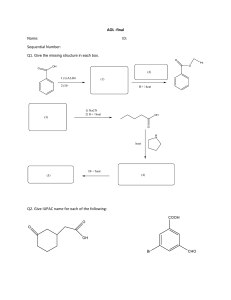

Chemical distribution Global picture, trends and opportunities Dr. Udo Jung The Boston Consulting Group, Frankfurt (Germany) México D.F., October 26, 2012 Agenda What is the state, globally, of the chemical distribution market? In particular, what is happening in Mexico and Latin America? What global trends can forecast a brighter future for the Mexican Chemical Distribution market? Chemical Distribution - ANIQ Oct 2012 -Final.pptx 1 Global State Chemical Distribution Chemical Distribution: A view from the Old World 1 Chemical distributors are a vital part of integrated chemical supply chains from producers to customers 2 Chemical producers consider leading distributors as an important element of their go-to- market strategies • Opening new markets and customer segments • Complexity reduction in marketing and sales 3 Chemical customers value bundled supply and one-stop-shopping of many products from chemical distributors 4 Leading distributors grow faster than most producers • Brenntag, the global market leader, is in the top league of value creators in the overall chemical industry 5 Responsible care is a precondition for the license to operate in the entire chemical value chain Source: BCG analysis Chemical Distribution - ANIQ Oct 2012 -Final.pptx 2 Global State Chemical Distribution Chemical distributors create value for producers: Realizing growth and managing complexity in marketing and sales "Contract business—sales outsourcing" • Usually formal contractual relationships with "principals" (often mutual exclusivity) Other smaller customers • Distributors often with high switching cost for their suppliers (principals) • High level of data integration Distributor • "Window of opportunity" (i.e., consolidation of sales partners; complexity reduction of marketing and sales) when major chemical producers ("principals") are restructuring their distributor base ... ... • Product-wise often—but not always— specialties Source: The Boston Consulting Group Chemical Distribution - ANIQ Oct 2012 -Final.pptx 3 Global State Chemical Distribution Key criteria for producers to choose chemical distributors Interview results of specialty chemicals suppliers Importance of success factors Performance of major distributors Product know-how Complementary products Quantity/ customer base Product know-how D1 Complementary products D2 Quantity/ customer base D4 Transparency on end-customers Transparency on end-customers Track record Track record Pan-Europeanreach Own vs. outsourced logistics Pan-Europeanreach Own assets in storage, mixing and filling Own vs. outsourced logistics Price Price Own assets in storage, mixing, filling Not rated Not Less Average Important Very important important important D3 Very Not InsuffiAverage Good insuffirated cient cient Very good Source: Market expert interviews; BCG analysis Chemical Distribution - ANIQ Oct 2012 -Final.pptx 4 Global State Chemical Distribution Chemical distributors create value for customers: Single sourcing and technical serve "Contract business—single sourcing" • Quite often formal contractual relationships with customers Other smaller customers • Outsourcing of parts of the procurement function with high switching cost for customer • "Window of opportunity" as more and more customers restructure their procurement Distributor • Typical business model for smaller customers (with diverse chemicals supply base— however with rather low overall volumes) ... ... Source: The Boston Consulting Group Chemical Distribution - ANIQ Oct 2012 -Final.pptx 5 Global State Chemical Distribution Key criteria for customers to choose chemical distributors Growth opportunity Single sourcing Current constraint "Currently we purchase from 5-6 distributors – currently a single distributor doesn't offer all the products and the required support we need." 59% - paint company Technical support 54% Application expertise "Distributors have far better speed and flexibility of delivery than chemical suppliers—unfortunately they lack the technical expertise we need in some categories." 48% - specialty company - "We would love to get rid of all the inventory management—unfortunately no one is offering something for medium-sized companies." Vendor managed inventory 31% Customer-tailored service 16% Regulatory support (REACH) 15% - specialty company - "We would value distributors even more, if they had more application expertise to revise formulations with us." - Asian specialty company - "We are a coating company - REACH is mainly a topic for chemical suppliers" - coating company - Customized mixing, blending etc 13% 0 50 100 % of answers Note: Quotes reflects statements from more than one individual Source: Customer survey; BCG analysis Chemical Distribution - ANIQ Oct 2012 -Final.pptx 6 Global State Chemical Distribution Chemical distributors create value for the whole value chain: Extending market reach and providing value added service "Value Added Services" • Very often local business with a need for high customer proximity Other smaller customers • Bundling of demand for several products into one customized delivery • Drum exchange service and waste disposal material loop Distributor • Addition of value adding steps -examples ... ... – Material services , e.g. formulation/blending, licensed production, filling/labeling – Immaterial services, e.g. VMI, certification, training Source: The Boston Consulting Group Chemical Distribution - ANIQ Oct 2012 -Final.pptx 7 Global State Chemical Distribution The business model of chemical distributors covers the whole value chain – Option space for distinct business models Set targets for volume per period Development of price models (boni, fixed price, …) Supplier Mgmt. Contract Spot Supplier Target •Acqu. setting •Report. Acquisition of new customers Customer care New (single) sourcing contracts • Compare product list with product portfolio • Find supplier for products not in portfolio • Plan logistics, coordinate information collection process • Overall profit calculation • Develop profit sharing system Development of marketing strategies • For introduction of new products • For sales increase of existing ones Order taking Solution provider for customer specific problems Technical consulting (usage, handling) Product development Value-added services (research, analyses) Mixing, blending of customer specific chemicals • Get recipe/make recipe • Blending • Quality control Filling of customer specific quantities • Determine quantity • Drum size and type • Filling • Weighting/measuring Accounts payable Accounts receivable General ledger Invoice verification Financial statement Planning/Budgeting Asset management Currency/risk mgmt. Treasury Cost calculation schema Invoicing initiated on receipt of delivery note Printing/submitting Bundling of invoices on demand Environmental and regulatory advice Marketing & Sales Purchasing Selection of supplier/producer Purchasing • Determine volume • Negotiation on price • Purchase order processing Two types of purchasing: • On stock • Point-to-point Foreign exchange hedging Inbound logistics Stockkeeping Transport/ route planning Release of transport documents Contr. bus. Spot bus. Cust. acqu. + care Sales Advice/ technical service Acquisition of new customers Customer care Selling/order taking • Advice on product • Negotiations on price • Product specific information to technical advice Price fixing, exchange hedging Order processing Mixing/ blending/ filling Outbound logistics Transport/route planning Release of Transport documents (input from order processing) Pick up of goods Loading of truck Invoicing Recycling/ drum return handling Finance, Accounting Controlling Coordinated route planning with delivery of goods Release of transport documents Initiate recycling of • Returned packages • Used drums Initiate disposal of used goods Pledge charging Accounting for returned packages Transportation "Acquisition" of a new supplier • Select target supplier to optimize product portfolio (green boxes) • Collect information about actual customer base to show industry expertise and sales potential • Contract negotiations (exclusivity, volumes, prices, logistics) Reporting • Provide information about sales, profitability, prices, market trends, customer needs, complaints Stock planning • Demand planning • Stock targets • Replenishment orders Warehouse management Goods receipt Quality assurance Handling (loading, pick up of goods) Security/environmental protection Order entry Order check • Regulatory aspects • Availability of products • (Export regulations) Calculation Credit limit check Printing of delivery note, pick up list, dispatch note and other documents Budgeting Cost center accounting Profitability analysis Evaluation of stock levels Reporting/MIS Monthly and quarterly reporting Capex control Source: Interviews; BCG analysis Chemical Distribution - ANIQ Oct 2012 -Final.pptx 8 Global State Chemical Distribution Business models in Chemical Distribution: Value chain coverage – product portfolio – customer industries/application Feedstock Industrial gas Cracker products Secondary basic chem. "Producers with distribution business" incl. antifreeze Inorganic acids Lubricants "Low cost /value "Product range specialists with Fats, oils opportunity seekers" vertical integration" Polymer intermediates Solvents & other interm. Cust.-industry spec. chem. Function-specific chem. "Producers Adhesive components with captive z "Industry distribution / Feed ingredients specialists" trading" Food ingredients Catalysts Other inorgan. (e.g. miner.) Active pharma. ingredients "Full-line providers with Standard polymers acquisitive growth" Elastomers Engineering polymers High performance polym. Fibers "Functional Lab chemicals specialists" Pesticides Fertilizers Biofuels Paints Inks Construction material Packaging material Textiles/clothes Installation & repair Loading & filling (cust./ supp.) Onsite logistics (cust./ supp.) Design Production operation Waste disposal/ mgmt. Chemical synthesis Batch processing Formulating Other activities Compounding Terminaling Prod./ app. devt. Prod. reg./ patent res. QM & lab analysis Training ESHQ, REACH Reg. services: Customer support Technical support Vendor-managed inventory Debt collection (for suppliers) Order & invoice mgmt. Financing Single sourcing Marketing Sales to broad customers Bundling, filling, pack., label Complexity management Diluting, blending Waste handling & transport Storage Document handling Drum return handling Products Physical handling of goods Transportation Activities Production Producti on Customer industries Agriculture Gas distribution Electricity production Mining and quarrying • Extraction of oil & gas Coke, refined petroleum prod. Chemicals excl. pharma. • • Cosm., pers. care, cleaning Paints & coatings Water treatment Rubber and plastics products Textiles and footwear Pulp & paper Wood and wood products Iron & steel Food products, bever., tobacco Other non-metallic mineral prod. Fabricated metal products Motor vehicles Pharmaceuticals Building & construction industry Electrical machinery Medical & optical instruments Communication equipment Office & computing machinery Other transport equipment Transport services Health and social work Research and development Hotels and restaurants Post and telecommunications Finance and insurance Real estate activities Computer and related activities Private households ... … Source: Market study; BCG Chemical Distribution - ANIQ Oct 2012 -Final.pptx 9 Global State Chemical Distribution Global chemical distribution landscape shows few large distributors and a sizable gap to mid-tier Sales 2011 in $B 200 115.4 164 150 19% share of global top 5 50 9.7 5.6 4.0 2.3 1.6 1.4 1.3 1.2 0.9 0.8 0.8 0.8 0.8 0.7 0.7 0.7 0.6 0.6 0.6 0.5 0.5 0.5 0.5 0.4 11.2 Total Others 0 "Top 25 distributors" 2011 Revenues Delta between market size and bottom-up sales of top 25 Overall market size based on market model Source: ICIS, Company websites, BCG analysis Chemical Distribution - ANIQ Oct 2012 -Final.pptx 10 Global State Chemical Distribution Brenntag is a top value creator in the overall chemical industry Brenntag, a success history Chemical Distribution Industry gaining more attention due to Brenntag´s IPO • IPO in 2010 – beforehand owned by two sequential PE firms • Complete exit of PE firm in several steps Brenntag´s multiple levers of organics growth & acquisition strategy • Example of acquisitions in 2012: – ISM/Salkat Group, Australia & New Zealand – The Treat-Em-Rite Corporation, Texas, USA Stock performance IPO´s media coverage Brenntag Fulfils Investor´s Wishes, 17 Mar 2010 The Right Chemistry Between Brenntag and Investors – IPO a Success, 29 Mar 2010 Brenntag ´s stock performance vs. leading chemical manufacturers Stock Brenntag BASF DuPont Oct 1, 2012 BNR.DE 99.15 BAS.DE 55.96 DD 47.63 Percentage change since Brenntag´s IPO Source: ICIS Top 100 Chemical Distributors, Yahoo finance, Brenntag´s website & press releases Chemical Distribution - ANIQ Oct 2012 -Final.pptx 11 Agenda What is the state, globally, of the chemical distribution market? In particular, what is happening in Mexico and Latin America? What global trends can forecast a brighter future for the Mexican Chemical Distribution market? Chemical Distribution - ANIQ Oct 2012 -Final.pptx 12 Mexican & LATAM markets Asia and Latin America with high growth rates in chemical distribution Europe1 North America2 Asia Pacific Latin America3 Middle East Market sizes in B$ Market sizes in B$ Market sizes in B$ Market sizes in B$ Market sizes in B$ 80 80 80 80 World Market sizes in B$ 80 200 +9% 164 155 +6% 60 54 54 60 60 +8% 48 40 40 +12% 39 60 60 150 40 40 100 138 48 43 41 35 40 38 +10% 20 20 20 20 12 13 14 20 5 0 0 2009 2010 2011 0 2009 2010 2011 0 2009 2010 2011 50 +18% 6 7 0 2009 2010 2011 0 2009 2010 2011 2009 2010 2011 1. Incl. Western and Central & Eastern Europe 2. North America includes USA and Canada 3. Incl. Mexico Note: Small differences due to rounding Source: ICIS, chemagility, BCG analysis Chemical Distribution - ANIQ Oct 2012 -Final.pptx 13 Mexican & LATAM markets Chemical trade between Latin America and other regions grew by more than 50 % since 2009 – significant net imports Mexico Brazil LATAM Billion USD, at current prices Billion USD, at current prices Billion USD, at current prices Year Exports1 Imports2 Balance Year Exports Imports3 Balance Year Exports Imports Balance 2011 14.2 39.5 -25.4 2011 15.1 41.8 -26.8 2011 55.6 154.2 -98.6 2010 11.9 34.1 -22.2 2010 12.2 32.3 -20.1 2010 44.7 124.4 -79.6 2009 10.1 27.8 -17.7 2009 10.5 25.3 -14.8 2009 39.2 99.9 -60.6 1. Coverage: Includes processing zones 2. Coverage: Includes processing zones; Method of valuation: Imports are valued f.o.b. 3. Method of valuation: Imports are valued f.o.b. Source: World Trade Organization Chemical Distribution - ANIQ Oct 2012 -Final.pptx 14 Mexican & LATAM markets Latin America with high fragmentation of the chemical distribution industry Share of top 5 Market share 2011 100% 25.2% 38.8% 18.1% 8.0% 25.5% Other 41 54 7 48 14 61.2 1.1 40% 74.8 8.3 17.3 4.4 10.3 8.6 7.5 M. Cassab 0% 20% 40% 60% North America Latin America 4.3 Azelis 2.7 REDA Chemicals 5.3 ICC Chemical Petrochem Middle East 6.2 1.2 1.9 Protea Chemicals 1.7 2.2 1.1 0% Connell Brothers Manuchar 92.0 2.3 2.4 2.5 4.1 DKSH Grupo Pochteca 81.3 3.5 5.5 Prinova IMCD Group 74.5 2.0 2.9 20% Market size 2011 USD B 80% Nexeo Solutions 7.1 Helm 100% Univar Brenntag Europe Ranking 1 2 3 4 5 Brenntag Helm Univar Azelis IMCD Group Brenntag Helm Univar Nexeo Solutions Prinova Brenntag quantiQ M. Cassab Manuchar Grupo Pochteca Asia – Pacific Brenntag Helm ICC Chemical Connell Brothers DKSH ME&A Brenntag ICC Chemical Protea Chemicals Petrochem Middle East REDA Chemicals Source: ICIS, chemagility, BCG analysis Chemical Distribution - ANIQ Oct 2012 -Final.pptx 15 Mexican & LATAM markets Major regional differences in the market shares of the top 5 chemical distributors North America Europe Market size (B$) Market shares and position Latin America Asia-Pacific 2011 2010 2011 2010 2011 2010 2011 2010 54.0 53.8 41.0 39.0 14.0 13.0 48.0 43.0 1 Brenntag 10.3% 9.7% Univar 17.3% 14.9% Brenntag 7.5% 7.4% Helm 2.2% 2.5% 2 Helm 5.5% 5.5% Brenntag 8.6% 8.3% quantiQ 4.1% 3.2% ICC Chemical 1.9% 1.9% 3 Univar 4.4% 3.5% Nexeo Solutions 8.3% 8.7% M. Cassab 2.5% 2.8% Connell Brothers 1.7% 1.7% 4 Azelis 2.9% 2.9% Helm 3.5% 3.7% Manucha b 2.4% 2.6% DKSH 1.2% NA 5 IMCD Group 2.0% 2.1% Hydrite Chemical 1.1% 1.2% Grupo Pochteca 2.3% 1.9% Brenntag 1.1% 0.7% 38.8% 36.7 18.1% 17.4% 8.0% NA Top 5 25.2% 23.8% Fragmented competitor landscape with sizable gap between Brenntag and the top 2–5 Gap between top 3 and followers Numerous national, medium-sized distributors Very fragmented market landscape (not a homogeneous region, mostly local competitors) Fragmented landscape Top 5 with lower market share than in North America Source: ICIS, Company press releases Chemical Distribution - ANIQ Oct 2012 -Final.pptx 16 Mexican & LATAM markets High market fragmentation in chemical distribution in Latin America Characteristics Market size Latin America Ranking Company US$ 14 Bn Revenue 2011 US$ M Growth 2009-2011 (CAGR) 10% Number of main Distributors 726 Top 10 Market Share 21% Distribution Model(s) 1 Brenntag 1,046 2 quantiQ 572 3 M. Cassab 344 4 Manuchar 332 5 Grupo Pochteca 325 Chemical Distributors, Traders, Agents 6 Bandeirante Brazmo 244 7 Indukern 144 Shipment Models Predominately Road 8 Makeni 104 Suppliers / Principals Foreign / Domestic Producers 9 Univar 100 10 Quimisa 95 Regulatory Environment Responsible Distribution – Brazil, Mexico. GHS1 implemented in most major countries 1. Globally Harmonized System of Classification and Labeling Chemicals Sources: World Chemical Distributor Directory, www.chemagility.com, ICIS 2012 – Top 100 Chemical Distributors Chemical Distribution - ANIQ Oct 2012 -Final.pptx 17 Mexican & LATAM markets Mexico still with a low share of chemical distribution vs. overall chemical market Characteristics Industry structure Share of chemical distribution conducted via 3rd. party distributors, 2010 1. Source: ICIS; BCG Mexico Highly fragmented • Few local & regional leaders with a large number of smaller family businesses ~ 8% 1 M&A activity, rationale: • Tier-1 (Global) distributors such as Brenntag and Univar looking for high growth rates outside developed nations, increasingly focusing on Asia-Pacific and Latin America M&A activity, 2011 (case example): Purchasing company: Brenntag Purchased company: Amco International S.A.de C.V. Strategic rationale2: • Improve full-line portfolio and expand it into aroma chemicals, essential oils and food ingredients Market Outlook, 2013 – 2020: • Consolidation trend, improving margins • Opportunity for larger regional players seeking growth through M&A • A push from suppliers and their customers for better practices & raising standards • Streamlining and development of distribution channels Share of chemical distribution in Europe is around 12% and 13-14% in the US Chemical Distribution - ANIQ Oct 2012 -Final.pptx 18 Agenda What is the state, globally, of the chemical distribution market? In particular, what is happening in Mexico and Latin America? What global trends can forecast a brighter future for the Mexican Chemical Distribution market? Chemical Distribution - ANIQ Oct 2012 -Final.pptx 19 Mexican & LATAM markets Key hypotheses for the market for chemical distribution in Latin America Value chain perspective Chemical distribution is a vital element of the overall chemical value chain – and needs to be recognized as such HSEQ "Responsabilidad Integral" (Health, Safety, Environment, Quality) is essential for the "license to operate" for any chemical distributor Consolidation Even higher fragmentation in Latin America than elsewhere – will lead to a significant consolidation Institutionalization Strong drivers to institutionalize chemical distribution companies: The requirements of the producers, the overall value chain perspective, the consolidation Growth ahead The share of third party distributors will present an over-proportional growth in Latin America Industry Associations Chemical Distribution - ANIQ Oct 2012 -Final.pptx Industry Associations in the chemical industry have a vital role in promoting HSEQ and institutionalization of business models from an overall value chain perspective 20 Global State Chemical Distribution Chemical Distribution: The future in Latin America 1 Chemical distributors will become a vital part of integrated chemical supply chains from producers to customers 2 Chemical producers in Latin America will consider leading distributors as an important element of their go-to-market strategies • Opening new markets and customer segments • Complexity reduction in marketing and sales 3 Chemical customers will increasingly value bundled supply and one-stop-shopping of many products from chemical distributors 5 Responsible care will be a MUST HAVE - A precondition for the license to operate in the entire chemical value chain Source: BCG analysis Chemical Distribution - ANIQ Oct 2012 -Final.pptx 21