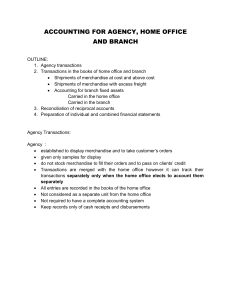

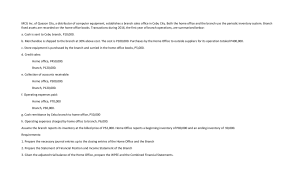

Republic of the Philippines Mindanao State University- General Santos City Accountancy Program First Semester, SY 2020-2021 HOME OFFICE AND BRANCH ACCOUNTING THEORIES AND PROBLEMS A Final Requirement Presented to the Faculty of Mindanao State University-General Santos City Business Administration and Accountancy Accountancy Department In Partial Fulfilment of The Requirements for the Accounting for Special Transactions Bachelor of Science in Accountancy ELLAINE MAE MELECIO JOYCE AVES KEZHA CALDERON MARK LOYD DEFENSOR MELANIE SAMSONA PITCHIE MAE BELDIA JANUARY 8, 2021 HOME OFFICE AND BRANCH ACCOUNTING THEORIES 1. In developing combined statements, the following are true, except: a. Accounts for the home office and the branch need not be restated. b. Combining branch and home office accounts results in those balances that would have been obtained if one set of accounts had been maintained in recording activities of both branch and the home office. c. Any balance sheet accounts that report interoffice debits and credits have no meaning when the related entities are recognized as one entity are eliminated. d. The above statements are all correct. Explanation The affiliated entities are recognized as one entity. Accounts for the home office and the ranch must be restated, so that, when combined, they will offer those balances that would have resulted if the transactions of the related entities had been recorded in one set of books. 2. Analyze the following statements. I. The accounting records for branches may be centralized in the home office. II. The accounting records for branches may be decentralized. a. Statement I is correct. Statement II is incorrect. b. Statement I is incorrect. Statement II is correct. c. Statements I and II are both correct. d. Statements I and II are both incorrect. Explanation The accounting records for branches may be centralized in the home office or may be decentralized so that each branch maintains a complete set of accounting records. If the accounting records are centralized in the home office, each branch prepares daily reports and documents that are used as sources for journal entries in the accounting records of the home office. If a branch maintains its own accounting records, some transactions or events relating to the branch may be recorded by the home office. Periodic financial statements are provided by the branch to the home office so that combined statements may be prepared. 3. A branch is an organization that: a. Is established to display merchandise. b. Does not stock merchandise to fill customer’s orders or pass on customer’s credit. c. Has no separate accounting or business entity. d. The statements above are all incorrect. Explanation All the given statements describe/define an agency. 4. Analyze the following statements. I. At the end of an accounting period, the balance of the Investment in Branch ledger account may not agree with the balance of the Home Office account. II. It is acceptable that the fiscal year for the home office does not coincide with the fiscal year for the branch. a. Statement I is correct. Statement II is incorrect. b. Statement I is incorrect. Statement II is correct. c. Statements I and II are both correct. d. Statements I and II are both incorrect. Explanation At the end of an accounting period, the balance of the Investment in Branch ledger account may not agree with the balance of the Home Office account. In such cases the reciprocal ledger accounts must be reconciled and brought up to date before combined financial statements are prepared. The fiscal year for the home office must coincide with the fiscal year for the branch to facilitate the preparation of combined financial statements. 5. As per AICPA SOP 98-5, start-up costs an entity undertakes when it introduces a new product or service, conducts business in a new territory or with a new class of customer or beneficiary, initiates a new process in an existing facility or commences some new operation: a. Must be expensed as the entity incurs them. b. Must be deferred as charges. c. Either A or B. d. Neither A nor B. Explanation As per AICPA SOP 98-5, start-up costs an entity undertakes when it introduces a new product or service, conducts business in a new territory or with a new class of customer or beneficiary, initiates a new process in an existing facility or commences some new operation must be expensed as the entity incurs them. 6. When billing at retail sales price, which of the following is incorrect? a. Branch statements may be prepared and submitted to the home office. b. If the branch is billed for goods at the sales price, the branch cost of goods sold will not be equal to sales, and branch activities will show a loss from operations equal to the expenses of operation. c. The home office, when informed of branch sales currently, is provided with a continuous record of the goods in the hands of the branch. d. The statements above are all true. Explanation If the branch is billed for goods at the sales price, the branch cost of goods sold will be equal to sales, and branch activities will show a loss from operations equal to the expenses of operation. Branch accounts may be adjusted and closed in the usual manner at the end of the fiscal period, and the home office account debited for the reported loss. 7. In accounting for branch transactions, it is improper for the home office to: a. Credit cash received from a branch to the Investment in Branch ledger account. b. Maintain Common Stock and Retained Earnings ledger accounts for only the home office. c. Debit shipments of merchandise to the branch from the home office to the Investment in Branch ledger account. d. Credit shipments of merchandise to the branch to the Sales ledger account. Explanation Shipments of merchandise to the branch under the periodic inventory system are recorded (if at cost) as debit to Investment in Branch and credit to Shipment to Branch in the home office books while they are recorded as a debit to Shipment from Home Office and credit to Home Office Equity in the books of the branch. Shipments of merchandise to the branch under the perpetual inventory system are recorded in the books of the home office as a debit to Investment in Branch and a credit to Inventories. While in the books of the branch, they are recorded as a debit to Inventories and a credit to Home Office, considering the transfer is at cost. 8. When a home office ships merchandise to Branch A which is later shipped to Branch B, the additional freight charged to ship the merchandise form Branch A to Branch B should: a. Treated as an expense on the Home Office books b. Included as part of the cost of merchandise to Branch A c. Included as part of the cost of merchandise to Branch B d. Both B and C are correct Explanation Excess freight costs are recognized as expenses of the home office. Excessive freight charges represent management mistakes or inefficiencies. Therefore, they are not considered normal operating or freight expenses. 9. For a home office that uses the periodic inventory system of accounting for shipments of merchandise to the branch, the credit balance of the Shipments to Branch ledger account is displayed in the home office separate: a. Income statement as an offset to purchase b. Balance sheet as an offset to Investment in Branch c. Balance sheet as an offset to inventories d. Income statement as revenue. Explanation In its separate income statement, the home office displays the Shipment to Branch ledger account as an offset to the net purchases to come up with the total cost of goods available for its own sale. 10. A branch journal entry debiting Home Office and crediting Cash may be prepared for: a. The branch’s transmittal of cash to the Home Office b. The branch’s acquisition for cash of plant assets to be carried in the home office accounting records only c. Either (a) or (b) d. Neither (a) nor (b) Explanation Home Office Ledger Account is an account used by the branch to account for all transactions with the home office. It is credited for all cash, merchandise or other assets provided by the home office to the branch. It is debited for all cash, merchandise, or other assets sent by the branch to the home office or to other branches. If a plant asset is acquired by a branch for its usage but the accounting record for this plant asset is maintained by the home office, the accounting treatments are: For the branch: debit Home Office, and credit cash or a liability account. For the home office: debit a plant asset account: branch, and credit Investment in Branch account. 11. In a working paper for combined financial statements of the home office and the branch of a business enterprise, an elimination that debits Shipments to Branch and credits Shipments from Home Office is required under: a. The periodic inventory system only b. The perpetual inventory system only c. Both the perpetual inventory system and the periodic inventory system d. Neither the perpetual inventory nor the periodic inventory system Explanation Under the perpetual inventory system, the ledger accounts “Shipment to Branch” and “Shipment from Home” are not used. The shipment of merchandise to branch, for instance, is recorded as debit to Investment in Branch and credit to Inventories in the book of home office, and debit to Inventories and credit to Home Office in the book of the branch. Under periodic inventory system, on the other hand, in a working paper for combined financial statements of the home office and the branch, the balance of the Shipment to Branch ledger account is eliminated against the balance of the Shipment from Home account together with the credit balance of the Allowance for Overvaluation of Inventories account if there is any. 12. A journal entry debiting Cash in Transit and crediting Investment in Branch is required for: a. The home office to record the mailing of a check to the branch early in the accounting period. b. The branch to record the mailing of a check to the home office early in the accounting period. c. The home office to record the mailing of a check by the branch on the last day of the accounting period. d. The branch to record the mailing of a check to the home office on the last day of the accounting period. Explanation Investment in Branch Ledger Account is a reciprocal ledger account to Home Office account of a branch used by the home office to account for any transactions with the branches. It is debited for cash, merchandise and services provided to the branch by the home office and for the net income reported by the branch. Thus, a debit in cash and a credit in Investment in Branch account may be a home office entry for a check mailed by the branch, cash in transit if the check that has been sent by the head office are still in transit, say on the last day of the reporting period. 13. A Home Office‘s Allowance for Overvaluation of Inventories: Branch ledger account, which has a credit balance, is a. an asset valuation account b. an equity account c. a liability account d. a revenue account Explanation The home office reports the credit balance of the Allowance for Overvaluation of Inventories: Branch ledger account, in its separate balance sheet as a valuation account of the Branch Current of the Investment in Branch ledger account. 14. Which of the following generally is not a method of billing merchandise shipments by a home office to the branch? a. Billing at cost b. Billing at a percentage above cost c. Billing at a percentage below cost d. Billing at retail selling price Explanation Three alternative methods are available to the home office in billing the merchandise shipped to the branches: a) billed at the home office cost, b) billed at a percentage above the home office cost, and c) billed at the branch’s retail selling price 15. The appropriate journal entry for the home office to recognize the branch’s expenditure of P10,000 for equipment to be carried in the home office accounting records is: a. Equipment 10,000 Inv in Branch 10,000 b. Home Office Equipment 10,000 10,000 c. Investment in branch Cash 10,000 10,000 d. Equipment-Branch Inv in Branch 10,000 10,000 Explanation If a plant asset is acquired by a branch for its usage but the accounting record for this plant asset is maintained by the home office, the accounting treatments are: For the branch: debit Home Office, and credit cash or a liability account. For the home office: debit a plant asset account: branch, and credit Investment in Branch account. 16. Does the branch use a Shipments from Home Office ledger account under the: Perpetual Inventory Periodic Inventory a. b. c. d. Method Method Yes Yes No No Yes No Yes No Explanation When a periodic inventory system is adopted, inventory account cannot be used for the shipments of merchandise between the home office and the branch. Thus, accounts such as “Shipments to Branch” (used by the home office) and “Shipments from Home Office” (used by the branch) are used. 17. If the home office maintains in its general ledger accounts for a branch’s plant assets, the branch debits its acquisition of office equipment to: a. Home Office b. Office Equipment c. Payable to Home Office d. Office equipment carried by home office Explanation If a plant asset is acquired by a branch for its usage but the accounting record for this plant asset is maintained by the home office, the accounting treatments are: For the branch: debit Home Office, and credit cash or a liability account. For the home office: debit a plant asset account: branch, and credit Investment in Branch account. 18. May be Investment in Branch account of a home office be accounted for by the Cost Method Equity Method a. b. c. d. of accounting of accounting Yes Yes No No Yes No Yes No Explanation The home office keeps a reciprocal account called Branch Current or Investment in Branch. This noncurrent asset account is debited for cash, goods, or services to the branch; and for branch income. Conversely, the account is credited for remittances from the branch or other assets received from the branch; and for branch losses. Thus, the Investment in Branch account reflects the equity method of accounting. 19. If Jibs Branch ships merchandise with a cost of $400 to Tibs Branch and the periodic inventory system is used, the following journal entries are required except: a. Home office 400 Shipments from Home Office 400 b. Shipments from Home Office Home Office 400 c. Investment in Tibs Branch Investment in Jibs Branch 400 400 400 d. All are correct. Explanation Letter A are accounting records of Jibs Branch. Letter B are accounting records of Tibs Branch. Letter C are accounting records of home office. 20. The following are limitations of branch accounting except: a. There are certain expenses which are incurred for the organization as a whole but cannot be attributable to the branches. b. Inter branch and intra branch comparison can be done. c. Separate accounts for each branch are maintained which increases the accounting charges. d. In case of foreign branch, conversion of foreign currency into domestic currency cannot be properly done due to regular fluctuations in exchange rate. Explanation Inter branch and intra branch comparison is an advantage of branch accounting to assess the performance of each branch. 21. Among the interoffice transactions in the accounting records of the home office of Sand Company was the following: Investment in Box Branch 10,000 Shipment to Box Branch 10,000 This journal entry indicates: a. A transfer of merchandise from home office at cost. b. A payment by home office of branch expenses. c. A transfer of merchandise from home office at above cost. d. A transfer of cash from the home office. Explanation The correct journal entries for letters B, C, and D respectively are the following: Investment in Box Branch xx Cash Investment in Box Branch xx xx Allowance for overvaluation xx Shipment to Box Branch xx Investment in Box Branch Cash xx xx 22. The home office ledger account in the accounting records of a branch is best described as as: a. A revenue account b. An equity account c. A deferred revenue account d. None of the foregoing Explanation The Home Office Ledger account is quasi-ownership account equity that shows the net investment by the home office in the branch. It indicates the extent of the accountability of the branch to the home office. 23. If both the home office and the branch of a business enterprise use perpetual inventory system, a Shipment to branch ledger account appears in the accounting records of: a. The home office only b. The branch only c. Both the home office and the branch d. Neither the home nor the branch Explanation When a merchandise is transferred to the branch the home office debits the branch account and credits Shipments to Branch, on the other hand, the branch debits Shipments from Home Office. However, when both uses perpetual inventory system, inventory accounts are being used, the home office will credit the appropriate inventory account and the branch will debit the appropriate inventory account. 24. In preparing the financial statements of the home office and its various branches: a. Nonreciprocal accounts are eliminated but reciprocal accounts are combines b. Both reciprocal and nonreciprocal accounts are eliminated c. Both reciprocal and nonreciprocal accounts are combines d. Reciprocal accounts are eliminated and nonreciprocal accounts are combined Explanation The process of combining home office and branch financial statement is similar to the process of consolidating the parent and subsidiary statements. Reciprocity is established between home office and branch records by eliminating reciprocal accounts and combining nonreciprocal accounts. We eliminate unrealized profits from internal transfers between the home office and the branches in preparing combined financial statements for the enterprise. 25. Which of the following accounts is a reciprocal account to the Investment in Branch account? a. Branch Income c. Home Office Capital b. Equity in Home Office d. None of the above Explanation Investment in Branch Ledger Account this account is a reciprocal ledger account (to Home Office account) used by the home office to account for any transactions with the branches. It is debited for cash, merchandise and services provided to the branch by the home office and for the net income reported by the branch. HOME OFFICE AND BRANCH ACCOUNTING PROBLEMS On November 2, 2015, Luffy Company created an agency in Davao, and transferred merchandise samples costing P15,000, equipment worth P36,000 and a cash working fund of P10,000 to be maintained on an imprest basis. The agency transmitted to the home office sales orders which were billed at P90,000 of which P46,550 was collected net of a 2% discount. The agency also paid for its operating expenses of P7,500 including supplies of P2,000. The agency received replenishment thereof from the home office before the year ended. On December 31, the agency samples were estimated to be useful over a period of 5 months while the equipment is estimated to have a useful life of eight years. Unused supplies on Dec 31 amounted to P1,000. Home office maintains a gross profit rate of 25% of cost. 1. How much is agency profit at the end of December? a) P3,800 c) P4,800 b) P13,800 d) P14,800 2. Give the agency real accounts that will be presented in the Dec. 31 balance sheet: Agency Samples: a) P7,000 b) P8,000 c)P9,000 d)3,400 3. Working Fund, Davao Agency a) P10,000 b) P7,000 c)P12,000 d)P13,000 4. Supplies, Davao Agency a) P200 b) P1,200 c) P1,000 d) P2,000 5. Equipment, Davao Agency a) P36,000 b) P35,250 c) P38,550 d)P36,750 6. Give the cost of sales of Home Office if its Inventory on Nov 2 is P1,250,000 while on hand at Dec 31 went down to 20% of total stock . Net purchases was P2,750,000 including freight of P50,000. a) P3,000,000 c) P3,113,000 b) P3,131,000 d) P3,010,300 a.) Income and Summary Expense Samples Used Sales 90,000 6,000 Supplies 1,000 Cost of Sales 72,000 Depreciation 750 Other expenses 5,500 Sales discount 950 Balance (1) 3,800 b.) Real Accounts (2)Agency Samples (3)Working Fund, Davao Agency (4)Supplies, Davao Agency (5)Equipment, Davao Agency Accumulated Depreciation P 9,000 10,000 1,000 P 36,000 ( 750) P 35,250 c.) Home Office Cost of Sales Inventory, Nov 2 P1,250,000 Net Purchases 2,700,000 Freight In 50,000 Shipments ( 87,000) Inventory, Dec 31 (800,000) (6)Cost of Sales P3,113,000 Trafalgar Corporation shows the following balance sheet accounts as at Jan 1, 2015: Cash P 476,500 Accumulated Depreciation P 93,750 Accounts Receivable 1,050,000 Accrued Expenses 7,250 Inventory 1,300,000 Accounts Payable 743,750 Furniture & Fixtures 750,000 Capital Stock 2,500,000 Allowance for Bad Debts 31,500 Retained Earnings 263,250 On this date, management decided to establish a branch in Baguio and reported the following transactions for the first quarter of 2015: I. Transferred cash P150,000, merchandise P500,000 with freight prepaid based on 2% of its shipment cost. II. Home office approved on Feb 1, the purchase by the branch of its furniture and fixtures costing P75,000 for its own use. Home office policy was to maintain and control all fixed assets. III. The branch was authorized to take over P60,000 home office accounts from its Baguio customers and make the necessary collections. Home Office issued a debit memo for this. IV. Summary of account sales and (collections) for the quarter : Home OfficeP1,865,000 and (1,499,400 net of a 2% discount) and for the Branch- P655,000 (P565,000). V. VI. VII. VIII. IX. X. XI. XII. XIII. Summary of account purchases and (payments): Home Office-P790,000 and (P745,000) and for the Branch- P150,000 and (P88,755 net of a 3% discount). Operating Expenses paid including accrued expenses, if any- Home Office, P230,000 and Branch, P 131,250. Returns from the original shipment amounted to P75,000. Freight on returns was paid by the branch. Allocated freight and freight paid by branch were all charged to home office as a loss account. From the Baguio accounts turned over in c), collections were made accordingly less a discount of 2% which the branch charged to the home office. P11,875 of the expenses paid by home office in f) were charged to the branch. Cash remittance was made by the branch in excess of original cash transfer. Depreciation was recorded at a rate of 12%. Unpaid utility bills: P67,500 for home office and P18,500 for the branch. Policy on doubtful accounts was to be maintained based on the previous rate. 1. The entry to record transaction I in the books of Home Office a) Cash 150,000 Freight In 10,000 Shipments from H.O. 500,000 Home office Equity 660,000 b) Investment in branch Cash Shipments to Branch 650,000 c) Cash Shipments from H.O. Home office Equity 150,000 510,000 d) Investment in branch Cash Shipments to Branch 660,000 150,000 500,000 660,000 160,000 500,000 2. The entry to record transaction IV in the Branch books a) Accounts Receivable 655,000 Sales 655,000 b) Accounts receivable Sales 1,865,000 c) Accounts Receivable Sales 565,000 d) Accounts Receivable Sales 1,449,200 1,865,000 565,000 1,449,200 3. The entry to record transaction XIII in the books of Home Office a) Bad Debts 2,700 Allowance for Bad Debts 2,700 90,000 x .03 b) Bad Debts 8,250 Allowance for Bad Debts 8,250 (1,325,000x.03=39,750-31,500) c) Bad Debts 7,293.75 Allowance for Bad Debts (1,293,125 x.03=38,793.75-31,500) 7,293.75 d) Bad Debts 38,793.75 Allowance for Bad Debts (1,293,125 x.03=38,793.75) 38,793.75 4. How much is the Plant Assets of the Home Office? a) P825,000 c) P708,750 b) P822,750 d) P706,500 5. How much is the Home Office Net Sales? a) P1,833,200 c) P1,338,200 b) P2,488,200 d) P2,884,200 6. How much is the Branch Net Sales? a) P565,000 b) P655,000 c) P1,865,000 d) P1,449,200 7. How much is the Combined Net Sales? a) P1,833,200 c) P1,338,200 b) P2,488,200 d) P2,884,200 8. How much is the Home Office Cost of Sales? a) P879,500 c) P897,500 b) P875,900 d)P895,700 9. How much is the Branch Cost of Sales? a) P455,000 c) P450,005 b) P450,000 d) P405,050 10. How much is the Combined Cost of Sales? a) P1,392,550 c) P1,352,505 b) P1,330,900 d) P1,329,505 11. What is the Home Office Gross Profit? a) P1,158,695 b) P953,700 c) P240,950 d) P1,150,690 12. How much is the Branch Gross Profit? a) P204,995 b) P209,445 c) P209,450 d) 240, 950 13. How much is the Combined Gross Profit? a) P953,700 c) P975,300 b) P1,158,695 d) P1,555,200 14. How much is the Home Office Profit/loss from Operations? a) P644,575 c) P567, 445 b) P654,447 d) P674,575 15. How much is the Branch Profit/loss from Operations? a) P38,420 c) P32,480 b) P34,800 d) P38,400 16. How much is the Combined Profit/loss from Operations? a) P689,295 c) P692,558 b) P682,995 d)P628,995 17. How much is the Home Office Net Profit a) P679,985 c) P682,995 b) P687,995 d) P679,995 18. How much is the Branch Net Profit? a) P38,400 b) P34,800 c) P32,480 d) P38,420 19. How much is the Combined Net Profit? a) P679,995 c) P682,995 b) P687,995 d) P689,225 PLANTS AND ASSETS #(4) Furniture &Fixtures Acc. Depreciation Furniture & Fixtures-Baguio Acc. Depreciation Total 750,000 116,250 75,000 2,250 633,750 72,750 P706,500 INCOME STATEMENT HOME OFFICE BRANCH COMBINED Sales P1,865,000 P655,000 P2,520,000 Less Discounts, ( 31,800) ( 31,800) Returns and Allowances Net Sales (5) P1,833,200 (6)P655,000 (7)P2,488,200 Cost of Sales: Inventory, Beginning 1,300,000 1,300,000 Net Purchases 790,000 147,255 937,255 Shipments to Branch (425,000) Freight In 8,500 8,500 Shipments from Home 425,000 Office Inventory, Ending (785,500) (8)879, 500 (130,750) (9)450,005 (916,250) (10)1,329,505 Gross Profit (11) P953,700 (12)P204,995 (13)P1,158,695 Less Operating Expenses: Bad Debts 8,250 2,700 10,950 Depreciation 22,500 2,250 24,750 Utility 67,500 18,500 86,000 Other operating 210,875 309,125 143,125 166,575 354,000 475,700 Expenses Net Profit from Operation (14) P644,575 (15) P38,420 (16)P 682,995 Branch Profit 38,420 Loss on Branch Transfers (3,000) (3,000) Net Profit (Loss) (17)P679,995 (18)P38,420 (19)P 679,995