Module 1 - Chapter 1 An Overview of Auditing - Download iLecture notes (1)

advertisement

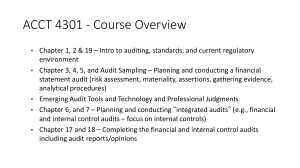

Module 1 Chapter 1: An overview of auditing ©2019 John Wiley & Sons Australia Ltd ELECTRONIC WARNING NOTICE FOR COPYRIGHT STATUTORY LICENCES Resource Copyright These slides have been reproduced with permission of Wiley. Modifications of slides by Curtin and the reproduction of those slides has also been permitted by Wiley. Learning objectives After studying this presentation, you should be able to: 1.1 explain what an audit is, what it provides, and why it is demanded 1.2 evaluate whether audits meet the demands of users 1.3 discuss the importance of regulation to auditing 1.4 explain the importance of national and international auditing standards. What is an audit? “A systematic process of objectively obtaining and evaluating evidence regarding assertions made about economic actions and events to ascertain the degree of correspondence between those assertions and established criteria and communicating the results to interested users” American Accounting Association (1973) What is an audit? • systematic process • objectively obtaining and evaluating evidence • regarding assertions made about economic actions and events • ascertain the degree of correspondence between those assertions and established criteria • communicate the results to interested users. What does an audit provide? • Auditor’s opinion: – Fair presentation framework: forms an opinion on whether the financial report presents fairly, in all material respects (or a true and fair view) in accordance with the applicable financial reporting framework – Compliance framework: forms an opinion on whether the financial report is prepared, in all material respects, in accordance with the framework. ASA 700 Why is there a demand for audits? • Agency theory • Information hypothesis • Insurance hypothesis • Regulation Agency theory • A principal contracts an agent to work on their behalf • Each party is motivated by self interest • Information asymmetry arises • An independent audit reduces the incentives for problems Information hypothesis • Investors demand quality information in assessing the risks and returns of their investments • Audits improve the quality of information in financial reports • Reduces information risk and leads to improved decision making Insurance hypothesis • Interested parties: – Investors and creditors demand an audit to be prudent and insure against losses – Regulators to insulate themselves from criticism by directing blame to auditors. Regulation • Annual audits required by: – Companies, registered schemes & disclosing entities (excludes small proprietary companies) – Commonwealth and state government departments, statutory authorities, government companies and business undertakings, and municipalities – Not-for-profit organisations including educational institutions. Who provides audits? • Financial audits are provided by independent auditors • Must be registered with ASIC to be able to perform audits on reporting entities • Criteria set out in s.1280 Corporations Act: – Educational qualifications – Work experience – Good character (fit and proper person) – Ordinarily resident in Australia – Member of CA ANZ, CPA Australia, or IPA. The audit expectation gap “the difference between what auditors actually do when they conduct an audit and what shareholders and others think auditor's do, or should do, in conducting the audit” Report of HIH Royal Commission Audit expectation gap Audit expectation-performance gap Society’s Perceived Performance Performance gap Reasonableness expectation gap of auditors of auditors Deficient Deficient performance standards Unreasonable expectations Regulation and other oversight • CLERP 9 changes – Major impacts: • Role of audit in corporate governance • Auditor independence • Audit quality. Quality-related changes • Role of Financial Reporting Council: – role broadened to include oversight of the AUASB – auditing standards given the force of law. • Annual general meetings: – Shareholders permitted to submit questions to the auditors before the AGM – Auditor must attend the AGM and answer questions asked by shareholders. Regulation and other oversight • Australian Securities and Investment Commission (ASIC): – Regulates corporate, markets and financial services sector – Advise on selling of and disclosure of financial products and services to consumers – Majority of work carried out under Corporations Act. Regulation and other oversight • Companies Auditors Disciplinary Board (CADB): – Established under ASIC Act – Hears breaches under Corporations Act by auditors and liquidators. • Australian Securities Exchange (AXS): – Monitors specific aspects of the businesses of other organisations – Listing Rules are enforceable against listed entities under the Corporations Act. Auditing Standards • Auditing and Assurance Standards Board (AUASB): – AUASB’s role is to develop high-quality auditing and assurance standards – Standards have the force of law under the Corporations Act s. 336 – Ensure ASAs conform with their IAASB equivalents, address local regulatory issues and promote consistency in application – Also issues ASREs (review engagements), ASAEs (assurance engagements) and ASRSs (related services). International auditing standards • Issued by the IAASB under the auspices of the International Federation of Accountants • IAASB’s objective: – serve the public interest by setting high-quality international standards for auditing, quality control, review, other assurance, and related services – facilitating the convergence of international and national standards.