\

Class IAr,v,'V

Student Name

Level 2 Accounting, 2021

91176 (AS 2.3) Prepare financial information for an entity that

operates accounting subsystems

Credits: Five

Achievement

Prepare financial information

for an entity that operates

accounting subsystems.

Achievement Criteria

Achievement

with Merit

Achievement

with Excellence

Prepare in-depth financial

information for an entity that

operates accounting subsystems.

Prepare comprehensive financial

information for an entity that

operates accounting subsystems.

Use the 2.3 Resource Booklet to answer the questions in this assessment.

You should answer ALL the questions in this booklet.

Show ALL working.

YOU MUST HAND THIS BOOKLET TO THE SUPERVISOR AT THE_END OF .THE EXAMINATION.

TOTAL

cSTION ONE

,efer to the Resourc e w hen answering all parts of this quest·,on.

Dirt

B Gone

a sole

proprietor

. 99 B

Gone_

orrersis both

d<>nestic

andb' :

end ..,,..,erad

by _

oeve

fo< GST on the ,,,,_ basi9. Olrl

Dave this year is attending the N rthl merc,al deanr~ services. Dave employs one part time cleaner.

Gone. The remainder of Dirt Go and H~e and Lifestyle Show 10 adVertise the servlceS of Dirt B

8 one advert,s,ng ,s done through his wet>site.

(a) Complete th e general journal entry for Dirt B Gone who rents out some of their spare offiCe space for

$2000 exduding GST per month This space was rented out for the full year

I 31/03/21 I

i,, I}()()

U,~

),()tPt7

k7Vll,

'

Rent Received in advance

I

I

(b) Complete the following general ledger accounts shOWing entries at 31 March 2021 including dosing

entries where relevant.

u

Cleaning Fees

1-__J~t:{.&lJ~

(ii)

~ ~0L.---'-~ = =

-·= -i...~~..J.2:=~ ~{r

~

Accounts Receivable

l!f v[O

Il 00

15 Elf o

ti~·o

IZ Ol(fJ

31/03/21

0/1

I J, g6CJ fJ

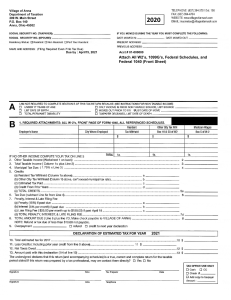

Complete the Income Statement for Dirt B Gone. You are required to dassify expenses as Cleaning

Expenses, Administrative Expenses and Finance Costs. Do not use abbntvlations.

Dirt B Gone Income statement for the year anded 31 March 2021

$

$

aozo

/5 5()

~

!6

ZCETA Accounting Level 2 Achievement Stan~ard 911 (~.3) ~ : : : = 1 o f this resource.

NZCETA has approval from NZQA to use their matenals m the

$

.:STION lWO

efer to the Resource when answering all parts of this question.

:a) Complete the general journal entry for Dirt B Gone to record the Home Show expenses paid in

advance, $2,760 including GST.

31/03/21

Home Show expenses paid in advance.

(b) Complete the general journal entry for Dirt B Gone to record the Dividends Received owing $200.

31/03/21

ZtJC

Dividends Received owing

(c) Complete the following general ledger account showing entries at 31 March 2021 induding dosing

entry where relevant.

Dividends Received

31/03/21

111111r.- NZCETA

~

CETA Aa;oooling Level 2 A,chieYement Standard 91176 (2.3)

2021

bas ~ a l m,m NZQA to me their ma,ials in th,, deulu;:,,_. ulthil resource.

Using information from the Resource

1 th e statement of Financial Position (extract) for Dirt

B Gone as at 31 March 2021.

'compete

Dirt B Gone Statem ent of F'manc1al

. Position (extract) as at 31 March 2021

$

$

Current Assets

50

o 1~soo

(e) Complete the following general ledger account showing entries at 31 March 2021 induding dosing

entry where relevant.

Drawings

31/03/21

30. r;tJO

I

I

(

CETA Accodlling Level 2 Achievement Standard 91176 (2.3) Assessment 2021

NZCETA bas appn,Yal from NZ0A to use their mallerials in the development of this resource.

5

(f) Using information from the Resource, complete the Statement of Financial Position (extract) for Dirt

B Gone as at 31 March 2021.

Dirt B Gone Statement of Financial Position (extract) as at 31 March 2021

Equity

. rJi CJO

3a. 00 0

Closing capital

.~·---M~01 111; 12 31 Assessment 2021 . .

JESTION THREE

Refer to the Resource to answer parts (a)_ (d)

(a) Complete the general journal ent f

.

Vacuum Cleaners (Cleaning E _ry or D,rt B Gone to record the invoice on hand for new Robot

qu,pment) $4,830 including GST.

31/03/21

[;,I ZtJ6

630

Invoice on hand for new Robot Vacuum Cleaners

(b) Complete the following general ledger account showing entries at 31 March 2021 induding dosing

entry where relevant.

Depreciation Cleaning Equipment

31/03/21

(J(JO

TA Accounting Level 2 Achievement Standard 91176 (2.3) Assessment 2021

_

th · _ _._rial5 in the development ol t111s ,esource.

CE ''

NZCETA has approval from NZQA to use eir ""'""

7

•) Complete the following extracts from the notes to the financial statements for Dltt B Gone.

Dirt B Gone Notes to the financial statements (extract)

Property, plant and equipment (extract)

Cleaning

Equipment

For the year ended 31 March 2021

tJ(}

t,,tl

Investment Asset

3

<10

1

I

\d) Complete

th e fallowing

. general led

cl ·

osing entry where relevant.

ger accoont showing entries as al 31 March 2021 indudinQ

Accounts Payable

31/03/21

I g~+

During April 2021 , Dave had the fol/owing information ab<>UI Dirt B Gone:

d/J!< P

• An invoice on hand from his cleaning product suppliers, totalling, $1 ,830 including GST.

ll

• Dave decided to fit out his deaning vehicles with she/VOS so cleaning product supplieS could be

conveniently stored on boanl. The cost of this fit out was $9,660 including GST, with a 20%

non-refundable depOSil tt,at had to paid immediately. Dave was sent an invoice tor the completed jot>

• On

18 April.

April, oave

on 12

~(} retumed some carpel deaning products to the suppliers as they were 1avender

scented instead of rose scented, he received a credit note of $450.

• Hwas recorded in

that the discount received for April was $275.

• On 30 April, the balance of Accounts Payable was $4,500 (dosing balance of Accounts Payable)

• The opening balance of Accounts Payable as at 1 April 2021 is the closing balance you calculated

earlier in the Accounts Payable /edger in (d) aboVe- In other words, the dosing balance of Accounts

xe,o

Payable on March 31.

Calculate the cash paid to accounts payable during April 2021 using relevant information from above.

(e) Show and fully label all your workings. Only labelled working will be marked.

:f

{ ~a!>

tw>:

f

Cash paid to Accounts Payabl $

- .

. -~ nH 7 1: I? ,.,

6.J q67

Assessment 2021