Accounting for Derivatives & Hedge Accounting Presentation

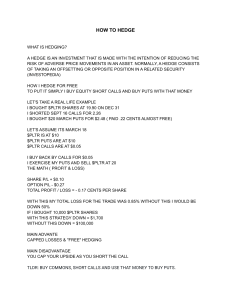

advertisement

5/8/2022 Accounting for Derivatives and Hedge Accounting 1 Chapter 10 Accounting for Derivatives and Hedge Accounting Copyright © 2016 by McGraw-Hill Education (Asia). All rights reserved. 2 1 5/8/2022 Learning Objectives 1. Understand what constitutes a derivative instrument; 2. Understand the different types of derivatives; 3. Know how derivatives are used; 4. Understand the accounting treatment of derivatives; 5. Understand hedge accounting, its rationale, and the conditions for applying hedge accounting; and 6. Appreciate the three main types of hedge relationships and their accounting treatments. 3 Accounting for Derivatives 4 2 5/8/2022 Công cụ tài chính phái sinh (Derivative instrument) • là các CCTC. Đó là một hợp đồng, mang lại cho một bên là TSTC và đối với đối tác khi đó CCPS này hoặc là nợ tài chính hay VCSH. 5 Derivative Financial Instruments A derivative is a financial instrument that meets the following three criteria: Its value changes in response to a change in an “underlying” Requires little or no initial investment Settled at a future date Scope Exemption: IFRS 9 exempts contracts which meet the definition of a derivative from the standard if the contract is entered into to meet the entity’s usual purchase, sale or usage requirements (own use exemption) 6 3 5/8/2022 Công cụ tài chính phái sinh (Derivative instrument) • CCTC phái sinh là CCTC mà phải thỏa mãn đồng thời 3 đặc điểm sau: - Nhà đầu tư ban đầu không phải bỏ vốn đầu tư, hoặc nếu có thì rất thấp so với HĐ cơ sở. - giá trị của HĐ sẽ thay đổi theo thời gian và sự thay đổi này tùy thuộc vào đối tượng cơ sở (thuộc HĐ cơ sở). - HĐ phái sinh được thanh toán trong tương lai. 7 Công cụ tài chính phái sinh (Derivative instrument) • Có 4 loại căn bản: - forward contract (HĐ kỳ hạn) - future contract (HĐ tương lai) - Options (HĐ quyền chọn) - Swap (Hđ hoán đổi). 8 4 5/8/2022 Derivative Financial Instruments Examples of derivative instruments and their underlying Types of derivative instruments Underlying Option contracts (call and put) Security price Forward contracts e.g. foreign exchange forward contract Foreign exchange rate Future contracts e.g. commodity futures Commodity prices Swaps Interest rate 9 1.1. Forward Contracts Definition • An agreement between two parties (counterparties) whereby one party agrees to buy and the other party agrees to sell a specified amount (notional amount) of an item at a fixed price (forward rate) for delivery at a specified future date (forward date) • Can either be a forward purchase contract or a forward sales contract, depending on the perspective of the counterparties “A” Company “Forward sales contract” Sells Forward Contract “B” Company “Forward purchase contract” 5 5/8/2022 Thí dụ 1 • Ngày 1/6/20X4, Cty Ace có đồng tiền chức năng là USD, nhập khẩu hàng hóa từ nhà xuất khẩu nước ngoài với giá 100,000 Euro, thanh toán vào 31/7/20X4. Cty Ace có hai lựa chọn: vào ngày 31/7 mua ngoại tệ (Euro) giao ngay để thanh toán cho nhà cung cấp, hoặc ký ngay hợp đồng kỳ hạn mua ngoại tệ vào ngày thanh toán. Giả sử tỷ giá mua HĐ kỳ hạn là 1,8$/euro. Như vậy, vào ngày 31/7 Cty trả cho nhà môi giới ngoại tệ 180.000 $ để lấy 100,000 Euro thanh toán. Thí dụ 2- Non- deliverable forward (NDF) • Ngày 5/1/20X2, NH X cung cấp NDF cho Cty Xuất khẩu: kỳ hạn 3 tháng, giá trị ngoại tệ: 1 tr USD, tỷ giá kỳ hạn 23.500 VND/USD. Vào ngày thanh toán: – (i) Tỷ giá giao ngay 23.600 VND/USD – (ii) tỷ giá giao ngay: 23.300 VND/USD (i) Tỷ giá giao ngay >Tỷ giá kỳ hạn: Khách hàng Ngân hàng (ii) Tỷ giá giao ngay <Tỷ giá kỳ hạn: 6 5/8/2022 1.1. Forward Contracts Fair value of forward contract Fair value of a forward contract = Notional x amount where (׀Current forward rate – contracted forward rate )׀ (1+r)t Contracted forward rate is forward rate fixed at inception r = discount rate Current forward rate is forward rate for remaining period to maturity t = period to maturity At inception date, the fair value of a forward contract is nil. Illustration 10.1. Fair value of a forward contract Ngày 1/3/20X5, Cty A ký 1 HĐ kỳ hạn mua ngoại tệ 1,000,000 FC (foreign currency), ngày thanh toán 31/5/20X5, tỷ giá kỳ hạn 1,2 $/FC (contracted forward rate). Các tỷ giá thay đổi như sau: Ngày Tỷ giá giao ngay (spot rate $/FC) Tỷ giá hiện hành của HĐ kỳ hạn (current forward rate $/FC) 1/3/20X5 $ 1.185 $1.2 31/3/20X5 1.19 1.21 30/4/20X5 1.2 1.205 31/5/20X5 1.215 1.215 Hãy tính FV của HĐ kỳ hạn với lãi suất 5%/năm. 7 5/8/2022 1.1. Forward Contracts Accounting for Forward Contracts • At the date of maturity of the forward contract forward rate converges to the spot rate – Fair value of the forward contract at maturity: difference between the spot rate at maturity date and the contracted forward rate x notional amount of the contract • Premium (or discount) on the forward contract is the interest or time value – Measured by the difference or spread between the forward rate and the spot rate at a point in time • Changes in the time value component are due to a number of factors including: – Cost of holding the commodity or underlying by the counterparty – Risk free rate – Period to maturity 1.1. Forward Contracts Accounting for forward contracts • Changes in fair value of a forward contract after inception date Current forward rate > Current forward rate < contracted forward rate contracted forward rate Forward purchase contract • Fair value is positive • Gain is recorded • Forward contract is an asset Forward • Fair value is negative sale contract • A loss is recorded • Forward contract is a liability • Fair value is negative • A loss is recorded • Forward contract is a liability • Fair value is positive • A gain is recorded • Forward contract is an asset 8 5/8/2022 1.1. Forward Contracts Accounting for Forward Contracts At inception No journal entry as fair value is nil During life of contract Closing position or at expiration Dr Forward Contract (asset) Cr Gain on forward contract Dr Cash or or Dr Loss on forward contract Cr Forward Contract (liability) Dr Forward contract Adjust fair value and record gain/loss Close out and record net settlement of contract Cr Forward contract Cr Cash Illustration 10.1. Fair value of a forward contract Ngày 1/3/20X5, Cty A ký 1 HĐ kỳ hạn mua ngoại tệ 1,000,000 FC (foreign currency), ngày thanh toán 31/5/20X5, tỷ giá kỳ hạn 1,2 $/FC (contracted forward rate). Các tỷ giá thay đổi như sau: Ngày Tỷ giá giao ngay (spot rate $/FC) Tỷ giá hiện hành của HĐ kỳ hạn (current forward rate $/FC) 1/3/20X5 $ 1.185 $1.2 31/3/20X5 1.19 1.21 30/4/20X5 1.2 1.205 31/5/20X5 1.215 1.215 FV của HĐ kỳ hạn được tính với lãi suất 5%/năm 9 5/8/2022 Illustration 10.2A- Accounting for forward contract (profit) Illustration 10.1 Ngày contracted forward rate (a) Current forward rate (b) Notional amount (c) 1/3/X5 $ 1.2 $1.2 $ 1.000.000 31/3/X5 $ 1.2 1.21 30/4/X5 $ 1.2 31/5/X5 $ 1.2 Discount factor (d) FV of Forward contract [(b-a)*c]/d Chang e in FV 0 0 0 1.000.000 (1+(5%/12))2 9,917 9,917 1.205 1.000.000 (1+(5%/12))1 4,979 -4,938 1.215 1.000.000 1 15,000 10,021 Ghi các bút toán theo từng thời điểm? 1.2. Future Contracts Definition • A future contract is a contract between a buyer or seller and a clearing house or an exchange. • Wide range of exchange-traded future contracts – Commodity futures – Interest rate futures – Currency future • A future contract is similar to a forward contract except that it: – is a standardized contract and is traded on an exchange – can be closed out before maturity by entering into an identical contract that is in opposite position – requires the payment of a margin deposit which has to be maintained through the contract period – marked-to-market and settled on a daily basis – Rarely result in physical delivery 10 5/8/2022 1.2. Future Contracts Definition • Long position: purchaser of a futures contract • Short position: seller of a futures contract • Since futures are traded on exchange, quoted price of futures contracts readily provides a measure of the fair value of a futures contract • When the underlying increases: – a long position results in a gain – a short position results in a loss • When the underlying decreases – a long position results in a loss – a short position results in a gain 1.2. Future Contracts Accounting for Future Contracts At inception During life of contract Dr Cash Cr Gain on future contract Dr Margin deposit or Closing position or at expiration Dr Cash Dr Loss on future contract Cr Margin Contract or Cr Cash Dr Loss on futures contract Cr Cash Dr Cash Cr Gain on future contract Cr Margin Contract Record payment of initial margin deposit Record daily settlement of future contracts Close out and recover margin deposit 11 5/8/2022 Illustration 10.3- Accounting for a future contracts • On 1 March, Capital Trust speculates that the price of gold will insrease and purchases 10 gold future contracts at a price of $800 per ounce. Each contract is for 100 ounces of gold and the maturity date is 31 May. The future exchange requires a payment of 10% of the notional amount as margin deposit. On 31 March, the price of gold increases to $ 850 per ounce and Capital Trust closes its long position. 1.3. Option Contracts Definition • Contract that gives holder the right but not the obligation to buy or sell a specified item at a specified price during a specified period of time • 2 type of option contracts 1. Call option – right, but not obligation to buy 2. Put option – right, but not obligation to sell • Can be American option (exercisable anytime to expiration) or European option (exercisable only on maturity date) • Can also be customized (not traded) or standard contract quoted on exchange (listed options) 12 5/8/2022 1.3. Option Contracts Definition – Asymmetrical pay-off profile • Holder has limited loss (due to premium) and unlimited gain • Writer has limited gain and unlimited loss Relationship between the strike price and the underlying Strike price > Underlying (spot price) Strike price = Underlying (spot price) Strike price < Underlying (spot price) Holder of call option Out-of-the-money At-the-money In-the-money Holder of put option In-the-money At-the-money Out-of-the-money • Pay-off profile for options 13 5/8/2022 1.3. Option Contracts Fair value • Fair value of option contract Fair value of an option = Intrinsic value + Time value Listed options = quoted price Not traded options = Valuation models (Black-Scholes model) Tham khảo Diminishes over time Zero at expiration Call option = Max [0, Notional amount x (Spot price – Strike Price) Put option = Max [0, Notional amount x (Strike price – Spot Price) 1.3. Option Contracts Accounting for Purchased Option Contract At inception During life of contract Dr Option Contract Cr Gain on option contract Dr Option contract (asset) Cr Cash or Dr Loss on option contract Cr Option Contract Closing position or at expiration Dr Cash* Cr Gain on option contract Cr Option Contract or Dr Cash* Dr Loss on option contract Cr Option Contract (*assume expires in-the-money; if out-of-money, no entries needed) Record payment of initial margin deposit Adjust for fair value and record gain/loss Close out and record net settlement of contract 14 5/8/2022 1.3. Option Contracts Accounting for Written Option Contract At inception During life of contract Dr Option Contract Cr Gain on option contract Dr Cash Cr Option contract (liability) or Record payment of initial margin deposit Adjust for fair value and record gain/loss Dr Loss on option contract Cr Option Contract Closing position or at expiration Dr Option contract Cr Gain on Option Contract (Expires out-of-themoney) Dr Option contract Dr/CR Loss on option/Gain on option Cr Cash (Expires in-the-money) Close out and record net settlement of contract Illustration 10.4- Accounting for a option contract • • Khi giá thị trường của cổ phiếu A là 38$/CP, Cty X quyết định cùng lúc mua HĐ quyền chọn mua (call option)& HĐ quyền chọn bán (Put option) 100.000 cổ phiếu A với giá mua quyền chọn (kể cả HĐ mua & bán) là 1,5$/CP. Giá thực hiện (strike price/or exercise price) của HĐ mua là 41$/CP, giá thực hiện của HĐ bán là 35$/CP. Vào thời điểm giá thị trường CP của A là 43$/CP (> giá thực hiện): giá thị trường (FV) của call option (in-the money) là 2,95$/CP; giá thị trường (FV) của put option (out-the money) là 0,5$/CP; cty X quyết định đóng cả hai HĐ Call option Put option Option buyer: FV Less premium paid G/L on option Option Writer Premium received Less FV G/L 15 5/8/2022 Illustration 10.4- Accounting for a option contract Option buyer Option writer At inception At closing of the option position Hedge Accounting 32 16 5/8/2022 1. Những vấn đề chung về phòng ngừa rủi ro và nguyên tắc kế toán phòng ngừa rủi ro 33 Risks that Qualify for Hedge Accounting Interest rate risk Foreign exchange risk Specific risks that qualify for hedge accounting Risks must be specific risk, not general business risks Market Price risk Credit risk Possible for a derivative to hedge more than one risk 34 17 5/8/2022 Rủi ro Sự kiện Đối Tượng Hậu quả -Xác suất xẩy ra -Tác động đến đối tượng -Mất mát, tổn thất 35 Rủi ro Sự thay đổi: -Lãi suất -Tỷ giá hối đoái -Chỉ số cổ phiếu -Giá cả -Chất lượng tín dụng …… Tác động đến: -Tài sản -Nợ phải trả -Các cam kết -Các giao dịch dự kiến Thay đổi -Giá trị hợp lý của TS/NPT -Luồng tiền trong tương lai Ảnh hưởng đến lợi nhuận của doanh nghiệp 36 18 5/8/2022 Thí dụ: • • • • DN đầu tư vào cơ sở nước ngoài 50 triệu USD (ngoại tệ). Tỷ giá hối đoái xu hướng giảm. Giá trị hợp lý của tài sản (Đầu tư ) giảm. Ảnh hưởng giảm lợi nhuận. Tỷ giá giảm ảnh hưởng làm giảm giá trị hợp lý của tài sản Rủi ro GTHL Giảm lợi nhuận Tỷ giá tăng: DN không có rủi ro 37 Phòng ngừa rủi ro What? How? DN cần phòng ngừa rủi ro thay đổi GTHL & luồng tiền làm giảm LN (1) Công cụ phi phái sinh ( rủi ro tỷ giá) (2) Công cụ phái sinh Why? Tạo ra trạng thái bù trừ được sự thay đổi GTHL & dòng tiền 38 19 5/8/2022 Qualifying Hedging Instruments • Qualifying hedging instruments include: a) Derivatives measured at FVTPL (except for net written options and derivatives embedded in hybrid financial instruments) b) Designated non-derivative financial assets/liabilities measured at FVTPL. Or a combination of (a) and (b) 39 Qualifying Hedged Items • Items qualified as hedged items for purpose of hedge accounting – Recognized assets or liabilities – Unrecognized firm commitments: – Highly probable forecast transactions with exposures to changes in future cash flow; and – A net investment in a foreign entity All the above items can be a component of such an item or group items 40 20 5/8/2022 41 Classification of Hedging relationships Three types of hedges Explanation Fair value hedge Hedge of “the exposure to changes in fair value of a recognized asset or liability or an unrecognized entity commitment, or an identified portion of such asset, liability or entity commitment, which is attributable to a particular risk and could affect profit or loss” Cash flow hedge Hedge of “the exposure to variability in cash flows that (i) is attributable to a particular risk associated with a recognized asset or liability (such as all or some future interest payment on variable debt instrument) or a highly probable future transaction; and (ii) could affect profit or loss” Hedge of a net investment in a foreign entity Hedge of the foreign currency risk associated with a foreign operation whose financial statements are required to be translated into the presentation currency of the parent company 42 21 5/8/2022 Thí dụ: Ngày 30/6/20X1, ABC phát hành trái phiếu trị giá CHF10 triệu, lãi suất cố định 7.5%/năm, lãi trả định kỳ 6 tháng, gốc trả khi đáo hạn. Cùng ngày, ABC thỏa thuận một HĐ hoán đổi lãi suất (swap) trả lãi thay đổi theo LIBOR- 6 tháng và nhận lãi cố định 7,5%/năm. HĐHĐ có giá trị danh nghĩa CHF10 triệu, kỳ hạn 3 năm, lãi thay đổi định kỳ 6 tháng. • Lãi suất thị trường xu hướng giảm. • Giá trị hợp lý của nợ phải trả (Trái phiếu phát hành) tăng. Rủi ro GTHL Giảm lợi nhuận Lãi suất tăng: DN không có rủi ro 43 Thí dụ: Phòng ngừa giá trị hợp lý với Swap Trái phiếu phát hành CHF 10 triệu (l/s) 7.5% trả lãi 7.5% Trả Libor Swap ABC Nhận 7.5% Lãi suất LIBOR- 6 tháng của hai kỳ đầu: 1/7 – 31/12/ 20X1: 6.0% 1 /1 – 30/6/20X2: 7.0% 44 22 5/8/2022 Hedge Accounting - Qualifying criteria (1)The hedging relationship consist only of eligible hedging instruments and eligible hedging items (2)At the inception: Documentation: hedging instrument, hedge item, how the entity will assess hedged effectiveness. (3) The hedging relationship meet all the following criteria for hedge effectiveness. 5/8/2022 45 Hedge Accounting - Qualifying criteria Criteria for hedge effectiveness: - There is an economic relationship between hedged item and hedging instrument - The hedge ratio: effect of hedge instrument is the same as effect of hedging item. - The effect of the credit risk does not dominate the value changes from that economic relationship. 5/8/2022 46 23 5/8/2022 Qualifying Criteria for Hedge Accounting (IFRS 9 Para B6.4.1) 01 H edging relationship consists only of eligible hedging instruments and eligible hedged items 02 At the inception of the hedge, there has to be formal designation and documentation of hedging relationship, risk management objective and strategy for undertaking the hedge 03 T he hedging relationship meets all of the following hedge effectiveness requirements: i. ii. iii. Economic relationship between hedge item and hedging instrument; Credit risk does not dominate the value changes from (i) Hedge ratio of hedging relationship is the same as that resulting from quantity of hedged item that entity hedges and quantity of hedging instrument the entity uses to hedge that quantity of hedge item 47 2. Fair Value Hedge Accounting 48 24 5/8/2022 Fair Value Hedge Accounting • Change in FV of the hedging instrument is recognized in P/L – Exception: when the hedged item is an equity instrument with change in FV to OCI, the gains or losses on the hedging instrument is recognized in OCI to allow offsetting • Basis adjustment: The gain or loss on the hedged item attributable to the hedged risk is taken to P/L. Its carrying amount is adjusted by the amount of gain or loss. – Applies even if the hedged item is otherwise at cost, e.g. inventory • When the hedged item in a fair value hedge is a firm commitment, the cumulative change in FV of the firm commitment attributable to the hedged risk is recognized as an asset or a liability with the corresponding gain or loss recognized in the P/L. 49 Accounting for a Fair Value Hedge Hedged Item (recognized asset or liability or entity commitment) Change in fair value Hedging Instruments Change in fair value Income statement Gain (loss) on hedging instrument offset loss (gain) on hedged item Exception: when the hedged item is an equity instrument with changes in FV to OCI, the gains or losses on the hedging instrument is recognized in OCI to allow offsetting Balance sheet Change in fair value adjusted Change in fair value adjusted against carrying amount against carrying amount 50 25 5/8/2022 Illustration: Hedge of Inventory (Fair Value Hedge) Scenario 31/10/20x3 – Inventory of 10,000 ounces of gold – Carried at cost of $3,000,000 ($300 per ounce) – Price of gold was $352 per ounce 1/11/20x3 – Sold forward contract on 10,000 ounce for forward price of $350 ounce – Forward contract matures on 31/3/20x4 31/12/20x3 – Forward price for 31/3/20x4 contract was $340 per ounce and spot price of gold was $342 per ounce – Hedge effective ratio of 1 on 31/12/20x3 51 Illustration: Hedge of Inventory (Fair Value Hedge) 1/11/20x3 No entry or just a memorandum entry as the fair value of the forward contract is nil 31/12/20x3 Dr Forward contract ………………. Cr Gain on forward contract ……... 100,000 100,000 Gain on forward contract: 10,000 x ($340 – $350) Dr Loss on inventory ……………… Cr Inventory ……………………….. Taken to income statement 100,000 100,000 Fair value loss on inventory: 10,000 x ($342 – $352) 52 26 5/8/2022 Illustration: Hedge of Inventory (Fair Value Hedge) 31/3/20x4 Inventory is sold to third-party at $330 per ounce (also maturity date of forward contract Dr Forward contract ………………. Cr Gain on forward contract ……... 100,000 100,000 Gain on forward contract: 10,000 x ($330 – $340) Dr Loss on inventory ……………… Cr Inventory ……………………….. 120,000 120,000 Loss on inventory: 10,000 x ($330 – $342) Dr Cash …………………………….. Cr Sales ……………………………. 3,300,000 3,300,000 Sale of inventory: 10,000 x $330 53 Illustration: Hedge of Inventory (Fair Value Hedge) 31/3/20x4 (continued) Dr Cost of goods sold ………….. Cr Inventory …………………….. 2,780,000 2,780,000 Cost of goods sold: $3,000,000 – $100,000 – $120,000 Dr Cash …………………………….. Cr Forward contract ………………. 200,000 200,000 Close forward contract and record net receipt on settlement, which is the notional amount multiplied by the difference between the contracted forward rate and spot rate on settlement [10,000 x ($350 – $330)] For illustration on (i) Hedge of an exposed monetary asset ii) Hedge of financial assets classified as FVOCI III) Hedge of a firm commitment, please refer to Tan, Lim & Kuah illustrations 10.6–10.9 54 27 5/8/2022 P10.1- Fair value hedge of inventory • On 1/11/X5, Company X, a manufacture of gold jewellery and ornaments, had an inventory of 10.000 ounces of gold ingots that cost $780 an ounce. The price of gold was $950 an ounce. Company X expected to use the gold to produce investmentgrade gold coins that would be sold in Feb X6. Company X was concerned that the price of gold would fall, which would in trurn affect the price of gold coins . Therefore, Company X decided to hedge the value of its gold inventory by selling gold futures on the commodity exchange. Gold future were traded in 100 troy ounce contracts ( 1lượng vàng = 1,20556 troy ounces); Company X entered into 100 31 Jan X6 contracts at price of 952 per ounce. The exchange required a margin deposit of $ 3.300 per contract. The spot price and the price of Jannuary future contracts are as follows: 55 P10.1- Fair value hedge of inventory Spot price of gold (per ounce) January gold future (per ounce) 1 Nov X5 $ 950 $ 952 31 Dec X5 $ 940 $ 941 31 Jan X6 $ 960 $ 960 Company X designated the future contracts as fair value hedge of the change in the value of the gold inventory due to changes in the spot price of the gold. Hedge effectiveness is assessed based on the ratio of the change in the entire fair value of the future contract to the change in the value of the inventory based on the spot gold price. Required: 1. Asses the effectiveness of the hedge at the inception and during the life of the future contract. 2. Prepare journal entries to record the hedging instrument and the hedged item. 56 28 5/8/2022 • Ngày 1/11/X5, Cty X, nhà sản xuất trang sức bằng vàng có lượng hàng tồn kho (NVL) là 10.000 ounces vàng với giá gốc $ 780/ounce, giá thị trường là $ 950/ounce. Cty X dự định sử dụng NL vàng cho sản xuất đồng tiền vàng để bán vào T2/X6. Cho rằng giá vàng sẽ giảm ảnh hưởng đến giá bán thành phẩm nên Cty X quyết định phòng ngừa FV cho số NL này bằng HĐ tương lai bán vàng trên sở giao dịch tương lai. Mỗi HĐ tương lai giao dịch 100 troy ounce ( 1 troy ounce = 1,09714286 ounces); Cty X đưa vào 100 HĐ tương lai, đáo hạn 31 Jan X6 với giá 952$/ounce. SGD yêu cầu ký quỹ $ 3.300/HĐ. Giá giao ngay của vàng và giá của HĐ tương lai (đáo hạn T1/X6) như sau: Spot price of gold (per ounce) January gold future 1 Nov X5 $ 950 $ 952 31 Dec X5 $ 940 $ 941 31 Jan X6 $ 960 $ 960 Cty X chỉ định HĐ tương lai là CC phòng ngừa thay đổi FV của NL vàng khi giá vàng thay đổi. Tính hữu hiệu của PN được đánh giá dựa vào tỷ số giữa biến động toàn bộ FV của các HĐ tương lai và thay đổi FV của NL Yêu cầu: 1. Đánh giá tính hữu hiệu của PNRR trong suốt thời gian nắm giữ HĐ. 2. Ghi sổ (định khoản) đối với KM được phòng ngừa và CCPN. 57 P10.1- Fair value hedge of inventory (1) Assessment of hedge effectiveness Change in value of inventory based on spot price of gold Change in fair value of futures contract 31 Dec X5 31 Jan X6 58 29 5/8/2022 Illustration 3: Hedge of a Net Investment in a Foreign Entity Scenario – Functional currency is the dollar ($) – Acquired 100% interest in foreign company (functional currency is FC) 31/12/20x3 – Exchange rate is $1.85 to FC1 – Loan of FC1,200,000 at 5% interest taken to hedge foreign investment – Foreign currency translation reserves showed $15,000 (credit balance) 31/12/200x4 – Exchange rate is $1.70 to FC1 – Average rate is $1.78 to FC1 – Foreign company reported net profit of FC380,000 59 Illustration 3: Hedge of a Net Investment in a Foreign Entity Translation difference in foreign investment’s FS for 31/12/20x4 On net assets on 1/1/20x4 (FC 1,200,000 x $(1.70-1.85) ……. $(180,000) On net profit for 20x4 (FC380,000 x $(1.70-1.85) …………….. (30,400) Translation loss for 20x4 $(210,400) Foreign currency translation reserve on 31/12/20x4 (credit balance) (195,400) Journal entries for parent 31/12/20x3 Dr Cash …………………………….. Cr Loan payable …………………... 2,200,000 2,200,000 The loan payable is designated as a hedge of the net investment: FC1,200,000 x spot rate of $1.85 60 30 5/8/2022 Illustration 3: Hedge of a Net Investment in a Foreign Entity 31/12/20x4 Dr Interest expense ………………. Cr Accrued interest ……………….. 106,800 106,800 Interest expense during the year at 5% x FC1,200,000 x $1.78 Dr Accrued interest ……………….. Cr Cash …………………………….. 102,000 Cr Exchange gain …………………. 4,800 106,800 Settlement of accrued interest at year-end Dr Loan payable …………………... Cr Foreign currency translation reserves ………………………… 180,000 Exchange gain on FC loan taken directly to equity: FC 1,200,000 x ($1.70 – $1.85) 180,000 Taken to equity to offset translation loss 61 3. Cash Flow Hedge Accounting 62 31 5/8/2022 Cash Flow Hedge Accounting • A cash flow hedge applies when: 1. Hedge of a recognized asset or liability with a variable interest rate (resulting in a variable future cash flow); and 2. A highly probable future transaction. Cash flow hedges are typically hedges against floating rate exposures. • Certain types of hedges have the characteristics of both a fair value hedge and a cash flow hedge. – E.g. the hedge of a firm commitment denominated in a foreign currency FV hedge view: An exchange rate movement will affect the fair value of the commitment, implying a fair value change. CF hedge view: The cash flows from a foreign currency denominated firm commitment are exposed to exchange rate changes when the commitment 63 is ultimately settled. Thí dụ: • • • DN dự kiến sẽ nhập khẩu thiết bị sản xuất với giá 50 triệu USD (ngoại tệ). Tỷ giá hối đoái xu hướng tăng. Dòng tiền cần chi ra để thanh toán cho nhà nhập khẩu tăng. Rủi ro dòng tiền Giảm lợi nhuận CC phi phái sinh: Đi vay 50 triệu USD Công cụ phòng ngừa RR CC phái sinh: Hợp đồng mua kỳ hạn 50 triệu USD Tỷ giá giảm: DN không có rủi ro 64 32 5/8/2022 Accounting for a Cash Flow Hedge Derivative is designated as a cash flow hedge Cumulative change in fair value of hedging instrument (A) Cumulative change in present value of expected cash flow (B) (A) ≤ (B) (A) > (B) Ineffective portion (A) – (B) Effective portion (B) Income statement Equity No ineffective portion; Effective portion = cumulative change in FV of hedging instrument Equity 65 33