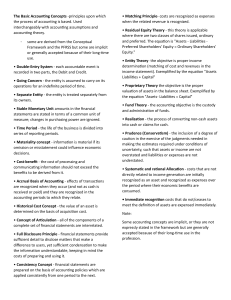

What is accounting? Accounting is the process of recording, summarizing, analyzing, and reporting financial transactions of a business entity. What are the basic accounting principles? The basic accounting principles include the principles of conservatism, consistency, materiality, matching, monetary unit, objectivity, and reliability. Define the accounting equation. The accounting equation states that assets equal liabilities plus equity. It forms the basis of double-entry accounting. What are assets? Assets are economic resources owned or controlled by a business entity, which are expected to benefit future operations. Explain liabilities. Liabilities are obligations or debts owed by a business entity to external parties, which must be settled in the future through the transfer of assets or services. Define equity. Equity represents the residual interest in the assets of a business entity after deducting liabilities. It reflects the ownership interest of the owners/shareholders. What is the accrual basis of accounting? The accrual basis of accounting recognizes revenues when earned and expenses when incurred, regardless of when cash is received or paid. Explain the cash basis of accounting. The cash basis of accounting recognizes revenues and expenses when cash is received or paid, respectively, regardless of when the transactions occur. What is the difference between a debit and a credit? Debit refers to an entry made on the left side of an account, while credit refers to an entry made on the right side of an account in double-entry accounting. Define revenue. Revenue is the income generated by a business entity from its primary activities, such as sales of goods or services. Explain expenses. Expenses are the costs incurred by a business entity in generating revenue or conducting its operations, such as salaries, utilities, and rent. What is the matching principle? The matching principle states that expenses should be recognized in the same period as the revenues they help to generate, thereby ensuring accurate measurement of income. Define depreciation. Depreciation is the systematic allocation of the cost of a tangible asset over its useful life, reflecting the wear and tear or obsolescence of the asset. Explain the concept of book value. Book value refers to the value of an asset as recorded on the balance sheet, calculated as the original cost of the asset less accumulated depreciation. What is the purpose of a trial balance? The trial balance is prepared to ensure the equality of debits and credits after posting transactions to the general ledger, thus serving as an internal control mechanism. Define GAAP. GAAP stands for Generally Accepted Accounting Principles, which are a set of standardized accounting principles, standards, and procedures used to prepare and present financial statements. What is the difference between GAAP and IFRS? GAAP is primarily used in the United States, while IFRS (International Financial Reporting Standards) is used in many other countries. Although they share similarities, there are differences in specific accounting treatments and reporting requirements. Explain the revenue recognition principle. The revenue recognition principle dictates that revenue should be recognized when earned and realized or realizable, regardless of when cash is received. Define the going concern concept. The going concern concept assumes that a business entity will continue its operations in the foreseeable future, allowing for the application of accrual basis accounting and the realization of assets. What is the historical cost principle? The historical cost principle states that assets should be recorded at their original cost at the time of acquisition, rather than at their current market value. Explain the conservatism principle. The conservatism principle suggests that when there are uncertainties or doubts about the outcome of transactions or events, accountants should choose the option that results in lower reported income or asset values. Define materiality in accounting. Materiality refers to the significance or importance of an item or event in influencing the decisions of users of financial statements. Items are considered material if their omission or misstatement could affect the judgment of users. What is the full disclosure principle? The full disclosure principle requires that all relevant information that could influence the decisionmaking of users of financial statements should be disclosed in the notes to the financial statements. Explain the relevance of the time period concept. The time period concept divides the economic life of a business entity into distinct and consecutive periods, usually months, quarters, or years, for the purpose of reporting financial performance. Define a journal entry. A journal entry is the recording of a financial transaction in the general journal, consisting of a date, accounts debited and credited, and a brief description of the transaction. What is a ledger? A ledger is a book or electronic database that contains all accounts and their respective transactions, serving as the primary data source for preparing financial statements. Explain the concept of a fiscal year. A fiscal year is a 12-month period used for financial reporting purposes, which may or may not coincide with the calendar year. It is often chosen based on business cycles or regulatory requirements. Define a contra account. A contra account is an account that is offset against another account on the balance sheet, representing deductions from the original account balance. Examples include accumulated depreciation and allowance for doubtful accounts. What is the difference between a balance sheet and an income statement? A balance sheet provides a snapshot of a company's financial position at a specific point in time, showing its assets, liabilities, and equity. An income statement, on the other hand, summarizes a company's revenues, expenses, and net income or loss over a period of time. Explain the principle of consistency. The principle of consistency requires that accounting methods and practices should be applied consistently from one accounting period to another, ensuring comparability of financial statements over time. Define the principle of objectivity. The principle of objectivity states that financial transactions should be recorded based on verifiable evidence and without bias, ensuring reliability and integrity of financial information. What is the difference between cash flow and profit? Profit refers to the excess of revenues over expenses during a specific period, as reported on the income statement. Cash flow, on the other hand, refers to the inflows and outflows of cash and cash equivalents during a specific period, reflecting the liquidity of a business. Explain the concept of conservatism in accounting. The concept of conservatism suggests that when there are uncertainties or doubts about the outcome of transactions or events, accountants should choose the option that results in lower reported income or asset values, thereby erring on the side of caution. Define the principle of materiality. The principle of materiality states that financial information should only be disclosed if its omission or misstatement could influence the decisions of users of financial statements. Items are considered material if they are significant enough to impact users' judgments. What is the purpose of the statement of cash flows? The statement of cash flows provides information about the cash inflows and outflows from operating, investing, and financing activities of a business entity during a specific period, helping users assess its liquidity and financial flexibility .