Partnership Formation: Definition, Characteristics, and Registration

advertisement

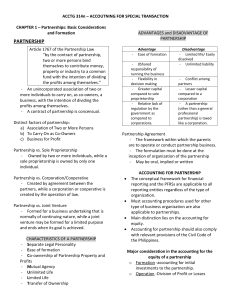

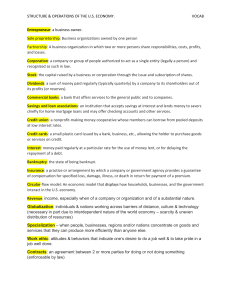

CHA PTE R I NAT URE AND FOR MAT ION OF A PARTNERSHIP This chapter deals with the study of d.ffi • classes of partnership and partners the characteristics of a partnership and the accoun~i ere;i 0 ~ Partnership formation. It also incl~des the comparison of partn ershi p with other fonn 0 usine ss organizations. ~t LEARNING OBJECTIVES: The student is expected to: ,,; I. Define partnership. . . 2. Differentiate partn ershi p from sole proprietorshi corporation and cooperative. 3. En~ erat e th~ characteristics of a partnership. P, . . 4. Iden~fy the d!fferent kinds of partnership • 5. Identify the diffe rent classes of partners. · ntage s and disadvantages of a partnersh.tp versus corporation and 6. Enum erate• the adva h. soIe prop neto rs 1p. ership be registered. 7. ldent~fy the required government agencies where the partn nting procedures compared to 8. Identify th~ areas_ wher e in there are differences in accou sole prop netor sh1p and corporation. . 9. Identify the diffe rent cases of forming a partnership. p. l 0. Reco rd trans actio ns concerning the formation of a partnershi Definition of a Partnership • more persons bind themselves A Partnership is defin ed as a contract whereby two or fund with the intention of dividing the to contribute mon ey, prop erty or industry to a common p Law). Two or more persons may profits amo ng them selve s (Article 1767 of the Partnershi . (1665a). The partnership is also form a partn ershi p for the exercise of a profession ers and creditors during creation, governed by a partn ersh ip law. The rights of the partn p are stipulated therein. The owners operations, disso lutio n, and liquidation of the partnershi of the partn ershi p are calle d partners. Organizing a Partnership into a c?ntract eith~r orally A partnership is formed by two or more persons entering tion and rn the formation, opera • or in writing. A writt en agre emen t which will gove Ofthe • Th. 15 . Is one . . rship artne Co-P of les Artic the as ed term is p ershi dissolution of the partn IS ment ion). This wntten agree requirements by the SEC (Securities and Exchange Commiss 1 required when: ership. l. Immovable or real right s are contributed into the partn ey or property) 2· The capital of the partn ershi p is three thousand pesos or more (mon 1 . I features of partnership . . . ust be a valid contract Essentia ract the cont l. There m. must have legal capacity to ente r into property, or industry to a common ey, 2. The partiest be a mutual contribution of mon . . There mus 3 fund. ct must be lawful . e obje prof its and to divide the same in Th obta to be t mus ose purp ary rpose or prim 4. . 5. The pu among the parties. . tents of the Articles of Co-Partnership: ness Thel ~am e, nature, purpose an~ lo~ati_on of the busi or limited Partners es of the partners tnd1cattng whether they are general Nam _ ' 2 addresses of the partners n and th , incase of property contribution, indicate the descriptio cash of unt Amo _ 3 each partner and e value of said property to be originally contributed by any additional contributions that may be made by the partners 4. Term of existence or duration of the partnership 5. Duties and powers of each partner partners 6. Manner of dividing the profits and losses among the personal use. 7. Conditions covering the withdrawals by partners for ' capitals shall be allowed or not. 8. Provisions regarding salaries, interest on partners th of the accounting period, the 9. Manner of keeping the books of accounts, the_ leng starting date and the end 10. Provision pertinent to disso~ution and liquidation 11. Other special provisions and stipulations. ents before it can operate The partnership must comply first with all the legal requirem in regi'stering a partnership with lq,,ally. The following are the steps and the requirements encies: corres ndin Certificate Issued Requirements for Registration Government SEC Certificate • Submit at least 3 possible business name Securities and for verification and approval Exchange Commission (SEC) • After the release of the approved business name fill up the required SEC registration name and submit together with the Articles of Co-Partners~ip and pay corres ondin fees. Registration of Department of SEC Certificate • Business Name ears 5 stry Indu and e Trad Articles of Co- Partnership • renew eve DTI SSS Certificate of Social Secwity • Filled SSS Application Form Membe1:5hiP °7~t-S· System (SSS) memo circular I 993 of DILG) 2 City or Municipal Hall • • • • • • • • Bureau of Internal • • Revenue (BIR) • • Filled application form from City/Municipal Office Bar~gay clearance, community tax certificate/corporate tax. Zoning compliance Fire Certificate - from fire department Secure clearance and computation of taxes, fees and charges -Treasurer's Office ~eat Property Tax OR certification as to o Real Property, if none-Assessor's Office Sub~it application together with all requirements for verification, sequence num~er and approval of payment .:.. :enn it and Licensing Division ay taxes, fees and charges - Treasurer's Office Tax Identification Number. SEC Certificate Articles of Co-Partnership Books of Accounts Mayor's Business Permit (renewal annually - on or before Jan 20) BIR Certificate of Registration be (to paid annually) • Authority to print documents such as OR, SI and • others. ations Partnership Versus Other Forms of Business Organiz ip and its purpose. Business organizations are classified as to ·ownersh As to ownership: organization. It is fonned Sole Proprietorship - is the simplest fonn of business r. and owned by only one person who is called a proprieto or more persons bind themselves to 2. Partnership - is a contract whereby two fund with the intention of contribute money, property or industry to a common of the New Civil Code of the djviding the profits among themselves (Article 1767 partners. Philippines). The owners of the partnership are called ation of law, having the right of 3• Corporation - is an artificial being created by oper expressly authorized by law or succession and the powers, attributes, and properties e of the Philippines). It is incident to its existence (Section 2 of Corporation Cod ons called lncorporators. The formed by at least five but not more than fifteen pers ers or shareholders while for owners of the stock corporations are called stockhold bers the non stock corporations the owners are called mem L l,, 3 legal form of business organization• It operates s· ·1 4. Cooperative - is another • corporation. It has its own set of board of directors and offi • mu to a corporation where the votes of the stockholders are dependent icerhs. Unhke a on t e number 0f • sharehold•ings, each member of a cooperati•ve 1s only entitled to one VOte. As to purpose: II. 1:.. . Service organizations - are those business firms which are engaged in d . enng • •services. The income is derived from use of skills, talents, expertise and Of engagement for services rendered. E~ample: repairs and maintenance : s laundry shops, beauty parlors, law offices, .accounting and auditing finns, docto!: clinics, schools, photography and many more. 2. Trading or merchandising - are those business firms which are engaged in the buying and selling of goods in the same form. They buy goods and sell them as is without changing the fonn. Example: Variety store, department stores, supermarkets, hai:dware, appliance companies, and many more. 3. Manufacturing firms~ are those companie s engaged in buying raw materials and making them into new items called finished goods. They are changing the fonn of what they procure (raw materials) and with. the application of labor and factory O:..'! overhe~ they produce a.different kind of product. The production process involves raw materials, labor and factory overhead. Example: Furniture f~ctory - from lumb~r to furniture (tables, chairs, cabinets) Shoe/bag factory - from leather to shoes or bags Fabrics factory - froin thread to fabrics or cloth RTW factory- from fabrics to dresses, pants and others 4. Agriculture - agriculture companies are concerned with the planting of crops or raising animals, and selling of their products either in raw or finished form at a - · .• ,. profit. Characteristics of a Partners hip ~;:: 1. Mutual Agency. In a sole proprietorship there is only one owner and oftentim O as a manager. In the partnership, there are two or more partners and each Ofthe may act as an agent of the partnership for the operation of its business. ~he act the partners as long as it is within the scope of the business of the partnership makes Partnership liable to the third parties. . Of a partneJ'ship 2 If his t . partner a be can age legal of person Any on. A,6·sociati ol11ntar, r • H~ is willing to be associated in the partnership. No one can be forced agains will to become a partner in a partnership. 3 • Based on Contract. In the fonnation of a partnership, it is required that t~o or;: It is persons agree to bind themselves to become partners of a p~nersbip . ·n . tbem. btorls that contract a agreement whether oral or in writing becomes 15 1 pr~f~rre? !hat the contract must be in writing to be enforceabl e. If the contract wnting it 1s called Articles of Co-Partne rship. 4 . . ·re because it m Limited Life. A. partners ay be dissolved at a n hi p has a hm1t~~ of th y .~ ~ 4. by the wi\\ of the pa e law. The life of th rtners or by op~ratlf th dependent upon the liv artners The busines e partne1:hip ts es and the will o _e s may conbnue to operate but it p em~ nt will be under a new pa rtnership agre • Unlimited Liability. The partnershi.p has un1· • d 1· b.1lity It S. partners but there m imite ta must be, at least, one •. . . ay• have limited ge neral partner. The h ers extends beyond their ab ih ty o f in tb te e re p st ar in tn the partnership. <?ur including industrial law ~tates tbat all J partner sha\\ be \iab '~ e : i le pro-rata with al th e pa rt ne rs hi p' s as l their property an_ sets ha ve be en exha a er usted.· T he cr ed it or after th e pe rs on al s o f the partnershi assets of th e partne p can run rs (ex ce pt limited o f the partnership partners) if after all ha ve be en exhauste the d and th er e are stil l claims fo r settlemen assets t. 6. Mutual Particip ation in Profits. Toe partners bi nd them property or indust selves to contribute ry to a common fu money, nd w it h th e in te nt am on g themselves io n o . E ac h partner f dividing th e prof ha s th e right to its partnership. The sh ar e profits will be divi in the profits o f de d th in accordance w it h e in th e articles o f the agreement stip co-partnership. In ul th at e ed divided in accordan absence o f th e ag re em en t, pr of it s ce w it h partners' ca w il l b e pital contribution. 7. Separate L eg al Entity. A partners hip ha s a legal entit o f every partner y separate and di st or owner (Article in ct from th at 1768 o f the Partne organization, partne rship Law). L ik rship operates unde e ot he r r its its ow n na m e and ca n enter into contract business name. It ca n ac qu ir e proper s. ties in 8. Co-ownership o f Contributed Ass ets. All the proper to th e partnership ties contributed by are owned by the pa th e partners rtnership by virtue E ac h partner ha s th o f it s separate lega e right or claims ag l entity. ainst the properties • their equities. owned by th e partne rship as 9. In co m e Tax,. Pa rtnership is suited to the practice or exer Professi(,nal Partn cise o f profession. erships are exempt General ed from income ta partnership is a pa x. A general prof rtnership formed by essional professionals engagi or li ne of service. ng in the same prof Example: CP As fo ession rming an accountin law office, engine g firm, lawyers fo ers rendering engine rming a ering services, doct of professionals form ors an d many mor ing a partnership ot e. Group her than services in is no t considered as general professi line w ith their prof onal ession ta x as a corporatio n. Although the ge partnership. Therefore, they are subj ect to neral professional income ta x the indi partnership is not vidual partner mus subject to t file their respectiv share in the distribu e income tax return ted partnership inco on the m income. Partners hips other than ge e and from other sources of their re spective neral professional income ta x as a corp partnership are su oration. (Refer to ta bject to xes on corporations ) t' n. The partnership may be created by oral or in written agreement 10. Ease 1Formam,oore individuals. The formation of a partnership is easier than that of between two or • t d ',, . : . l:' •. a corporation'. It requ~res less~r leg~ re~u1remen s ~om pare to a corporation. 0 • • t • ' • #I• Partnerships are classified as to: 1. Activity . - one whtc • • h the matn • act1v1ty • • ts • buy1ng • and selling · of goods . Trading Partnership • or manufacturing of goods. • .Non Trading Part~ership - one which is organized for a specific purpose or : project or for rendering services. 2. Liability of partners . General Partnership -. is a partnership wh~rein all of the partners are general • partners. They are all personally liable_ for the debts of the partnership, Limited Partnership - is a partnership formed by one or more general partners with one or more limited partners. ,There must be at least one general partner who ·will assume.- the unlimited liability of the pat1nership. The word "LIMITED" or "LTD." is attached to the name of the partnership to notify the • public that it is a limited-partnership. . . ,. •• • • .· .. ·.. . ... ' 3. Object of the partnership • ;• , · - ·.. .·. . .' ! . • . . . . - Universal partnership - may refer to all the pres~nt property or to all the profits in a universal partnership of all present property. the partners ~ontribute their property into a common fund with ~he intention of dividing the property and all ·the profits they may acquire among themselves. The property becomes the common property of all the partners because the ownership of the property contributed/acquired passes to the partnership. . . . A universal partnershin of profits cOmprises all that·the partners may acquite by their in~ustry or work during the· existence of the partnership. The ~ers retain the ownership of the property that they contributed at of the formation of the partnership. Only the usufruct or the 0 which •hall pass on to the partnership. ,,..,~•.,__ • . . thing~ tpeir ..,,,,,,,,,., r'lllt#lnl,lp- one which has for its object detemunate . n 0r • o, fnill, or I IJ)Hitlc undertakings or of a e x e r c i s e 4, p r o f e S S l o ~-- I \ I Q h has no time specitied and raunated ~m-P.e!Jle11t f ono or all of the partners or by mutual CIIY .. m a y . b e f f xistence o ... one which the term or penod O e 5. Representation to Others Ordinary Partnership - one which is in reality existing among the partners as well as to the third parties. Partnership by Estoppel - one which is in reality not a partnership but considered as a partnership only in. relation to those who by their conduct or omission are precluded to deny or disapprove its existence. 6. Legality of Existence De Jure Partnership - one which has complied with all the legal requirements for its existence. De Facto Partnership - one which has not complied with all the legal requirements for its existence. 7. Publicity Secret Partnership - one wherein the existence of certain partners is not made known to the public by any of the partners. • Open Partnership - one whose existence is made known to the public by the partners of the firm Characteristic elements of the contract of partnership 1. Consensual - because it is perfected by mere consent, that is, upon the express or implied agreement of two or more persons 2. Nominate - because it has a special name or designation in our law 3. Bilateral - because it is entered into by two or more persons and the rights and obligations arising there from are always reciprocal 4. Onerous - because each of the parties aspires to procure for himself a benefit through the giving of something • 5. Commutative - because the undertaking of each of the partner is considered as the equivalent of that of the others. . . . . 6. Principal - because it does not depend for its existence or vahd1ty upon some other contract. It can stand alone. 7. Preparatory- because it is entered into as a means to an efndd: ~d~amphle: to engage~.n business for the realization of profits with the view o 1v1 1ng t em among e contracting parties. A partnership contract, in its essence, is a contract of agency, (Art, l8l8) Partners are classified as to: 1. Liability . ed liability. He is liable for the · General partner - 1s the one who assumes unlimit . h• to the extent of his personal assets. Lim~;:: ~~eu~hose liability for the deb~s ~f ~~r~h ip is only up t:the extent of his interest in the partnership. His hab1hty is ltm1ted. :~!:t~:;~: 7 . . . 2• Contribution Capitalist partner~ 1s the one whose contr1but1ons to the Partnershi . P are in the form of money or property. Industrial partner - is the one whose contribution to the partnersh· . . tp is hts labor, industry, skill, talent or professional services. h d 3. Management of the busine~s fidr~ . Managing partner - 1s es1gnate to manage t e affairs or business Operations of . the partnership. . Silent partner - has financial interest in the firm but does not take active the business although he may be known to the public as a partner. part in 4. Other classification Liquidating partner - one who is in charge of the winding up of the partnership affairs in case of dissolution. Ostensible partner - takes active part in the partnership and known to the public as a partner in the partnership whether or not he has an actual interest in the firm Nominal partner - is not really a partner having no financial interest in the partnership nor a party to the agreement of the partnership, but represented being in fact a partner and make liable as a partner. Secret partner - has financial interest in the firm and takes active part in the business but he is not known: to the public as a partner. Dormant partner - does not take ,active part in the management and is not known to the public as a partner. In forming a partnership, there are advantages as well as disadvantages over a corporation and sole proprietorship. • . . Advantages: l. It is easier to form and has lesser legal requirements compared to a corporation. 2 - Lesser cost to be incurred in the formation than the corporation. 3. Exempted.from income tax if it is a general professional partnership. 4• Flexibility of operations. rsbiP h85 5• It is more reliable from the point of view of the creditor, sine~ partne unlimited liability compared to a corporation which has limited habdity. 6 . a es of the parlllers • More capital to be generated than a sole proprietorship_. 7 • More and better business opportunities due to contnbuted Imk g than a sole proprietorship. wiJI of • time at the . of 1. t less stable because of its limited life. It can be dissolve any 1fl1 p0 the the Partners artn rship frot11 • 2 U r1 · e .~ .~ited liability of the partners· for the debts of the P • view· of the Partner~ Disadvantages . I 18 d 3. Every partner has an authority and may act as an agent of the partnersh ip (divided authority). 4. Disagreement might occur wh en partners have the same level of authority in the management of the partnership. 5. Partners may suffer from the con sequence of the negligence or wrong partners. action of other 6. The partner can 't easily sell his inte rest or withdraw from the partnership. Consent from all the remaining partners is nee ded. Accounting for a Partnership Accounting for a partnership is basically the same with that of a sole proprietorship Business transactions are recorded . in the same manner and the same req uire d books of accounts are maintained such as cas h receipts journal, cash payments journa l, sale s journal, purchases journal, general and subsid iary ledgers. The difference in accoun ting procedures exists only in the areas of formation, profit distribution, dissolution and liqu idation. Capital and Drawing Accounts In a sole proprietorship, there is only one owner. Therefore; there is only one cap account and also one drawing accoun ital t maintained by the company. In a partne rsh ip, there are two or more partners. The capital and drawing accounts are as many as the number of partners. The capital and drawing acc ounts are specified respectively with the partners. To illustrate: ,L J ove, oy and Happy are partners of Happy Lovely Joy Company. They share in the . 1 dd • b l profits and 1osses equal ly. The following are their. capita an raw1ng a ances: Partners Capital 100,000 250,000 150,000 Love Joy Happy Drawin2 5,000 20,000 10,000 . accounts should be presented in The capital and drawing the general ledger as · follows: AP TAL 100,000 LOVE DRAWING 5,000 JOY CAPITAL JOY DRAWING L VE 250,000 20,000