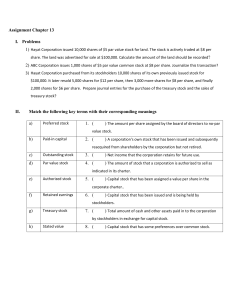

CORPORATION LAW Sources: Atty. Divina’s Lecture; “Commentaries on the Revised Corporation Code” by Villanueva; Lectures of ATTY. MOMONGAN, A.Y. 2020-2021 CORPORATION LAW Sources/Legend: Codal Provisions Atty. Divina’s Highlights of the Revised Corporation Code (Zoom lecture and book) Atty. Momongan’s slides and lectures; Re-arranged, simplified lines from various notes and lectures from 2019 thru 2021. Contents Overview of the Revisions...............................................1 Types of Business Organizations....................................1 (1) Sole Proprietorships....................................................1 (2) Partnerships...............................................................1 (3) Corporation................................................................1 Elements/Attributes of a Corporation...........................2 Types of Business Organizations, Distinguished:..........2 Advantages, Disadvantages of a Business Corporation 3 Theories on the Formation of a Corporation..................3 Concession Theory.......................................................3 Corporate Enterprise Theory.........................................3 Genossenchaft Theory..................................................3 Classes of Corporations....................................................3 Tests To Determine Nationality of Corporations..............4 Parties Involved in a Corporation..................................4 Commencement of the Juridical Personality of a Corporation 5 Articles of Incorporation (AI)........................................5 Contents of an AI (Sec. 14)..........................................5 Three levels of Capital Structure...................................5 Liabilities of a Corporation...............................................5 Veil of Corporate Fiction..................................................6 Piercing the Veil of Corporate Entity..................................6 Instances of Piercing The Veil...........................................6 Relationships of a Corporation...........................................7 Introduction to Shares...................................................7 Classification of Shares..................................................9 R.A. No. 11232 An Act Providing for the Revised Corporation Code of the Philippines TITLE I. GENERAL PROVISIONS, DEFINITIONS AND CLASSIFICATIONS Section 1. Title of the Code. This Code shall be known as the “Revised Corporation Code of the Philippines”. Overview of the Revisions 1 / 14 CORPORATION LAW Sources: Atty. Divina’s Lecture; “Commentaries on the Revised Corporation Code” by Villanueva; Lectures of ATTY. MOMONGAN, A.Y. 2020-2021 Approved by Congress on Feb 20, 2019 and became effective Feb 23, 2019. The law promotes ease of doing business. That is why you have provisions such as: 1. One-person corporation (OPC) that allows persons to put up corporate entities yet limited liability insofar as your contribution to the corporation is concerned. 2. The rule on perpetual existence so there is no need to keep on renewing the term of the corporation. 3. There is also no need to extend the term of the corporation until the board of directors or stockholders decide to end it. 4. RCC also dispensed with the requirements for subscription and payment upon incorporation. a. As you all know in the OCC, when you incorporate you have to subscribe to at least 25% of the authorized capital stock and pay ¼ of the subscription. That is not true anymore. You can now put up the corporation without being bothered with the payment of subscription and pay the capital. It’s only when you increase your authorized capital stock that you have to comply with the subscription and payment requirement. 5. RCC also adopted best practices on good corporate governance. That is why the RCC requires that the notice of the meeting. The agenda of the stockholders’ meeting must contain certain information all aimed at fostering transparency. 6. It afforded greater protection to minority stockholders by widening the list of books and records required to be kept by the corporation available for examination and expanded the remedies in case of violation of stockholders’ right to inspection. a. Under the OCC, you only have two remedies when your right of inspection is denied by the corporation: i. (1) you can file a complaint for violation of right of inspection and ii. (2) you can file a petition to inspect the covered books. Under the RRC, they added a third remedy: iii. You can now report to the SEC the inaction or denial by the corporation. And within five days from that report, the SEC must conduct summary investigation and ordered the corporation to allow you to inspect and examine the books of the corporation. 6. It codified internationally accepted practices and norms on conducting businesses that is why you have the use of technology. You can provide notices of meetings electronically and you can participate in meetings electronically based on the guidelines of the SEC. 7. And lastly, it strengthened the powers of the SEC so that it can exercise venue and jurisdiction over corporations. a. Later on, we’ll discuss acts that SEC considers as criminal in nature. Under the old code, it only has one offense and that is the violation of the right of inspection. Under the RCC, there are so many acts which are considered criminal offense. INTRODUCTION: TYPES OF BUSINESS ORGANIZATIONS (1) Sole Proprietorships A form of business organization with only one proprietary owner. It is when a person personally or a single individual conducts business under his own name or under a business name. (2) Partnerships By a contract of partnership, two or more persons bind themselves to contribute money, property or industry to a common fund, with the intention of dividing the profits among themselves. Two or more persons may also form a partnership for the exercise of a profession. (3) Corporation Section 2. Corporation Defined. A corporation is an artificial being created by operation of law, having the right of succession, and the powers, attributes, and properties expressly authorized by law or incidental to its existence. ELEMENTS/ATTRIBUTES OF A CORPORATION: 1. It is an artificial being. 2. It is created by operation of law. 3. It enjoys the right of succession. 4. It has the powers, attributes and properties expressly authorized by law or incident to its existence. Attribute of a Corporation #1 1. A corporation is an artificial being Under the law, it is granted a separate and distinct personality from that of its owners or stockholders. Consequence as a Juridical Person 1. Corporation is separate and distinct personality 2. Properties owned by the corporation is owned by the corporation alone and not of stockholders. 3. Any liabilities of the corporation belong only to the corporation and not to the stockholders. Attribute of a Corporation #2 It is created by operation of law. 2 / 14 CORPORATION LAW Sources: Atty. Divina’s Lecture; “Commentaries on the Revised Corporation Code” by Villanueva; Lectures of ATTY. MOMONGAN, A.Y. 2020-2021 Concession Theory - espouses that a corporation is an artificial creature without any existence until it has received the imprimatur of the state acting according to law, through the SEC. (Tayag vs. Benguet Consolidated, Inc., 26 SCRA 242) Attribute of a Corporation #3 It enjoys the Right of Succession If a stockholder or a member dies, withdraws, is insolvent or suffers incapacity, the corporation will still continue and not be dissolved. Important: The heirs will succeed. Death of a stockholder does not dissolve the corporation. Even so, in an extreme possibility that all of the stockholders will die, still, there is a right of succession. The heirs of all the stockholders, themselves, become the stockholders. And they will now assume the rights of the stockholders. Succession takes effect at the moment of death. There is no gap as there is an automatic new stockholder. In fact, stockholdings are transferrable. If you own a share, you can transfer or assign it. Situation: A group of young, newly married persons decided to organize a corporation. After a year of existence it was able to realize huge profits so they wanted to celebrate and spend their Christmas outside the Philippines. They also decided to hold their board meeting aboard a cruise ship. So the stockholders went together with their wives. The children were left behind. Unfortunately, the vessel got lost in a typhoon and all passengers perished. They left behind their children with an average of 3 years old. What happens to the corporation? A: The corporation remains to exist and will not be dissolved. The interests of the stockholders will be transferred to their respective heirs. This is the right of succession of a corporation. So during a stockholders meeting, since the heirs are children, then they have to be represented by their guardians or by the respective executor or administrator as the case may be. Attribute of a Corporation #4 It has the powers, attributes and properties expressly authorized by law or incident to its existence. Unauthorized Act: Acts of officers done beyond the powers granted to them. Example of Unauthorized Act: The board of directors decided to borrow money from a bank to finance a particular project. If expressly authorized or if within the by-laws, then the act of the board is valid. The act of borrowing is also part of the power of the corporation. However, if it was discovered that the resolution is only signed by the president and not by the board, then it can be considered an unauthorized act. Types of Business Organizations, Distinguished: Comme ncement Sole Propriet orship Partnership Corporation Upon selling Upon agreement of the parties By Operation of Law No. of Incorporators 1 At least 2 persons New Law: One Person Corporation is allowed Old:At least 5 incorporators Comme ncement of Juridical Persona -lity No Juridical Personalit y Upon execution of the contract From the date of the Certificate of Incorporation Liable up to the extent of personal properties Liable personally and subsidiarily for partnership debts to 3rd persons Management Managed by the sole proprietor Absence of any agreement, every partner is an agent of the partnership. Transfer ability of Interest Transferra ble thru asset sale Needs consent of all the partners (delectus personae) Liability 1. Express powers Those found in the Corporation Code, the articles of incorporation, and other laws regarding corporations. 2. Incidental powers Powers which are necessary to carry out the express powers or for furtherance of the purpose of the corporation itself. Important: The acts of the corporation shall be within it powers. Otherwise, if it goes beyond its powers, it shall be considered an ultra vires act. Ulta vires vs unauthorized acts Ultra Vires Act: Acts of the corporation which are beyond the powers of the corporation Right of Successi on No Right of Succession Stockholders are liable only to the extent of their investments as represented by the shares subscribed by them. Important: Veil of Corporate Fiction applies only to a Corporation Power to do business is vested in the Board of Directors (BOT) or Board of Trustees. Does not need prior consent of the stockholders There is Right of Succession. 3 / 14 CORPORATION LAW Sources: Atty. Divina’s Lecture; “Commentaries on the Revised Corporation Code” by Villanueva; Lectures of ATTY. MOMONGAN, A.Y. 2020-2021 ADVANTAGES VIS-À-VIS DISADVANTAGES OF A BUSINESS CORPORATION Advantages 1. A corporation has a legal capacity to act and contract as a distinct unit in its own name 2. There is continuity of existence because the right of succession; 3. its credit is strengthened by its continuity of existence 4. centralized management in the board of directors. 5. its creation, management, organization and dissolution are standardized as they are governed under one general incorporation law. 6. limited liability 7. shareholders are not the general agents of the business 8. transferability of shares Corporate Enterprise Theory The corporation is not merely an artificial being, but more of an aggregation of persons doing business. Disadvantages 1. A corporation has complicated in formation and management 2. High cost of formation and operations 3. Its credit is weakened by the limited liability feature 4. No delectus personae, lack of personal element. 5. greater degree of governmental supervision 6. management and control are separated from ownership. 7. Stockholders have little voice in the conduct of the business. 8. Higher income tax liability The profits of the corporation is taxed twice: corporate income tax and income tax on the stockholders for the dividends. THEORIES ON THE FORMATION OF A CORPORATION Concession Theory aka Fiat Theory, Gov’t Paternity Theory; Franchise Theory. A corporation is not a person. The law treats it as though it were a person by process of legal fiction or by regarding it as an artificial person distinct and separate from its stockholders (SHs). Espouses that a corporation is an artificial creature without any existence until it has received the imprimatur of the state acting according to law, through the SEC. (Tayag vs. Benguet Consolidated, Inc., 26 SCRA 242) Franchises of Corporations: 1. Primary Franchise: the franchise to exist as a corporation, granted by the RCC, except those with special charters. 2. Secondary Franchise: special authority given to a corporation to engage in a specialized business. Genossenchaft Theory Treats a corporation as the reality of the group as a social and legal entity, independent of the state of recognition and concession. (Opposite of Concession, but rejected by the latter) CLASSES OF CORPORATION Section 3. Classes of Corporations. Corporations formed or organized under this Code may be stock or nonstock corporations. Stock corporations are those which have capital stock divided into shares and are authorized to distribute to the holders of such shares, dividends, or allotments of the surplus profits on the basis of the shares held. All other corporations are nonstock corporations. 1. As to organizers a. public – by State only; and b.private – by private persons alone or with the State. 2. As to functions a. public – Created to govern a portion of the State. Its purpose is for the general good and welfare (Sec. 3, Act 1456). b. private – usually for profitmaking c. Publicly-listed corporations- Private corporations whose stocks are listed in the PSE (Philippine Stock Exchange). Examples: (1) San Miguel Corporation (2) Philippine Long Distance Telephone Company (3) SM Prime Holdings, Inc. d. Quasi-public corporations- Private corporations performing public functions. (Example: VECO) e. Government-Owned and Controlled Corporations- Private corporations created by the Congress through a special charter and the majority of its shareholdings are owned by the government. A GOCC has a personality of its own, separate and distinct from that of the government. Examples: (1) Development Bank of the Philippines (2) Philippine Ports Authority (3) Philippine Amusement and Gaming Corporation (4) Land Bank of the Philippines The test to determine whether a GOCC or private corporation: if a corporation is created by its own charter for the exercise of a public function, then GOCC; if by incorporation under the general corporation law, then private corporation (Baluyot vs. Holganza, 2000) 3. As to governing law a. public – Special Laws; and b. private – Law on Private Corporations 4. As to legal status a. De jure corporation – organized in accordance with the requirements of law. 4 / 14 CORPORATION LAW Sources: Atty. Divina’s Lecture; “Commentaries on the Revised Corporation Code” by Villanueva; Lectures of ATTY. MOMONGAN, A.Y. 2020-2021 b. De facto corporation – organized with a colorable compliance with the requirements of a valid law. Its existence cannot be inquired collaterally. Such inquiry may be made by the Solicitor General in a quo warranto proceeding. (Sec. 20) c. Corporation by estoppel – group of persons that assumes to act as a corporation knowing it to be without authority to do so, and enters into a transaction with a third person on the strength of such appearance. It cannot be permitted to deny its existence in an action under said transaction. (Sec. 21) It is neither de jure nor de facto. d. Corporation by prescription – one which has exercised corporate powers for an indefinite period without interference on the part of the sovereign power, e.g. Roman Catholic Church. forming and composing the corporation and who are signatories thereof. 5. As to existence of shares of stock a. Stock corporation – a corporation (1) whose capital stock is divided into shares and (2) which is authorized to distribute to shareholders dividends or allotments of the surplus profits on the basis of the shares held. (Sec. 3) b. Non-stock corporation – does not issue stocks nor distribute dividends to their members. Corporators – those who compose a corporation, whether as stockholders or members. 6. As to place of incorporation a. Domestic corporation- a corporation formed, organized, or existing under Philippine laws. B. Foreign corporation – a corporation formed, organized, or existing under any laws other than those of the Philippines. (Sec. 123) Board of Directors or Trustees- The Board of Directors or Board of Trustees are the group of people who manage the corporation. Tests To Determine Nationality Of Corporations 1. INCORPORATION TEST – determined by the state of incorporation, regardless of the nationality of the stockholders. 2. DOMICILE TEST – determined by the state where it is domiciled. The domicile of a corporation is the place fixed by the law creating or recognizing it; in the absence thereof, it shall be understood to be the place where its legal representation is established or where it exercise its principal functions. (Art. 51, NCC) 3. CONTROL TEST – determined by the nationality of the controlling stockholders or members. This test is applied in times of war. Also known as the WARTIME TEST. Corporations Created by Special Laws or Charters Section 4. Corporations Created by Special Laws or Charters. – Corporations created by special laws or charters shall be governed primarily by the provisions of the special law or charter creating or applicable to them, supplemented by the provisions of this Code, insofar as they are applicable. CORPORATORS AND INCORPORATORS, STOCKHOLDERS AND MEMBERS Section 5. Corporators and Incorporators, Stockholders and Members. Corporators are those who compose a corporation, whether as stockholders or shareholders in a stock corporation or as members in a nonstock corporation. Incorporators are those stockholders or members mentioned in the articles of incorporation as originally PARTIES INVOLVED IN A CORPORATION Incorporators - They are those mentioned in the Articles of Incorporation as originally forming and composing the corporation, having signed the Articles and acknowledged the same before a notary public. They have no powers beyond those vested in them by the statute. Note: Under the New Code, juridical persons can now be incorporators. Under the Old Code, only natural persons can be incorporators. Stockholders – owners of shares of stock in a stock corporation Members – corporators of a corporation which has no capital stock Promoter - A person who, acting alone or with others, takes initiative in founding and organizing the business or enterprise of the issuer and receives consideration therefor. He is an agent of the incorporators but not of the corporation. Contracts by the promoter for and in behalf of a proposed corporation generally bind only him, subject to and to the extent of his representations, and not the corporation, unless and until after these contracts are ratified, expressly or impliedly, by its Board of Directors/Trustees. Thus: GR: The promoter binds himself personally and assumes the responsibility of looking to the proposed corporation for reimbursement. XPNs: 1. Express or implied agreement to the contrary 2. Novation, not merely adoption or ratification, of the contract Subscriber – persons who have agreed to take and pay for original, unissued shares of a corporation formed or to be formed. Underwriter – a person who guarantees on a firm commitment and/ or declared best effort basis the distribution and sale of securities of any king by another company. (Sec. 3 R.A. 8799) Underwriters are mostly banking companies. As distinguished from promoters who have no commitment since they simply promote, underwriters have commitment such that they guarantee the sale of stocks and if these were not sold, they will be the ones who will buy the shares. The underwriters therefore assume 5 / 14 CORPORATION LAW Sources: Atty. Divina’s Lecture; “Commentaries on the Revised Corporation Code” by Villanueva; Lectures of ATTY. MOMONGAN, A.Y. 2020-2021 liability. Example: The underwriters commit that 60% of the stocks will be bought. If they cannot sell such committed shares, they will guarantee that they will buy such stocks themselves. Founders- The founders are those who came about the idea – they are the think tanks of the corporation. As a matter of fact, they are given privilege. They are entitled to an exclusive right to vote and be voted for, but limited for 5 years only from date of inception of the Corporation. NO ONE ELSE have the right to nominate and elect. This is used to guide the infant corporation. Q: What is the purpose of having the exclusive right to vote and be voted for? A: To ensure that the corporation will eventually succeed because they are the ones who envisioned the Corporation. Note: Exclusive right of founder’s shares to be elected in the BoD shall not be allowed if its exercise will violate Anti-Dummy Law, Foreign Investments Act and other pertinent laws. COMMENCEMENT OF THE JURIDICAL PERSONALITY OF A CORPORATION A juridical entity comes into existence after having complied with the requirements of the law. In the case of a corporation, it is the issuance of the Certificate of Incorporation by the SEC. Articles of Incorporation (AI) It is the document prepared by the persons establishing a corporation and filed with the SEC containing the matters required by the Code. It is an essential requirement for the existence of a corporation, even a de facto one. Contents of an AI (Sec. 14) 1. name of corporation; 2. purpose/s, indicating the primary and secondary purposes; 3. place of principal office; 4. term of existence; 5. names, citizenship and residences of incorporators; 6. number, names, citizenship and residences of directors or trustees; 7. names, nationalities, and residences of the persons who shall act as directors or trustees until the first regular ones are elected and qualified; 8. capital structure of the corporation. Three levels of capital structure: (1) Authorized Capital Stock (ACS) – the maximum amount that a corporation intends to invest on a business (2) Subscribed Capital Stock (SCS) – the number of shares a stockholder intends to invest in the corporation which he commits himself to pay – it is the committed investment of the stockholder (3) Paid-Up Capital – stock actually paid for by the stockholders; it is the initial amount that the stockholders are obliged to pay. This is the initial amount that shall be used in starting the corporation. Q: If you are a new corporation, how much should be subscribed? A: GR: The Revised Corporation Code does not require a minimum subscribed capital stock. Reason: To attract the formation of more business organizations. XPN: However, the the 25% subscribed capital stock is compulsory when there is an increase in the capital stock. Thus, it requires that at least 25% must be subscribed, and 25% must be paid-up. Note: Under the Old Corporation Code, newly formed corporations were required to have 25% of their ACS subscribed, of this subscribed capital stock, 25% must be paid-up (paid-up capital stock). However, this requirement has now been removed under the Revised Corporation Code. Note: You do not have to pay the subscription immediately. The balance or may be due or payable later. LIABILITIES OF A CORPORATION Doctrine of Separate Personality of a Corporation The liability of the corporation is separate and distinct from that of the stockholders. Whatever their liabilities are, remains to be their own. Consequences: 1. Liability for acts or contracts Obligations incurred by a corporation, acting through its authorized agents are its sole liabilities. 2. Right to bring actions Corporations may bring civil and criminal actions in its own name in the same manner as natural persons. (Art. 46, Civil Code) 3. Right to acquire and possess property Property conveyed to or acquired by the corporation is in law the property of the corporation itself as a distinct legal entity and not that of the stockholders or members. (Art. 44(3), Civil Code) 4. Acquisition of court of jurisdiction Service of summons may be made on the president, general manager, corporate secretary, treasurer or inhouse counsel. (Sec. 11, Rule 14, Rules of Court). 5. Changes in individual membership Remains unchanged and unaffected in its identity by changes in its individual membership. (The Corporation Code of the Philippines Annotated, Hector de Leon, 2002 ed.) 6. Entitlement to constitutional guaranties: a. Due process b. Equal protection of the law c. Protection against unreasonable searches and seizures (Stonehill vs. Diokno). 6 / 14 CORPORATION LAW Sources: Atty. Divina’s Lecture; “Commentaries on the Revised Corporation Code” by Villanueva; Lectures of ATTY. MOMONGAN, A.Y. 2020-2021 7. Liability for Crimes GR: Since a corporation is a mere legal fiction, it cannot be held liable for a crime committed by its officers, since it does not have the essential element of malice; in such case the responsible officers would be criminally liable. (People vs. Tan Boon Kong, 54 Phil.607) XPNs: (1) When the crime is punishable by a special law; Note: The special law must specify that it imposes penalties on the officers of the corporation. To be able to punish the officers, the law should specifically provide that in case the corporation becomes liable, the officers shall be directly punishable for the commission of the act or violation, and that they will suffer the penalty of imprisonment. Otherwise, they cannot be held liable. (2) When the penalty imposed is a fine; A corporation can be made criminally liable by being made to pay a fine. Fines are not civil obligations, but are penalties. (3) When the corporation violates the Anti-Money Laundering Act (AMLA) Penalties in the AMLA include: a. Suspension b. Revocation of license c. Fine 8. Liability for torts A corporation is liable whenever a tortuous act is committed by an officer or agent under the express direction or authority of the stockholders or members acting as a body, or, generally, from the directors as the governing body (PNB vs CA, 83 SCRA 237). But corporation is not entitled to moral damages because it has no feelings, no emotions, no senses. (ABS-CBN vs. Court of Appeals) Illustration: If the assets of the corporation is worth Php 10M, and their credit is worth Php 15M, is it enough to pay the liabilities? A: No. The creditors of that corporation cannot fully recover the amount they lent to the corporation. Here, they can only recover Php 10M. To recover the remaining or unpaid Php 5M, they could go after the properties in the name of the corporation. If the properties are still not enough, they cannot go after the stockholders. It is, as to the creditors, a “game over” situation. Unlike in Partnership, wherein if in case its assets are not enough to pay its liabilities, then the creditors can go after the personal assets of the partners because, as a general rule, it does not enjoy the Limited Liability Rule enjoyed by a corporation. VEIL OF CORPORATE FICTION A corporation has a separate and distinct personality from its shareholders, officers, and directors. Once said corporate fiction is created, the veil hides the stockholders such that when a corporation incurs liability, the stockholders are shielded from liability. In so far as the law is concerned, we are only dealing with the corporation. PIERCING THE VEIL OF CORPORATE ENTITY Requires the court to see through the protective shroud which exempts its stockholders from liabilities that they ordinarily would be subject to, or distinguishes a corporation from a seemingly separate one, were it not for the existing corporate fiction. (Lim vs. CA, 323 SCRA 102) Rules on Piercing the Veil Rules: (Philippine Corporate Law, Cesar Villanueva, 2001 ed.) 1. has a res judicata effect 2. to prevent wrong or fraud and not available for other purposes 3. judicial prerogative only 4. must be with necessary and with factual basis INSTANCES OF PIERCING THE VEIL When the corporate veil: (Memory Aid: WAP-Fraud) 1. Is used to defend a crime or is used to justify a Wrong. 2. Alter Ego cases 3. Defeats Public convenience; 4. Perpetuates Fraud; Effect: Stockholders may now be liable if the corporation: 1. Is used to defend a crime or is used to justify a wrong. 2. In Alter Ego Cases – when the corporate entity is merely a farce since the corporation is an alter ego, business conduit or instrumentality of a person or another corporation. This is in relation to the Anti-Dummy Law. Rules: a. It applies because of the direct violation of a central corporate law principle of separating ownership from management. b. If the stockholders do not respect the separate entity, others cannot also be expected to be bound by the separate juridical entity. c. Applies even when there are no monetary claims sought to be enforced. 3. It defeats public convenience; Illustration: The current networks involved are Globe and Smart. The stockholders of Globe and Smart agreed to create another corporation, with the intention to break the monopoly. By doing this, they now DEFEAT PUBLIC CONVENIENCE or violate the law on Anti-trust. Thus, pursuant to piercing the veil doctrine, the public can now lift the veil protecting the corporations in this illustration because they are defeating public convenience. 4. Is used to perpetuate fraud; 7 / 14 CORPORATION LAW Sources: Atty. Divina’s Lecture; “Commentaries on the Revised Corporation Code” by Villanueva; Lectures of ATTY. MOMONGAN, A.Y. 2020-2021 There must have been fraud or evil motive in the affected transaction and the mere proof of control of the corporation by itself would not authorize piercing. The main action should seek for the enforcement of pecuniary claims pertaining to the corporation against corporate officers or stockholders. Illustration: Corporation A defrauds its creditors by transferring its assets to Corporation B. When the sheriff came to attach the property of Corporation A, the sheriff was shown a document that the assets are sold to Corporation B. Q: As counsel for the defrauded creditors, how will you pursue their cause? A: I’ll further their cause by proving that the assets were actually owned by Corporation A through establishing that the stockholders of Corporation A are the same stockholders of Corporation B. RELATIONSHIPS OF A CORPORATION 1. Between the Corporation and the Shareholders The relationship between the corporation and the stockholders is well established in the Articles of Incorporation (AOI). The AOI is considered as the contract or agreement of the Corporation and the Stockholders. Since this is their agreement, the AOI binds their relationship and regulates their relationship. Illustration: The primary purpose of the corporation is to maintain, operate, run and manage a funeral parlor. Q: May the corporation maintain, operate and manage a hospital instead? A: It cannot, because their agreement is to engage in a funeral business. Q: What can the stockholder do? A: Even if the Board of Directors (BOD) want to have a hospital, they cannot immediately do so if the Articles of Incorporation is not amended. The stockholders must ratify it, and there should be an amendment of the Articles of Incorporation. 3. Between the Corporation and the State A corporation is a creation of the law. In other words, it is a privilege granted by the State. The term extended or granted by the state is subject to the condition that the corporation will comply with the reportorial requirements and behave within the bounds of the law. Otherwise, the State may revoke or cancel the license. It may also suspend and/or charge a fine. 4. Between the Corporation and the Public. The public here includes the clients. INTRODUCTION TO SHARES What are “shares”? Shares represent the interest or the investment of a stockholder in a corporation. Note: The terms “share” or “stock” may be used interchangeably to refer to shares of stock in a corporation. The share/stock represents: 1. The interest or right of the stockholder in the management of the corporation through the exercise of the voting right; 2. The interest of right of the stockholder in the earnings of the corporation in the form of the dividends to be distributed; and 3. The interest or right of the stockholder in the residual assets of the corporation upon dissolution. So, the share of stock represents your share in the corporation in the form of dividends. Shares of stocks are therefore an asset on the part of the shareholder. It is an intangible asset representing its right and interest in the corporation. Example: you have 1M capital divided into 1M shares, that means that your capital is divided into 1M parts and each share represents 1 part. The moment the corporation intends to pursue another business, the stockholder may ask for an amendment of the Articles of Incorporation to reflect such changes. Otherwise, the contract will be violated. Amending the Articles of Incorporation is basically amending the contract between the shareholders and the corporation. 2. Among Shareholders themselves This can be found in their by-laws. Contents of the By-Laws of the Corporation (1) How many boards and officers will be elected (2) Term of office (3) Functions and Powers (4) Manner of election (5) When will the stockholders and/or board meet (6) Definition of various types of shares 8 / 14 CORPORATION LAW Sources: Atty. Divina’s Lecture; “Commentaries on the Revised Corporation Code” by Villanueva; Lectures of ATTY. MOMONGAN, A.Y. 2020-2021 CLASSIFICATION OF SHARES for its no-par value shares shall be treated as capital and shall not be available for distribution as dividends. Section 6. Classification of Shares. – The classification of shares, their corresponding privileges, or restrictions, and their stated par value, if any, must be indicated in the articles of incorporation. Each share shall be equal in all respects to every other share, except as otherwise provided in the articles of incorporation and in the certificate of stock. A corporation may further classify its shares for the purpose of ensuring compliance with constitutional or legal requirements. The shares in stock corporations may divided into classes or series of shares, or both. No share may be deprived of voting rights except those classified and issued as “preferred” or “redeemable” shares, unless otherwise provided in this Code: Provided, That there shall always be a class or series of shares with complete voting rights. Holders of nonvoting shares shall nevertheless be entitled to vote on the following matters: (a) Amendment of the articles of incorporation; (b) Adoption and amendment of bylaws; (c) Sale, lease, exchange, mortgage, pledge, or other disposition of all or substantially all of the corporate property; (d) Incurring, creating, or increasing bonded indebtedness; (e) Increase or decrease of authorized capital stock; (f) Merger or consolidation of the corporation with another corporation or other corporations; (g) Investment of corporate funds in another corporation or business in accordance with this Code; and (h) Dissolution of the corporation. Except as provided in the immediately preceding paragraph, the vote required under this Code to approve a particular corporate act shall be deemed to refer only to stocks with voting rights. The shares or series of shares may or may not have a par value: Provided, That banks, trust, insurance, and preneed companies, public utilities, building and loan associations, and other corporations authorized to obtain or access funds from the public whether publicly listed or not, shall not be permitted to issue no-par value shares of stock. Section 6 now includes “preneed companies” and “other corporations authorized to obtain or access funds from the public, whether publicly listed or not” as among the corporations which cannot issue no-par value shares. WHAT ARE THE CLASSIFICATIONS OF SHARES? A: Shares are classified as: (1) Common shares (2) Preferred shares (3) Par value shares (4) No-par value shares (5) Founder’s shares (6) Redeemable shares (7) Treasury shares (8) Convertible shares (9) Voting shares (10) Non-voting shares 1;2: COMMON VS. PREFERRED SHARES NOTE: Common and preferred shares are the 2 main classes or forms of stock. Common Shares Definition Entitles the holders to a pro rata share in the profits of the corporation without preference over the other stockholders. Shares having certain rights and privileges not available to holders of common shares. Stocks which are given preference by the issuing corporation in: (1) Distribution of dividends; (2) Distribution of the assets of the corporation in case of liquidation; or (3) Such other preferences as may be stated in the AOI which do not violate the Code. Preferred shares of stock issued by a corporation may be given preference in the distribution of dividends and in the distribution of corporate assets in case of liquidation, or such other preferences: Provided, That preferred shares of stock may be issued only with a stated par value. The board of directors, where authorized in the articles of incorporation, may fix the terms and conditions of preferred shares of stock or any series thereof: Provided, further, That such terms and conditions shall be effective upon filing of a certificate thereof with the Securities and Exchange Commission, hereinafter referred to as the "Commission". Shares of capital stock issued without par value shall be deemed fully paid and nonassessable and the holder of such shares shall not be liable to the corporation or to its creditors in respect thereto: Provided, That no-par value shares must be issued for a consideration of at least Five pesos (₱5.00) per share: Provided, further, That the entire consideration received by the corporation Preferred Shares Stockholders’ Rights and their limitations Stockholders in common shares are given voting rights. Also has the same voting right, unless the right to vote is clearly withheld. 9 / 14 CORPORATION LAW Sources: Atty. Divina’s Lecture; “Commentaries on the Revised Corporation Code” by Villanueva; Lectures of ATTY. MOMONGAN, A.Y. 2020-2021 The most common type of shares, which enjoy no preference, but the owners thereof are entitled to: 1. Management of the corporation (via the exclusive right to vote); and 2. Equal pro-rata division of profits after preference. However: 1. Preferred shares can only be issued with par value 2. Preferred shares must be stated in the AOI and in the COS. 3. The BOD may fix the terms and conditions only when so authorized by the AOI, and such terms and conditions shall be effective upon the filing of a certificate with the SEC. Users/Holders Suitable for parties that wish to exert some control (voting), participate in earning dividends, and growth of the company Preference shares are a useful investment tool for parties with the following objectives: 1. For investors who don’t require voting rights and control of the company; 2. For those opting for medium risks and returns. Payment of Dividends Ordinary shareholders They receive dividends receive dividends after first in priority ahead of preference shareholders common/ordinary are paid. shareholders. Features of Common Shares 1. Automatically has voting rights; 2. May be issued without par value 3. If issued without pay value: a. It must not be lass than P5.00 b. Share is fully paid; c. Holder of such share is not liable to the corporation or its creditors; d. Shares are treated as part of the corporation’s capital; e. No dividends. Features of Preferred Shares 1. Does not automatically have voting rights; 2. It may be deprived of voting rights under the AOI; 3. Even if non-voting share, may still vote on: a. Amendment of the articles of incorporation; b. Adoption and amendment of bylaws; c. Sale, lease, exchange, mortgage, pledge, or other disposition of all or substantially all of the corporate property; d. Incurring, creating, or increasing bonded indebtedness; e. Increase or decrease of authorized capital stock; f. Merger or consolidation of the corporation with another corporation or other corporations; g. Investment of corporate funds in another corporation or business in accordance with this Code; and h. Dissolution of the corporation. 4. Preference in the distribution of dividends; 5. Preference in the distribution of assets, in case of liquidation; 6. May be issued only with a stated par value. KINDS OF PREFERRED SHARES a. As to assets Share which the holder thereof has preference in the distribution of the assets of the corporation in case of liquidation. It has been held that preferred stock, standing alone, creates a preference only to dividends and not to assets in case of liquidation. b. As to dividends Share the holder of which is entitled to receive dividends on said share to the extent agreed upon before any dividends at all are paid to the holders of common stock. The preference simply means that holders of common stock may receive dividends only after the satisfaction of the prior claims on dividends of preferred stockholders. There is no guaranty that it will receive any dividends. The corporation is not bound to pay dividends unless the BOD declare them. The following are the kinds of preferred shares as to dividends: 1. Cumulative Preferred Shares 2. Non-Cumulative Preferred Share 3. Participating Preferred Shares 4. Non-Participating Preferred Shares Cumulative vs. Non-cumulative Preferred Share Cumulative Share which entitles the holders thereof not only to the payment of current dividends but also to dividends in arrears. What are Dividends in arrears? means that for every year that the company did not declare dividends, each cumulative preferred Non-Cumulative Share which entitles the holder thereof to the payment of current dividends only in preference to commons stockholders. The stockholder does not have any right for the years that the corporation did not declare dividends but only entitled to the 10 / 14 CORPORATION LAW Sources: Atty. Divina’s Lecture; “Commentaries on the Revised Corporation Code” by Villanueva; Lectures of ATTY. MOMONGAN, A.Y. 2020-2021 shareholder will have an interest in those undeclared dividends. dividends declared in the current year. Example: In 2017 and 2018 the corporation did not declare dividend. In 2019 it declared dividend. In this case, the stockholder shall be entitled to the dividends in 2017, 2018, and 2019. Illustration: 1,000 shares; Stated in the AOI that these are preferred shares entitled to cumulative dividends at Php5/share per year. 2017 and 2018, no dividends declared. 2019 – corporation declares dividends. Entitled to how much dividends? Cumulative: 2017, 2018 and 2019, entitled to 5000/yr Non-cumulative: 5000 only for the current year. Participating vs. Non-Participating Shares Q: What are non-participating preferred shares? A: The stockholder does not have any right for the years that the corporation did not declare dividends but only entitled to the dividends declared in the current year. This is the kind of Share which entitles the holder thereof to receive the stipulated preferred dividends and no more. The balance, if any, is given entirely to the common stocks. Q: Participating preferred shares? A: The stockholder is not only entitled to his preferred shares but also entitled in the distribution with the common shareholders. It gives the holder the ff: the right to receive the stipulated dividends at the preferred rate; to participate with the holders of common shares in the remaining profits pro rata (or in the proportion stated in the articles of incorporation) after the common shares have been paid the amount of the stipulated dividend at the same preferred rate. IOW, after the holders get their share of the dividends, they still participate in the sharing of dividends of the common stockholders. Cumulative-participating - Share which is a combination of the cumulative share and participating share. This means that the holder is entitled not only to dividends in arrears but also, after receiving his preferred share of dividends, to participation with the holders of common stock in the remaining profits Doctrine of Equality of Shares If the articles of incorporation are silent, preferred shares are presumed to be noncumulative and non-participating. In the absence of an agreement, express or implied, dividends should be deemed noncumulative and non-participating in accordance with the presumption established in Section 6 par.5 that shares are equal in all respects unless otherwise stated in the articles of incorporation and in the certificate of stocks. 3;4 PAR VALUE AND NO PAR VALUE SHARES Par Value No Par Value Definition One with a specific It is one without any money value fixed in the stated value appearing on articles of incorporation the face of the certificate and appearing in the of stock; a stock which certificate of stock. does not state show much money it represents. Requirement as to its issuance: 1. A par value share 1. Shares of stock issued cannot be issued without par value shall be below par but can be deemed fully paid and issued more than par; non-assessable and the and holder of such shares shall not be liable to the 2. the excess thereof corporation or to its shall form part of the creditors in respect paid-in capital, but it thereto. is accounted for as a The consideration premium or as an given shall be additional paid-in considered as the capital. full amount of the issue price, there can be no subscription receivable. 2. The shares without par value may not be issued for a consideration less than the value of Five pesos (P5.00) per share. This is the minimum consideration for a non par value share 3. The entire consideration received by the corporation for its non-par value shares shall be treated as capital and shall not be available for distribution as dividends. (2nd to the last paragraph, RCC) 5. FOUNDER’S SHARES SECTION 7 – FOUNDER’S SHARES Section 7. Founders’ Shares. – Founders’ shares may be given certain rights and privileges not enjoyed by the owners of other stock. Where the exclusive right to vote and be voted for in the election of directors is granted, it must be for a limited period not to exceed five (5) years 11 / 14 CORPORATION LAW Sources: Atty. Divina’s Lecture; “Commentaries on the Revised Corporation Code” by Villanueva; Lectures of ATTY. MOMONGAN, A.Y. 2020-2021 from the date of incorporation: Provided, That such exclusive right shall not be allowed if its exercise will violate Commonwealth Act No. 108, otherwise known as the "Anti-Dummy Law"; Republic Act No. 7042, otherwise known as the "Foreign Investments Act of 1991"; and otherwise known as "Foreign Investments Act of 1991"; and other pertinent laws. GR: Common shares cannot be deprived the right to vote. XPN: In the case of Founder’s Shares – for a limited period of 5 years, owners of founders’ shares shall have an exclusive right to vote and be voted. (Sec. 7) 1. What are the founder’s shares? These are shares classified as such under the Articles of Incorporation (AOI) and given certain rights and privileges, such as the right to vote for board of directors. Duration of the effectivity of right to vote; when reckoned? It is effective for a period of five years from a period of incorporation. It used to be five years from the approval of SEC and now it’s five years from period of incorporation. Effect: After the lapse of 5 years the founder’s shares will be treated and given the same rights as other common shareholders. What does this mean? It means that if the founder’s shares will be included in the amendment of the AOI, then the five years shall be reckoned not from the amendment but from the incorporation of the corporation. Unlike before where it is five years from the period of approval of SEC. 2. The Founder’s shares cannot be used to circumvent the rules and laws on public utility and the laws related to foreign investment. Illustration: Under the constitution, 60% of the capital of the public utility must be owned by Filipinos. Let’s say, in Corporation X, there are ten directors, and foreigners hold 40% of the public utility corporation. That means they can be represented in the board up to 40% of the ten directors because the right to participate and the right to be elected as directors is proportionate to their shareholdings in the corporation. Let’s say we have 40% of the equity of the public corporation, they can get four seats. Q: What if two foreigners have founder’s shares, can those two foreigners get to be voted as directors on top of the 40% vote for directors? A: NO. It is not allowed. It will circumvent the antidummy law and the Foreign Investment Act. Second, we said if the privilege granted to the holders of the founder’s shares is the right to vote and be voted valid for five years, what about this one: Let’s say the AOI provides that for every one share, the holder of the founders’ shares gets 10 votes. One share, ten votes. Q: Is that subject to the five-year limitation under the SEC? A: SEC said NO. The only right subject to the five-year limitation is the right to vote and be voted as directors. All other rights and privileges are not subject to the five year limitation period. It depends on the term provided in the AOI. Another, let’s say the holder of founder’s shares is given the right to receive dividends ahead of the right to preferred shareholders. And it does not contain any limit. Q: So, can they get dividends ahead of the preferred or common shareholders? A: Yes. Again, the five year limit only applies to the right to vote and be voted as directors. Is the 1-10 voting rights ratio for founder’s shares subject to a limited period not to exceed five (5) years provided under Sec. 7 of RCC? The 1-10 voting rights ratio for Founder’s shares is not subject to the limited period not to exceed five (5) years provided under Sec. 7 RCC since the provision only applies to the exclusive right to vote and be voted for in the election of directors. (Close Holding Corporation: Founder’s Shares, SEC OGC Opinion No. 02-10 (January 15, 2010) Situation: ABC Corporation is a public utility corporation, 60% owned by Filipinos and 40% by Foreigners. It has 10 directors as specified in the Articles of Incorporation. X and Z are foreigners who hold founders shares with the right to be voted as directors of the corporation for a period of five years. Q: Can X and Y be voted as directors together with 4 other foreigners whose collective shares are enough to be assured of four board seats? A: No, the right granted to founders’ shares cannot be exercised if it will violate the Anti-Dummy Law. Foreigners can be elected to the board of directors of corporations engaged in partially nationalized activities only in proportion to their actual foreign equity in the corporation. Foreigners are allowed to own 40% of the equity of a public utility corporation. Therefore, they can only have four seats in the board of directors. The right granted to X and Y to be voted as directors cannot be exercised if it will result in the foreigners having more than the number of seats allowed by law, in violation of the Anti-Dummy Law and the Foreign Investment Act. Thus, pursuant to Sec. 7, as revised: 1. The RCC made it clear that the exclusive rights of the holders of the founders shares to vote and be voted as directors shall not be allowed if its exercise will violate Commonwealth Act No. 108 otherwise known as the Anti-Dummy Law, RA 7042 or the Foreign Investments Act of 1991 and other pertinent laws 2. The five-year limitation is counted from date of incorporation and not from SEC’s approval. 6. REDEEMABLE SHARES 12 / 14 CORPORATION LAW Sources: Atty. Divina’s Lecture; “Commentaries on the Revised Corporation Code” by Villanueva; Lectures of ATTY. MOMONGAN, A.Y. 2020-2021 Section 8. Redeemable Shares Section 8. Redeemable Shares. - Redeemable shares may be issued by the corporation when expressly provided in the articles of incorporation. They are shares which may be purchased by the corporation. They are shares which may be purchased by the corporation from the holders of such shares upon the expiration of a fixed period, regardless of the existence of unrestricted retained earnings in the books of the corporation, and upon such other terms and conditions stated in the articles of incorporation and the certificate of stock representing the shares, subject to rules and regulations issued by the Commission. What are redeemable shares? They are shares which may be purchased by the corporation. They are shares which may be purchased by the corporation from the holders of such shares upon the expiration of a fixed period, regardless of the existence of unrestricted retained earnings in the books of the corporation, and upon such other terms and conditions stated in the articles of incorporation and the certificate of stock representing the shares, subject to rules and regulations issued by the Commission. What is the purpose of redeemable shares? A: They are issued for the purpose of attracting capital. What are the Rules in Redemption? (1) Redeemable shares may be issued only when expressly provided for in the AOI. (2) The terms and conditions affecting said shares must be stated both in the AOI and in the COS. (3) Redeemable shares may be deprived of voting rights in the AOI. (4) The corporation is required to maintain a sinking fund to answer for redemption price if the corporation is required to redeem. (5) The redeemable shares are deemed retired upon redemption unless otherwise provided in the AOI. (6) Unrestricted RE is not necessary before shares can be redeemed, but there must be sufficient assets to pay the creditors and to answer for operations (Republic Planters Banks vs. Agana, G.R. No. 51765, 1997) (7) Redemption cannot be made if such redemption will result in insolvency or inability of the corporation to meet its obligations. Who can redeem? Corporation/ shareholder. When to redeem? It depends: 1. As a matter of right - when the redemption date comes, the stockholder can compel redemption as a matter of right; 2. As a matter of agreement - redemption date comes and the corporation does not redeem and the stockholders do not compel redemption, it is now a matter of agreement between the two. Illustration: If the stockholder dili ganahan magpa redeem sa iyahang shares , then the corporation and the stockholder can just agree that we’ll just amend our AOI to put in there that it’s no longer redeemable. But if the redemption date arrives and the stockholders and corporation does not say anything and after a few years the stockholders now say “uy, redeem or shares”, it’s now a matter on how the redemption date was worded: Ex: 1. “Redemption can take place anytime after March 30” Effect: Redemption can still be done. Ex. 2. “Redemption shall only be until March 30” Effect: They can no longer redeem. 7. TREASURY SHARES Sec. 9. Treasury shares. - Treasury shares are shares of stock which have been issued and fully paid for, but subsequently reacquired by the issuing corporation by purchase, redemption, donation or through some other lawful means. Such shares may again be disposed of for a reasonable price fixed by the board of directors. What are treasury shares? This refers to the shares wherein it is fully issued and paid but is subsequently reacquired by the corporation who issued such shares through redemption, donation or any other means. 8. CONVERTIBLE SHARES What are convertible shares? These are shares which are convertible or changeable by the stockholder from one class to another class (such as from preferred to common) at a certain price and within a certain period. 2-Step Process of Converting Shares: 1. Provide Convertibility Feature in your AOI. If your articles do not provide for Convertibility, you need to amend the articles first to allow for the conversion. 2. Then WIPE OUT OR DELETE THE CONVERTIBLE SHARE. Example: Preferred shares to be converted to Common shares1. Amend your articles to provide for the Convertibility Feature. (Preferred to Common) 2. Do a 2nd Amendment to wipe out the Convertible preferred and they are now all Common Shares. The two amendments can be filled simultaneously with the SEC because they will not allow you to change without going though conversion. So what you will do is 13 / 14 CORPORATION LAW Sources: Atty. Divina’s Lecture; “Commentaries on the Revised Corporation Code” by Villanueva; Lectures of ATTY. MOMONGAN, A.Y. 2020-2021 to apply for the convertibility feature and at the same time you need to apply for the ACTUAL CONVERSION. without amendment of the AOI or approval of the shareholders. Note: Generally it needs 2 amendments unless the Convertibility feature is already there. You only need to amend for the actual conversion. (2) Subscribed Capital Stock It is the amount of capital stock subscribed (purchased), whether fully paid or not. 9. VOTING SHARES 10. NON-VOTING SHARES A. Voting Share: a share with a right to vote; B. Non-Voting Share: no right to vote. Requirements for Issuance of Non-Voting Shares: 1. Only preferred or redeemable shares may be made non-voting shares. 2. There must remain other shares with full voting rights Conditions for the issuance of non-voting shares 1. If the stock is originally issued as voting stock, it may not thereafter be deprived of the right to vote without the consent of the holder. 2. Under the Code, no share may be deprived of voting rights except those classified and issued as "preferred" or "redeemable" shares, unless otherwise provided in the Code. 3.Where non-voting shares are provided for, the Code requires that there shall always be a class or series of shares which have complete voting rights. 4. Under Section 6 (par. 1), only preferred or redeemable shares may be denied the right to vote. The issuance of common stock with a feature that voting rights thereof shall be exercised by a trustee violates the rule that common shares cannot be deprived of voting rights. The automatic assignment of voting rights in an indirect violation of Section 6. It connotes an original subscription contract for the acquisition by a subscriber of unissued shares in a corporation and would, therefore, preclude the acquisition of shares by reason of subsequent transfer from a stockholder or resale of treasury shares. (3) Outstanding Capital Stock It is the portion of the capital stock which is issued and held by persons other than the corporation itself. (4) Paid-up Capital Stock The portion of the subscribed/outstanding capital stock that has been fully paid. (5) Unissued Capital Stock That portion of the capital stock that is not issued or subscribed. It cannot vote, and draws no dividends. (6) Legal Capital It is the amount equal to the aggregate part value and/or issued value of the outstanding capital stock. When par value shares are issued above par, the share premium or excess is not considered as a part of the legal capital. In the case of no-par value shares, the entire consideration received forms part of the legal capital, and shall not be available for distribution as dividends. (7) Shareholder’s Equity (Subscribed Capital) That portion of the capital of the corporation that is composed of all the investments that the subscribers put in (meaning, for stock corporations issuing par value shares at a price above par, the share premium is included). It is also known as the subscribed capital of the corporation. 5. In case any amendment of the articles of incorporation has the effect of changing or restricting the rights of any stockholder, the latter shall have the right to dissent and demand payment of the fair value of his shares. Note: The rule is that a corporation must always have voting shares there can be no valid agreement where a corporation has all non-voting share. Any agreement that will take away the right to vote of all the shares of a corporation is not valid. OTHER IMPORTANT PRINCIPLES TO REMEMBER; TYPES OF CAPITAL STOCK (1) Authorized Capital Stock Refers to the amount of capital stock as specified in the AOI. Additional shares may not be issued unless the AOI is amended by the vote of the stockholders. However, unissued authorized shares may be issued at a later date 14 / 14