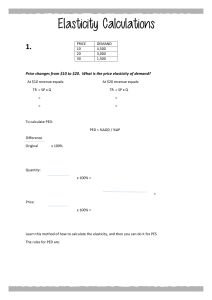

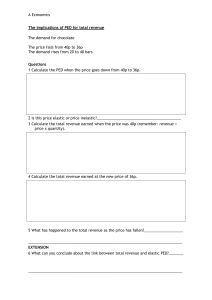

What is an Economics? - Economics is a study of how society solve basic economic problem. (uses limited resources to satisfy unlimited wants.) Difference between Economic goods and free goods. - Economic goods are scarce and therefore have an opportunity cost. - Free goods are those in unlimited supply and therefore no opportunity cost. Opportunity cost? - The value of what I have to give up in order to choose something else. - Cost of the best alternative given up. An Economy? - An Economy is a system that tries to manage a country’s available resources. - It tries to answer the questions of what, how, why, and for whom to produce. Ceteris Paribus - An assumption that “all other things remain the same” Positive economics - Deals with facts. Objective branch of economics. Normative economics - Deals with value judgement. Subjective branch of economics. 4 Main factors of production - Land - Labour: human capital- measure of skills, knowledges, and other qualities. - Capital - Entrepreneurship Rewards of factors of production - Land: rent, royalties, leasing, etc - Labour: wages, salaries. - Capital: (machinery’s) rent, leasing, dividends, - Entrepreneurship: profit PPF? - PPF shows the maximum possible output combination of two goods that can be produced using all available resources. - Any points on the PPF is product efficient point. However, not all of them are allocatively efficient. - Any points inside the PPF is inefficient. - Points outside of the PPF are not yet attainable. Efficiency - Refers to that an economy is making the best use of its resources. - Resources are being used to their maximum potential. Economic Growth - Increase of product capacity. - This is shown when PPF shifts to the right. Other factors that shifts PPF to the right - Investment in education/training can lead to improvement in human capital. - Technology advancement - Increase in quality or quantity of the inputs PPF shifts inwards - Natural disaster. - War might destroy infrastructures. - Fall in population -> decrease in labour resources. - High level of unemployment. Specialisation - Is when a country or an individual company focuses all of resources on producing a limited range of products. - This means that they have to forego other goods and obtain those from other company -> international trades -> Globalisation Globalisation - refers to the integration of national economies into a single international market. - This means countries are interdependent each other. Division of labour - Dividing production processes to enable workers to focus on specific tasks. Advantages of division of labour - Capital productivity and Labour productivity will increase. Because workers will be experts. - Cost effective – provide workers specialist tools; for example, every farm worker with motor vehicle is not efficient. - Time is saved since workers constantly staying in the same spot. - Workers can focus on what they are good at -> output will be higher. Disadvantages of division of labour - Boredom: repeating same tasks -> lost interests -> fall in efficiency -> lower output. - Workers will do everything to avoid work such as going to the toilet for 30min, sick every Monday and Friday and many others. - Overspecialisation may create structure unemployment, shortage of skills. - Breakdown in chain of production may cause chaos within the system. Structure of economy / Sectors of the economy - Primary – Extraction of raw material. Such as fishing, farming forestry and mining. - Secondary = manufacturing – takes raw materials and produce finished goods. Example, refining oil. - Tertiary = service – providing services, intangible goods. Such as insurance, entertainment tourism and restaurants. Private sector Verses Public sectors - Private sector – part of an economy that is run by individual for profit. - Public sector – is run by states/governments to produce public goods and services. Definition of a Market - Market is a place where buyers and sellers meet to exchange but nowadays internet made this easier, they do not necessarily meet each other. Barter - Is a cashless economic system where G&S are exchanged for others. There has to be a ‘double coincidence of wants’ for trades to occur. Money – legal tender - Means that it must be accepted if offered in payment of debts. Four main functions of Money - Medium of exchange. - A measure of values – measured by price of the goods. - Store of values - However, it may not be good way since it depreciates during periods of inflation. - A method of different payments – direct consequences of store of values and measure of values. Inflation may affect this function of money. Forms of money - Cash – most liquid form of money. - Money in current account – money in bank account. - Near monies – assets that can easily converted to cash such as accounts receivables and government bonds. - Non-money financial assets - shares of businesses - Money substitutes – anything that can be used as a medium of exchange but are not store of values; i.e Credit cards. Financial market - This is a market where financial assets are traded such as bonds, equities(stocks and shares), currencies and other securities. Role of Financial market - Facilitate(enable) saving – transferring spending power into the future. - Make funds available to firms and individuals – Loan. - Provide forward markets in commodities and currencies – to even out price fluctuation i.e sales of crop and paid in advance and delivery in six months. - Facilitate exchange of goods and services - Credit cards, debit cards. Economic agents - Households – own factors of production (Land, Labour, Capital, Entrepreneurship). - Firms – Groups and charities. - Government – laws and regulations. Allocation of resources - Means how scarce resources are distributed in an economy. - Through price mechanism (invisible hand) and planning (administrative decisions) Different types of economy - Free market economies (capitalist economies) – all resources are allocated through price mechanism. - Advantage – competition encouraged, rivalry – homogeneous goods, innovative and highquality goods: consumer can make choice. ->efficient ->Larger economies of scale. Politically free - Disadvantage – High level of income inequality, more risks. - Planned economies (command economies) – government controls allocation of resources. - Advantages – government provides welfare, so it is safer. - disadvantage – less choice, scarce innovation, poor quality, workers not motivated, Lack of competition, Autocratical political freedom, centralised. - Mixed economies – resources are allocated partly by the market and partly by the government. – good welfare, democratic. Rational decision making - Making decision that brings highest benefit possible. Economic theory - Assumes that all the economic agents are being rational. Margin - Additional or marginal. Reasons why consumers make irrational decision - Influence of other people – people tent to feel valued. E.g. teenager may insist his parents to buy expensive branded cloths rather than cheap one even if they cannot afford it. - Habitual behaviour – rule of thumb, routine behaviour because consumers feel easy and comfortable. - Consumer inertia – people have awareness that there is a better option, but they do not switch to better one because of laziness or they need too much effort. - Consumer weakness at computation. - Framing and bias – Framing is manipulating the way information is delivered. Demand - Refers to the quantity of goods or services that will be bought at any given price over a period of time. Non-price factors that affects demand curve - Increase in income level. - Change in price of substitutes and complements. - Changes in population – increase in demand of necessities. - Changes in fashion and trends. - changes in legislation. Law of diminishing marginal utility - As consumption increases, the marginal utility gain from each additional unit declines. It will reach to maximum at some point and eventually decline to below zero. - Extra satisfaction gotten from consumption of additional unit of product. Consumer surplus - Actual market price (minus) consumers’ wishing price. PED - %Change in quantity demanded divided by %change in price. - It represents the sensitivity of quantity demanded respect to change in prices. Price elastic PED>1 - Inferior goods. Inelastic PED<1 - Necessities Perfectly elastic PED=infinite Perfectly inelastic PED=0 Unitary elastic PED=1 PED on a straight-line demand curve - Perfectly elastic -> relatively elastic -> unitary elastic -> relatively inelastic -> perfectly inelastic. (descending order from left top to right bottom) Determinant of PED - Availability of substitutes – less substitutes -> inelastic since effect of price change is little. Width of market definition - food in general has no substitutes however crisps has thousands of substitutes. Therefore, when market definition is narrow, more likely elastic and vice versa. Time - In a short run, PED for most goods are inelastic since consumer may not have alternatives. But in a long run, PED becomes more elastic due to the innovations and inventions e.g oil in the past was inelastic but nowadays, there are some alternative energies such as nuclear power plant made oil relatively more elastic. Degree of necessity and luxury Proportion of consumer’s income How often consumer consumes the product Addictiveness of the product Chapter 9-18 YED - measures responsiveness of demand to a change in income Normal good - demand increases when income rises Inferior good - demand decreases when income rises Necessities - when YED is positive but less than 1 Luxuries - YED is positive and greater than 1 XED - responsiveness of quantity demanded in one good to a change in price of other good. When XED>0 = substitutes XED<0 = complements XED=0 not related PES - measures responsiveness of how much supply of a good will change when price changes. PES<1 inelastic PES>1 elastic Determinants of PES -Availability of substitutes. -Time -Spare capacity -Ability to hold stocks Supply: - amount of goods that producers are willing to sell at a given price over a period of time. Shifters of supply curve -Cost of production - Technology -Price of other goods -Government legislations -Weather -Producer cartel Producer surplus - Difference between price that sellers willing to sell and actual market price Price mechanism: - is a system where the forces of demand and supply determine prices and allocate resources in an economy Functions of Price mechanism -Rationing -Signalling -Incentive Indirect tax - is a tax paid indirectly by a consumer, it is included in the price of a product. Ad valorem tax - Tax is charged as a percentage of price, such as, VAT - Pivotal shifts Excise duty - Tax where a fixed amount of money is added to the price - Parallel shifts - Vertical distances between New equilibrium price and old price is total amount of taxes - Upper part is consumer burden / Lower part is producer burden - Sum of these are Government tax revenues Incidence of tax - It is how the tax is distributed between the producer and the consumer. Subsidy - Is a payment made to suppliers to encourage the production and consumption of a good. High consumer burden of tax or share of subsidy - PED INELASTIC AND PES ELASTIC. High producer burden of tax or share of subsidy - PED ELASTIC AND PES INELASTIC. Market failure - Is when price mechanism misallocates resources. Partial market failure - Over or under production. Complete market failure - Goods are not produced at all. Sources of Market failure - Externalities - Under-provision of public goods - Moral hazard - Information gaps - Speculation and market bubbles Externalities - The positive or negative effects of an economic activity on third parties. - Negative externality is where MSC > MPC - Positive externality is where MSB > MPB - Cost is Supply curve and Benefit is demand curve. - Market equilibrium when MPC=MPB - Social optimum when MSC=MSB Non-Provision of public goods Non-Excludable - Once a good is provided, it is impossible to prevent others benefit from the good such as radio Non-Rivalry - Ownership of a good does not prevents others using it, such as lighthouse. Public goods - Non rival and non-exclusive Quasi-public goods - Goods that are public in nature but do not exhibit full characteristics of non-rivalry and non-excludabilities such as TV subscriptions. Private goods - Both rival and excludable. Why public goods may not be provided by the private sector? - Firms have no incentive to make them because of “free rider problem” Imperfect market - For the market to work efficient, buyers and sellers have the same access to the same amount of information(symmetric). But in imperfect market, one party have more information than the other(asymmetric). As a result, the party with more information will take advantages from it. - This is called information failure, information gaps OR imperfect information. - Therefore, it leads to misallocation of resources (market failure) Principal-agent Problem - Is a situation when a party(agent) is allowed to make decisions on behalf of another party(principal) - Principal has ownerships and agent has controls. - For example, kids(principal) and parents(agent), Shareholders(principal) and managers (agent) - This will lead to market failure. Moral Hazard - It occurs when one party takes a risk with awareness that another party has to bear the risk. (There must be information gap) - For example, insurance and banking industry. (Read page 116) Market bubbles - It is when the value of an asset experiences a rapid rise followed by a significant decrease. Speculation - It is a risky action in which a person tries to predict what will happen to the price of an asset in the future and then buys and sells them with the hope of making profit.