. I will cover everything you need to know including the setup, entry, stop placement and trade management. This strategy will be a great addition to your trading plan, and can be a very powerful system when used as shown in this manual. Page 4 The Ultimate Forex Edge – 2 Bar Reversal Play PRICE FORMATIONS For this strategy, we will be looking at the following price formation: 2 bar reversal play formation Pivot formation The 2 bar play formation will be the actual price formation that will trigger entry, and the pivot formation is what we will use in our trade management. I will cover both formations now, and will then explain how we will use them in the later chapters of this manual. Page 5 The Ultimate Forex Edge – 2 Bar Reversal Play 2 Bar Reversal Play Formation This is a very simple price formation which obviously involves 2 price bars. It simply consists of 2 down bars or 2 up bars. With the down bars (red bars), we want the close of the second bar to be LOWER than the LOW of the first bar. With the up bars (green bars), we want the close of the second bar to be HIGHER than the HIGH of the first bar. Example of 2 Bar Play Formation (2 Up Bars) Example of 2 Bar Play Formation (2 Down Bars) Page 6 The Ultimate Forex Edge – 2 Bar Reversal Play Wrong Formations Here are examples and reasons why these price formations are NOT 2 Bar play formations: We will be using the 2 Bar Play formation for generating entry signals for this strategy (covered in next chapter) Page 7 The Ultimate Forex Edge – 2 Bar Reversal Play Pivot Formation A pivot is simply when the “high” or “low” of a bar “sticks out” from other bars around it. If the pivot is a “pivot high” (highs of other bars around it are lower), then we know there is supply around this pivot. If the pivot is a “pivot low” (lows of other bars around it are higher), then we know there is demand around this pivot. Page 8 The Ultimate Forex Edge – 2 Bar Reversal Play The technical definition of a pivot is: For a pivot high: A high of a bar is a pivot high if the bar to the left and right of it have a lower high than the high of the pivot high. Page 9 The Ultimate Forex Edge – 2 Bar Reversal Play For a pivot low: A low of a bar is a pivot low if the bar to the left and right of it have a higher low than the low of the pivot low. Page 10 The Ultimate Forex Edge – 2 Bar Reversal Play The more bars on either side with a higher low (for pivot lows) or lower highs (for pivot highs), the stronger the demand or supply is. We will be using pivot formations for the trade management of this strategy (covered later) Page 11 The Ultimate Forex Edge – 2 Bar Reversal Play TRADE SETUP Trading Tools Candle Stick Charting Daily Timeframe 10, 20, 50, & 200 Period Exponential Moving Averages 2 Bar Play formation The Moving averages are there just to give you sentiment of which direction the trend is. Of course you can judge this by just price itself, but there are times where prices can be trending up but price could still be below some of the longer term moving averages, so putting the moving averages on the chart can be helpful so you can always see the general picture of chart. Page 12 The Ultimate Forex Edge – 2 Bar Reversal Play TRADE ENTRY Long Setup 2 Bar Play Formation (Down Bars) Long Entry: 2nd Bar’s high broken Enter on break of high. Page 13 The Ultimate Forex Edge – 2 Bar Reversal Play Short Setup 2 Bar Play Formation (Up Bars) Short Entry: 2nd Bar’s low broken Enter on break of low. Page 14 The Ultimate Forex Edge – 2 Bar Reversal Play TRADE STOP PLACEMENT Long Stop Loss: Below low of 2nd bar in 2 bar play formation. (allow for broker spread) Short Stop Loss: Above high of 2nd bar in 2 bar play formation. (allow for broker spread) Page 15 The Ultimate Forex Edge – 2 Bar Reversal Play TRADE MANAGEMENT Long Trade Management: Move stop to Break even (entry price) when your profit in the trade equals the risk you put on the trade (when you are in profit the same number of pips you risked on the trade) ½ position taken off at previous pivot high. If this rule cannot be used (maybe previous pivot high too far or too close), then follow exit as per the 2 nd half exit: ½ remaining position to be trailed by placing a trailing stop under each pivot low formed. Page 16 The Ultimate Forex Edge – 2 Bar Reversal Play Short Trade Management: Move stop to Break even (entry price) when your profit in the trade equals the risk you put on the trade (when you are in profit the same number of pips you risked on the trade) ½ position taken off at previous pivot low. If this rule cannot be used (maybe previous pivot low too far or too close), then follow exit as per the 2 nd half exit: ½ remaining position to be trailed by placing a trailing stop above each pivot high formed. Page 17 The Ultimate Forex Edge – 2 Bar Reversal Play TRADE OVERVIEW Long Trade Overview: Long Setup 2 Bar Play Formation (Down Bars) Long Entry: 2nd Bar’s high broken Enter on break of high. LONG STOP LOSS: Below low of 2nd bar in 2 bar play formation. (allow for broker spread) LONG TRADE MANGEMENT: Move stop to Break even (entry price) when your profit in the trade equals the risk you put on the trade (when you are in profit the same number of pips you risked on the trade) ½ position taken off at previous pivot high. If this rule cannot be used (maybe previous pivot high too far or too close), then follow exit as per the 2 nd half exit: ½ remaining position to be trailed by placing a trailing stop under each pivot low formed. Page 18 The Ultimate Forex Edge – 2 Bar Reversal Play Short Trade Overview: Short Setup 2 Bar Play Formation (Up Bars) Short Entry: 2nd Bar’s low broken Enter on break of low. Short Stop Loss: Above high of 2nd bar in 2 bar play formation. (allow for broker spread) Short Trade Management: Move stop to Break even (entry price) when your profit in the trade equals the risk you put on the trade (when you are in profit the same number of pips you risked on the trade) ½ position taken off at previous pivot low. If this rule cannot be used (maybe previous pivot low too far or too close), then follow exit as per the 2nd half exit: ½ remaining position to be trailed by placing a trailing stop above each pivot high formed. Page 19 The Ultimate Forex Edge – 2 Bar Reversal Play TRADING RULES I will now cover some very important rules and scenarios that need to be addressed for this strategy: Change of Bar The first thing we need to address is a “change of bar” that can occur after the setup. This is simply a bar which has not broken the entry point (otherwise you would be in the trade), but has instead formed the opposite bar to the 2 bar setup (if going short then a down bar has formed after 2 up bars, or if going long an up bar has formed after 2 down bars) What you can do is trade it the next day as this Is still a valid setup (so enter on break of the high/low of this “change of bar”) Page 20 The Ultimate Forex Edge – 2 Bar Reversal Play Valid Break of Entry Price If the next bar formed after the setup does not break the entry point the next day, then this setup is considered void unless this bar is a “Change of bar” as explained above. e.g.1 e.g.2 Page 21 The Ultimate Forex Edge – 2 Bar Reversal Play Not Valid Play Page 22 The Ultimate Forex Edge – 2 Bar Reversal Play Trend Consideration When Setup Occurs It is very important that we understand when a setup is low risk or when it is high risk. Obviously it is best to just not trade the higher risk trades, but that doesn’t mean that you cannot make money from them. I recommend staying away from the higher risk trades and just sticking to the low risk ones. So what determines what is high risk or low risk? …….The Trend! Now generally we will be trading with the trend. I say “generally” because there will be times where we may trade against the general trend but with the smaller term trend. It is advisable to initially always trade with the trend and then as you gain experience, you may want to take some of the higher probability counter trend trades (even though I say counter trend here, these trades will still be going with the shorter term trend) Long Trades The easiest trades to take here are the trades that are in an up trending chart with all the ma’s nicely going up underneath price action. These long trade formations are no brainers. Page 23 The Ultimate Forex Edge – 2 Bar Reversal Play Then we may get trades that occur in the following scenario: We may get a 2 bar long play when price has failed to make a higher high but is still in a general up trend. The fact that price could not create a higher high is an indication of a shift of power from the buyers to the sellers. These trades should be left as there could be a high probability of getting stopped out. We want to avoid trading long positions where the previous pivot high before the setup is not higher than other recent pivot highs before it. To take this further and ensure we are trading the highest probability trades, we can avoid any long positions that happen when price is below the 50 EMA. If you would like to be more aggressive, then you can take trades in the long direction where previous low pivots are not being broken and the previous pivot before the setup is a recent high pivot. Page 24 The Ultimate Forex Edge – 2 Bar Reversal Play Short Trades The easiest trades to take here are the trades that are in a down trending chart with all the ma’s nicely going down above price action. These short trade formations are no brainers. Then we may get trades that occur in the following scenario: We may get a 2 bar short play when price has failed to make a lower low but is still in a general down trend. The fact that price could not create a lower low is an indication of a shift of power from the sellers to the buyers. These trades should be left as there could be a high probability of getting stopped out. Page 25 The Ultimate Forex Edge – 2 Bar Reversal Play We want to avoid trading short positions where the previous pivot low before the setup is not lower than other recent pivot lows before it. To take this further and ensure we are trading the highest probability trades, we can avoid any short positions that happen when price is above the 50 EMA. If you would like to be more aggressive, then you can take trades in the short direction where previous high pivots are not being broken and the previous pivot before the setup is a recent low pivot. Page 26 The Ultimate Forex Edge – 2 Bar Reversal Play TRADE EXAMPLES Long Trade Examples Trade 1: We see a 2 bar play (long) formation in an uptrend. (Entry tomorrow is blue line) Entry point is not broken the next day, but a change of bar forms the next day, so this play is still valid. We wait for the next day to break the entry point. (blue line) Page 27 The Ultimate Forex Edge – 2 Bar Reversal Play Entry point is broken the next day and we’re in! The stop is placed as shown (red line) The breakeven point is where the profit in the trade equals the risk put in the trade. This is as indicated. As we can see, this is very close to the last high, therefore even though generally we would be taking off ½ our position at the last high, in this case (seeing as it is so close to our breakeven point), we will simply trail the whole position as we would the second half (as if we had taken ½ off at the last high). Page 28 The Ultimate Forex Edge – 2 Bar Reversal Play The trade is managed as shown. The red lines show how the stop is moved as the trade unfolds. Page 29 The Ultimate Forex Edge – 2 Bar Reversal Play Trade 2 We see a 2 bar play (long) formation in an uptrend. (Entry tomorrow is blue line) Entry point is broken the next day and we’re in! The stop is placed as shown (red line) Page 30 The Ultimate Forex Edge – 2 Bar Reversal Play The breakeven point is where the profit in the trade equals the risk put in the trade. This is as indicated. As we can see, the last high was close to the entry point, so there is no point looking to take half the position of here, therefore even though generally we would be taking off ½ our position at the last high, in this case (seeing as it is so close to our entry point), we will simply trail the whole position as we would the second half (as if we had taken ½ off at the last high). The trade is managed as shown. The red lines show how the stop is moved as the trade unfolds. Page 31 The Ultimate Forex Edge – 2 Bar Reversal Play Short Trade Examples Trade 1: We see a 2 bar play (long) formation in an uptrend. (Entry tomorrow is blue line) Entry point is not broken the next day, but a change of bar forms the next day, so this play is still valid. We wait for the next day to break the entry point. (blue line) Page 32 The Ultimate Forex Edge – 2 Bar Reversal Play Entry point is broken the next day and we’re in! The stop is placed as shown. The breakeven point is where the profit in the trade equals the risk put in the trade. This is as indicated. As we can see, this is very close to the last low, therefore even though generally we would be taking off ½ our position at the last low, in this case (seeing as it is so close to our breakeven point), we will simply trail the whole position as we would the second half (as if we had taken ½ off at the last low). The trade is managed as shown. The red lines show how the stop is moved as the trade unfolds. Page 33 The Ultimate Forex Edge – 2 Bar Reversal Play Trade 2 We see a 2 bar play (long) formation in an uptrend. (Entry tomorrow is blue line) Entry point is broken the next day and we’re in! The stop is placed as shown (red line) Page 34 The Ultimate Forex Edge – 2 Bar Reversal Play The breakeven point is where the profit in the trade equals the risk put in the trade. This is as indicated. As we can see, the last low was close to the breakeven point, so there is no point looking to take half the position of here, therefore even though generally we would be taking off ½ our position at the last low, in this case (seeing as it is so close to our breakeven point), we will simply trail the whole position as we would the second half (as if we had taken ½ off at the last low). The trade is managed as shown. The red lines show how the stop is moved as the trade unfolds. Page 35 The Ultimate Forex Edge – 2 Bar Reversal Play FINAL THOUGHTS The 2 bar play takes advantage of the minor pullbacks in a trend and uses this pullback to generate a low risk buy or sell signal so you can trade high risk reward, high probability trades. We have also talked about how you can trade this strategy aggressively or conservatively depending on your trading objectives. In developing this system, I wanted to create a strategy that was very simple to follow yet gave high risk reward results, which has definitely been achieved here. I’m confident that if you take the time to trade this system, then you will be able to generate great profit from this strategy. To Your Trading Success, Kumar Kaushal Page 36