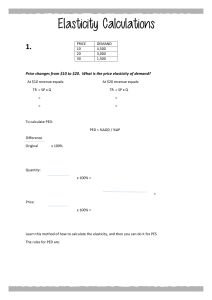

To assess whether Sarah's assumption is accurate, we need to delve into the concept of price elasticity of demand (PED). PED measures the responsiveness of quantity demanded to a change in price, and it is calculated as the percentage change in quantity demanded divided by the percentage change in price. Sarah believes that cutting the price in half will double her revenue. This assumption implies that the demand for her product is very elastic, meaning that any decrease in price will lead to a proportionally larger increase in quantity demanded. However, this is not always the case. The actual outcome depends on the elasticity of demand for her product: 1. Elastic Demand (PED > 1): If the demand for Sarah’s product is elastic, a decrease in price will lead to a more than proportional increase in quantity demanded. This could potentially increase total revenue, but not necessarily double it. 2. Inelastic Demand (PED < 1): If the demand is inelastic, a decrease in price will lead to a less than proportional increase in quantity demanded. In this case, total revenue would decrease. 3. Unitary Elastic Demand (PED = 1): If the demand is unitary elastic, a decrease in price will lead to a proportional increase in quantity demanded, leaving total revenue unchanged. Note that the steeper the curve the more elastic the demand. For instance, in the graph1 below, D1 is more elastic than D2, while graph2 depicts the special case of unitary elastic demand (D3). To elaborate further, the PED varies between different products due to several determinants: Availability of Substitutes: Products with many close substitutes tend to have more elastic demand. Necessity vs. Luxury: Necessities usually have inelastic demand, while luxuries have elastic demand. Proportion of Income: Products that take up a larger proportion of consumers’ income tend to have more elastic demand. Time Period: Demand is usually more elastic in the long run as consumers have more time to adjust their behaviour. In fact, even for a single product, the PED can vary along a straight-line downwardsloping demand curve: At higher prices and lower quantities, demand tends to be more elastic (i.e. the A to B portion of D4 in the graph3 below). At lower prices and higher quantities, demand tends to be more inelastic (i.e. the B to C portion of D4). Note that in point B, the PED equals 1. Therefore, for Sarah’s revenue to double when she halves the price, there is a unique elasticity that makes this possible. Let’s denote the initial price as P and the initial quantity as Q. The initial revenue is TR = P*Q. When the price is halved, the new price is 0.5P. For the revenue to double, it must be 2TR. Solving 2TR = 0.5P*xQ, gives as that the new quantity demanded (x) must be 4Q. The percentage change in price is: (0.5P-P)/P=-0.5 The percentage change in quantity demanded is: (4Q-Q)/Q=3 Using the formula for PED: PED=% change in price / % change in quantity demanded=−0.5/3=−6 This means the PED must be exactly six for Sarah’s expectation to hold true. This is an extremely high elasticity, indicating that the product’s demand is very sensitive to price changes. This scenario is rare and typically applies to luxury goods or products with many close substitutes. Summing up, Sarah’s belief hinges on the assumption that her product’s demand is highly elastic. In reality, the elasticity of demand varies across different products and possibly for the same product across time (as its price changes). Therefore, it’s crucial for Sarah to understand her product’s demand elasticity before making any pricing decisions to avoid potential revenue losses.