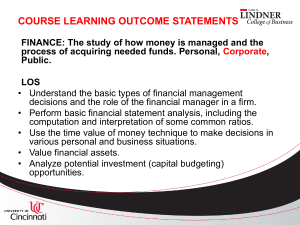

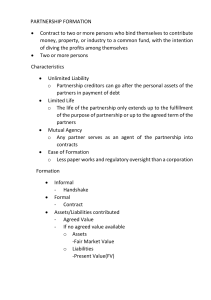

Business Finance Introduction Chapter 1. Introduction to Corporate Finance Note: These lecture notes summarize the in-class presentation by the instructor and the online video lectures covered in this week. Reading these notes alone does not guarantee understanding everything discussed or required by the course. Disclaimer: These notes have not been subjected to the usual scrutiny reserved for formal publications. They may be distributed outside this class only with the permission of the Instructor. 1 What is finance? There is a broad definition and a narrow one. Finance classes basically focus on the narrow definition. 1.1 Broad Definition Finance broadly defined as: Identifying what you need to buy; Where you are going to get the money to buy it; How to manage those things once they’re inside the company 1.2 Narrow Definition Item 2 in the above list. Involves two parties and a middleman: The company: How to get the money? Borrow it? Seek it from investors? The investor: Which company to invest? Financial institutions: match the two parties together. 1.3 The Four Basic Area Corporate finance (= business finance = financial management) : focus of this course Investments – Value of financial assets, risk vs. return, and asset allocation – Job opportunities: Stockbroker or financial advisor / Portfolio manager / Security analyst Financial institutions 1-1 1-2 Lecture 1: – Banks, insurance companies, brokerage firms International finance – May allow you to work in other countries or travel – Need to be familiar with exchange rates and political risk – Need to understand the languages and customs of other countries Relationship between the four areas: 2 Business Finance 2.1 What is business finance? The process of making a company more valuable in the long-run. Focuses on 3 questions: What should we invest in? (Capital budgeting) How do we finance those investments? (Capital structure) How do we manage the day-to-day operations of the firm? (Working capital management) 2.2 The role of the financial manager The chief financial officer (CFO) or vice president of finance. CFO coordinates the activities of the treasure: oversees cash management, credit management, capital expenditures, and financial planning the controller: oversees taxes, cost accounting, financial accounting, and data processing 2.3 Financial management decisions The chief financial officer (CFO) concerned with 3 types of questions Capital budgeting: planning and managing a firm’s long-term investments. Capital structure: the mixture of debt and equity maintained by a firm. Working capital management: managing a firm’s short-term assets, such as inventory, and its shortterm liabilities, such as money owed to suppliers. Lecture 1: 3 Forms of Business Organization 3.1 Sole Proprietorship (one owner) 1-3 Pros: Easy startup. Taxed as personal income. Cons: Unlimited liability. Life limited to that of owner. Equity limited to owner’s wealth. Difficulty in transferring ownership. 3.2 Partnership (two or more owner) General vs. Limited Partners General partnership: all partners share in gains or losses, and all have unlimited liability for debts Limited partnership: one or more general partners will run the business and have unlimited liability, but there will be one or more limited partners (silent partners) Pros: Easy startup. Taxed as personal income. Cons: Unlimited liability Life limited to that of the owners. Equity limited to owners’ combined wealth. Difficulty in transferring ownership. 1-4 Lecture 1: 3.3 Corporation A business created as a distinct legal entity composed of one or more individuals or entities. Separation of Ownership and Control Shareholders Directors Managers Pros: Separation of ownership and management. Easy transfer of ownership. Unlimited life. Limited liability for corporate debts. Equity is not limited, easy to raise capital by selling new shares. Cons: Difficult to startup. Corporation profits are taxed twice (double taxation). 4 The Goal of Financial Management 4.1 In a corporation The goal of financial management is to maximize the current value per share of the existing stock. 4.2 A more general goal Maximize the market value of the existing owners’ equity. 4.3 Sarbanes-Oxley Act, a.k.a. “Sarbox” To strengthen protection against corporate accounting fraud and financial malpractice Contains a number of requirements designed to ensure that companies tell the truth in their financial statements. Lecture 1: 5 Financial Markets 5.1 Cash Flows to and from the Firm Figure 1.2 of the textbook 5.2 Primary vs Secondary Market Transactions in the primary markets – Public offering: selling securities to the general public – Private placement: negotiated sale involving a specific buyer Secondary market transactions involves one owner or creditor selling to another 1-5