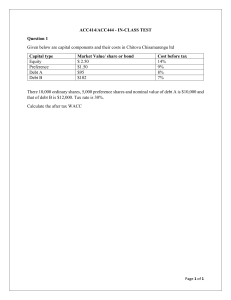

Capital Structure II Dr Yifan Zhou Capital Structure II • Does debt policy matter? • Corporate Taxes (tax shield) • The “trade-off ” theory and “pecking-order” theory Capital Structure II MM proposition 1: “The market value of any firm is independent of its capital structure.” Choice of capital structure The investors can borrow or lend on their own account on the same terms as firm: They can “undo” the effect of any changes in the firm’s capital structure. MM proposition 1: “The market value of any firm is independent of its capital structure.” Choice of cap ital structure Slice a pizza into five. We have one pizza, Slice a pizza into ten. We have two pizzas? No, we still have one! Capital Structure I MM’s argument that debt policy is irrelevant is an application of a simple idea. • Law of conservation of value • The value of an asset is preserved regardless of the financial claims. The Law of Conservation of Value MM’s argument that debt policy is irrelevant is an application of a simple idea. • Firm value is determined on the real assets • Not by the proportions of debt and equity securities issued to buy the assets Capital Structure II “The market value of any firm is independent of its capital structure.” • These assumptions are used to prove MM’s proposition 1. • • • • No taxes No bankruptcy costs No effect on management incentives Investors do not need choice or there are sufficient alternative securities Financial Risk and Expected Returns The MM’s proposition 2: Higher debt–equity ratio (D/E) then higher return on the common stock rE rA = rD(D / V) + rE(E / V) rE = rA + (rA – rD) [D/E] For an all-equity firm rA = rE ? Financial Risk and Expected Returns The MM’s proposition 2: Return on equity increases linearly with leverage (debt-equity ratio): rE = rA + (rA – rD)[D/E] Financial Risk and Expected Returns The MM’s proposition 2: Return on equity increases linearly with leverage (debt-equity ratio): rE = rA + (rA – rD)[D/E] Financial Risk and Expected Returns The MM’s proposition 2: Return on equity increases linearly with leverage (debt-equity ratio): rE = rA + (rA – rD)[D/E] Financial Risk and Expected Returns MM’s proposition 2 The expected return on equity rE increases linearly with debt–equity ratio so long as debt is risk-free. But if leverage increases the risk of debt, debtholders demand higher return on deb t. This causes the rate of increase in rE to slow down. Financial Risk and Expected Returns The MM’s proposition 2: 1. Borrowing raises the expected rate of return on shareholders’ investments 2. It also increases the risk of the firm’s shares 3. Thus, higher risk exactly offsets the increase in expected return 4. Stockholders no better or worse off Financial Risk and Expected Returns Two Warnings: Warning 1 Shareholders want management to increase the firm’s value. Shareholders are more interested in being rich than in a low weighted-a verage cost of capital. Financial Risk and Expected Returns Warning 2 Trying to minimize the weighted-average cost of capital seems to encourage logical short circuits like the following. We can reduce the weighted-average cost of capital by borrowing more? The extra borrowing leads stockholders to demand a still higher expected rate of return The cost of equity capital rE increases will hold WACC constant After-Tax Weighted-Average Cost of Capital When corporate taxes are introduced: • The cost of debt is much cheaper than other sources of funds • The after-tax WACC is calculated using the following expression: After-tax WACC = rD(1 – TC) (D/V) + rE(E/V) After-Tax Weighted-Average Cost of Capital MM’s Proposition Does debt policy matter? 1. WACC doesn’t depend on capital structure. 2. If debt is risk-free, the required return on equity increases linearly with the debt-equity ratio, but the overall return on asset does not change. 3. “There is no magic in financial leverage.” Corporate taxes Why Tax Shields? The interest that the company pays is a tax-deductible expense. Thus the return to debtholders escapes taxation at the corporate level. How much should a corporation borrow? Corporate taxes Why Tax Shields? For example, company pays €1 million in interest on its €10 million of debt. The cost of this debt is not €1 million Interest expense reduces taxable income by €1 million, resulting in a lower tax. Corporate taxes Why Tax Shields? If the company has a marginal tax rate of 40%, the €1 million of interest reduces the company’s tax bill by €0.4 costs the company (€1 million) (1 − 0.4) = €0.6 million before-tax cost of debt is 10%, after-tax cost of debt is (€0.6 million)/(€10 million) = 6%, or 10%(1 – 0.4). Corporate taxes Why Tax Shields? If the company not having sufficient income to offset with interest expense Effective marginal cost of debt would be10% rather than 6% If the limit on tax deductibility is reached, the marginal cost of debt is the cost of debt without any adjustment for a tax shield. Corporate taxes The tax deductibility of interest increases the total income that can be paid out to bondholders and stockholders. Corporate taxes Simplified balance sheets for Johnson & Johnson, September 2014(figures in millions). Corporate taxes Balance sheets for Johnson & Johnson with additional $10 billion of long-term debt substituted for stockhold ers’ equity (figures inmillions). Corporate taxes MM and Taxes: Value of firm = value if all-equity-financed + PV(tax shield) Corporate and Personal Taxes Perhaps corporate and personal taxation will: Uncover a tax disadvantage of corporate borrowing? Offsetting the present value of the interest tax shield? Corporate and Personal Taxes Corporate and Personal Taxes Costs of financial distress How much should a corporation borrow? The standard theory of optimal capital structure: firm balancing the present value of interest tax shields against the present value of costs of bankruptcy or financial distress. Value of a firm = value if all-equity-financed + PV(tax shield) – PV(costs of financial distress) Costs of financial distress How much should a corporation borrow? The “trade-off theory” suggests: To balance the tax advantage of borrowing against the costs of financial distress This theory successfully explains many industry differences in capital structure Costs of financial distress The “trade-off theory” suggests: This theory successfully explains many industry differences in capital structure Companies with safe, tangible assets and plenty of taxable income to shield could have high target ratios. Costs of financial distress The “trade-off theory” suggests: This theory successfully explains many industry differences in capital structure There are costs of adjusting capital structure. Costs of financial distress How much should a corporation borrow? The “trade-off theory” suggests: But cannot explain why many successful companies have little debt. The empirical studies show that evidence to support the trade-off theory is mixed. The pecking order of financing choices How much should a corporation borrow? The “pecking-order” theory: Managers know more about their companies than investors Because of this asymmetric information: 1. Companies will issue debt when they are confident about the future. 2. Companies will issue equity when they are doubtful. Thus, the security issued serves as a signal of managers’ confidence in their company’s future. The pecking order of financing choices The “pecking-order” theory: Managers know more about their companies than investors Asymmetric information: security issued serves as a signal of managers’ confidence in their company’s future. Issue debt when they are confident about the future Issue equity when they are doubtful Outsider investor Outside investor The pecking order of financing choices How much should a corporation borrow? The “pecking-order” theory: Why most profitable firms generally borrow less—don’t need outside money. Less profitable firms issue debt — do not have internal funds sufficient. The pecking order of financing choices How much should a corporation borrow? 1. Size. Large firms tend to have higher debt ratios. 2. Tangible assets. Firms with high ratios of fixed assets to total assets have higher debt ratios. 3. Profitability. More profitable firms have lower debt ratios. 4. Market to book. Firms with higher ratios of market-to-book value have lower debt ratios. Capital Structure II • Does debt policy matter? • Corporate Taxes (tax shield) • The “trade-off” theory and “pecking-order” theory