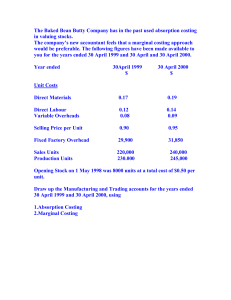

Special Qualifying Examination-Part 2 1. What is the contribution margin ratio? a. Total Sales / Total Variable Costs b. (Total Sales - Total Fixed Costs) / Total Sales c. (Total Sales - Total Variable Costs) / Total Sales d. Total Fixed Costs / Total Sales Answer: c) (Total Sales - Total Variable Costs) / Total Sales Supporting Computation: Contribution Margin Ratio = (Total Sales - Total Variable Costs) / Total Sales 2. If the contribution margin ratio is 0.40 and the total sales are Php100,000, what is the total variable cost? a. Php60,000 b. Php40,000 c. Php50,000 d. Php30,000 Answer: Php60,000 Supporting Computation: Total Variable Costs = Total Sales - (Total Sales * Contribution Margin Ratio) = Php100,000 - (Php100,000 x 0.40) = Php100,000 - Php40,000 = Php60,000 3. What is the break-even point in units if the selling price per unit is Php20, variable cost per unit is Php10, and total fixed costs are Php30,000? a. 3,000 units b. 2,000 units c. 1,500 units d. 1,000 units Answer:3,000 units Supporting Computation: Break-Even Point (in units) = Total Fixed Costs / Contribution Margin per Unit = Php30,000 / (Php20 - Php10) = Php30,000 / Php10 = 3,000 units 4. If the break-even point in peso is Php50,000, the selling price per unit is Php25, and the contribution margin ratio is 0.60, what are the total fixed costs? a. Php20,000 b. Php30,000 c. Php40,000 d. Php50,000 Answer: Php30,000 Supporting Computation: Total Fixed Costs = Break-Even Point (in dollars) / Contribution Margin Ratio = Php50,000x 0.60 = Php30,000 5. What is the profit at a sales level of Php80,000, given a selling price per unit of Php15, variable cost per unit of Php8, and total fixed costs of Php20,000? a. Php5,000 b. Php10,000 c. Php15,000 d. Php17,600 Answer:Php17,600 Supporting Computation: Profit = (Total Sales - Total Variable Costs) - Total Fixed Costs = [Php80,000 x (Php15-Php8)/Php15]- Php20,000 = [Php80,000x.47) - Php20,000 = Php17,600 6. What does the Margin of Safety represent in Cost-Volume-Profit analysis? a. The difference between actual sales and break-even sales b. The percentage difference between selling price and variable cost c. The safety measures taken to prevent losses d. The difference between budgeted sales and actual sales Answer: The difference between actual sales and break-even sales 7. How is the Margin of Safety calculated? a. Margin of Safety = Total Sales - Total Variable Costs b. Margin of Safety = (Total Sales - Break-Even Sales) / Total Sales c. Margin of Safety = (Total Sales - Total Fixed Costs) / Total Sales d. Margin of Safety = (Break-Even Sales - Total Sales) / Break-Even Sales Answer: Margin of Safety = (Total Sales - Break-Even Sales) / Total Sales 8. If the Margin of Safety is 20% and the total sales are Php100,000, what is the break-even sales? a. 20,000 b. 80,000 c. 125,000 d. 25,000 Answer: Php80,000 Supporting Computation: Break-Even Sales = Total Sales - (Margin of Safety * Total Sales) = Php100,000 - (0.20 xPhp100,000) = Php80,000 9. What is the Break-Even Point in peso if the contribution margin ratio is 0.30, the selling price per unit is Php50, and the total fixed costs are Php30,000? a. Php100,000 b. Php150,000 c. Php50,000 d. Php75,000 Answer: Php100,000 Supporting Computation: Break-Even Point (in dollars) = Total Fixed Costs / Contribution Margin Ratio = Php30,000 / 0.30 = Php100,000 10. If the desired profit is Php15,000, the selling price per unit is Php30, and the variable cost per unit is Php15, and a total fixed cost of Php30,000, how many units must be sold to achieve the desired profit? a. 1,000 units b. 1,500 units c. 2,000 units d. 3,000 units Answer: 3,000 units Supporting Computation: Units to be Sold = (Total Fixed Costs + Desired Profit) / Contribution Margin per Unit = (Php30,000,000 + Php15,000) / (Php30 - Php15) = Php45,000 / Php15 =3,000 units 11. If the break-even point is 2,000 units, and the actual sales are 2,500 units, what is the Margin of Safety in units? a. 500 units b. 1,000 units c. 2,000 units d. 2,500 units Answer: 500 units Supporting Computation: Margin of Safety (in units) = Actual Sales - Break-Even Sales = 2,500 units - 2,000 units = 500 units 12. If the contribution margin ratio is 0.25, the desired profit is Php20,000, and the total fixed costs are Php40,000, what are the required total sales to achieve the desired profit? a. Php240,000 b. Php100,000 c. Php80,000 d. Php120,000 Answer: Php240,000 Supporting Computation: Required Total Sales = (Total Fixed Costs + Desired Profit) / Contribution Margin Ratio = (Php40,000 + Php20,000) / 0.25 = Php60,000 / 0.25 = Php240,000 13. If the selling price per unit is Php40, variable cost per unit is Php25, and the desired profit is Php15,000, and Php30,000 fixed cost, what is the break-even point in units? a. 2,000 units b. 3,000 units c. 4,000 units d. 5,000 units Answer: 2,000 units Supporting Computation: Break-Even Point (in units) = Total Fixed Costs / Contribution Margin per Unit = Php30,000 / (Php40 - Php25) = Php30,000 / Php15 = 2,000 units 14. If the contribution margin ratio is 0.40, the desired profit is Php25,000, Php10,000 fixed cost, and the selling price per unit is Php60, what are the required total sales to achieve the desired profit? a. Php87,500 b. Php50,000 c. Php62,500 c. Php75,000 Answer: Php87,500 Supporting Computation: Required Total Sales = (Total Fixed Costs + Desired Profit) / Contribution Margin Ratio = (Php10,000 + Php25,000) / 0.40 = Php35,000 / 0.40 = Php87,500 15. If the contribution margin ratio is 0.20, the break-even sales are Php200,000, and the selling price per unit is Php50, what are the total variable costs? a. Php50,000 b. Php160,000 c. Php50,000 d. 40,000 Answer: Php160,000 Supporting Computation: Total Variable Costs = Break-Even Sales x Cost Ratio = Php200,000 x (1.00-0.20) = Php200,000 x .80 = Php160,000 16. Which of the following statements is true regarding absorption costing? a. It only considers variable manufacturing costs in product cost calculation. b. It includes both variable and fixed manufacturing costs in product cost calculation. c. It excludes all manufacturing costs from product cost calculation. d. It only considers fixed manufacturing costs in product cost calculation. Absorption costing involves the allocation of both variable and fixed manufacturing costs to products. The formula for calculating the total product cost under absorption costing is as follows: Total Product Cost=Direct Materials+Direct Labor+Variable Manufacturing Overhead+Fixed Manufacturing OverheadTot al Product Cost=Direct Materials+Direct Labor+Variable Manufacturing Overhead+Fixed Manufacturing Overhead Therefore, option B is correct as absorption costing includes both variable and fixed manufacturing costs in the calculation of the total product cost. 17. What is the primary objective of absorption costing? a. To allocate only variable costs b. To allocate both variable and fixed costs c. To exclude fixed costs from product cost d. To minimize total manufacturing costs Answer: B. Absorption costing allocates both variable and fixed costs to products. 18. In absorption costing, fixed manufacturing costs are assigned to: a. Cost of goods sold b. Inventory c. Selling expenses d. Administrative expenses Answer: B. Fixed manufacturing costs are assigned to inventory. 19. Which cost is NOT considered in the calculation of total product cost under absorption costing? a. Direct materials b. Direct labor c. Variable selling expenses d.Fixed manufacturing overhead Answer: C. Variable selling expenses are not part of the total product cost under absorption costing. 20. What is the impact of producing more units than are sold on net income under absorption costing? a. Net income increases b. Net income decreases c. Net income remains unchanged d. Cannot be determined Answer: A. Net income increases as fixed costs are spread over more units. 21. Which statement is true about absorption costing and variable costing net income in periods of increasing production? a. They are equal b. Absorption costing is higher c. Variable costing is higher d. They cannot be compared Answer: B. Absorption costing is higher due to the inclusion of fixed manufacturing costs in inventory. 22. What is the formula for calculating the cost of goods sold under absorption costing? a. Beginning Finished Goods + Cost of Goods Manufactured - Ending Finished Goods b. Beginning Inventory + Purchases - Ending Inventory c. Beginning WIP Inventory + Total Manufacturing Costs - Ending WIP Inventory d. Beginning Work-in-Progress (WIP) + Direct Materials Used - Ending WIP Answer: C. The formula for calculating cost of goods sold under absorption costing is Beginning WIP Inventory + Total Manufacturing Costs - Ending WIP Inventory. 23. Which of the following is an advantage of absorption costing? a. Provides better decision-making information b. Eliminates the need for allocating fixed costs c. Matches costs with revenues for external reporting d. Ignores variable costs Answer: C. Absorption costing matches costs with revenues for external reporting. 24. In absorption costing, when production exceeds sales, what happens to the amount of fixed manufacturing costs allocated to each unit? a. Increases b. Decreases c. Remains constant d. Becomes zero Answer: A. When production exceeds sales, fixed manufacturing costs are spread over more units, causing the cost per unit to increase. 25. Which statement is correct about the treatment of fixed manufacturing overhead in absorption costing? a. It is expensed when incurred b. It is capitalized as part of the product cost c. It is ignored in product costing d. It is considered a variable cost Answer: B. Fixed manufacturing overhead is capitalized as part of the product cost under absorption costing. 26. How does absorption costing affect inventory values compared to variable costing? a. Higher ending inventory under absorption costing b. Lower ending inventory under absorption costing c. No impact on ending inventory d. Ending inventory is not reported Answer: A. Absorption costing typically results in higher ending inventory values compared to variable costing. 27. Which of the following statements is true regarding absorption costing and external reporting? a. Absorption costing is not suitable for external reporting. b. Variable costing is preferred for external reporting. c. Absorption costing is generally required for external reporting. d. External reporting does not consider any manufacturing costs. Answer: C. Absorption costing is generally required for external reporting as per Generally Accepted Accounting Principles (GAAP). 28. Under absorption costing, how are fixed manufacturing costs treated when units are sold? a. Expensed immediately b. Deferred to the next period c. Included in the cost of goods sold d. Treated as an operating expense Answer: C. Fixed manufacturing costs are included in the cost of goods sold when units are sold under absorption costing. 29. Which of the following costs is not included in the calculation of total product cost under absorption costing? a. Direct labor b. Variable manufacturing overhead c. Variable selling expenses d. Fixed administrative expenses Answer: D. Fixed administrative expenses are not included in the total product cost under absorption costing. 30. How does absorption costing treat fixed manufacturing overhead when production is less than sales? a. Allocates a portion to cost of goods sold b. Allocates the entire amount to ending inventory c. Allocates the entire amount to cost of goods sold d. Does not allocate any fixed costs Answer: B. Absorption costing allocates the entire amount of fixed manufacturing overhead to ending inventory when production is less than sales. 31. In absorption costing, what is the impact on net income when production equals sales? a. Net income is higher than variable costing b. Net income is lower than variable costing c. Net income is equal to variable costing d. Net income cannot be determined Answer: C. Net income under absorption costing is equal to variable costing when production equals sales. 32. What is the primary drawback of absorption costing for internal decision-making? a. Difficulty in calculating b. Overemphasizes fixed costs c. Ignores variable costs d. Excludes selling expenses Answer: B. The primary drawback is that absorption costing overemphasizes fixed costs, which can distort internal decision-making. 33. Which of the following costs is treated as a period cost under absorption costing? a. Direct materials b. Direct labor c. Variable manufacturing overhead d. Fixed selling expenses Answer: D. Fixed selling expenses are treated as a period cost under absorption costing. 34. Under absorption costing, what happens to net income when production exceeds sales? a. Net income increases b. Net income decreases c. Net income remains constant d. Net income is not affected Answer: A. Net income increases when production exceeds sales under absorption costing. 35. How is the under-applied or over-applied overhead adjusted in absorption costing? a. It is ignored b. It is allocated to cost of goods sold c. It is allocated to ending inventory d. It is allocated to both cost of goods sold and ending inventory Answer: D. Under-applied or over-applied overhead is allocated to both cost of goods sold and ending inventory in absorption costing. 36. What is the primary focus of direct costing in cost accounting? a. Allocating both variable and fixed costs to products b. Excluding fixed manufacturing costs from product costs c. Ignoring variable costs in product cost calculation d. Considering only variable manufacturing costs Answer: D. Direct costing focuses on considering only variable manufacturing costs in product cost calculation. 37. Which statement is true regarding the treatment of fixed manufacturing overhead in direct costing? a. It is included in product costs. b. It is excluded from product costs. c. It is allocated to ending inventory. d. It is expensed when incurred. Answer: B. Fixed manufacturing overhead is excluded from product costs in direct costing. 38. Under direct costing, how are fixed manufacturing costs treated when units are sold? a. Expensed immediately b. Deferred to the next period c. Included in the cost of goods sold d. Treated as an operating expense Answer: A. Fixed manufacturing costs are expensed immediately when units are sold under direct costing. 39. What is the primary advantage of direct costing for internal decision-making? a. Simplifies cost calculations b. Matches costs with revenues c. Conforms to GAAP d. Allocates fixed costs to inventory Answer: A. The primary advantage of direct costing for internal decision-making is that it simplifies cost calculations. 40. Which statement is true about the treatment of variable selling expenses in direct costing? a. They are included in product costs. b. They are excluded from product costs. c. They are allocated to ending inventory. d. They are treated as a period cost. Answer: D. Variable selling expenses are treated as a period cost in direct costing. 41. What is the primary distinction between absorption costing and direct costing? a. Treatment of variable costs b. Inclusion of fixed costs c. Exclusion of direct labor d. Allocation of selling expenses Answer: B. The primary distinction is the inclusion of fixed costs in absorption costing. 42. In absorption costing, fixed manufacturing costs are: a. Expensed when incurred b. Capitalized as part of the product cost c. Ignored in product costing d. Treated as variable costs Answer: B. Fixed manufacturing costs are capitalized as part of the product cost in absorption costing. 43. What does direct costing focus on when calculating product costs? a. Both variable and fixed costs b. Only variable manufacturing costs c. Variable and fixed selling expenses d. Variable and fixed administrative expenses Answer: B. Direct costing focuses on only variable manufacturing costs. 44. How does direct costing treat fixed manufacturing costs when calculating the cost of goods sold? a. Allocates a portion to cost of goods sold b. Excludes fixed costs from the cost of goods sold c. Allocates the entire amount to ending inventory d. Treats fixed costs as a separate line item Answer: B. Direct costing excludes fixed manufacturing costs from the cost of goods sold. 45. ABC Inc. produced 10,000 units and sold 8,000 units during the year. The variable manufacturing cost per unit is Php20, and the fixed manufacturing cost is Php30,000. Calculate the cost of goods sold under absorption costing. a. Php240,000 b. Php160,000 c. Php200,000 d. Php184,000 Solution: Cost of goods sold = Variable mfg. cost + Fixed mfg cost = (8,000 x Php20) + (Php30,000x 8/10) = Php160,000 + Php24,000 = Php184,000 46. XYZ Company produced 15,000 units and sold 12,000 units during the year. The variable manufacturing cost per unit is Php15, and the fixed manufacturing cost is Php40,000. Calculate the ending inventory under absorption costing. a. Php50,000 b. Php60,000 c. Php40,000 d. Php53,000 Solution: Ending Inventory = (Ending Inventory in Units x VC per unit) + Allocated Fixed Mfg Cost for EI = (3,000 units x Php15) + (Php40,000 x 3,000/15,000) = Php45,000 + Php8,000 = Php53,000 47. The standard variable manufacturing cost per unit is Php25, and the actual variable manufacturing cost incurred is Php28. Calculate the variable manufacturing cost variance per unit. a. Php2 b. Php3 c. Php1 d. Php4 Solution: Variable Manufacturing Cost Variance per Unit=Actual Variable Cost per Unit−Standard Variable Cost per UnitVariable M anufacturing Cost Variance per Unit=Actual Variable Cost per Unit−Standard Variable Cost per Unit =Php28 - Php25 = Php3 Answer: Php3 48. A company produced 12,000 units and sold 10,000 units during the year. The variable manufacturing cost per unit is Php12, and the fixed manufacturing cost is Php60,000. Calculate the variable cost of goods sold under direct costing. a. Php120,000 b. Php100,000 c. Php125,000 d. Php110,000 Solution: 10,000 units x Php12.00 = Php120,000 49. What is the primary objective of Activity-Based Costing (ABC)? a. To allocate costs based on direct labor hours b. To allocate costs based on machine hours c. To allocate costs based on activities that consume resources d. To allocate costs based on the number of units produced Answer: c. To allocate costs based on activities that consume resources 50. In ABC, which of the following is used as the primary cost driver for allocating overhead costs? a. Direct labor hours b. Machine hours c. Number of units produced d. Activity measures related to cost drivers Answer: d. Activity measures related to cost drivers 51. What is the first step in implementing Activity-Based Costing? a. Identify cost pools b. Assign costs to cost objects c. Identify cost drivers d. Identify and classify activities Answer: d. Identify and classify activities 52. How does ABC differ from traditional costing methods? a. ABC allocates costs based on volume, while traditional methods allocate costs based on activities. b. ABC uses one cost pool for all overhead costs, while traditional methods use multiple cost pools. c. ABC allocates costs directly to products, while traditional methods use indirect cost allocation. d. ABC considers the impact of various activities on costs, while traditional methods rely on direct labor hours. Answer: d. ABC considers the impact of various activities on costs, while traditional methods rely on direct labor hours. 53. What is a cost driver in the context of Activity-Based Costing? a. The total cost of production b. A factor that causes costs to be incurred in an activity c. The variable cost per unit d. The fixed cost per unit Answer: b. A factor that causes costs to be incurred in an activity 54. Which of the following is a limitation of Activity-Based Costing? a. It is more accurate than traditional costing methods. b. It is time-consuming and costly to implement. c. It allocates all overhead costs to a single cost pool. d. It is suitable for all types of industries. Answer: b. It is time-consuming and costly to implement. 55. In ABC, what is the formula for calculating the activity rate? a. Activity Rate = Total Cost / Total Units Produced b. Activity Rate = Total Cost / Total Direct Labor Hours c. Activity Rate = Total Cost / Total Machine Hours d. Activity Rate = Total Cost / Total Activity Level Answer: d. Activity Rate = Total Cost / Total Activity Level 56. Which of the following is an example of a unit-level activity in ABC? a. Machine setup b. Product testing c. Materials handling d. Assembly Answer: d. Assembly 57. Question: What is the purpose of using cost hierarchy in Activity-Based Costing? a. To identify high and low-cost activities b. To classify costs into different levels based on their traceability to products c. To allocate costs to cost objects directly d. To determine the total cost of production 58. What is relevant costing? a. Historical costs b. Future costs that differ between alternatives c. Sunk costs d. All of the above Answer: b) Future costs that differ between alternatives 59. In relevant costing, which of the following costs is not considered? a. Sunk costs b. Variable costs c. Fixed costs d. Historical costs Answer: a) Sunk costs 60. Which type of costing is most applicable when making short-term decisions? a. Absorption costing b. Variable costing c. Relevant costing d. Historical costing Answer: c) Relevant costing 61. In relevant costing, what is the primary focus? a. Past costs b. Future costs c. Average costs d. Total costs Answer: b) Future costs 62. What is the key factor to consider in relevant costing analysis? a. Total costs b. Sunk costs c. Incremental costs d. Average costs Answer: c) Incremental costs 63. Which of the following costs is always relevant in decision-making? a. Fixed costs b. Variable costs c. Sunk costs d. Historical costs Answer: b) Variable costs 64. What is the opportunity cost in relevant costing? a. The cost of the chosen alternative b. The benefit sacrificed by choosing one alternative over another c. Sunk costs d. Variable costs Answer: b) The benefit sacrificed by choosing one alternative over another 65.In relevant costing, which term refers to costs that will be incurred in the future as a result of a particular decision? a. Historical costs b. Sunk costs c. Incremental costs d) Average costs Answer: c) Incremental costs 66. What is the decision rule for relevant costing? a. Choose the alternative with the highest total costs b. Choose the alternative with the lowest variable costs c. Choose the alternative with the lowest incremental costs d. Choose the alternative with the highest historical costs Answer: c) Choose the alternative with the lowest incremental costs 67. Which of the following is an example of a relevant cost? a. Historical cost of machinery b. Future maintenance cost for new machinery c. Sunk cost of training employees d. Total production cost Answer: b) Future maintenance cost for new machinery 68. What role does time play in relevant costing decisions? a. Past costs are more important b. Present costs are more important c. Future costs are more important d. Historical costs are the most relevant Answer: c) Future costs are more important 69. In relevant costing, which cost is often considered irrelevant? a. Fixed costs b. Variable costs c. Sunk costs d. Opportunity costs Answer: c) Sunk costs 70. What is the purpose of using relevant costing in decision-making? a. To minimize total costs b. To maximize variable costs c. To identify and consider only costs that affect the decision at hand d. To focus on past costs Answer: c) To identify and consider only costs that affect the decision at hand 71. A manufacturing company is considering replacing an old machine with a new, more efficient model. The old machine's book value is Php10,000, and the new machine costs Php50,000. The old machine can be sold for Php8,000. What is the relevant cost of the old machine for the decision-making process? a. Php10,000 b. Php50,000 c. Php8,000 d. Php2,000 Answer: d) Php2,000 Calculation: Book value (Php10,000) - Resale value (Php8,000). 72. A company is deciding between two suppliers for a raw material. Supplier A offers a lower per-unit cost of Php15, while Supplier B's cost is Php18 per unit. Supplier B offers a bulk discount of 10% for orders over 1,000 units. What is the total cost for 1,200 units from Supplier B? a. Php18,000 b. Php19,440 c. Php16,200 d. Php17,280 Answer: d)Php19,440 Calculation: Php18 (cost per unit) x1,200 units x (1 - 0.10)= Php19,440 73. A company is considering discontinuing a product line with total fixed costs of Php30,000 and variable costs of Php20 per unit. If the company sells 2,000 units, what is the relevant cost for the decision? a. Php50,000 b. Php70,000 c. Php40,000 d. Php110,000 Answer: Php40,000 Calculation; 2,000 units x Php20.00 = Php40,000 74. A company is evaluating whether to process a product further or sell it as is. The product can be sold for Php50 per unit as is, or processed further at an additional cost of Php10 per unit. If 1,000 units are in inventory, what is the incremental revenue from processing further? a. Php10,000 b. Php40,000 c. Php50,000 d. Php60,000 Answer: Php10,000 Calculation: 1,000 units x Php10.00 = Php10,000 75. A company is considering outsourcing a service that currently costs Php25,000 per month to perform in-house. If the outsourcing cost is Php20,000 per month, what is the monthly incremental cost of outsourcing? a. Php5,000 b. Php20,000 c. Php25,000 d. Php45,000 Answer: Php5,000 Calculation: Php25,000-Php20,000=Php5,000 76. What is the primary objective of capital budgeting? a. Maximizing shareholder wealth b. Minimizing operational costs c. Increasing short-term profits d. Enhancing employee satisfaction Answer: A) Maximizing shareholder wealth 77. Which of the following is a key method used in capital budgeting for evaluating projects? a. SWOT analysis b. Payback period c. Break-even analysis d. Marketing research Answer: B) Payback period 78. What does the Net Present Value (NPV) method consider when evaluating a project? a. Initial investment only b. Cash flows over the project's life c. Payback period d. Accounting profits Answer: B) Cash flows over the project's life 79. Which discount rate is commonly used in the Discounted Cash Flow (DCF) analysis for capital budgeting? a. Market interest rate b. Prime lending rate c. Cost of capital d. Inflation rate Answer: C) Cost of capital 80. What does the Internal Rate of Return (IRR) represent in capital budgeting? a. The rate at which the project breaks even b. The discount rate that makes the NPV zero c. The payback period of the project d. The accounting rate of return Answer: B) The discount rate that makes the NPV zero 81. In capital budgeting, what does the term "Sunk Cost" refer to? a. Initial investment b. Ongoing operational costs c. Costs that cannot be recovered d. Projected future cash flows Answer: C) Costs that cannot be recovered 82. Which of the following is a disadvantage of using the Payback Period as a capital budgeting tool? a. Ignores the time value of money b. Difficult to calculate c. Considers only cash flows d. Provides a measure of profitability Answer: A) Ignores the time value of money 83. What does the Profitability Index (PI) indicate in capital budgeting? a. The project's accounting rate of return b. The project's contribution margin c. The ratio of present value of cash inflows to outflows d. The payback period Answer: C) The ratio of present value of cash inflows to outflows 84. Which capital budgeting technique is particularly useful for evaluating projects of different scales by expressing profitability as a percentage? a. Net Present Value (NPV) b. Internal Rate of Return (IRR) c. Profitability Index (PI) d. Accounting Rate of Return (ARR) Answer: D) Accounting Rate of Return (ARR) 85. An investment requires an initial outlay of Php50,000 and is expected to generate cash inflows of $20,000 annually for the next five years. If the discount rate is 10%, what is the Net Present Value (NPV) of the investment? a. Php30,000 b. Php(30,000) c. Php25,813 d. (Php25,813) Answer: c Php25,813 PV of future Cash inflows PV of OA: 0.90909+0.82645+0.75131+0.68301+0.62092=3.79078 NVP= (Php20,000x3.79078)-Php50,000 NVP=Php75,813-Php50,000 86. An investment costs Php75,000 and generates annual cash inflows of Php25,000. Calculate the payback period. a. 2 years b. 3 years c. 4 years d. 5 years Answer: B) 3 years 1st yr 25,000 2nd yr 25,000 3rd yr 25,000 ---------------------------------3 yrs 75,000 ==================== 87. Which of the following industries is most likely to use job order costing? a. Retail b. Automobile manufacturing c. Fast-food restaurant d. Utility services Answer: b) Automobile manufacturing 88. What is the primary characteristic of job order costing? a. Continuous production b. Mass production c. Customized production d. Assembly line production Answer: c) Customized production 89. In job order costing, direct labor costs are typically: a. Assigned to specific jobs b. Treated as indirect costs c. Ignored in cost calculations d. Allocated based on machine hours Answer: a) Assigned to specific jobs 90. Which of the following is an example of a job in job order costing? a. Producing identical units of a product b. Manufacturing widgets on an assembly line c. Building a custom-designed yacht d. Baking cookies in a bakery Answer: c) Building a custom-designed yacht 91. What is the purpose of a job cost sheet in job order costing? a. To track the production of identical units b. To allocate indirect costs to products c. To record the cost of direct materials and labor for a specific job d. To monitor the overall factory overhead costs Answer: c) To record the cost of direct materials and labor for a specific job 92. What is the primary characteristic of process costing? a. It is used in industries with customized products b. It is applicable only to service-based businesses c. It is used in industries with mass production of homogeneous products d. It is suitable for job order production only Answer: c) It is used in industries with mass production of homogeneous products 93. In process costing, how are costs typically accumulated? a. By job b. By department c. By customer d. By product Answer: b) By department 94. What is the main objective of using process costing? a. To track costs for individual custom orders b. To determine the profitability of specific customers c. To allocate costs uniformly to similar products d. To calculate the cost of goods sold for a specific time period Answer: c) To allocate costs uniformly to similar products 96. Which of the following industries is most likely to use process costing? a. Custom furniture manufacturing b. Automobile assembly c. Boutique clothing design d. Architectural consulting Answer: b) Automobile assembly 97. In process costing, how are the total costs of a production process calculated? a. By dividing total costs by the number of units produced b. By allocating costs based on direct labor hours c. By dividing total costs by the number of production runs d. By allocating costs based on the number of units processed Answer: a) By dividing total costs by the number of units produced 98. XYZ Company produces 10,000 units of a product during the month. If the total production costs for the month are Php50,000, what is the cost per unit using process costing? a. Php5 b. Php10 c. Php15 d. Php20 Answer:Php10 Calculation: Php50,000 / 10,000 units = Php10 per unit 99. ABC Manufacturing has two production departments: Assembly and Finishing. If the total costs incurred in the Assembly department are Php80,000 and 20,000 units are produced, what is the cost per unit for the Assembly department? a. Php2 b. Php4 c. Php6 d. Php8 Answer: Php2 Calculation: Php80,000 / 20,000 units =Php2 per unit 100. LMN Corporation allocates manufacturing overhead based on machine hours. If the total machine hours for the month are 8,000 and the overhead costs are $40,000, what is the overhead rate per machine hour? a. Php2.00 b. Php4.00 c. Php5.00 d. Php8.00 Answer: Php5.00 Calculation: Php40,000 / 8,000 machine hours = Php5 per machine hour